REIT mall owner CBL & Associates filed for Ch.11 bankruptcy on Nov.1.

Actions taken by the administrative agent for bank lenders forced the bankruptcy filing.

A new term sheet for recoveries was filed on Oct. 27 that would give a less favorable recovery for noteholders than the RSA.

Unsecured noteholders are attempting to do a "cram up" Ch.11 reorganization plan.

There could be a very nasty fight between stakeholders before this bankruptcy case is over.

CBL & Associates Properties, Inc (OTCPK:OTCPK:CBLAQ) (CBL) (OTCPK:CBLEQ) (OTCPK:CBLDQ) was effectively forced to file Ch.11 bankruptcy on November 1 because actions taken by the administrative agent, Wells Fargo, for bank lenders. This bankruptcy case should be followed very closely by investors holding other REIT securities because there are a number of critical issues that will impact the industry. While a Restructuring Support Agreement ("RSA") was agreed to by many stakeholders, I do not think the actual confirmed Ch.11 reorganization plan will reflect the recoveries in the RSA.

Actions Taken By Bank Lender's Administrative Agent

I "attended" the November 2 hearing (docket 86) via the telephone (I often attend bankruptcy courtroom hearings in person) and the tone by various parties against the administrative agent for the bank lenders was very hostile. A lawyer representing unsecured noteholders stated that the bank lender's actions were "so over-the-top and unprecedented" because the bank lender's had asserted a non-monetary/non-economic default, which forced CBL to file for bankruptcy, while negotiations were still on going.

Wells Fargo, the bank lender's administrative agent, sent 400 Tenant Direction Letters to CBL's mall tenants instructing them to send rental payments directly to Wells Fargo for the benefit of the bank lenders and not to CBL entities. The lenders were also removing mall managers and replacing them with their own managers. Without going into technical issues, the lenders were also using proxies to take over boards of various CBL entities.

Judge Jones signed an Emergency Motion for A Temporary Restraining Order (adversarial docket 5) to stop lender's actions. A preliminary hearing on this issue is currently set for November 13.

Starting in May, lenders have been asserting various defaults had occurred, but the most interesting one for REIT investors is that the bank lenders considered the August announced RSA, which the bank lenders were not a party to, was effectively a bankruptcy event. The administrative agent sent a "Notice of Acceleration" for payment of the $1.1 billion bank loans. Not until after the bank lenders received an October 27 "Term Sheet" from the Ad Hoc Group of Noteholders, who hold approximately 62% of the unsecured notes, did the bank lenders try to enforce any default remedies.

This issue is absolutely critical for investors in other REIT securities and even other financially weak companies. Can a secured lender who is not a party to a RSA be able to assert a default event occurred-effectively a bankruptcy process? If the court finds that "yes" a RSA is effectively a bankruptcy default event unless secured parties agree to the terms, future restructuring support agreements for companies would have to make sure that secured lenders are parties to that RSA (or actually the lenders within that lending group that effectively controls that group).

A second reason why this case is so important to REIT investors is that if a secured lender asserts a default occurred, can they use the remedy of revoking the borrower's right to collect rent and then send tenants direction letters to send future rent payments directly to lender's administrative agent? For a lender to a retail store, for example, it would be completely impossible for shoppers to pay the administrative agent for products they purchase, but it is not unrealistic for a tenant to send rental payments directly to the lender's administrative agent. A REIT could immediately try to go into court to stop the lender's actions, but it could also mean the REIT uses Ch.11 bankruptcy protection. Some REITs, therefore, may file for bankruptcy sooner than expected and even when negotiations are in progress.

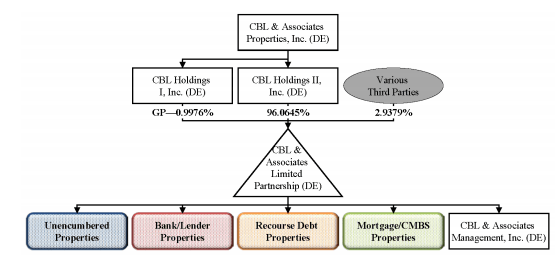

Another key reason why this case needs to be followed is that not all the CBL business structure was included in the bankruptcy filing. Approximately $2.0 billion debt at the property level is not currently included in the jointly administered bankruptcy case. There is still the risk that other entities and, therefore, holders of current non-debtor securities get pulled into the bankruptcy process. This was even mentioned during the recent hearing. Investors need to follow how the current non-debt securities stay out of or get entangled into this bankruptcy case.

