Mr. Cooper Group: Strong Revenue Growth Appears Priced In

Management’s efforts, including new hires and investments in technology, will likely drive earnings next year.

The mortgage market will likely remain robust next year due to low interest rates that will drive refinance activity. Further, revenue from Xome will likely increase.

Valuation analysis suggests that the market has already incorporated the earnings growth outlook.

Mr. Cooper Group Inc.’s (NASDAQ: COOP) stock price has rallied since the middle of March as the Federal Funds rate cuts have propelled the company’s revenues. I’m expecting revenues to continue to grow through 2021 due to the positive market dynamics that will keep mortgage volumes robust. Further, the management’s efforts to expand will likely drive revenues in the coming quarters. Overall, I’m expecting COOP to report earnings of around $4.44 per share in 2021. My valuation analysis suggests that the market has already incorporated the prospects of strong revenue growth. The target prices determined using the price-to-earnings and price-to-book multiples show a small downside from the current market price; hence, I’m adopting a neutral rating on COOP.

Revenues to remain strong in 2021

COOP’s revenue surged for a second consecutive quarter to $872 million in the third quarter, up from $630 million in the second quarter, and $278 million in the first quarter of 2020. The 150bps Federal Funds rate cuts in March triggered the surge in the mortgage origination volume and the mortgage servicing portfolio, which drove revenues. I’m expecting revenues to continue to grow in the coming quarters because of high demand in the mortgage market and the management’s efforts to expand its business.

As mentioned in the third quarter’s conference call, COOP has hired 1,100 new team members since late summer of this year, which will likely propel volumes in the direct-to-consumer (“DTC”) channel. To put the number of new hires in perspective, COOP had 9,100 employees at the end of 2019, as mentioned in the last 10-K filing. Further, the management expects the margin to remain attractive in the DTC segment because of deeper relationships. Additionally, the management mentioned in the conference call that it had won about $8 billion in small bulk portfolios, which will close in the fourth quarter and early next year.

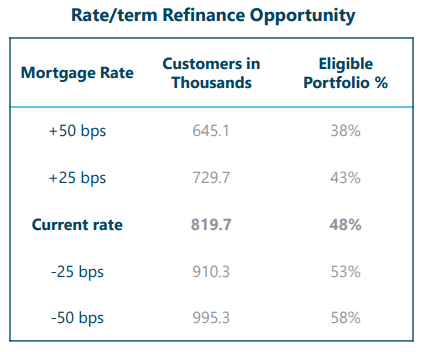

The management expects the refinance activity that was spurred by the rate cuts to remain robust in 2021. As mentioned in the conference call, the management believes that around 820 thousand of its customers can save $200 per month in mortgage payments by refinancing. The following table from the third quarter’s investor presentation shows the number of customers that can benefit from refinancing at different rates.

Apart from the originations and the servicing segments, COOP also derives revenues from Xome, which provides real estate solutions including property disposition, asset management, title, close, valuation, and field services for COOP and third-party clients. Revenue from Xome suffered in the last two quarters due to moratoriums on foreclosures on the national level and in some local markets, as mentioned in the third quarter’s 10-Q filing. I’m expecting the moratorium to be lifted once the COVID-19 pandemic becomes manageable, most probably in early to mid-2021. Therefore, revenues from Xome will likely increase in 2021.

Further, I’m expecting forbearances to continue to improve in the coming quarters as the pandemic comes under control. The economy is already on the path to recovery as unemployment is down to 6.9% in October from a peak of 14.7% in April 2020. Forbearances had already improved to 6.1% of total customers by October 25, 2020, down from a peak of 7.2%, as mentioned in the investor presentation.

Considering the market dynamics and the management’s efforts discussed above, I’m expecting COOP’s revenues to increase by 5% quarter over quarter in the fourth quarter of 2020. Further, I’m expecting the revenue to increase by 5% year over year in 2021.

