The S&P BSE Sensex continued its northward journey gaining +4.1% in October 2020, after retracing -1.5% in the previous month. The reduction in numbers of new COVID-19 cases and active cases was a positive signal for the Indian equity markets. Overall, sentiments seemed hopeful that with phase-wise unlocking and easing COVID-19 restrictions, the Indian economy would recover faster from the contraction.

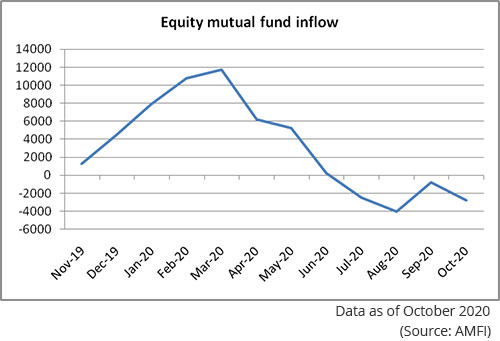

Domestic Mutual Funds, however, continued to be net sellers for the fifth consecutive month in the Indian equity market. Their net sales were to the tune of Rs 16,027 crore as against Rs 2,596 crore in the previous month after being concerned with the valuations and not ruling out a second wave of coronavirus in the winter months. Additionally, concerns on who wins the U.S. Presidential elections and that economic recovery may not be very smooth for the world given the headwinds at play.

--- Advertisement ---

Your FREE GIFT Goes "Bye-Bye" in Just 36 Hours...

Are you coming to the No.1 Stock - 2021 MEGA Summit tomorrow?

Because there are so many bonuses in store for you...

... Including a FREE COPY of 'Small Caps That Will Race Ahead of the Sensex.'

Written by our top analyst Richa Agarwal, this premium guide is one of our most important works since 1996.

And it contains details of smallcaps stocks that could potentially beat Sensex well over its race to the 100,000 mark.

Proper Use of This Guide Could Possibly Make You Incredibly Wealthy in the Long Run.

This Guide Currently Sells for Rs 950, But You Can Get It for 100% FREE as Soon as You...

Sign Up for Richa's No. 1 Stock - 2021 MEGA Summit by Clicking Here.

This exclusive MEGA Summit is happening tomorrow at 5 PM IST... and reveals Richa's special investing system that she uses to find out stocks with crorepati-making potential...

PLUS, the details of her No.1 stock for 2021 that could potentially make you a crorepati in the long run.

However, only 36 hours are left before the registrations finally close down...

Make sure to grab your FREE Seat right now...Yes, Reveal to Me the No.1 Stock for 2021

------------------------------

After the markets scaled up +50% since March 23 low (the sharpest recovery compared to its global peers), redemption pressures bogged down fund managers. Naturally, Investors preferred to take their money off the table amidst the economic uncertainty looming.

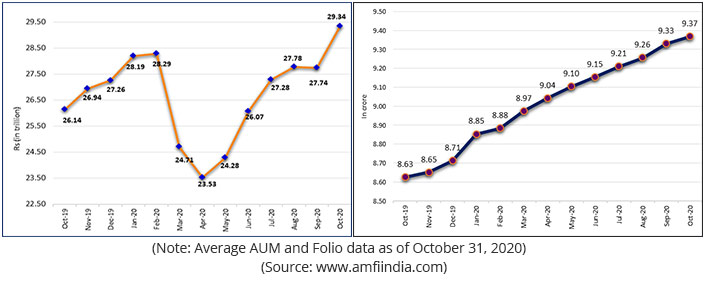

The Average AUM of the Indian mutual fund industry has increased by +2.2% from the previous month because of the market function. However, equity-oriented funds continued to witness outflows for the fourth month in a row to the tune of Rs 2,725 crore in October 2020.

Among the equity-oriented funds, multi cap funds witnessed the highest outflows. Sharp underperformance rate and uncertainty regarding SEBI's guidelines on definition of multi cap funds could be the reason behind outflows in the category. Large cap funds and value funds were among the other categories that witnessed high outflows.

