Vanguard Total Bond Market ETF: A Poor Choice In The Long Run

BND gives an investor broad exposure to the bond market and has historically been a source of safety.

While valuable as a defensive investment in certain scenarios, it falls short compared to other options in the long term, even for retirees.

Long-term factors such as interest rates, recoveries, inflation, and the consistency of equities make BND only valuable as a short-term hedge or to the most risk-averse investor.

The Vanguard Total Bond Market ETF (BND) is a broadly-diversified bond ETF managed by the pioneer of low-cost index funds, Vanguard. BND is backed by nearly 10,000 U.S. bonds with 80% of the ETF focused on replicating the Bloomberg Barclays U.S. Aggregate Float Adjusted Bond Index. BND currently has a yield to maturity just under 1.2% annually.

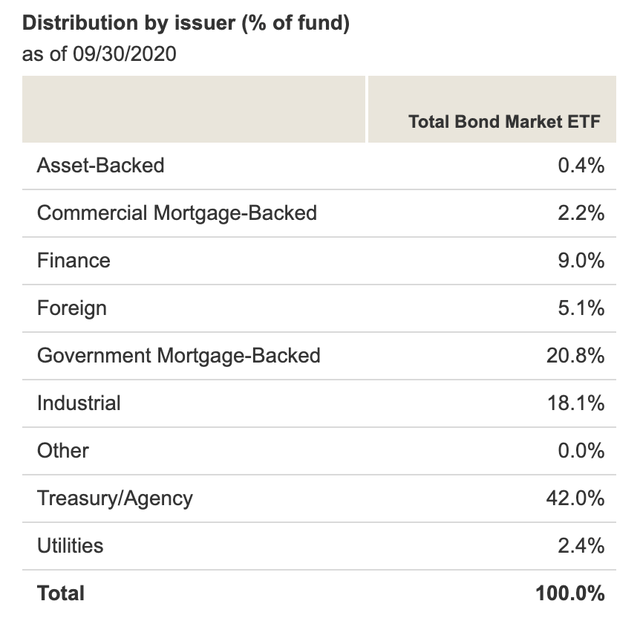

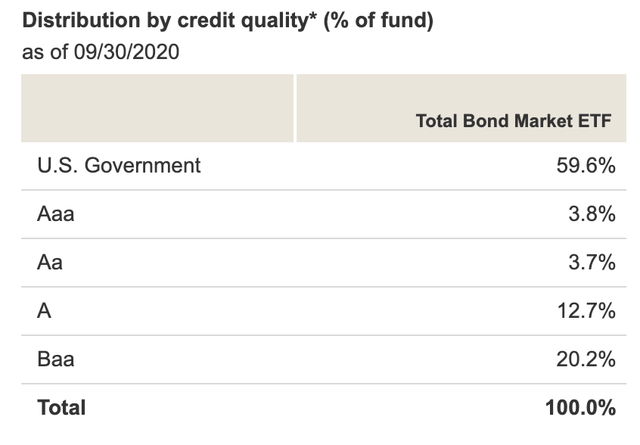

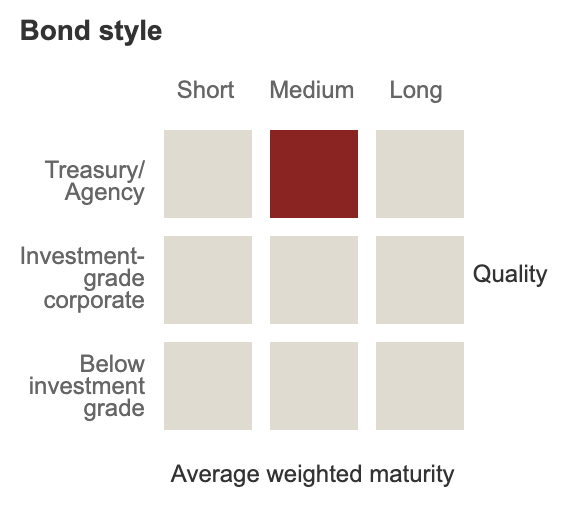

BND is mostly exposed to U.S. government treasuries and government-backed mortgages (Fannie Mae (OTC:FDDXD)/Freddie Mac (OTCQB:FMCC)). However, it also has exposure to corporate bonds, mostly centered in defensive industries such as financials, industrials, and utilities. BND only includes corporate bonds with a Baa rating or above which is the lowest tier of investment-grade, ensuring that investors' capital is preserved while still providing a diversified source of yield.

