Lakeland Industries: Significant Upside With Bullish Trends Beyond The Pandemic

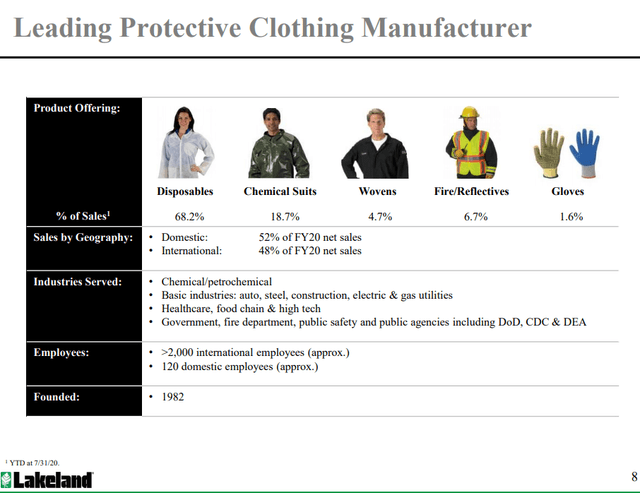

Lakeland Industries has had a record year for sales and earnings given the boost in demand for PPE during the pandemic.

The company is a leader in specialty safety equipment for various industries beyond healthcare which remain growth markets with a positive long-term outlook.

We are bullish on shares considering overall solid fundamentals and a cheap valuation with upside to earnings in 2021.

Lakeland Industries Inc. (NASDAQ:LAKE), with a market cap of $150 million, is a U.S.-based manufacturer of specialty safety garments and accessories. The segment has had high visibility this year given the importance of personal protective equipment (PPE) during the COVID-19 pandemic. Indeed, Lakeland has benefited from strong demand and record sales driving the stock up over 75% year to date. While shares have pulled back recently considering an expectation that a COVID-19 vaccine may limit the demand for PPE in 2021, we believe the company maintains a positive outlook with overall solid fundamentals. Comments by management suggest the company has been manufacturing products at near capacity, and we expect the growth momentum across its various products to remain supported beyond the pandemic. We are bullish on LAKE, which trades at an attractive valuation with significant upside over the next year.

(Source: Seeking Alpha)

Company Financials Recap

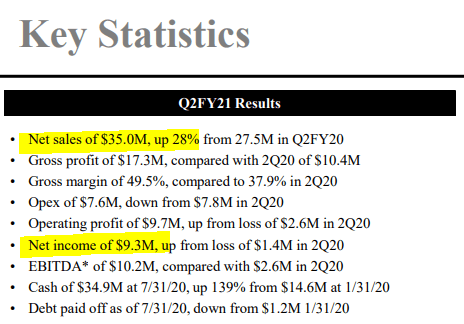

Lakeland Industries last reported its fiscal 2021 Q2 results back in September with GAAP EPS of $1.16, which beat expectations by $0.85. Revenue of $35 million in the quarter was up 28% year over year, and also ahead of estimates. It was a blowout quarter for the company, which was able to capture the strong demand for its PPE disposable garments and protective safety equipment.

(Source: Company IR)

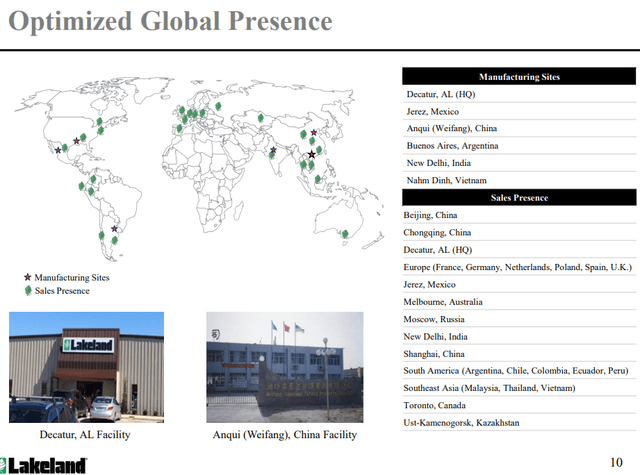

Management explains that the gross margin at 49.5%, up from 37.9% in the period last year, benefited from the combination of top line momentum and greater capacity utilization. The company has expanded production by running its factories at near capacity for 12 hours a day, six days a week across six global sites this year. Impressively, total operating expenses were slightly lower on a year-over-year basis, which helped drive the improved profitability, as the operating margin reached 27.8%, up from 9.6% in Q2 fiscal 2020.