Nonetheless, Systematic Investment Plans (SIP), a worthy mode of investing in mutual funds regularly to plan for financial goals, registered higher inflow compared to the previous months and SIP AUM grew. Plus, SIP folios rose to 3.37 crore. On this... here's what AMFI CEO, N S Venkatesh said:

"Rise in both SIP Contribution and SIP AUMs during October 2020 and continued slowing outflow in equity schemes reinforces the retail investor confidence in the mutual fund as an asset class. This trend is reflective in the economy improving further with green shoots amply visible - attractive interest rates, rise in GST Collections, digitalisation-driven efficiencies making Indian corporates healthier, conducive Government of India policy for attracting FDI and continued surge in FII investment coupled with favourable geopolitical scenario would continue to keep Indian equity markets an attractive investment destination over a long term."

--- Advertisement ---

It's time to load up on this defence stock

Our co-head of research, Tanushree Banerjee, has uncovered a huge opportunity in defence.

Our co-head of research, Tanushree Banerjee, has uncovered a huge opportunity in defence.

She has identified a high-potential defence stock.

And she believes, it's a MUST HAVE stock in your portfolio.

This single stock could possibly offer 10x gains to investors in the long run.

Click here to learn more...

------------------------------

The trailing 12-month P/E of the S&P BSE Sensex and the S&P BSE large-cap index is over 29x and 30x, respectively. These levels certainly look expensive as against the sub-20x levels at the end of March 2020.

The S&P BSE Mid-cap and S&P BSE Small-cap Indices have moved up valuation wise with the broader market. Hence, the margin of safety in the small and mid-cap segments has narrowed. With looming economic uncertainty, these market cap segment will be vulnerable and attract high risk.

For the mid-and-small-caps to perform well, broader macroeconomic recovery is necessary. The unprecedented pandemic situation we are facing today is already weighing on the economy and smaller companies are likely to be more vulnerable. Moreover, highly leveraged companies may find it difficult to service their loans (considering many of them are still not functioning at optimal levels).

REVEALED: How to Unlock Almost 3x More Gains Post the Corona-Crisis...

The above backdrop may also weigh on the performance of equity-oriented mutual funds subject to their portfolio characteristics. Therefore, set realistic post-tax return expectations from your investment portfolio. Do not get caught in the earnings trap (where often the near-term estimates are toned down while the future earnings estimates are increased).

If your investment objective is wealth appreciation and you have long-term financial goals to address, want to clock an appealing real rate of return that could counter inflation, have a high-risk appetite, have sufficient time horizon (at least 5 years), equity mutual funds are a suitable avenue.

Given that the markets have scaled up over 45% since the March-23-low and intense volatility cannot be ruled out, take exposure to only worthy diversified equity funds, either directly or via the equity-oriented Fund of Fund scheme in a staggered manner. Remember that selecting schemes prudently will play a crucial role even as you decide to SIP into mutual funds.

Under the given circumstances, the performance of equity-oriented mutual fund schemes, particularly the mid-and-small cap funds, could be susceptible. The large-cap funds, on the other hand, maybe a little more stable.

In the current scenario, it would be wise to diversify across market capitalisation via multi-cap funds, while holding some proportion of your equity allocation in large-cap funds as well as mid-cap funds.

This is because large caps are established names and the biggest advantage of having them is the stability they can provide to your portfolio. Large-cap funds should ideally be a part of the core holdings of your portfolio. Whereas to clock higher returns by assuming very high risk, mid-cap funds can be a part of your satellite portfolio provided you have an investment time horizon of over 5-7 years.

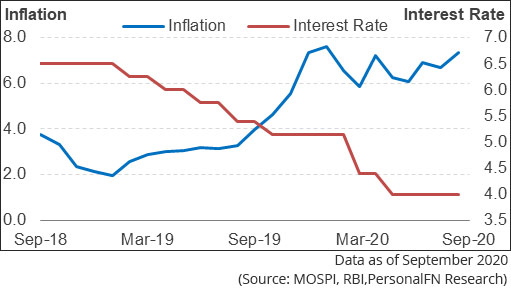

On the debt mutual fund side, net inflow to the tune of whopping Rs 1.1 lakh crore was reported after outflow in the previous month. All debt mutual fund sub-categories except Long Duration Funds and Credit Risk Funds reported net inflow in October.