Source: Vanguard

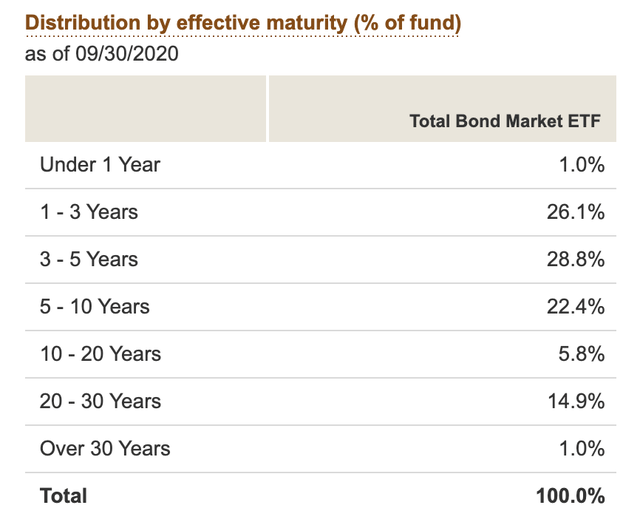

The maturity of BND's holdings, which is the length of time until the fixed income securities are repaid to the investor, is broadly diversified across all of short-term (1-10 years), medium-term (5-20 years), and long term (20-30 years) bonds. This gives BND an average effective maturity of 8.5 years, which is a medium average.

Shorter effective maturities are less sensitive to interest rate movements as investors can quickly reinvest into the market rate and have much fewer payouts being discounted by the current market interest rate. Longer effective maturities are more sensitive as investors are locked into rates for longer and have much more payouts being discounted by the current market interest rate.

Source: Vanguard

BND's risk profile is very safe from a credit risk perspective and average risk from an interest rate perspective.

A Source Of Safety

Bond funds like BND serve as a valuable hedging tool during volatile markets. They often hold their value or even rise during recessionary periods with minimal volatility while still providing consistent cash flow and coupons.

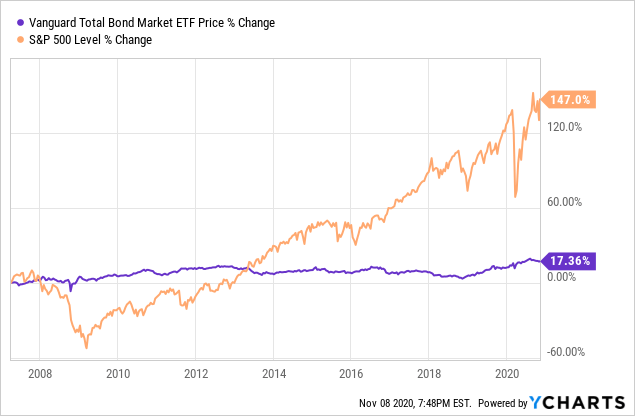

BND has held its value incredibly well and with incredibly high stability, even during both the 2008 and recent 2020 downturns, compared to the S&P 500. The S&P 500 saw dips of nearly 50% and 30%, respectively, in those times whereas the dips for BND barely registered. However, this is with the trade-off of total return.

Data by YCharts

Data by YCharts

However, despite the appeal of the stability and safety in BND, there are several reasons why it is not a great long-term investment and only valuable as a short-term hedge or to the most risk-averse retirees.

Better Equity-Based Options

As evidenced by the price change graph above, given enough time, equities will typically outperform BND in total return by a significant amount. Investing in BND for the stability is just a psychological crutch for investors who cannot stomach volatility. The S&P 500 recovered from the 2008 recession in only a few years and the 2020 recession in less than six months.

