TAL Education: Growth At A Very Reasonable Price

TAL takes a hit in 2Q21 as online competition ramps up.

But the prospects in offline and OMO are brightening and should more than offset online headwinds in the coming quarters.

Long term, I still see TAL emerging as an industry leader in online and offline.

At the current price, investors are paying a very reasonable implied valuation for the offline business.

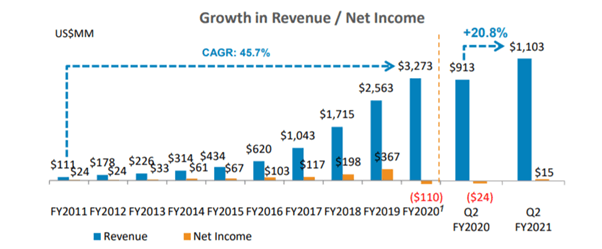

TAL Education (NYSE:TAL) stock sold off post-2Q21, as signs of escalating competition among online education companies emerge. While the market has (rightly) taken a particularly bearish view on recent developments, I think the long-term thesis remains unchanged. Yes, the earnings inflection point moves further out, but the gap between the tier-1 players and the rest of the group is also set to widen post-COVID, and thus, I believe TAL's long-term earnings power remains intact. With the offline "stub" now trading at a discounted implied valuation of ~3x P/Sales, I am bullish.

2Q21 Misses on Intensified Online Competition

TAL's recent 2Q21 results were surprisingly below consensus expectations heading into the print. To be clear, it wasn't all bad - revenue growth remained strong at ~21% YoY to $1,103m on resilient offline growth but a (relatively) below par online performance. But I think online needs to be viewed in context - for instance, XRS Online grew ~87% YoY for the quarter, but was still behind fairly lofty consensus expectations on a step-up in competition from private players (e.g., Yuanfudao's marketing push in the primary school segment).

Source: Investor Presentation

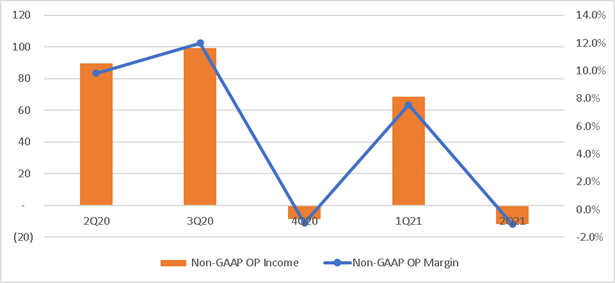

The competitive headwinds in online filtered through to margins as well - non-GAAP operating margin dropped to -1.1% in 2Q21 (from 9.8% in 2Q20) as customer acquisition costs ramped up. With private players just completing their funding rounds (Yuanfudao completed its $2.2bn Series G round in October, while Zuoyebang completed its $750m Series E round in June), I think there's reason for caution on the margin outlook over the coming quarters. For now, I see TAL's non-GAAP operating margins remaining below FY19 levels for the foreseeable future.

Source: Company Filings

Offline Shaping Up for a Recovery

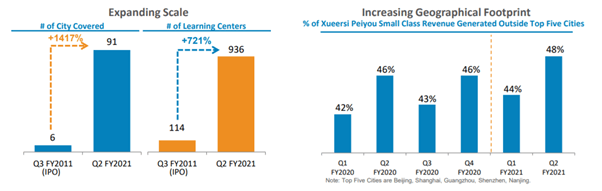

TAL's offline segment hasn't been a source of strength in recent quarters - Peiyou offline small class, for instance, was weaker than its offline peers for the quarter, with revenue guidance of 28-32% YoY pointing toward a lagging offline recovery into 3Q. That said, I would caution against extrapolating this trend as pricing discounts offered during the summer promotional period and the COVID-driven delays in offline expansion likely played a part.

Instead, I am bullish on the long-term, post-COVID outlook, as TAL expands into lower-tier markets, leveraging an OMO (Online-Merge-Offline) model with smaller learning centers in cooperation with Peiyou Online. Thus far, it has already added 14 new learning centers in 3QTD, with >50 additional centers in the pipeline.

Source: Investor Presentation

While the new centers will likely be a short-term drag on margins, I believe they will prove accretive to the long-term margin expansion path as the proportion of mature classrooms increases over time. Over time, I see offline non-GAAP operating margins moving to >20% levels.

Peiyou Online Spearheads the OMO Ramp

With Peiyou Online enrollments already on par with Peiyou Offline enrollments in tier-1 cities like Beijing and Shanghai, and twice Peiyou Offline enrollments in Tianjin, TAL's OMO push appears to be heading in the right direction. And there is plenty of room for growth - with TAL's overall Peiyou Online enrollments only ~32% of Peiyou Offline in FY20, I see a clear runway toward an >50% contribution in FY21.

Further, Peiyou Online could also prove more margin accretive, given the higher subject expansion ratio, and by extension, higher ASP potential, relative to Peiyou Offline. In fact, I think Peiyou Online ASPs could move well above Xueersi.com long-term, given its pricing is already on par. Plus, Peiyou Online also benefits from lower student acquisition costs, given its affiliation with the Peiyou Offline brand. No surprises then that management sees Peiyou Online delivering 30-40% net profit margins upon maturity, highlighting the extent of the long-term runway at hand.

Prioritizing Market Share Over Margins in Online

Online competition is ramping up, and though TAL remains the de facto leader, the likes of GSX Techedu (NYSE:GSX), Yuanfudao and Zuoyebang are snapping at its heels. It makes sense to me that management is focused on maintaining its leading position and protecting market share, given the substantial scale advantage for Tier-1 players like TAL. But the short-term margin implication is negative, and with 4Q set for a seasonal upswing in marketing costs and potentially higher customer acquisition costs, margins will likely come under pressure.

The medium-term implication is that the break-even target is likely delayed to FY23 or so (from FY22 prior). That will weigh on the earnings outlook, but I think investors willing to underwrite a long-term investment will benefit as TAL looks set to emerge as a clear winner due to its scale advantage and online penetration (particularly in lower-tier markets), with entry barriers moving ever higher in a post-COVID environment.

Pay for Online, Get the Offline Business (Almost) for Free

While TAL faces margin headwinds ahead in online, I do not think recent developments fundamentally change the long-term outlook for an industry-wide consolidation among the leading players. Instead, I think the higher entry barriers post-COVID put industry leader TAL in pole position for the long-term across both offline and online. And with offline set to ramp up and a margin accretive OMO runway ahead, I see ample buffer for online weakness.

With the stock down significantly post-2Q, the valuation has become quite compelling. Assuming a relatively conservative ~7x P/Sales multiple for online, the current market cap would imply a heavily discounted ~3x fwd P/S for the offline "stub." This compares to the recent post-funding valuation for online comp Yuanfudao at $15.5bn (implying a ~10x P/Sales multiple relative to the prior 2020 revenue target).

Downside risks include adverse regulatory shifts and intensifying competitive headwinds in online.

USD'm | |

TAL: Market cap | 27,610 |

(-) FY22E Online business @ 7x P/Sales | 14,552 |

= Offline Stub | 13,058 |

(/) FY22E Offline Sales | 4,263 |

Stub FY22E P/S (ex-online) | 3.1x |

Source: Company Filings, Author's Est

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.