Salesforce: One Cloud Investment To Rule Them All

Salesforce.com has the best CRM in the market, and this is now allowing it to expand into other growth areas.

Furthermore, through Salesforce Ventures, the company is investing in the next generation of cloud companies, and being rewarded handsomely for it.

The stock is not cheap but is a good long-term investment and a must-add on any pullback.

Thesis Summary

Salesforce.com (CRM) dominates the worldwide CRM market. Qualitatively, the business has a strong product and a good growth outlook. What makes this a compelling investment, in our view, is the exposure to investments in other companies through the Salesforce Ventures arm of the company. This makes the company a very well-rounded cloud investment with a lot of potential. The stock is not cheap, but the financial solidity, quality of its product, and growth outlook make this a decent investment now, and a very compelling one on any pullback.

Source: Salesforce

Source: Salesforce

Company Overview

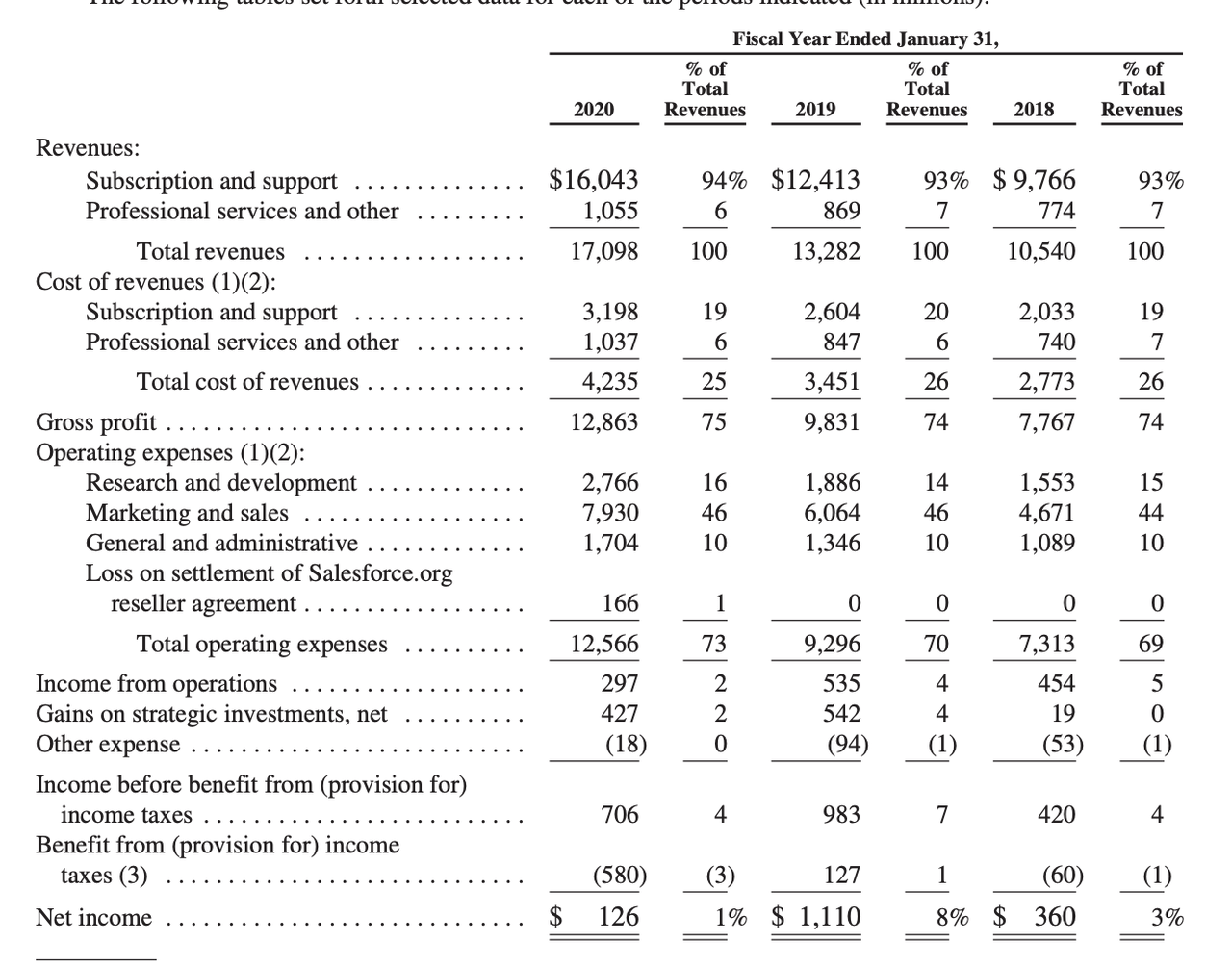

Salesforce was founded as a CRM in 1999. Since then, the company has expanded its product offerings to four distinct verticals; Sales Cloud, Service Cloud, Salesforce, and Marketing and Commerce Cloud. Rather than look at the latest quarterly results, which are not that recent, in this article, we will zoom out to get a bird's eye view of Salesforce’s trajectory over the last three years:

Source: Annual Report

The thing about Salesforce is that it doesn't generate a huge profit. Overall, the company has achieved a revenue CAGR of 27.22% in the last 3 years. For the most part, expenses have remained stable, although the last year had proportionally higher OpEx, which can be