Source: Docket 3

Possible Cram Up Reorganization Plan

The problem for bank lenders is that the value of the collateral assets securing the loans is currently significantly less than the amount of the loans. They are going to have a secured claim and a deficiency claim, which is at the same class level as general unsecured claims. Often bank lenders try to reduce this problem by rolling-up part of the bank debt into a DIP loan that is fully secured by unencumbered assets, but CBL does not need cash from DIP financing. They are not currently in a cash bind.

The unsecured noteholders are trying to get a "cram up" Ch.11 reorganization plan confirmed. Most investors understand the features of the typical "cram down" case, but this could be a cram up case where the lower priority class, unsecured noteholders, votes to approve a plan and a higher priority class, bank lenders, strongly objects to that plan. The key to unsecured's deal is that they must get the court to classify bank lender's claims as "unimpaired". If they are classified as unimpaired, they are deemed to have "accepted' the Ch.11 reorganization plan under section 1126((f)).

I have serious doubts that they will be able to get the bank lender's claim to be classified as unimpaired, but I am guessing that the unsecured noteholder's lawyers will try to show the recovery bank lenders receive under the plan is "indubitable equivalent" to their claim, which could make their claim be considered unimpaired under section 1129((b))(2)(A)((iii)). (Of course, the code does not actually define "indubitable equivalent"-that would be too easy.) There is some case law on this issue, but I expect Judge Jones is quite capable of deciding for himself. The intent of the code was to give the judge wide discretion on this issue.

October 27 Term Sheet Compared To RSA

The original RSA (docket 3 exhibit B) gave a recovery of $49.6 million cash, $500 million 10%'28 1lien notes, and 90% of the new equity, subject to dilution, to holders of $1.375 billion unsecured notes. Under the October 27 Term Sheet proposed by the Ad Hoc Group of Noteholders, unsecured noteholders would get an estimated $577 million PIK preferred stock and 90% of the new stock, subject to dilution. The October 27 terms are much less favorable to unsecured noteholders because they are not getting any cash nor are they getting secured debt and are instead getting PIK preferred equity.

The bank lenders would get secured "takeback debt" that matures in 2027 with a L+350 interest rate and an estimated $173 million PIK preferred stock. They would not, however, get additional collateral securing their debt. The amount of the takeback back debt would be "amount will be equal to the value of the collateral." The stated amount of the takeback debt is $950 million (compared to about $1.1 billion par amount). The difference between the par value of the bank loans and takeback debt would be paid in PIK preferred stock (estimated at $173 million).

The terms for the preferred and common stockholders seem to be the same under both term sheets. I think that the less unsecured noteholders accept as a recovery, the more likely noteholders, who are not part of the Ad Hoc Group of Noteholders, will object to the reorganization plan. Giving 10% of new equity and warrants is a "real gift" to equity holders. (I would only give them a token amount, if anything, because unsecured noteholders are not getting a full recovery.)

Conclusion

CBL was in trouble even before Covid-19 shut many mall stores and their bankruptcy filing was not a surprise. What is disturbing to many REIT investors is that actions taken by the administrative agent for bank lenders forced an immediate Ch.11 filing. Just the assertion by the administrative agent of a default and their subsequent actions forced a bankruptcy. There was no actual legal process that concluded there was an actual default. The potential of sending of Tenant Direction Letters by bank lenders should be a concern of investors in other distressed REITs.

As I wrote a few months ago in an article, I think the RSA is illogical. The October 27 Term Sheet is less favorable for unsecured noteholders, but it is still illogical. Equity holders are getting too large of "gift" in my opinion. A token amount, if anything, would be appropriate because higher priority classes are getting no recovery. I would, therefore, avoid CBL equity. Unsecured notes are a "crap shoot" at current prices.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.