Travelers: The Discount Is Gone

Travelers Companies recently posted Q3 2020 earnings, which were better than expected.

The insurance company benefited from the stock market bounce-back on the investment side and generated higher underwriting gains for the third quarter.

The underwriting improvement was mainly due to $403 million pre-tax of Pacific Gas and Electric subrogation recoveries for California wildfires, and a lower combined ratio on the private business.

Before the results release, Travelers traded at slightly above 1x book value vs. the 1.2x book value it traded at prior to COVID-19.

Nonetheless, with the recent market rally, the discount went away, and Travelers is now traded at 1.17x book value.

Executive Summary

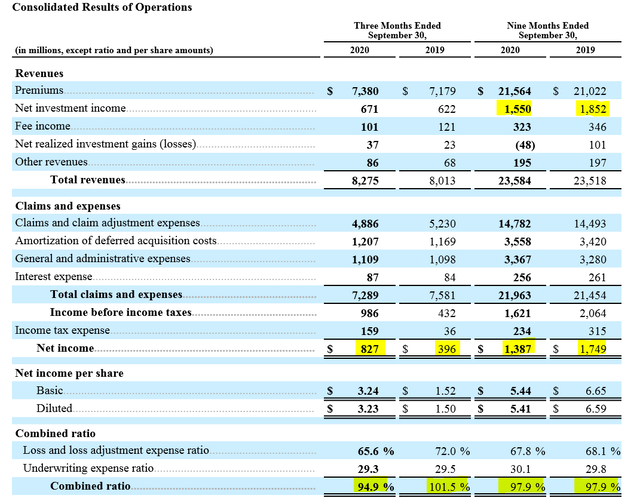

The Travelers Companies Inc. (NYSE:TRV) recently reported results for the third quarter of 2020. Quarterly net income more than doubled to $827 million. The company benefited from higher investment income, an improved combined ratio, and a low single-digit premium growth.

Even though the company launched tariff initiatives to improve the underwriting profitability of the portfolio, adverse prior-year reserve developments erased these efforts. In addition, investment income was insufficient to offset the drop in the underwriting gains.

On a year-to-date level, underwriting gains were at the same level as one year ago, with a flat combined ratio of 97.9%. The underwriting margins benefited from an improved underlying loss ratio and favorable prior year gains. These were partially offset by higher catastrophe losses, mainly occurring in Q2 and Q3 of 2020.

Although the insurer decided to stop repurchasing shares because of the uncertainties related to the COVID-19, the dividend policy remained unchanged, and every Travelers shareholder enjoys a 2.7% growing dividend yield.

In total, Travelers returned over $1.117 billion, including $471 million of share repurchases, or about 3.5% of the current market capitalization.

Although Travelers continues to be well-positioned to generate growing earnings that support its dividend-oriented strategy, I do not think paying more than 1.2 times book value is warranted, as the insurer will continue suffering from the low interest rate environment and the deteriorated underwriting margins of the business insurance portfolio.

Improved Overall Underwriting Margins, But Constrained Situations

Net income increased from $396 million in Q3, 2019, to $827 million in Q3, 2020. This was largely due to improved underwriting margins and slightly higher investment income.

Source: Travelers' Q3 2020 Report

In addition, Travelers benefited from a one-off effect, which affected the prior claims positively. Pacific Gas and Electric (PG&E) Corporation emerged from bankruptcy on July 1, 2020, and the Chapter 11 Plan of reorganization dated June 19, 2020 (the Plan) became effective. Hence, PG&E funded a trust from which Travelers and other subrogation claimants have received, and/or will receive, recoveries related to the 2017 and 2018 California wildfires.

In the third quarter of 2020, the insurer recognized a subrogation benefit related to these claims of $403 million and received payments from the trust of $366 million. The remaining $37 million should be pending.

On a year-to-date level, net income dropped by more than 20% to $1.38 billion, adversely affected by second quarter performance. The post-tax profit drop was mainly driven by the adverse effects from COVID-19, which impacted both insurance and investment portfolios, mostly during the second quarter of the year.

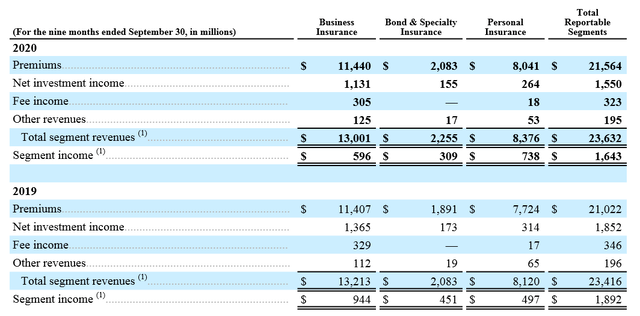

Segment-wise, the drop in the year-to-date segment income was largely due to the business insurance, while personal insurance recorded higher income, benefiting from the improved margins of the motor insurance businesses.