(Source: Company IR)

It's worth noting that only about 35% of the sales in the quarter were directly related to COVID-19 demand, which is important considering the broader business is still larger and can support growth beyond the pandemic. Certain product lines have been suspended this year as the company shifted to COVID-19 specific equipment, creating an order backlog at the end of the July quarter. Lakeland Industries intends to gradually shift production going forward depending on market trends citing continued demand for its other products. The result is that the company believes it can maintain elevated margins and high factory utilization rates. From the Q2 2021 conference call:

We have not yet resumed production of a number of disposable and chemical SKUs or product variations that had been curtailed or eliminated in the first quarter, but anticipate that we will begin to slowly add additional SKUs in the coming quarters. The reintroduction of these products to our manufacturing schedule will be metered and managed so that we emerge from COVID-19 with a rationalized product offering that preserves the majority of the manufacturing efficiencies we have realized and the resultant impact on margins. This rationalization means that we expect to offer far fewer products than we have previously. This streamlining has led to reduce customer lead times, more efficient and higher volume manufacturer, stronger gross margins and improve inventory turns.

The comments here imply that if and when the COVID-19 related demand winds down, Lakeland Industries can transition back towards its broader product portfolio with applications for industry verticals like oil and gas production, auto manufacturing, chemical processing, and even fire-fighting protective equipment. The international market, which represents about half the business, is also seen as a growth driver.

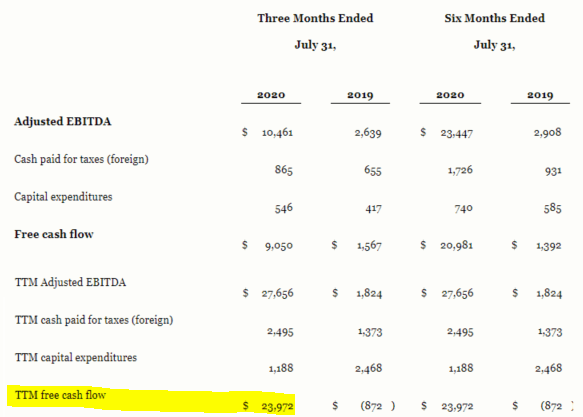

(Source: Company IR)

Finally, we highlight that Lakeland Industries ended the quarter with $35 million in cash and equivalents against zero long-term debt. For context, the company has generated nearly $9.1 million in free cash flow during the last quarter and $24 million over the past. The fundamentals are strong, in our opinion.

(Source: Company IR)

Management Outlook and Consensus Estimates

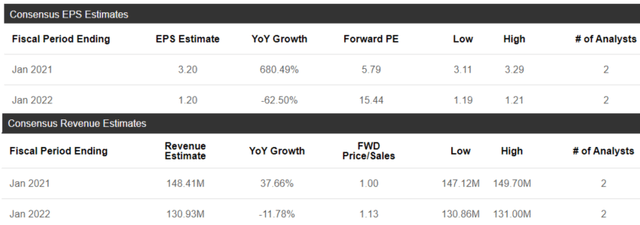

While the company does not offer official forward targets, there is an expectation that the current financial momentum should continue including the firming margins. According to consensus estimates, Lakeland Industries is on track to reach $148 million in revenue this year, representing a 38% y/y increase from fiscal 2020. A forecast for EPS of $3.20 is a significant improvement compared to $0.41 in fiscal 2020.

(Source: Seeking Alpha)

For fiscal 2022, there is an expectation that revenue may decline 12% to $131 million, while EPS pulls back to $1.20 presumably as the pandemic-related boost fades. That being said, keep in mind that these levels are still higher compared to fiscal 2020, and our view is Lakeland Industries is well-positioned to outperform these expectations. The broader point is that the company is profitable with a long history of steady growth we believe can continue.

Data by YCharts

Data by YCharts

Analysis and Forward-Looking Commentary

We're covering LAKE today because the stock is now down nearly 34% from its recent high back in August, which we believe is unjustified and doesn't reflect the underlying dynamics. On one hand, the latest development has been an announcement by Pfizer Inc. (PFE) that trial data for its COVID-19 vaccine appears to be highly effective and the company will seek an emergency authorization as early as this month. While this is great news and we're all hoping the pandemic can end as soon as possible, the reality is that it's likely many months before wide-scale global distribution can begin to have a noticeable effect on eliminating the virus. At present, coronavirus infections and fatalities continue to mark new records, which suggests demand for PPE likely remains at a high level.

As it relates to Lakeland Industries, we believe the company is well-positioned to capture the tail-end of the pandemic through next year. There is also a dynamic where government agencies may look to restock supplies and inventories in preparation for the next "public health crisis" supporting the overall market for PPE. With an end to the pandemic on the horizon, other segments for Lakeland Industries that utilize the specialized safety equipment and protective garments are likely to drive demand based on improving macro conditions. Investors should recognize that the applications for these products go beyond infectious disease protection with end-users in various industries. The company counts on major corporations as key customers.

