Here's Why I'm Not Excited About Berkshire Hathaway's Buybacks

The best way to determine whether Berkshire is undervalued is to look at what the company is doing.

Buffett's view on share buybacks and the recent numbers reported by Berkshire suggests the company is significantly undervalued in the eyes of the Oracle of Omaha.

Value investors might want to jump on board with that piece of information, but the wait continues for growth investors looking for an entry point.

Investors love buybacks. In addition to being a source of income, buybacks go a long way in helping a company reduce its share count, setting up a strong platform to report better per-share numbers in the future. Considering the fact that Berkshire Hathaway Inc. (BRK.A) (NYSE:BRK.B) repurchased $9 billion of its stock in the third quarter - the highest ever in any quarter - it wouldn't be a surprise if investors bid up the stock price on Monday (Nov. 8). Many investors, including yours truly, have questioned the company's stance on cash hoarding in the last few years, and we might finally be reaching an inflection point where the company decides to reward shareholders in the absence of lucrative investment opportunities in the market. A closer inspection of Berkshire's decision to buy back shares, Buffett's remarks on stock buybacks in general, and an evaluation of prospects for the conglomerate have led me to believe that Berkshire might find it difficult to deliver alpha returns in the coming years.

Warren Buffett's view on buybacks

The Oracle of Omaha has discussed stock buybacks in detail in his letters to shareholders and also during televised interviews. In a 2015 interview With CNBC, Buffett said:

Many managements are just deciding they’re gonna buy X billions over X months. That’s no way to buy things. You buy when selling for less than they are worth. It’s not a complicated equation to figure out whether it is beneficial or not to repurchase shares.

His approach to buybacks, as expected, is one that promotes value investing principles. Rightly so, he dismisses the idea that a company should have a stated repurchase policy. Rather, he holds the view that a decision to buy back shares should only be considered if the company is undervalued in the market.

Berkshire bought back around $5 billion of stock in 2019, and in his annual letter to shareholders, Buffett wrote:

In past reports, we’ve discussed both the sense and nonsense of stock repurchases. Our thinking, boiled down: Berkshire will buy back its stock only if a) Charlie and I believe that it is selling for less than it is worth and b) the company, upon completing the repurchase, is left with ample cash. Calculations of intrinsic value are far from precise. Consequently, neither of us feels any urgency to buy an estimated $1 of value for a very real 95 cents. In 2019, the Berkshire price/value equation was modestly favorable at times, and we spent $5 billion in repurchasing about 1% of the company. Over time, we want Berkshire’s share count to go down. If the price-to-value discount (as we estimate it) widens, we will likely become more aggressive in purchasing shares. We will not, however, prop the stock at any level.

Going by the remarks of Buffett, an investor can reasonably assume that Berkshire Hathaway stock is undervalued in the eyes of Buffett, which could be a reason itself for value investors to pounce on this opportunity. Being a growth investor, however, I look for opportunities that could deliver alpha returns during my investment time horizon. Because of this, I am not ready to initiate an investment just because Buffett believes the stock is undervalued. More on this in the next couple of segments.

Berkshire Hathaway is cheap

Using a multiple of book value to infer return expectations could sound overly simplistic to value a well-diversified business like Berkshire Hathaway, but Buffett seems to be keen on promoting this technique to derive an intrinsic value estimate for the company. In the 2011 Annual Report, Buffett wrote:

We have no way to pinpoint intrinsic value. But we do have a useful, though considerably understated, proxy for it: per-share book value. This yardstick is meaningless at most companies. At Berkshire, however, book value roughly tracks business values. That's because the amount by which Berkshire's intrinsic value exceeds book value does not swing wildly from year to year, though it increases in most years. Over time, the divergence will likely become ever more substantial in absolute terms, remaining reasonably steady, however, on a percentage basis as both the numerator and denominator of the business-value/book-value equation increase.