Source: Travelers' Q3 2020 Report

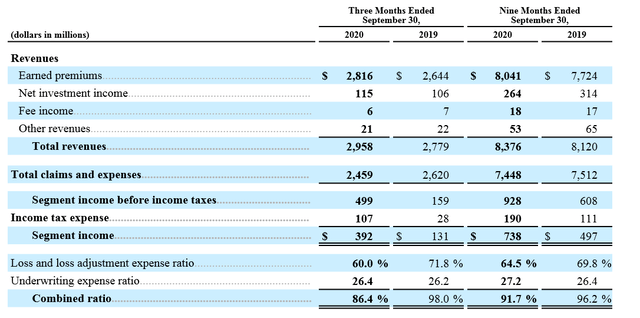

Personal Insurance

The personal insurance continued to benefit from the COVID-19 situation. The segment reported a quarterly combined ratio of 86.4% and year-to-date combined ratio of 91.7%.

Source: Travelers' Q3 2020 Report

Source: Travelers' Q3 2020 Report

The higher underlying underwriting margins primarily reflected the impacts of lower losses in the automobile product line due to a decrease in miles driven. This is attributable to COVID-19 related-economic conditions, and higher business volumes but is also partially offset by higher non-catastrophe weather-related losses, including losses from wildfires, in the homeowners, and other product line. Travelers continued to reprice its homeowners' insurance portfolio, as an 8.2% price increase was observed on the renewed policies during the third quarter of 2020.

Although catastrophe costs represented an adverse contribution of 11.3 points on the personal insurance business's combined ratio, Travelers succeeded in improving significantly the profitability of the private insurance segment, which was not the case for the business insurance portfolio.

Business Insurance

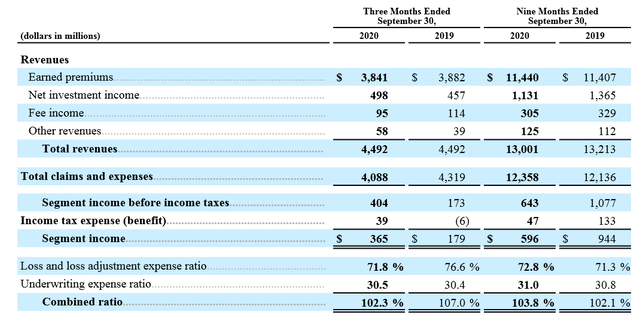

The business insurance portfolio has continued to struggle with underwriting margin issues.

Source: Travelers' Q3 2020 Report

The commercial insurance segment experienced $59 million in underwriting losses, resulting in a combined ratio of 102.3%.

YTD, the combined ratio deteriorated by 1.7 points, primarily driven by higher catastrophe losses, which accounted for 5.8 points of the 9M2020 combined ratio, vs. a 3.7-point impact for 9M2019.

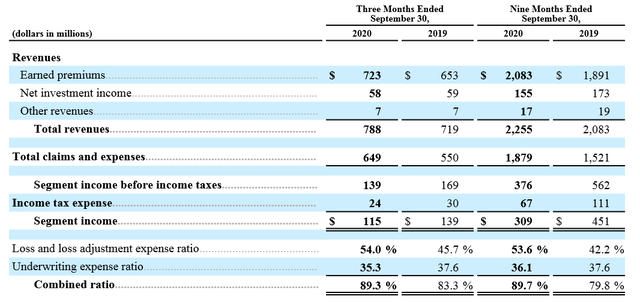

Bond & Specialty Insurance

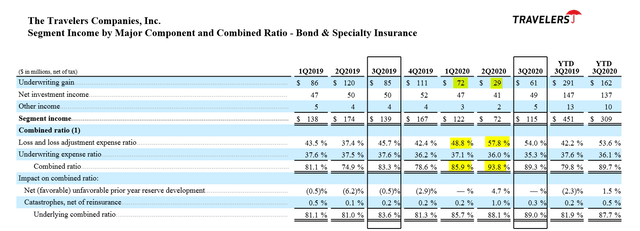

The bond and specialty insurance segment is the most profitable business of Travelers' insurance portfolio. The combined ratio used to oscillate between 85% and 90% over the years. During the two prior quarters, the segment posted lower underwriting gains, resulting from higher loss ratio.

Source: Travelers' Q3 2020 Financial Supplements

For the third quarter of 2020, the specialty segment recorded a combined ratio of 89.3%, resulting in an underwriting gain of $61 million, or $24 million lower than in Q3 2020.