attributed to higher R&D. The big reason for the disparity in earnings in the last 2 years comes from the tax provision. Other than that, the company’s business operations haven’t changed much. Despite the low earnings, the company boasts a 30% FCF margin and a similar growth rate for it.

Looking at the balance sheet, the company is in great financial health with proportionally small long-term debt, around $2.6 billion, and a D/E of 0.13. Meanwhile, liquidity sits at around $12 billion. Salesforce is a great company to value, due to the stability of its business and predictability of its revenues. But is it a good time to invest? The stock has outperformed the broader market in recent years. By most measures of “value,” the company is expensive, although it seems harsh to value Salesforce on P/E. As always, we have used our 5-year DCF model to reach a price target for Salesforce.com

Salesforce: Best-in-class

Qualitatively, and although this is subjective, we could be looking at the best CRM in the world. There are a few key areas that set Salesforce apart from the competition. Firstly, its scalability and customization. Salesforce is not a one size fits all, and customers can change things within the platform easily.

Another big point in favor of Salesforce is security. CRMs manage a litany of data that must be protected from both outsiders and some insiders. Salesforce's software comes with preinstalled security modules.

But if you are not happy with what Salesforce has to offer, there is also a whole ecosystem of apps and developers to help you find exactly what you need. This type of open and free collaboration works very well, and companies like Shopify Inc. (SHOP) have used a similar model very successfully.