Shorter Duration and Money Market Funds in particular reported sizeable net inflows amidst the current interest rate scenario and the flight to safety witnessed over the last few months. The inflow in Gilt Funds was toned down as the rate cut cycle seemed to have almost bottomed out.

Overall it appears that the present interest rate cycle has bottomed out. Most of the rally at the longer end of the yield curve has already come about since the time RBI started reducing policy rates. So, the longer end of the yield curve thus could prove less rewarding and riskier (may encounter high volatility) in the foreseeable future.

You'll be better off deploying your hard-earned money in shorter duration debt mutual funds. Cautiously approach even short-term debt funds with your eyes wide open and pay attention to the portfolio characteristics and quality of the scheme. A fact is, many debt mutual funds across maturity profiles are grappling with downgraded, toxic debt papers which heightens the investment risk. Do not approach debt mutual funds looking at the brand value.

Yield hunting by debt fund managers by compromising on the quality of debt papers to clock high returns can imperil your hard-earned money as the investment risk is also high-to-very-high. Since SEBI allowed side-pocketing in December 2018, fund managers have created several side-pockets for the recovery from toxic debt papers held in the portfolio.

Due to the COVID-19 lockdown and slow economic activity, recovery of this money has been impacted. And with the government announcing a halt on fresh insolvency cases for at least six months, the credit crisis continues to loom. There could be many instances of defaults happening if COVID-19 crisis continues to impair livelihoods of people and if the economy contracts.

Do note that the COVID-19 crisis has amplified the credit risk (owing to a slowdown in business). Hence, stick to debt mutual funds where the fund manager does not chase yields by taking higher credit risk.

In the current scenario, it would be imprudent to invest in debt mutual fund schemes whose underlying portfolios are compromised with low rated papers of private issuers. As far as possible, avoid Credit Risk Funds as they are likely to be more vulnerable amidst the financial crisis followed by COVID-19 pandemic. Remember, investing in debt funds is not risk-free.

At present, you would do better going with only a pure Liquid Funds and/or Overnight Fund that does not have exposure to private issuers. Assess your risk appetite and investment time horizon while investing in debt funds. Lastly, prefer the safety of your principal over generating returns.

Alternatively, if you prefer to keep your capital safe, opt for bank fixed deposits, but choose the bank carefully.

Sensible and astute investment strategy paves the path to wealth creation and is always good for your long-term financial well-being.

PS: If you wish to select worthy mutual fund schemes, consider subscribing to PersonalFN's unbiased premium research service, FundSelect. Each fund recommended under FundSelect goes through our stringent process, where funds are tested on both quantitative as well as qualitative parameters.

Every month, PersonalFN's FundSelect service will provide you with insightful and practical guidance on equity mutual funds and debt schemes - the ones to Buy, Hold, or Sell. Click here to subscribe to PersonalFN's FundSelect service.

Author: Divya Grover

This article first appeared on PersonalFN here.

PersonalFN is a Mumbai based personal finance firm offering Financial Planning and Mutual Fund Research services.

The views mentioned above are of the author only. Data and charts, if used, in the article have been sourced from available information and have not been authenticated by any statutory authority. The author and Equitymaster do not claim it to be accurate nor accept any responsibility for the same. The views constitute only the opinions and do not constitute any guidelines or recommendation on any course of action to be followed by the reader. Please read the detailed Terms of Use of the web site.

Investing in this smallcap could open doors of huge, long-lasting wealth.

Keep me in your thought's dear viewers!

SEBI has introduced Flexi Cap Fund as a new category under equity schemes that can invest dynamically across large cap, mid cap, and small cap stocks.

If you could invest in one stock in 2021, which would be it?

The financial markets were signalling change in the White House as far back as July. This is how I spotted it.

More Views on NewsWill Joe Biden be good or bad for the markets if he becomes the next US president?

In this video, I present my top 5 ideas for traders this festive season.

Oct 29, 2020The two main traits of HDFC Bank that smallcap investors need to follow.

Ajit Dayal on why you shouldn't let your guard down as an investor.

What should be your action plan in view of the Nifty PE reaching an all-time high?

More

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!