According to recent research, the S&P 500 beat long-term government bonds over a 30-year period more than 99% of the time from 1926 to 2020. This research is already in favor of bonds as long-term government bonds will generally return more than medium-term funds such as BND.

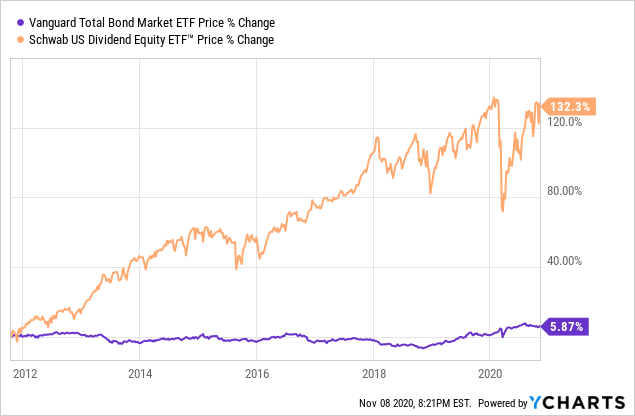

Even those who are afraid of the volatility of general equity indices like S&P 500 can invest in relatively stable and consistent dividend-paying equity ETFs such as the SPDR S&P Dividend ETF (SDY) (see my recent article) or Schwab U.S. Dividend Equity ETF (SCHD). SCHD has nearly 3x the dividend yield of BND at 3.26%, a stable price level including a quick recovery in the 2020 recession, while completely crushing BND's price return.

Data by YCharts

Data by YCharts

Some retiree investors may want to invest primarily or solely in BND as they have no consistent wage income and do not want to be wiped out by a sudden market downturn. This is a safety illusion. This decision may actually hurt them in the long run as equities actually help retirees provide the return they need to make their retirement portfolio last the duration of their long-term retirement.

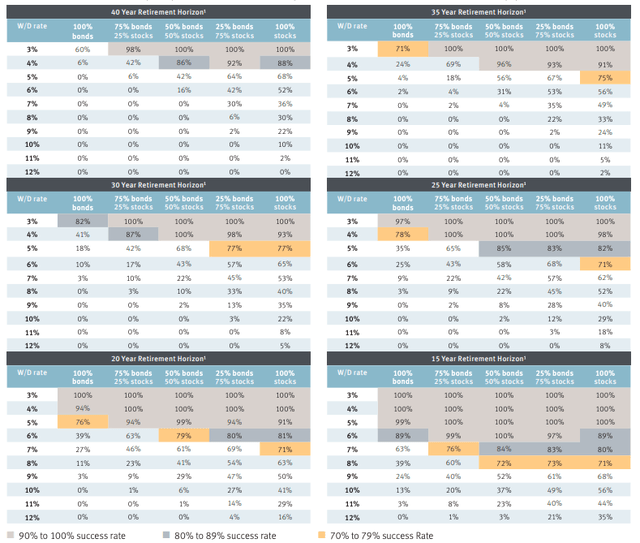

The famous Trinity study that produced the standard 4% withdrawal rate for retirees was recently updated accounting for market volatility as well as low interest rates up to 2014. To illustrate the safety illusion, the following charts show that for long-term retirement horizons (30+ years) and/or higher withdrawal rates (5%+), having 50% or more of your portfolio in bonds puts a retiree at significantly higher risk of running out of money in their portfolio before the end of their retirement. Having 100% of your portfolio in bonds for a 30+year retirement is even very risky at a conservative 3% withdrawal rate.

Source: RBC

Finally, investing in BND will not give you exposure to the inevitable global recovery. The economy is recovering much quicker than expected from the recession caused by the COVID-19 pandemic. In October 2020, job growth was stronger than expected and the U.S. unemployment rate has fallen to 6.9%, quite a relief considering people were worried about 20% unemployment back in March. Most importantly and recently, Pfizer (NYSE:PFE) announced that their COVID-19 vaccine is over 90% effective, sending markets into a frenzy on Monday. This could realistically mean COVID-19 is controlled by the end of 2021, especially if other vaccines in trials perform similarly.

