CyberArk: Business Model Transition Hurts

CyberArk dipped below $100 as Q3 results missed revenue estimates.

Their financials are suffering from a quick shift to recurring revenue streams away from perpetual licenses.

The stock isn't exactly cheap at $100 trading at over 40x '21 estimates.

CyberArk is a buy here, but the stock might provide a better entry point in early '21 as the business model transition reaches a tipping point.

For a while now, CyberArk (NASDAQ:CYBR) has been a good stock to buy on weakness. The cybersecurity specialist is now facing the transitional headwinds of shifting to a recurring revenue stream. My investment thesis remains bullish on the stock below $100, while this shift will make for a volatile stock heading into 2021.

Image Source: CyberArk website

Recurring Revenues

Anybody just needs to look at the most valuable stock in the world to understand how recurring subscriptions impacts revenues and market valuations. Apple (AAPL) saw their valuation multiple double and triple as the Services business became a larger part of the company as the consistent growth was rewarded by investors.

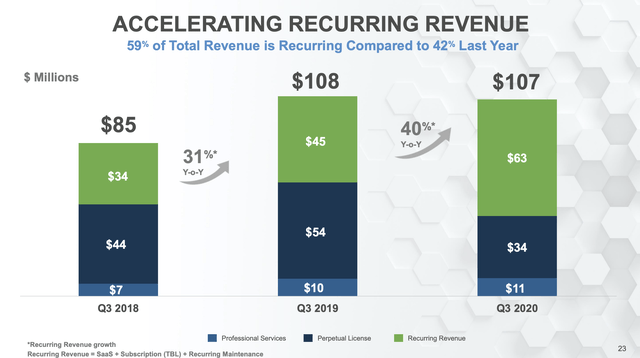

Unfortunately, CyberArk is still going through the transition. In 2018, the company had 40% of total revenues as recurring, and the figure reached 59% in the last quarter.

Source: CyberArk Q3'20 presentation

Over 45% of Q3 license bookings were SaaS and subscription in Q3, up from just 10% last year. Even seven of the top 10 license deals were recurring revenue deals last quarter.

The company estimates the shift to subscription deals caused a $14 million revenue headwind in the quarter, up from just $9 million in the prior quarter. CyberArk ended the quarter with annual recurring revenue of $250 million, up from just $178 million last Q3.

Eventually, the market will reward these measures. In the short term, though, CyberArk will move ahead with an even more aggressive transition to recurring revenue models by actually incentivizing both the sales department and customers to make the shift in 2021.

Per CFO Josh Siegel on the Q3 earnings call:

...in January, we are also implementing a comprehensive strategy to support our transition, which includes modifying our compensation plans to further incentivize the team to sell recurring revenue, rolling out attractive subscription packages, strengthen our customer success culture and team to ensure long-term sustainable growth, and shifting our reporting and financial systems towards a recurring revenue model, as demonstrated by the introduction of ARR and mix of percent bookings.

Even the Q4 guidance was greatly impacted by the headwinds of the subscription models. Adding back the $18 million headwinds, revenues for the quarter would approximate $143 million to $153 million, up from $130 million last Q4.

For the fourth quarter of 2020, we expect total revenue of $125 million $135 million, which assumes about $18 million in revenue headwind from our increased mix of SaaS and subscription bookings projected for the fourth quarter of 2020.

Last Q4, CyberArk generated $130 million in revenues for a solid 19% growth. The cybersecurity company has seen reported growth dip from greater than 30% back in early 2019 to no growth now. Without the $14 million headwind in Q3, the company could've reported revenue growth of 11.6%, providing a completely different story for investors.

The $18 million Q4 headwind prevents what otherwise would be 14.2% growth. While analysts still appear bullish on the stock, these headwinds will hold back CyberArk until the company is back to reporting actual growth.

Trend Change

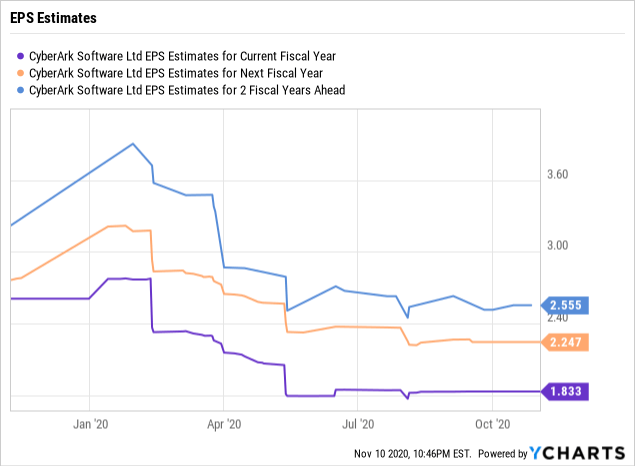

Due to COVID-19 impacts and the transition to recurring revenues, CyberArk is only expected to earn $1.83 per share this year. The stock still appears expensive up here near $100 with 2021 EPS targets at only $2.25.

Data by YCharts

Data by YCharts

The company earned $2.77 last year, so plenty of upside potential exists as recurring revenue streams kick in over the next year. The shift from the upfront perpetual license revenue is a short-term impact, especially on earnings. CyberArk no longer has revenues matched with expenses that are usually incurred in the current quarter while revenues flow in for years.

The time to purchase the stock is likely as the EPS trends start heading higher. With Q4 guidance at $0.52 to $0.67 versus consensus of $0.63. At the midpoint, the new target is $0.035 lower, suggesting analysts will take down the above estimates.

Takeaway

The key investor takeaway is to let the transition play out before rushing into the stock. CyberArk isn't exactly cheap here at $100 with the updated earnings potential. As the cybersecurity company completes the transition next year and returns to growth, the stock will become a solid long-term play in the sector.

If you'd like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to catch the next multi-bagger gain.

Disclosure: I am/we are long AAPL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.