Geron: Pandemic And Legal Trials Cloud A Promising Clinical Trial

Geron's only therapeutic candidate currently undergoing a Phase III trial has superior efficacy.

The consensus has underestimated its sales potential, and the shares have yet to reach the 2018 high.

Subject to regulatory approvals, a swift achievement of the fullest sales potential paints an attractive risk-reward opportunity.

Yet, with lawsuits hurting the financial outlook and the pandemic clouding the trial progress, we remain neutral on the stock.

Investment Thesis

Cancer drug development is a gamble worth taking. Just ask Geron (GERN). The clinical trials dragging over nearly two decades and a loss of a major collaborator haven't deterred the company from advancing its late-stage candidate, imetelstat, towards Phase III trials targeting MDS (myelodysplastic syndromes) and MF (myelofibrosis). Previously known as GRN163L, the telomerase inhibitor has gone through its paces since the early 2000s, and as its Phase III timeline becomes clear, so does the company's long-term prospects. Imetelstat's mid-stage trial data compares favorably to a recently-approved rival, and yet, the market seems to have vastly underestimated the drug's sales potential.

Assuming the drug to reach the peak sales opportunity in MDS sooner, our sales projection for Geron with the current forward price to sales multiple for 2025 indicates only a modest premium. But the drug's full sales potential subject to regulatory approvals for both indications depicts an attractive risk-reward opportunity. Yet, with multiple lawsuits threatening the financials and the COVID-19 clouding the progress of the ongoing clinical trial, we remain neutral on the stock.

Source: The Company Annual Report - 2016

Serving An Unmet Medical Need

MDS and MF are two rare forms of blood cancers with a significant unmet medical need. With ~3K new cases each year in the U.S., MF affects ~13K patients, ~70% of whom belong to the intermediate‑2 or high-risk category targeted by imetelstat. For patients who fail to respond to the only available therapy known as JAK inhibitors, there's no other therapeutic option. For MDS, the patient population in the U.S. is estimated at ~60K with ~16K newly reported cases annually, ~70% of them belonging to the lower risk category targeted by imetelstat. Because many of these patients suffer from chronic anemia, they require frequent blood transfusions to correct the low hemoglobin level. Yet, MDS had no new therapies since 2006, and even the currently available therapeutics showed a tendency to fail after a period of initial success. That was until April when Acceleron Pharma (XLRN) and Bristol-Myers Squibb (BMY) collaborated to secure the FDA approval for Reblozyl (luspatercept-aamt) while Geron was trialing imetelstat against the disease.

The IMerge trial is a Phase II/III study targeting lower-risk MDS patients dependent on blood transfusions, and the yet-to-start IMpactMF evaluates the effect of imetelstat in intermediate‑2 or high-risk MF patients refractory to JAK inhibitors. With a market worth ~$500 million and ~$750 million in annual revenue in the U.S. for MDS and MF, respectively, the company now has the sole global rights for the drug after Janssen Biotech ended the co-development agreement in 2018. Now, all eyes are on the Phase III portion of IMerge as it is on track to complete the enrollment in Q1 2021 (first quarter of 2020) and deliver top-line data in 2H 2021 (second half of 2021). Though we can't foresee how the trial will succeed against MDS, we are pitting the Phase III data of luspatercept against the mid-stage data of imetelstat in an attempt to gauge its chance of a regulatory go-ahead. Phase II trial of the latter is currently closed for enrollment.

Source: The Company Presentation - October 2019

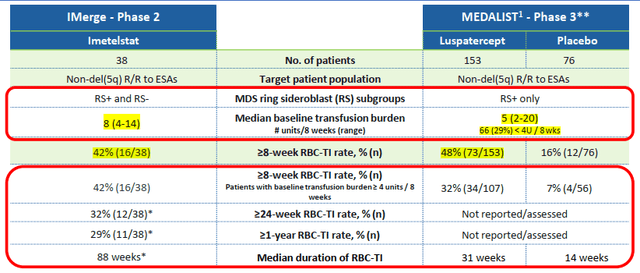

Mid-stage Data Indicate Higher Therapeutic Efficacy

Keep in mind such an evaluation is like comparing apples and oranges: the FDA approval for the former was based on the Medalist trial, a randomized, double-blind, placebo-controlled Phase III trial, whereas the Phase II trial of the IMerge was an open-label, single-arm trial. The primary efficacy endpoints of both are red blood cell transfusion independence (RBC - TI) for a minimum of eight weeks at a stretch. The rate was monitored in two groups of patients with different RBC transfusion burdens: Medalist had 153 patients on the active arm with a median burden of five units, and the IMerge had 38 patients with a median of eight. Only ~71% of patients in the former had a transfusion burden of more than four units over eight weeks, compared to ~92% of the latter. Despite the higher disease burden as indicated, imetelstat has performed well, with 42% of patients reaching the primary endpoint just falling short of ~48% achieved by Medalist.