Investing in BND will not give you any benefit from this recovery. The underlying bonds will continue to pay a fixed 1.2% average yield for the average maturity of 8.5 years. The U.S. government will not offer you more interest because the economy is recovering and nor will companies pay more interest on the bonds you own because revenue and profits are recovering. They, will however, reward their equity shareholders instead as their businesses recover.

Inflation Will Crush Returns

Inflation is the bane of fixed income securities such as BND's holdings. A safe 1.2% yield isn't so great if inflation is 2%, meaning you're actually consistently losing 0.8% every year in purchasing power. BND's yield is not indexed to inflation, meaning an investor is out of luck if inflation rises.

Inflation has been quite muted in the past decade so this may not be a concern on the forefront of investors' minds. However, the Fed has stated they are targeting higher than 2% target inflation to make up for a decade of low inflation, indicating potential high inflation to come.

A bond-believer could argue that in 2008, when the Fed began its Quantitative Easing (QE) to try to bring inflation back up, it was unsuccessful as the 2010's was a period of very low inflation. However, the QE and subsequent money printing in 2008 were purely targeted at bank liquidity and to bring bank reserves to a sustainable level. The money never entered the broader economy and thus was never part of the broader money supply. In the most recent money printing action, $4 trillion was printed by the Fed and directly injected into the economy via fiscal stimulus, thus increasing the money supply. See this excellent Seeking Alpha article that compares money printing in 2008 vs. 2020.

If and when the economy recovers from deflationary pressures of the COVID-19 pandemic, this increased broader money supply could be a catalyst for inflation.

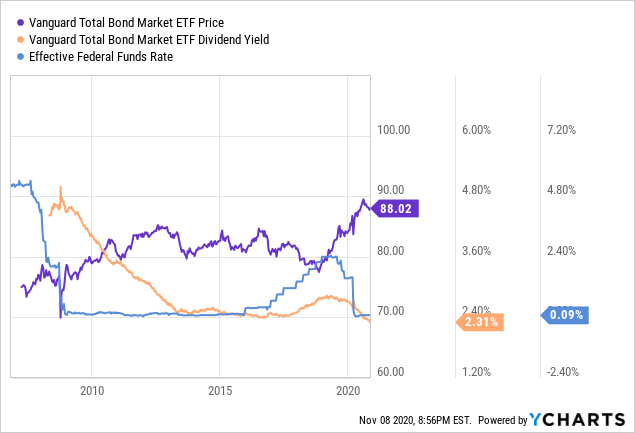

Interest Rates Are At All-Time Lows

BND's yield will follow that of the Federal Funds rate, which is at an all-time low. While investing in BND is certainly safe from a capital preservation perspective, its yield is at its lowest ever.

The Fed has stated they intend to keep interest rates near zero until at least end of 2022. This means investors won't be seeing higher interest rates from BND for several more years. Rates are also so close to zero that BND will not see a price increase benefit from lower interest rates like it did from the rate lowering in 2008 and 2020.

Additionally, it is better to wait until after interest rate increases are announced to buy as bonds typically decrease in value after interest rates rise. BND has a duration of roughly 6.6, which means every 1% increase in rates results in a 6.6% decrease in price of BND. The yield for BND also lags the change in Federal Funds rate as the medium-term maturities of BND's holdings means it takes about an average 8.5 years for BND to exchange its holdings for current market bonds with current rates. Investors have plenty of time to jump into BND at a later and better time.

Data by YCharts

Data by YCharts

Conclusion

BND is not a great investment option in general for long-term investors and especially poor in the current low interest rate environment. The safety it provides is mostly an illusion as there are significantly better equity-based options for retirees. BND may become a better option in the future if inflation does not turn out to be as high as expected and rates rise to a more historically normal level. Until then, I recommend continuing to stick with equities.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not a financial advisor. All recommendations here are purely my own opinion and is intended for a general audience. Please perform your own due diligence and research for your specific financial circumstances before making an investment decision.