Source: Travelers' Q3 2020 Report

In total, this segment recorded a year-to-date underwriting gain of $162 million, or an almost 45% drop compared to the same period one year ago. The lower underlying underwriting margins primarily reflect the impacts of higher loss estimates for management liability coverages, including the impact of COVID-19 and related economic conditions, partially offset by higher business volumes.

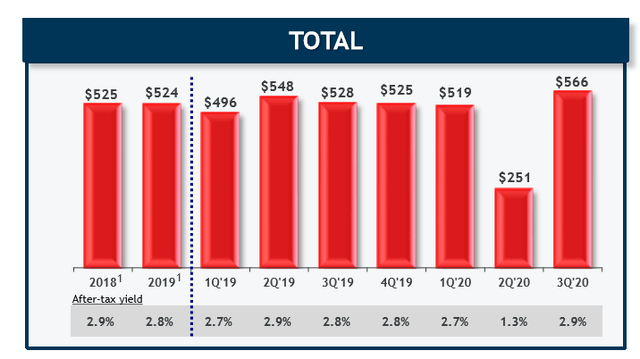

The Investment Portfolio: A Bounce Back In Q3 But Some Concerns for 2021

As I have repeatedly written in many articles, P&C insurers need to focus more on underwriting excellence. For Travelers, the investment portfolio performs a sort of lifeguard duty. When the insurance portfolio suffers from adverse impacts (major catastrophe losses in 2017, an increase in asbestos claims, and environmental reserves in 2019 and 2020), investment gains frequently help save the day.

In Q3 2020, Travelers' investment portfolio did well, income more than doubled compared to Q2 2020 and increased by about 7.2% from Q3 2019.

Source: Travelers' 2020 Q3 Presentation

For Q4 2020, the company expects that after-tax net investment income from the fixed income portfolio will be approximately $35 million to $40 million lower in the fourth quarter of 2020 as compared to the corresponding quarter of 2019.

In 2019, the fixed income portfolio generated a post-tax income of around $1.86 billion. Based on the company's expectations, that portfolio might generate an FY2020 income after tax of about $1.76 billion.

Last but not least, Travelers expects that after-tax net investment income from that portfolio will be approximately $420 million to $430 million for each quarter of 2021, or $1.68-1.72 billion on a full-year view. Unfortunately, as with almost all insurers, Travelers will continue to suffer at the hands of a low interest rate environment.

Dividend and Share Repurchases

Travelers' capital allocation strategy is straightforward, emphasizing the distribution of capital to shareholders. Over the years, the company has consistently returned billions to shareholders via share buybacks and dividends.

Because of the COVID-19 situation, the company decided to stop repurchasing shares, starting Q2 2020. Hence, there was no share buyback during the third quarter. Nonetheless, the insurer maintained its dividend at $0.85 per share. The $643 million paid to shareholders was covered by company earnings of $1.39 billion of net income. In my opinion, the dividend is not endangered, and Travelers will continue rewarding shareholders' loyalty by paying a growing dividend over the years.

Investor Takeaways

Q3 2020 results were driven by the underwriting margin improvement, boosted additionally by the one-off effect from PG&E's bankruptcy.

As expected, the company benefited from the market bounce back, which affected the equity portfolio positively.

Although the commercial insurance portfolio continued struggling with profitability issues, the personal and specialty segments, maintained profitability. Even better, the personal insurance business benefited from a decrease in miles driven and the tariff increases initiated in prior quarters.

However, Travelers, like all insurance companies, will continue to struggle in a low interest rate environment, which is expected to continue for the foreseeable future.

Even though I will not invest in Travelers for the moment, the company is worth following.

One Last Word

If you found this article interesting or helpful, it would be greatly appreciated if you "Follow" me by clicking the button at the top, or if you "Like this article" below, as this will help me in building an audience and continuing to write on SA. If you want to share your opinion or perspective, you are also very welcome to comment below. Happy investing!

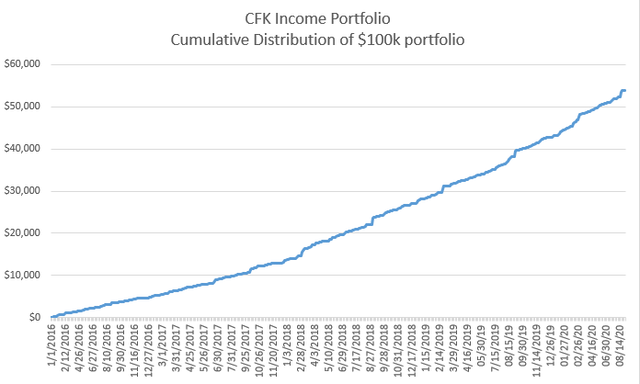

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% - 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio's price can fluctuate, the income stream not so much. Start your free two-week trial today!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.