Expecting Earnings of $4.44 per Share in 2021

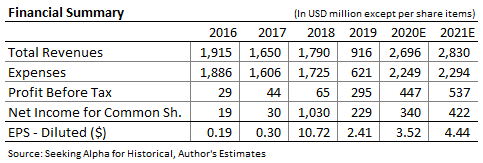

The 5% increase in total revenues will likely drive earnings next year. Further, I’m expecting total expenses, including salary and administrative expenses, to grow by just 2% next year. COOP’s investment in technology under Titan projects over the last couple of years will likely continue to bear fruit through 2021. Further, the management mentioned in the conference call that COOP currently has several new projects underway that are designed to lower origination costs. Overall, I’m expecting COOP to report earnings of around $4.44 per share in 2021, up 26% from my expected earnings of $3.52 per share for 2020. The following table summarizes my estimates for income statement estimates.

Earnings may differ materially from estimates because of the uncertainties surrounding the COVID-19 pandemic. Further, COOP’s earnings are generally very volatile, as can be seen from the historical numbers shown above.

Valuation Analysis Shows COOP Might be Slightly Overvalued

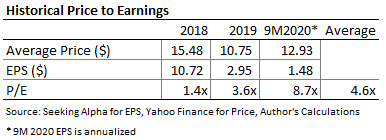

I’m using the historical price-to-earnings multiple (“P/E”) to value COOP. The stock has traded at an average P/E multiple of 4.6x in the last few years, as shown in the table below.

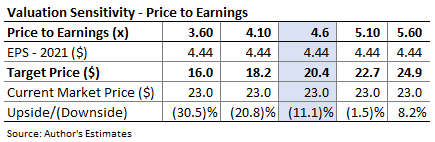

Multiplying the P/E ratio with the forecast 2021 earnings per share of $4.44 gives a target price of $20.4 for the end of next year. This price target suggests an 11% downside from the November 9, 2020, closing price of $23.0. The following table shows the sensitivity of the target price to the P/E ratio.

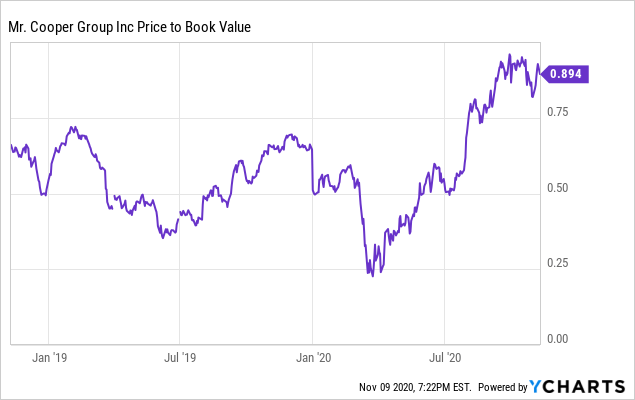

As COOP’s earnings are highly volatile (see ‘Financial Summary’ table above), and COOP is a financial services company, it is also worthwhile to look at the price-to-book multiple (“P/B”). The following chart shows the historical trend of the P/B multiple over the last two years.

Data by YCharts

Data by YCharts

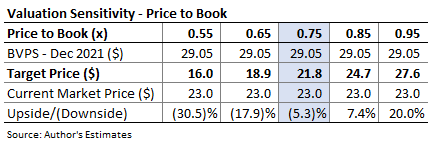

Based on the P/B ratio for the second and third quarters, I’m using a multiple of 0.75 to value COOP. Multiplying this ratio with my forecast book value of $29.05 per share for December 2021 gives a target price of $21.8. Like the P/E method, the P/B method suggests a downside from the November 9 closing price. The following table shows the sensitivity of the target price to the P/B ratio.

There is no dividend yield component in the total expected return for COOP because the company currently does not pay out dividends. However, there is a chance of a share buyback late next year. I’m not expecting a buyback before then because the management mentioned in the conference call that repurchasing stock before August 2021 could jeopardize COOP’s tax benefit as it will be within three years of the 2018 merger.

The target prices determined by the P/E and P/B multiples suggest that the market has already incorporated the earnings increase outlook. Based on the small downsides suggested by the target prices, I’m adopting a neutral rating on COOP.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: This article is not financial advice. Investors are expected to consider their investment objectives and constraints before investing in the stock(s) mentioned in the article.