Lenabasum Exposure Wipes Shareholder Upside For Corbus Pharmaceuticals

Underwhelming data from phase 2b and phase 3 study readouts reduces the applicable market for Lenabasum, placing downward pressure on fundamental outlook.

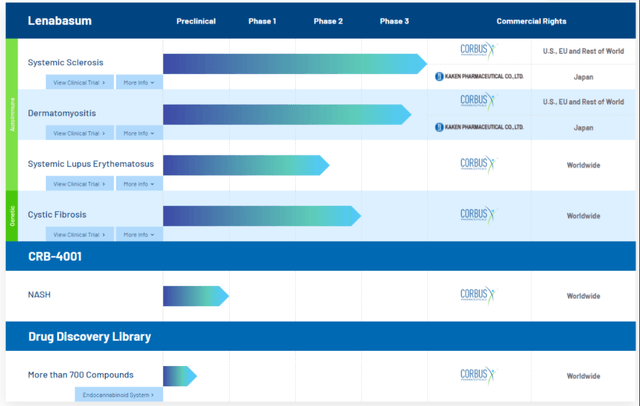

There is a lack of meaningful catalysts in the near-term, the only upcoming catalyst is in Q42021 via phase 3 readouts from dermatomyositis data for Lenabasum.

The exposure of the company's entire pipeline to Lenabasum highlights the lack of operating leverage and need for diversifying the development portfolio.

We hold a neutral stance on the company, until further evidence is displayed on management's success in meeting primary endpoint objectives in phase-stage trials.

Investment Summary

We had previously viewed Corbus Pharmaceuticals (NASDAQ:CRBP) as a high risk investment with reward geared to the upside earlier this year. This was on speculation of data release from the suite of Lenabasum readouts, which occurred in early September and again in October. Unfortunately, underwhelming data in systemic sclerosis ("SS"), cystic fibrosis ("CF") and systemic lupus erythematosus ("SLE") application places doubts on the therapeutic impact of Lenabasum. The study missed its primary endpoints in the phase 3 study for SS and phase 2b study for CF, which is concerning. Therefore, unlike our initial thesis, we believe that the molecule can only address a certain portion of the patient population at best, which significantly reduces commercialization opportunities for CRBP. Therefore, we believe the risk/reward symmetry has mobilized towards the downside.

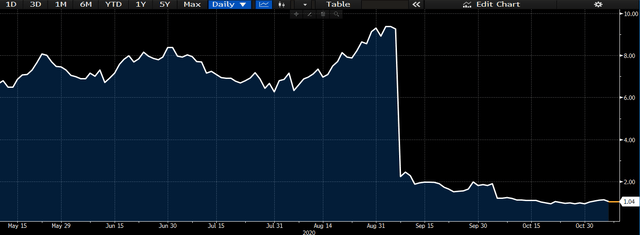

Data Source: Author's Bloomberg Terminal

Data Source: Author's Bloomberg Terminal

Furthermore, extended potential indications to SLE and especially cystic fibrosis look too risky for investors to bank on. Although potential abnormalities within the control group have been flagged as a potential cause for failed data, we believe that investors may want to seek exposure to these segments elsewhere. Further, the dermatomyositis readouts in this segment aren't due until late 2021, thus, with a lack of meaningful catalysts in the near-term, we hold a neutral stance on the company.

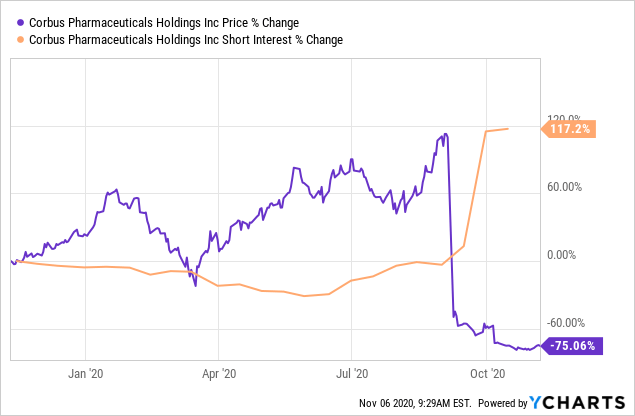

Data by YCharts

Data by YCharts

Shares immediately gave away huge volumes in price returns on the back of the news, as investors saw de-risking from exposure to the company as the better move. Shares are down -75% YTD to today's trading, and short interest has peaked at 117% at the start of November. Future upside seems unlikely at this point, and we believe the risk profile attached to Lenabasum has increased markedly on the back of the study readouts back in September and October. With the data precluding access to CF, SLE and perhaps dermatomyositis populations, the addressable market opportunity for the molecule has shrunk overwhelmingly. Therefore, there is high pipeline risks for CRBP at the current time, and the probability of failure to convert on the Lenabasum pathway is high.

