Duke Realty Corp.: Ride The Secular Tailwinds Of E-Commerce

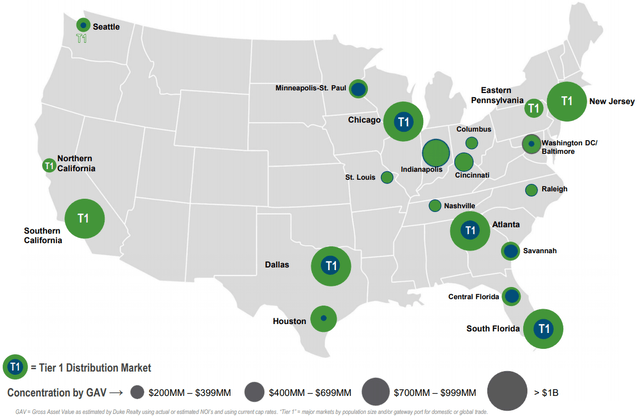

Duke Realty Corp. has a high-quality portfolio that is mostly located in Tier 1 markets.

It continues to post strong operating results, and is poised to benefit from the secular tailwinds of e-commerce.

While the shares are not exactly cheap, I see it as being a wonderful company trading at a fair price.

Duke Realty Corp. (DRE) shares did not react well to the news of a vaccine on November 9th, as the share price fell by nearly 5% from the end of trading on November 8th to end of trading on November 9th. Apparently, Wall Street believes that the end of the pandemic would harm Duke Realty’s growth prospects. In this article, I show why this may not be the case and what makes it an attractive long-term investment. So, let’s get started.

(Source: Company website)

A Look Into Duke Realty Corp.

Duke Realty Corp. is a self-managed REIT that has a rather simplistic business model of owning and managing U.S. industrial assets. It has over 800 tenants, and 156 million of gross leasable space across 518 properties. Duke Realty is also a member of the S&P 500 and has a 25+ year history as a public company. As seen below, it’s well-diversified geographically, with a presence in 20 markets. By 2021, management expects that 70% of its geographic focus will be on Tier 1 markets.

(Source: September Investor Presentation)

Duke had a rather strong Q3, with a revenue beat and FFO/share that was in line with analyst expectations. Revenue grew by 8.6% YoY, and importantly, Core FFO per share grew by 8.1% YoY, from $0.37 in Q3’19 to $0.40 in the latest quarter. The rent collection rate also remained very strong with a 99.9% collection rate for the third quarter, and portfolio occupancy remained strong at 95.6%.

I’m also encouraged to see that same-property NOI grew by 5.0% YoY during Q3. This is far higher than the pace of inflation and tells me that Duke Realty is benefiting from favorable supply and demand characteristics in its markets. Looking forward, I see strong external growth prospects for the company. This is supported by the four development projects that Duke currently has underway, totaling $261 million, which management noted as having solid value-creating margins. Plus, as management noted during the recent conference call, its pipeline of build-to-suit projects is now back above pre-COVID-19 levels.

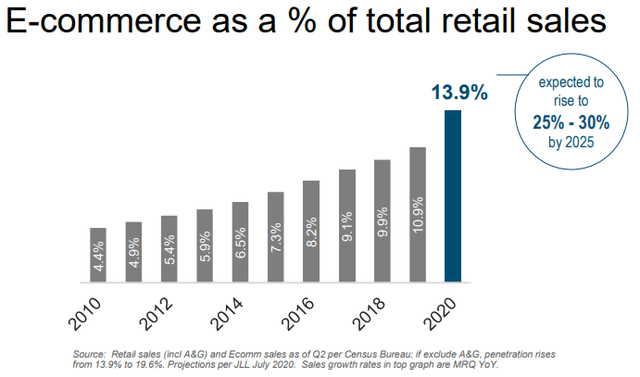

As noted earlier in the article, one of the risks to Duke Realty Corp. is a slowdown in e-commerce growth due to progress on a vaccine. I don’t share the same view, as I believe the current pandemic has fundamentally changed some consumer behaviors that benefit the secular trend towards e-commerce. As seen below, per the U.S. Census Bureau, e-commerce now comprises nearly 14% of total retail sales and is projected to rise to 25-30% by 2025.

(Source: September Investor Presentation)

In addition, according to CBRE (CBRE), e-commerce requires approximately 2.5x the square footage of logistics vs. bricks-and-mortar. As such, I see higher incremental demand for industrial properties for any drop in supply of traditional brick-and-mortar, and this should benefit Duke Realty.

Meanwhile, Duke Realty maintains a strong balance sheet, with a BBB+ credit rating from S&P. Its Q3 annualized debt-to-EBITDA stood at just 4.6x, which is far below the 6.0x that I generally consider to be safe for REITs. It also maintains plenty of liquidity, which, at $1.2 billion, includes over $1.1 billion in undrawn capacity on its revolving line of credit.

Valuation

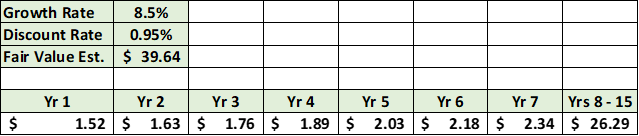

Turning to valuation, I wanted to calculate a fair value for the shares based on a Net Present Value model, with the following inputs:

Starting Core FFO/Share: $1.52 - based on midpoint of 2020 guidance

Perpetual Growth Rate: 8.5% - a slightly higher growth rate than the 8.1% YoY growth during Q3

Discount Rate: 0.95% - based on the current 10-year Treasury rate. I use this for well-established REITs with very low risk (i.e., no pandemic risk)

Holding Period: 15 years (based on generally accepted P/E or P/FFO of 15)

(Created by author)

As seen above, I calculated a fair value of $39.64, which sits just slightly above the current share price of $39.57. Wall Street analysts have a higher average price target of $42.80, which equates to an 8% upside.

Investor Takeaway

Duke Realty Corp. posted strong Q3 results, with both top line revenue and FFO/share growth. The latest operating metrics suggest that it’s benefiting from favorable supply and demand characteristics in its key markets. The development pipeline is now back above pre-COVID-19 levels, and I see long-term secular trend of e-commerce growth as being intact. Meanwhile, management expressed confidence in the company’s prospects with the recent 8.5% dividend raise.

Plus, I see the 2.6% dividend yield as being safe, with a payout ratio of just 64% (based on annualized Q3 Core FFO of $0.40). As the valuation exercise showed, the shares are currently trading just under my fair value estimate. While Duke Realty is not a bargain, I see this as being an opportunity to “buy a wonderful company at a fair price”. As such, I see the shares as a buy for both income and growth.

Thanks for reading! If you enjoyed this piece, then please click "Follow" next to my name at the top to receive my future articles. All the best.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.