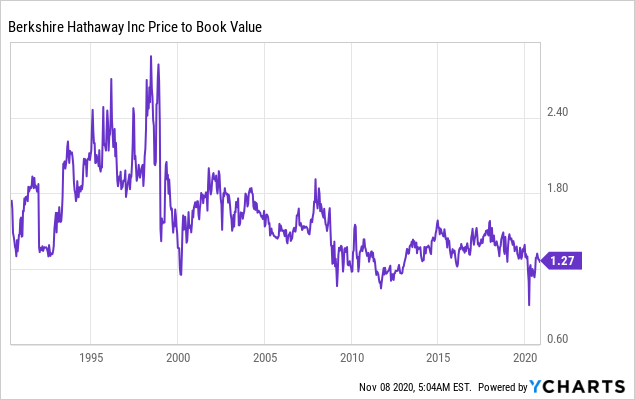

Times have changed, but it's quite likely that Buffett incorporates book value into his formula for calculating Berkshire's intrinsic value. The fact of the matter is that he, Charlie, and possibly his other lieutenants have found the company to be undervalued using such a technique, triggering the decision to buy back a record $9 billion worth common stock in the third quarter. As the below chart illustrates, the stock is currently trading well below the recent highs seen from a price-to-book perspective.

Data by YCharts

Data by YCharts

According to data from GuruFocus, Berkshire has traded at a median P/B of 1.34 in the last 13 years. Even in the base-case scenario where the stock converges with this median, we are looking at a return of 13% using a book value estimate of $264,600 for the quarter ended on Sep. 30.

This is not Buffett's favorite playing field

Back in March, I thought a nice platform was setting up for Buffett to do what he knows best; being greedy when others are fearful. Then came the Fed to the rescue, using unprecedented measures to save the American economy from entering a dark abyss. Markets bottomed on March 23, and the S&P 500 index has appreciated a staggering 56% since then, brushing off the threat to the economy posed by the pandemic.

Some of the best investments Berkshire has ever made have come during difficult times for the American economy or when the particular company was going through a rough patch. The virus-induced recession could have led markets significantly lower if not for the intervention of the Fed and the positive impact of economic stimulus packages. If things went this way, playing conditions would have favored the likes of Buffett and value investors, which was not to be. For this reason, Berkshire still sits on approximately $146 billion of cash and an "elephant-sized" acquisition seems to be a distant reality.

Are repurchases good or bad for Berkshire investors?

Berkshire seems to have repurchased more shares in the fourth quarter as well, and it looks as if the company is ramping up share buybacks. This makes sense given that the company is sitting on a massive cash pile. On the other hand, there's no reason to believe that companies in Berkshire's universe will trade at cheap or fair multiples in the foreseeable future as there's strong momentum for stocks going into 2021. Buying back shares not only seems to be a logical choice but is also good news for shareholders. While rewarding investors, Berkshire would be positioning itself to report better per-share numbers in the coming years thanks to buybacks. One need not look beyond Apple Inc. (AAPL) to gauge a measure of how buybacks drive shareholder returns. Share repurchases, therefore, are good for existing investors and value-oriented investors looking for steady returns.

In the 2012 annual letter to shareholders, Buffett revealed his thinking about how capital should be allocated efficiently to achieve long-term success. He notes that a company has 4 distinct but not mutually exclusive ways to allocate capital.

- Reinvesting in the company.

- Acquiring other companies.

- Repurchasing shares.

- Distributing wealth through dividends.

As Berkshire continues to ramp up repurchases, investors need to acknowledge that the company is running out of investment opportunities, and prudent investments have been the key to the success of the conglomerate for multiple decades. As much as I want to be excited about buybacks, I can't, because I would not settle for returns in line with the market. Berkshire was special because of its ability to beat the market more often than not, which has not happened in the last decade as the odds tilted in favor of growth stocks. I don't have a crystal ball to see whether things would be similar in the coming decade, but chances are that Berkshire will reward investors handsomely but not enough to beat the market.

If Berkshire fails to find a use for its cash pile through the end of 2021, I believe the company would finally look at declaring a dividend as the reality sets in. A dollar invested in Berkshire proved to be far more valuable than hypothetical dividends the company could have paid out in the past, but this might not be the case going forward.

Takeaway

Berkshire Hathaway stock is cheap from a price-to-book multiples approach and the company is repurchasing shares at a record pace. These are good signs for value investors. There are investors I know who hold Berkshire Hathaway for the sole purpose of diversifying their portfolios, and I do not see how this could go wrong in the coming years as well. However, Berkshire is increasingly becoming a company that is unlikely to beat the market consistently like it used to, and this is a good reason for me to remain on the sidelines. As always, I will closely monitor Berkshire's capital allocation decisions to identify an entry point.

If you enjoyed this article and wish to receive updates on my latest research, click "Follow" next to my name at the top of this article.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.