Smith & Nephew: A Long-Term Buy And Hold In Medical Devices

Smith & Nephew has a solid, growing business which will grow with market growth as well as by acquisition.

It has a decent dividend payment history.

Don't expect amazing performance, but on a mid- to long-term basis (3-5+ years), I expect share price appreciation will reward the investor.

British medical devices manufacturer Smith & Nephew (SNN) has had a somewhat bumpy several years but in broad terms, the shares have continued their long upward trajectory. With new management since last year, a clear focus and strategy and an established reputation in their fields, I expect them to continue to grow revenues and grow the dividend, which is decently covered by free cash flow. For now I don't see the name as an exciting growth story, and I don't expect this share to be a best-in-class performer in medical devices given its large legacy business, but nonetheless I think it is a solid choice for medium- to long-term incremental share price appreciation. On that basis, it is a buy.

Smith & Nephew is a Growing Medical Devices Manufacturer

The company has a long history in medicine and more recently, in medical devices. After a period of underperformance, there was a management change last year and growth looks solid. Revenue was up 4.8%, or 4.4% on an underlying market. It has embarked on a number of acquisitions, such as that of ENT specialist Tusker Medical. These should grow its footprint and earning power, positioning it well for long-term growth.

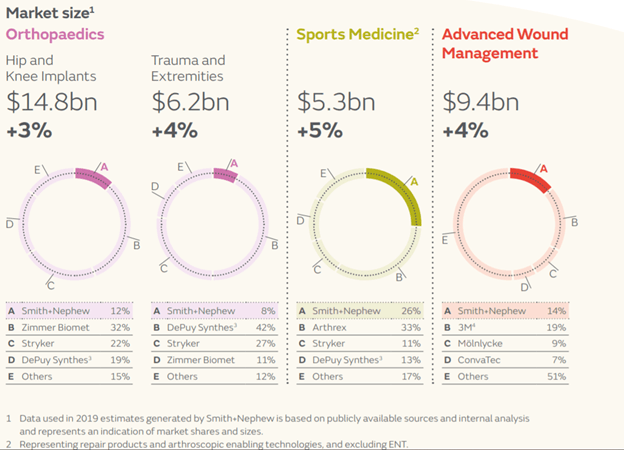

The company's biggest business line is orthopaedics, but it also has substantial businesses in sports medicine and ENT and advanced wound management. It is not the market leader in any of these markets, on its own analysis.

Source: company annual report

There are a number of interesting opportunities in the business, one of which appeals to me is the robotics space. It has a robotics-assisted NAVIO system and is investing in a new robotics research center in Pittsburgh.

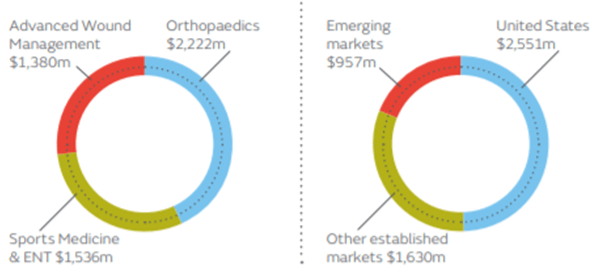

Although the company is U.K. headquartered, the key market is the U.S. China and India show strong future growth potential. China currently represents 7% of group revenue and I expect that to grow above group average in coming years, in line with the fast rate of device market growth in China.

Source: company annual report

So at this point, the business seems decently well-positioned. It doesn't have knockout technological advantages, but it has a clear strategy, decent product portfolio and an approach to acquisitions based on building a more rounded portfolio which I expect should strength its sales relationships with purchasers.

The Balance Sheet is Sustainable

Net debt at the time of the most recent annual report sat at $1.77 billion, a notable run up from the previous year, in part due to acquisition activity. However, I still find that a reasonable level for an enterprise of this size. Executive rewards were recently reduced to give less weight to meeting gearing targets, which I don't see as completely positive, so taken together with the run up in debt last year, although the current net debt levels don't concern me, one thing to watch out in coming years will be to ensure that management don't take on a lot of debt for any acquisitions which aren't clearly value accretive.

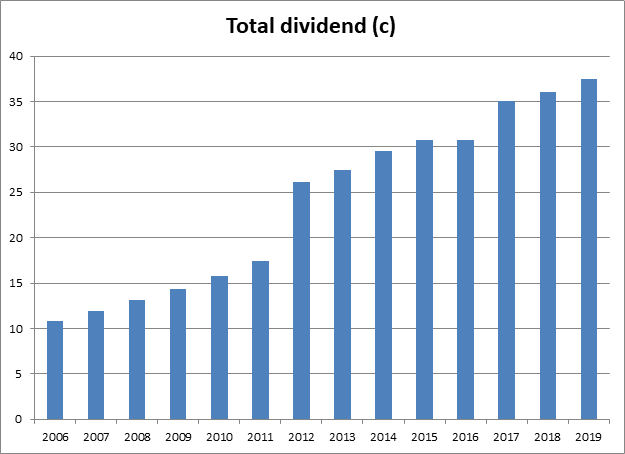

Dividends Have Mostly Been Growing for Many Years

The company's dividend policy is to aim to increase the US Dollar value of ordinary dividends over time broadly based on the Group's underlying growth in earnings, taking into account capital requirements and cash flows.

The company switched from declaring its dividend in sterling to United States dollars in 2006. Since then, dividends have grown well over time. In the past eight years, single digit growth has been the norm most years.

Chart compiled by author using data from company annual reports

As long as earnings and cash flow continue in the right direction, the dividends should continue to increase, which I expect to support the share price.

Dividend cover is decent. With long-term earnings growth, I expect the dividends to continue to grow.

Free cash flow ($m) | 457 | 714 | 584 | 714 |

Dividends paid ($m) | 279 | 269 | 321 | 318 |

Dividend coverage from free cash flow | 1.6 | 2.7 | 1.8 | 2.2 |

Table calculated and compiled by author using data from company annual reports

The dividend yield at the current share price is around 2.1%. While not great, I think that is respectable for a long-established medical devices manufacturer. So, at current prices the yield rewards the wait for share price appreciation.

There is Upside Potential at Today's Share Price

The shares are currently trading at 1,421p. That equates to a p/e ratio of around 27. While it does not represent value, I find that acceptable for a company in this sector which I expect to continue growing revenues and earnings through both organic growth and acquisitions in coming years. If it can do that, and so far, there is no reason to expect that it cannot, then over the medium to long-term I expect share price appreciation from today's price, as well as a continued progressive dividend. As a long-term buy and hold, therefore, I think there is a case to invest in Smith & Nephew.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.