Outlook and Catalysts For Price Change

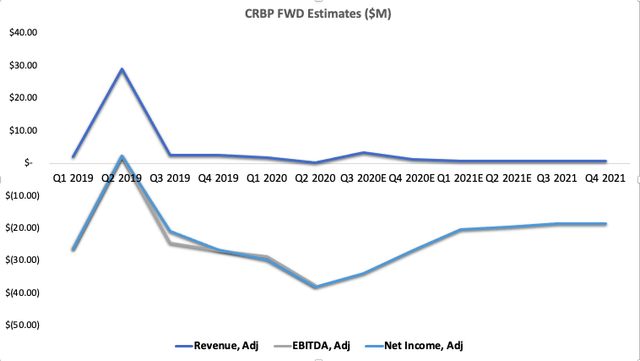

We had baked significant upside potential into our modelling on the back of the Lenabasum studies, however we have pulled this for now. We see revenues slumped for the upcoming 4 quarters at least, with anemic growth and thin margins that advocate against the case for long-term entry. Thus, the path to profitability looks far less defined than was previous for CRBP. We also see no meaningful catalysts for price change over the coming periods until the end of next year, as the next data readout is also not expected until Q4 2021. The entire fate in the medium-term is based on the phase 3 dermatomyositis data that will occur at this stage. On analysis of the most recent data, we see a higher risk profile for Lenabasum, and therefore reserve our confidence in the dermatomyositis outcomes.

Data Source: CRBP SEC Filings; Author's Calculations

We can see the data outlay of earnings in the chart above positively skewed towards 2019 actuals. This supports our thesis that future growth remains undefined, and that the asymmetry in risk/reward is geared to the downside. There is also tremendous downward pressure on share price, which will likely continue as short-interest remains so high. The commentary on CRBP's outlook is undoubtedly bearish, therefore, current investor sentiment is also bearish in our view. We cannot continue to speculate for this company, that is currently relying on a single-skewed readout over a year away.

At the end of September, the company held cash & equivalents of just over $64 million, excluding ~$8.6 million in long-term debt. Back in October, the company had also reduced headcount by 54% in a restructuring and cost-savings measure, which should see the runaway on cash last into 2022. We envision a large capital allocation to data analysis of the Lenabasum pathway, trying to salvage its pipeline here. This would include heavy focus onto the phase 3 dermatomyositis outcomes. Further costings will be involved in engaging the FDA, consultation fees for the next moves regarding the failed study, contract termination costs and legal fees. Basically all of the company's pipeline was geared towards SS, CF and SLE, and has since been quashed for the time being. Early investigations into non-alcoholic fatty liver disease with CRB-4001 is in preclinical stags, however there has been little mention on progression of this to date.

Data Source: Seeking Alpha

Credit Summary and Valuation

On a short-term solvency basis, the company has just over 2x coverage on short-term obligations from liquid assets. Total debt to equity is almost 18%, whilst long term debt to capital is sitting at ~13%. The debt ratio is 8.76% and long-term debt to equity is 15.72%, both of which are on the lower end. Equity to assets is also just under 50% to support this view. Thus, equity holders have bared the brunt of financing risk to date. We feel there will be additional drains on liquidity, from ongoing data analysis in the failed studies, alongside FDA engagement and consultation fees. Offsetting these costs is the reduction in headcount, but additional cash may be hard to come by at this stage. Total assets cover liabilities by 2.3x, but asset growth has slumped over the single-year period to date. We don't see overwhelming strength on the balance sheet, that would offset the recent setbacks in pipeline progression. Without additional liquidity injected from top-line earnings, the company will rely on its cash balances. Back in July, the company engaged in a debt facility with K2 HealthVentures on a principal of $50 million dollars, where they received access to the first tranche of $20 million and the option to draw $20 million and then $10 million from the 2nd and 3rd tranches, respectively. The draw-down option is dependent on specified milestones, therefore access to additional liquidity through the subordinated classes seems at risk right now.

