NHF: Unusual Dutch Auction Tender Offer

NHF conducts an unusual Dutch auction tender offer as it converts into a REIT.

80% of the tender proceeds will be paid in 5.50%-yielding preferred stock.

Despite massive -46% discount, some risks remain.

Author's Note: This article was released to CEF/ETF Income Laboratory members on October 27, 2020, and data are from that date unless stated otherwise. Please check latest data before investing.

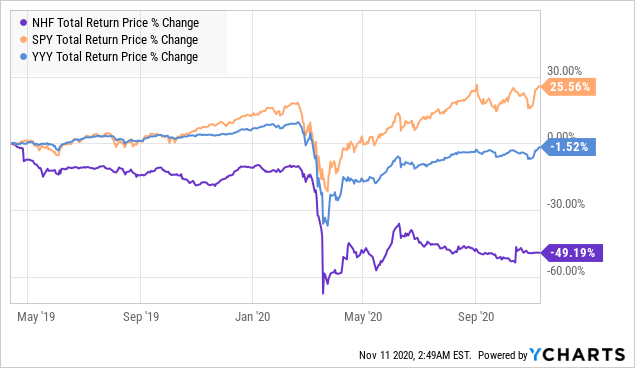

NexPoint Strategic Opportunities Fund (NHF) is a fund that we had owned previously in both of our model portfolios, but sold it last year when we felt increasingly uncomfortable with a number of "red flags" that we spotted with the fund. This turned out to be a good decision in hindsight as NHF severely underperformed the broader market (SPY) as well as a high-yield CEF index (YYY) over the next year.

Data by YCharts

Data by YCharts

However, the fund has recently re-emerged on our radar due to its massive discount of nearly -50%, as well as the announcement of a rather unusual tender offer as they initiate the process of converting into a REIT.

Dutch action tender offer

The offer is unusual because of two reasons. First, instead of repurchasing a fixed proportion of outstanding shares at a certain percentage of NAV, the offer will be for a set aggregate purchase price of $150 million shares under a "modified Dutch auction" format.

Here's the explanation from the press release:

The Fund will conduct the Exchange Offer through a procedure called a "Modified Dutch Auction." For a common shareholder choosing to participate in the Exchange Offer, this procedure allows the shareholder to select a price, within a set price range, at which they are willing to sell their Shares. The proposed price range for the Exchange Offer is $10.00-$12.00 per Share. After all tendering shareholders indicate their respective sale prices, the Fund will pay the lowest price indicated that will permit the Fund to purchase as many Shares as possible, up to the maximum aggregate purchase price of $150 million.

For example, if the lowest price indicated is $10.00 per Share, the Fund will purchase 15 million Shares. Conversely, if the lowest price indicated is $12.00 per Share, the Fund will purchase 12.5 million Shares. The maximum aggregate purchase price for all Shares will be $150 million, regardless of the actual purchase price per Share.

NHF will purchase all Shares at the same purchase price, as required by Exchange Act rules; however, the Exchange Offer is conditioned on, among other things, shareholders validly tendering (and not properly withdrawing) Shares representing an aggregate purchase price of at least $75 million, regardless of the purchase price per Share, prior to the offering's expiration date.[2] The Exchange Offer will only be made to NHF's current shareholders.

The proposed price range is from $10 to $12 per share, but the actual price paid for the shares will be the lowest tendering price by any shareholder. I take it to mean that even if the holder of a single share of NHF decides to tender their shares for $10, then NHF will rebuy all shares at that price. This creates some uncertainty as to the final tender price, but the conservative assumption would be $10, the lowest end of the range.

The tender offer will expire on December 10, 2020.

80% of tender paid in preferred shares

This potential alpha is complicated by the fact (and this is the second reason that the offering is unusual) that only 20% of the tender payout will be in the form of cash. The other 80% of the tender payout will be in the form of preferred shares. From the press release:

The Company will purchase Common Shares at a maximum aggregate purchase price of $150 million in exchange for consideration consisting of approximately 20% cash and 80% newly-issued shares of the Company's 5.50% Series A Cumulative Preferred Shares valued at their liquidation preference $25.00 per share ("Series A Preferred Shares") (collectively, the "Exchange Offer").

(Update: The preferred shares will be issued at a yield of 5.50%, and have been rated BBB- by Egan-Jones).

While REIT shares are traditionally quite solid, there's no guarantee that they would trade at par once issued. This could mean that an investor who received the new preferred shares (issued to them at par) could be potentially saddled with capital losses should the market not value the preferreds highly. There could also be some short-term selling pressure from investors who received the preferred shares in the tender, but do not wish to hold on to them. However, I think there is a decent chance that the preferreds will eventually return to trading at around par value, or at least in line with other BBB-rated REIT preferreds.

NAV uncertainty still remains

The final uncertainty comes from the fact that we don't know how accurate NHF's NAV is, in the first place. Around half of NHF's portfolio is in "level 3" assets, which constitute the most illiquid positions and are ones that are hardest to accurately value. NHF managers claim that the tender offer "will increase NAV per Share by approximately 11%-20% based on current NAV and the proposed auction range," but this is only true if the current NAV can be trusted. Presumably, the fund will have to sell some of its more liquid assets to meet its 20% cash obligation, making the NAV of the remaining portfolio even more uncertain and subject to a sudden "surprise" downward revision.

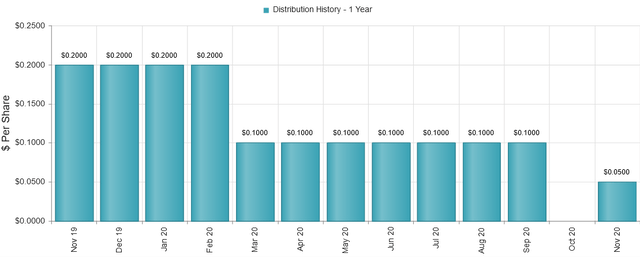

Distribution rate halved (again)

Oh, and there was also a halving of the monthly distribution rate as well from $0.10 to $0.05 per share. This followed a halving of the distribution rate earlier this year (from $0.20 to $0.10).

(Source: CEFConnect)

The reason managers gave for the cut was to conserve cash for the cash component of the tender offer as well as for future preferred dividends. Not pleasant for NHF holders, but their minds should be more focused on the tender offer situation currently and how they wish to play it. The forward market yield is 6.55% (as of November 10).

Summary

Overall, I think there could be a potential for attractive gains with an NHF position at its current wide discount of -46.68% (as of November 10) as well as potential alpha and NAV accretion from the tender offer. However, there is also uncertainty stemming from the preferred shares as well as how the NAV of the portfolio is valued. In my opinion, investing in NHF remains a speculative proposition. However, if I owned it, I would probably keep holding it and tender all of my shares.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage market-beating closed-end fund (CEF) and exchange-traded fund (ETF) portfolios targeting safe and reliable ~8% yields to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage market-beating closed-end fund (CEF) and exchange-traded fund (ETF) portfolios targeting safe and reliable ~8% yields to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.