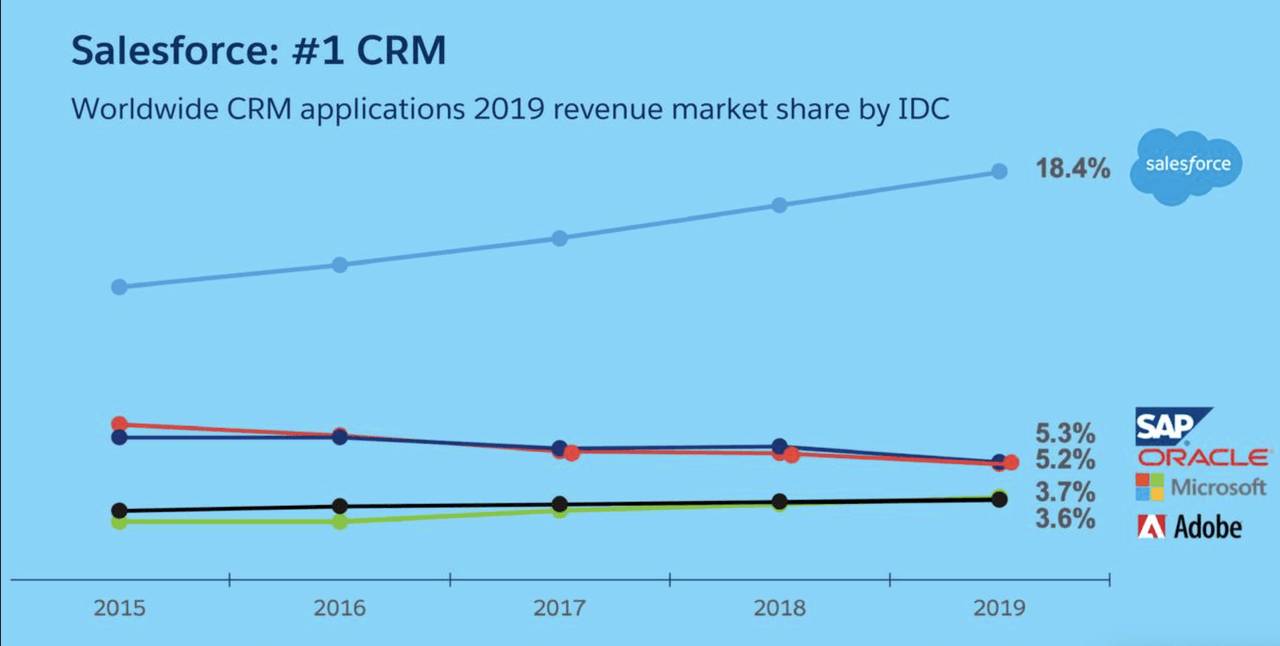

In conclusion, the platform just works better, has more features, and is overall more complete. Proof that Salesforce has a superior product can be found in the fact that the company is taking market share from competitors:

Source: Investor Presentation

Salesforce owes its success to the fact that it chose to focus on one thing, CRM, and do it right. With one foot through the door, the company can now explore various new avenues to continue to pursue growth.

Growth Outlook

There are at least three very compelling reasons why Salesforce.com could sustain incredibly high levels of growth, and even higher profitability, over the next five years.

Salesforce Ventures

One of the first things that popped out to us when looking at the income statement was the fact that in the last couple of years combined, it has brought in almost $1 billion of revenues. This is huge, and before we looked at this company in-depth, we had no idea just how involved in the cloud space its ventures arm is.

Salesforce ventures not only invests in cloud-related businesses, but it is also involved in the business operations of the companies it invests in. Much like a VC firm, Salesforce leverages both its money and expertise in the cloud area to help other companies succeed. Notable investments include Stripe (STRIP) and Dropbox Inc. (DBX). Just last week, the company announced a 9.9% stake in the recently IPO’d Snowflake Inc. (SNOW).

Salesforce Ventures has 468 investments spread along 13 different funds. This alone is an incredibly compelling reason to invest in Salesforce today. You are diversifying your investment along hundreds of different cloud-related companies. Nurturing and growing these companies is something that Salesforce.com can do very well, and cannot be easily replicated by others.