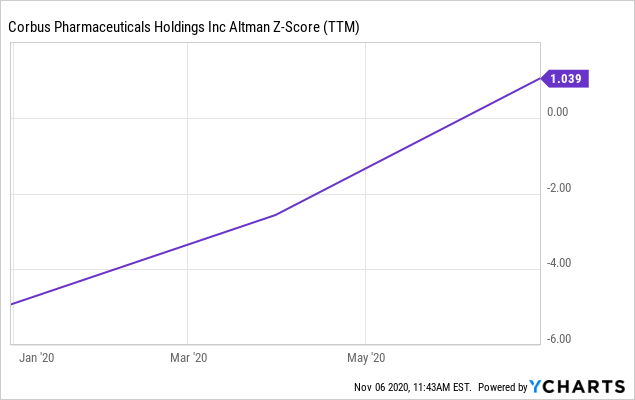

However, the chances of an additional debt offering remain low in our view. Lenders will view the lack of predictability and certainty in future cash flows as a mitigating factor in engaging lending facilities for the company. Hence equity holders are at risk for further dilution, on this basis. Therefore, cash burn will also be watched closely by investors over the coming periods. Interest coverage is not well splayed from EBITDA level earnings either, meaning the interest expense on the total debt level is a credit risk investors must factor in. The Altman Z-score of 1.04 also signals that the next 2 years are risky for maintaining solvency, in our view. Therefore, we see validity in our thesis that risk/reward has mobilized towards the downside, as there is high uncertainty of the company's future pipeline conversion.

Data by YCharts

Data by YCharts

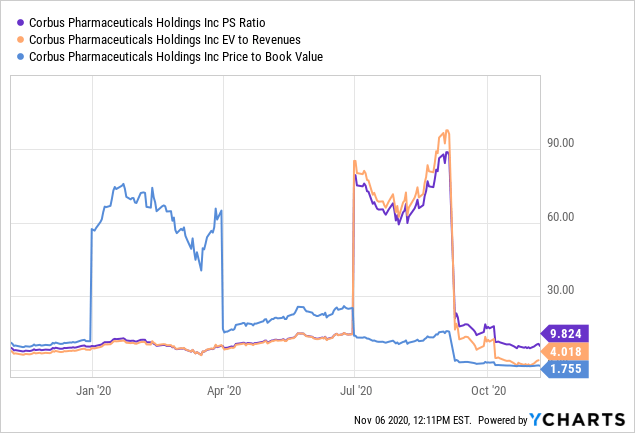

As a non-commercial company in its clinical stages, ROA and ROIC are undoubtedly well below the cost of capital for CRBP, and this supports the low valuation relative to peers. Shares are trading at 9.82x gross sales, and around 1.75x book value. The low price to book figure signals to us that value has not been created to shareholders, above and beyond book value. With a current market cap of $92.3 million, total debt of $8.6 million and around $64 million in cash, we price current enterprise value at $32.6 million. Thus, the company holds ~$7.70 in EV per share and EV/sales of 5.19x on TTM values. Cash per share is $0.79, and FCF per share is -$0.36 on a FCF yield of -17%, both on the low side. Thus, the company trades at a discount to peers, however the discount does not correspond to value. The fundamental outlook obviously is disconnected from the valuation, notwithstanding the murkiness in the path to profitability.

Data by YCharts

Data by YCharts

On this basis, the valuation is not compelling, especially when combined with the fundamental outlook. Therefore, the case cannot be made for immediate entry at this stage. We are certainly happy waiting on the sidelines and seeing how this one pays out, awaiting for any news on the failed endpoint data, and of course the dermatomyositis phase 3 readouts at the end of 2021.

Conclusion

The failed endpoint data from the Lenabasum studies this year have dissolved shareholder attractiveness for CRBP. We struggle to see further upside in share price, or the fundamental outlook for the company in the near term. The next upcoming catalyst is over a year away, via the dermatomyositis phase 3 readouts. Positive top-line data there will being to prove Lenabasum's hypothesis, and hopefully demonstrate an applicable market. As the company's pipeline was so heavily exposed to the Lenabasum series, the developmental portfolio has seen a significant loss in fair value, alongside the future potential cash flows tied to this series. Therefore, the pipeline risks are exquisitely high for CRBP, notwithstanding the suite of other risks pertaining to investing in clinical-stage companies. Without clear guidance from management at this stage, then modelling future top-line growth involves far more speculation than we are comfortable with right now. Thus, we have pulled all DCF modelling and analysis of price direction. We believe that shares will remain flat, unless data analysis on the pulled studies this year show some sort of reversal, and the FDA accepts the findings. However, this in itself is too risky to speculate on. Shares do trade at a discount to peers, however the discount does not signal value for the factors outlined in this report. This, alongside the higher risk profile now tied to Lenabasum, plus the loss of commercial applicability, balances our neutral standing on the company, and we simply cannot adjust the stance without evidence to the contrary. Therefore, we advocate investors to consider the facts outlined in this report for their own investment reasoning. We look forward to providing additional coverage.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.