(Source: Company IR)

Valuation Check

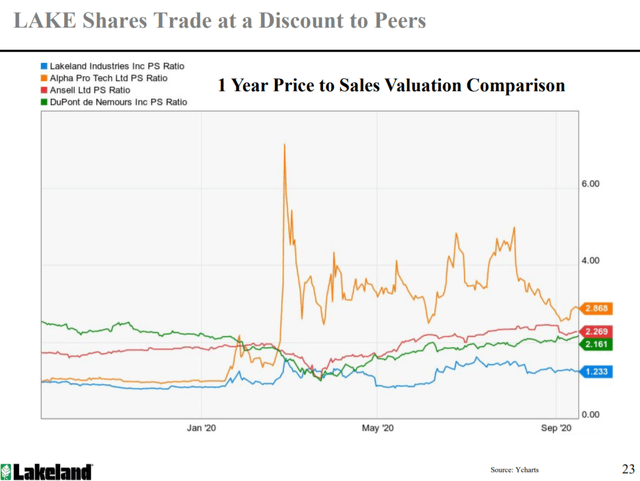

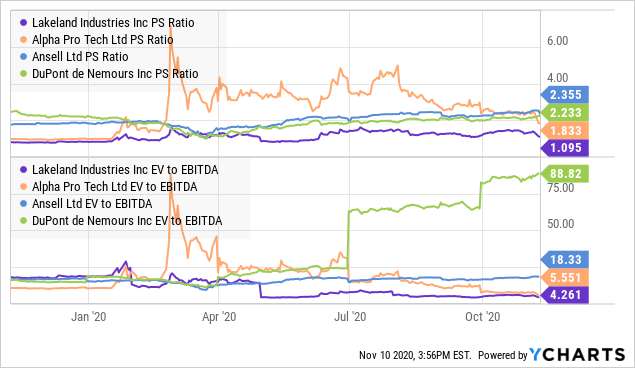

In terms of valuation, the metrics we're looking at, including a current P/E of 7.4x and price-to-free cash flow of 5.2x, suggest Lakeland is fundamentally undervalued. In our opinion, considering the solid balance sheet with no long-term debt and a long history of consistent profitability, there is no reason to see why the stock should be this cheap. Again, this is in the context of 28% revenue growth in the last quarter and record profitability. Lakeland Industries' investor presentation highlights that the stock also trades at a discount to peers in terms of its price-to-sales ratio.

(Source: Company IR)

Compared to protective equipment manufacturers Alpha Pro Tech Ltd. (APT) and Ansell Ltd. (OTCPK:ANSLY), along with large-cap diversified DuPont de Nemours Inc. (DD), identified by the company as comparables, LAKE trading at a P/S of 1.1x is well below the average for the peer group considering APT at 1.8x, ANSLY at 2.5x and DD at 2.2x. LAKE's EV-to-EBITDA multiple of 4.3x is also below the average for the group.

Data by YCharts

Data by YCharts

To be clear, while each of these companies has a different business model and is not necessarily directly comparable, the point here is that Lakeland Industries offers a significant upside, should the valuation spread converge higher to the group average. One explanation we offer as to why shares of LAKE trade at a deep discount is simply the low profile of the company and potentially misunderstood growth opportunity. There may also be some skepticism that the growth momentum can be maintained beyond next year. In our view, this is more than just a "pandemic stock" and the company is on track to consistently generate higher earnings.

Final Thoughts

There's a lot to like about Lakeland Industries as a high-quality small cap with solid fundamentals, a strong balance sheet with no debt, consistent profitability, impressive growth, and long-term tailwinds. We rate shares of LAKE as a Buy, with a price target of $25 for the next year representing 35% upside from the current level. We believe the market is too bearish on the company's long-term outlook and current estimates for growth and earnings are too low.

While a date has not been confirmed, we expect the company to next report its fiscal Q3 earnings in early December, which could be a catalyst for the next leg higher in the stock. A strong report, coupled with positive comments by management, could support renewed bullish sentiment in the stock.

Risks here beyond a deterioration to the global macro environment include any indication that demand for COVID-19-related PPE has significantly been reduced in the near term, which we don't believe to be the case. Monitoring points include the trends in financial margins, which we'll be watching as an indication of pricing power in the operating environment. A softer quarter for growth and earnings could likewise pressure the stock, forcing a revision lower to long-term estimates.

Add some conviction to your trading! We sort through +4,000 ETFs/CEFs along with +16,000 U.S. stocks/ADRs to find the best trade ideas. Click here for a two-week free trial and explore our content at the Conviction Dossier.

Disclosure: I am/we are long LAKE. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.