Data, Sales Marketing and Ecommerce

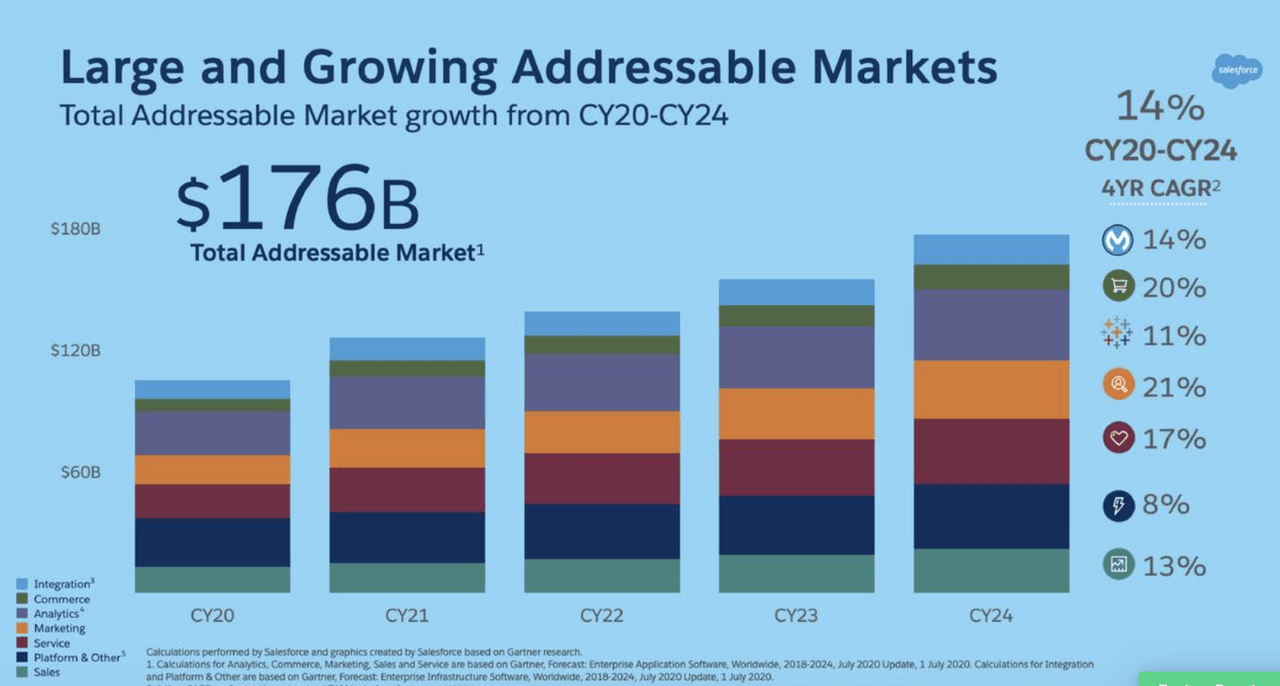

The biggest growth opportunity for Salesforce’s own business is data. This has been identified as one of the highest growth areas by the company itself.

Source: Investor Presentation

Starting with data and sales, we are looking here at the purple segment which refers to analytics, and the green at the bottom which refers to sales. These go hand in hand in our opinion because more data will ultimately be used to increase sales. These segments have a potential CAGR of 11-13%. CRM is at the core of most businesses, and the amount of data that is going to be embedded in them is going to grow exponentially. This is only going to increase Salesforce’s advantage over its competitors since aiding sales is what they do best, and this will give prospective customers even more incentives to join Salesforce.

The even bigger area of growth, though, will be marketing and commerce. Looking at the product revenue breakdown, the Marketing and Commerce cloud is the smallest, but the second-fastest-growing product line, behind the Salesforce Platform. Salesforce is not well-known for its e-commerce capabilities, but looking at what they offer and how they offer it, we see a very compelling opportunity here. Amongst other things, we love that Salesforce offers a licensing model, where companies can pay for the service as a % of revenues. A literal win-win. Salesforce certainly has the right capabilities to be a big player in the space but hasn’t quite achieved the presence. In this regard, a strategic partnership with some other established player could be an incredible tailwind for both parties. Shopify, for example, which has come to dominate the landscape, could be a prime candidate. The company has an easy to use platform and a great marketing team, but it lacks a lot in the out-of-the-box functionality department, specifically CRM.

Overall, the company has growth opportunities which will be powered by data and, most importantly, AI. We believe the latter will be a big part of the future of Salesforce, aiding both growth and profitability. Salesforce has invested a considerable amount of money in developing its own AI, named Einstein, which is already shown encouraging improvements such as Dynamic Priority.