Source: The Company Presentation - September 2020

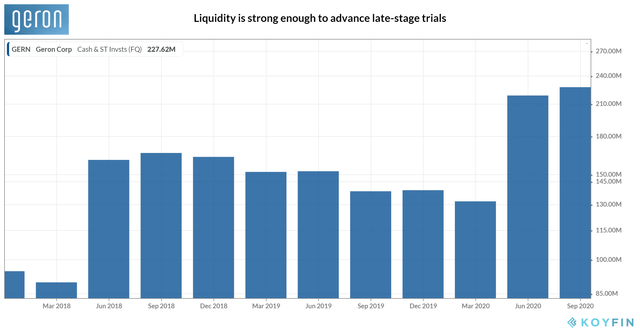

Liquidity Topped Up As Late-Stage Trials Proceed

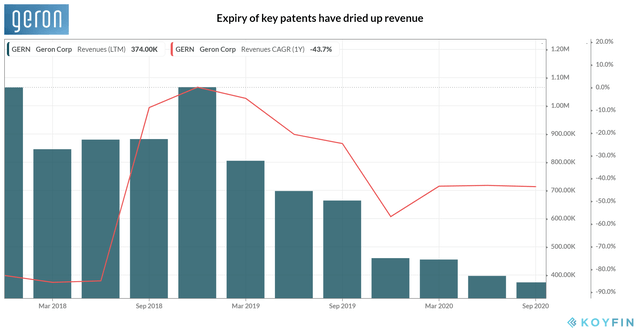

However, the late-stage clinical trials are a costly exercise, particularly for Geron, with revenue on the decline and having a narrow pipeline of experimental drugs. Thanks to collaboration revenue from Janssen, the company had a one-off boost to the top-line in 2015, making the period its only year of profitability. Revenue has contracted lately as license fees dried up with the expiry of key US patents related to telomerase in 2019. Even worse, the cash burn is set to rise as the company has one late-stage clinical trial in progress while another anticipates initiation. Yet, according to management, the operating expenses are likely to reach ~$70-75 million in 2020, roughly in line with last year.

Source: Koyfin

But unlike in the previous year, it has managed to replenish liquidity. Due mainly to a public offering netting $140 million of proceeds in May, the current cash and equivalents have risen to ~$274 million, ~72% higher than December 2019. Two-third of the recent-non-dilutive financing arrangement worth $75 million is still available through 2022. A market issuance sales agreement is also in place, allowing the company to issue common stock to raise as much as ~$200 million. With shares trading at the penny stock range, that option is, however, likely to be a long shot given the impact on ownership dilution. In March, when the share price dipped below ~$1, Geron nearly risked delisting from the NASDAQ.

Source: Koyfin

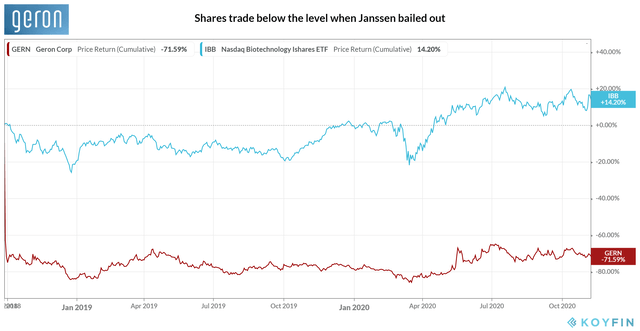

Catalysts Could Lift The Undervalued Stock

But since then, a few catalysts have propelled the shares by almost 100% in value compared to ~40.9% gain in the NBI (NASDAQ Biotechnology Index). An end of phase II meeting and the subsequent discussions with FDA set the trial design for IMpactMF, leading to more clarity over its regulatory path towards MF in May 2020. And in August, Imetelstat won the orphan drug designation in the EU for MDS. More catalysts will be along the way when the IMpactMF starts and the IMerge finishes the clinical trial recruitment. However, the stock continues to trade ~71.6% below the level in September 2018, the month the company formally announced the end of the collaboration with Janssen. Our valuation provides further proof of room for upside.

Source: Koyfin

For imetelstat in MDS, Geron projects an annual revenue potential of more than $500 million in the U.S., far below the analyst estimates for luspatercept's revenue potential in MDS at ~$1.3-2.0 billion. Even though the company expects top-line data from the IMerge Phase III trial in H2 2022, possibly leading to regulatory approval in the following year, subject to positive results, the current consensus estimates for Geron for 2025 stands at ~$392.6 million. Therefore, with the current price to sales estimate for the year at ~1.4x, our revenue forecast of ~$475-525 million for 2025 suggests an upside of ~21.0-33.8% for the stock. The premium looks modest, but the full sales potential of the drug - including that in high-risk MF, the trial of which is expected to conclude in 2024 - can highlight an attractive risk-reward benefit. However, with significant near-term headwinds ahead, the stock is not for the faint-hearted.

Yet, Near-term Headwinds Remain

Geron warns about the impact of COVID-19 on clinical trial recruitment, particularly for the IMerge trial, as the trial sites can pause the clinical trials amid a resurgence of the pandemic. Such a scenario will drag the timeline for enrollment from Q1 2021 to Q2 2021, the company notes. However, as long as the enrollment finishes by the first half of next year, it continues to expect top-line data by H2 2022. Meanwhile, a set of disgruntled shareholders have opened another front to hurt the fast-rising share price. In the first nine months of the year, two class-action lawsuits and three shareholder derivative lawsuits have been filed against the company. Any adverse outcome could severely hurt the share price as Geron has yet to financially estimate and account for the possible damages given the early stage of the legal trials.

Conclusion

Targeting two hematological malignancies with an unmet medical need, Geron's only therapeutic candidate has a clear path towards regulatory approval now. Yet, the consensus estimates seem to have significantly underrated its potential, and the shares continue to trade well below 2018 high. Our sales forecast for 2025, assuming a faster run towards the drug's peak sales opportunity, points to a modest premium based on relative valuation. However, the full sales potential, subject to regulatory approval, can indicate a compelling risk-reward opportunity. Yet with multiple lawsuits threatening the company's financials, and the pandemic overshadowing the clinical trial progress, we remain neutral on the stock.

If you enjoyed this article and wish to receive updates on my latest research, click "Follow" next to my name at the top.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.