Despite Declining Earnings And Revenue, Nuance Communications Has Rallied Sharply

Nuance saw its stock rally over 160% off its March low and it did so in a very steady and organized manner.

The company is set to report earnings on November 18 with earnings and revenue both expected to decline from 2019.

Sentiment toward the stock is mixed with short-sellers very bearish and option traders extremely bullish.

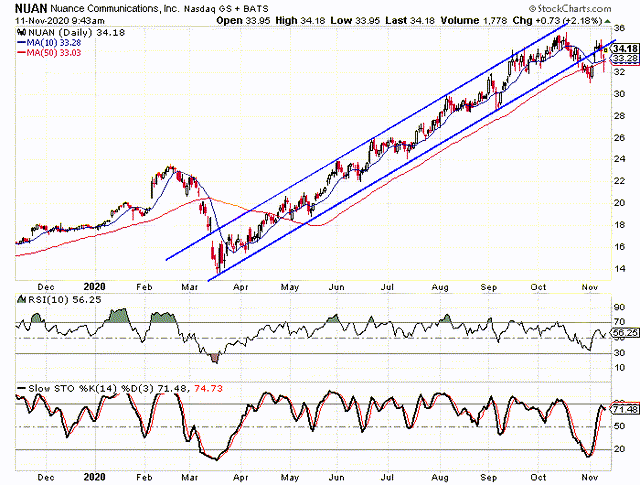

Nuance Communications (NUAN) experienced an incredibly steady and impressive rally off of its March low through mid-October. The stock rallied over 160% during that stretch and the biggest drawdown during that time was 10.8%. An upwardly sloped trend channel formed during the rally and we will look at that later. For now, I want to focus on the company and its upcoming earnings report.

Nuance is an artificial intelligence company whose products allow communication between humans and computers. Using natural language technology the software helps companies boost productivity and security. The company was originally founded in 1992 as ScanSoft, but the name was changed to Nuance Communications in 2005.

The company is set to report fiscal fourth quarter earnings results on November 18, after the closing bell and analysts expect the company to earn $0.16 per share for the quarter. The consensus estimate for revenue is $345.55 million.

Unfortunately, both the EPS and the revenue estimates are lower than what the company reported in Q4 2019. Last year the company reported EPS of $0.34 on revenue of $489.34 million. This means analysts are expecting earnings to drop by 52.9% and revenue is expected to drop by 29.4%.

That isn’t really what investors want to hear after such a big rally in the stock. The company has seen earnings decline by an average of 4% per year over the last three years and they dropped 10% in Q3 when compared to the previous year. Revenue has been declining by 8% per year over the last three years and it was also down 10% in the third quarter.

Analysts do see things getting better in 2021 with earnings expected to grow by 6.1% and revenue is expected to grow by 4%.

One area where Nuance does fare better is in its management efficiency measurements. The company’s return on equity is 13.5% and that is in the average range. The profit margin is 19.1% and that is slightly above average.

The current valuations on the stock are pretty high with a trailing P/E ratio of 55.3 and a forward P/E at 42.9. The company doesn’t pay a dividend at this time. These two factors, high valuations and no dividend could hurt the stock as it limits the types of investors it will attract. Value investors and income seekers will more than likely shy away from the stock.

A Beautiful Trend Higher

My wife makes fun of me when I call charts “beautiful.” What can I say, some people like beautiful pieces of art and I like beautiful charts. The chart for Nuance was beautiful from mid-March through mid-October. There was a very clear trend channel that defined the cycles within the overall upward trend and it was a very tight channel. Unfortunately, the stock just broke below the lower rail of the channel at the end of October.

Given the decline in earnings and revenue over the last few years and quarters, it’s hard to understand why the stock was rallying in such a steady fashion. Sure, the earnings reports in May and August beat the consensus estimates, but they still showed declines from the previous year.

When we look at the weekly chart, we see the trend channel and what it looks like from a longer-term perspective. The steepness of the rally really stands out compared to other rallies in the stock over the last few years. I even looked at a monthly chart that went back 20 years and this recent rally even stands out on the monthly chart.

At the March low, the 10-week RSI was close to oversold territory as were the stochastic indicators. Both of the indicators moved sharply higher from March through May and moved into overbought territory in June. The indicators would remain in overbought territory for over four months before dropping down slightly in the last few weeks.

Sentiment toward Nuance is Mixed

I wasn’t sure what to expect from the sentiment indicators given the mixed picture from the fundamentals and the technical analysis. The fundamentals are average in my view while the price performance has been well above average. With that backdrop, I should have expected a mixed sentiment picture as well.

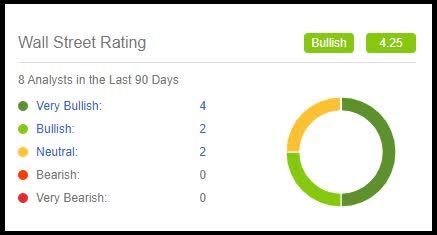

There are only eight analysts covering Nuance, but six of the eight have the stock rated as a “buy.” The other two have the stock rated as a “hold.” This gives us a buy percentage of 75% and that is right at the high end of the average range when compared to other stocks. The average buy percentage falls between 65% and 75%.

Short-sellers are pretty bearish toward Nuance with a short interest ratio of 8.75. The ratio jumped in the first half of October, but the bulk of the change was due to a big drop in the average daily trading volume. The short interest increased from 18.96 million shares to 19.16 million, but the average daily trading volume dropped by more than half. If the ratio had jumped due to a big increase in short interest, it would be more of an indication of increasing bearish sentiment.

Option traders are far more bullish on Nuance than short-sellers and analysts. There are 4,856 puts open and 23,514 calls open at this time. This gives us a put/call ratio of 0.21 and that is one of the lowest ratios I have seen in a long time. While the number of shares the open interest represents isn’t huge, such a low ratio is indicative of excessive optimism from this group.

What we see from these three indicators is an average buy percentage from analysts, excessive bearish sentiment from short-sellers, and excessive bullish sentiment from option traders. This essentially renders the overall sentiment picture neutral.

My Overall Take on Nuance Communications

As impressive as the rally from the March low was, I am having a hard time justifying why it happened. The simplest answer as to why a stock moves higher is the foundation of economics - more buyers than sellers. But the fundamentals for Nuance aren’t great and they aren’t expected to improve all that greatly in the next year. The fundamentals are what generally attract investors and would help explain why there were more buyers than sellers. For Nuance, it’s hard to attribute the rally to good or even improving fundamentals.

In some recent communications with subscribers of the Hedged Alpha Strategy, I described one of my investment philosophies. I believe you have to like the company the stock represents, but you also have to like the price you are paying. With Nuance, I am concerned about both the company and the price.

Seeing earnings and revenue decline over the last three years is a major concern to me because we were in an economic expansion until the virus hit in the first quarter. If the company is seeing declines during an economic expansion, what’s going to happen if the contraction continues?

Nuance has been able to beat EPS estimates in each of the last eight quarters and in most cases the stock moved higher after the report. We may see the stock move higher again after the upcoming earnings report, but I am not sold on Nuance being a stock I want to hold for the long term. The move the stock has made over the last seven months has made it overvalued by my estimations. Even earnings and revenue continue to decline, the stock is highly overvalued.

If you would like to learn more about protecting and growing your portfolio in all market environments, please consider joining The Hedged Alpha Strategy.

One new intermediate to long-term stock or ETF recommendation per week.

One or two option recommendations per month.

Bullish and bearish recommendations to help you weather different market conditions.

A weekly update with my views on the market, events to keep an eye on, and updates on active recommendations.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.