Valuation

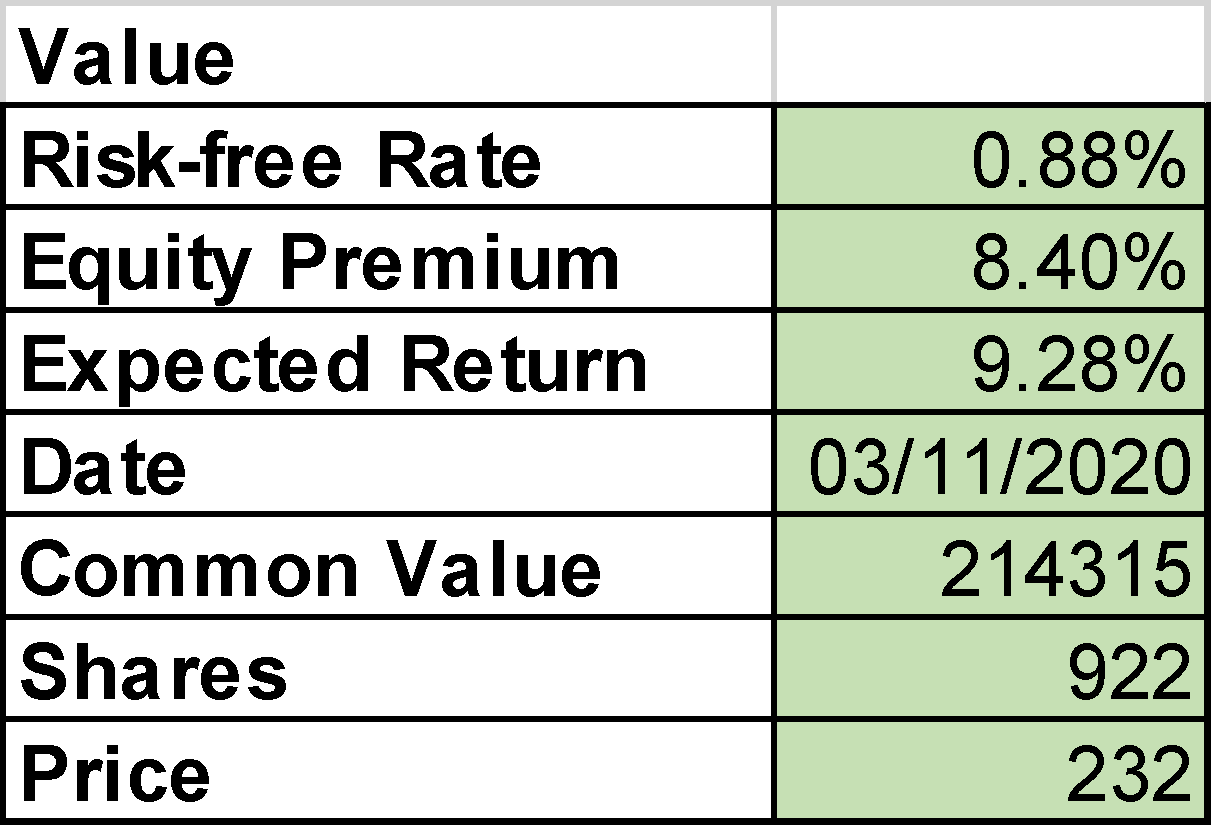

We have estimated the potential cash return for CRM’s common stock using our valuation method, which is further described in this post.

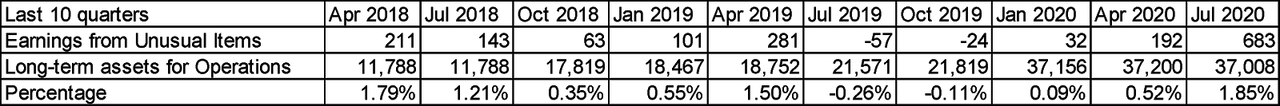

In this case, we have made an important change, since a large aspect of the business in recent quarters is earnings from strategic investments. Seeing how the balance sheet is packed with long-term assets, particularly goodwill, and earnings from unusual items have increased, we have changed the system so that the unusual items (we include these in the operating income) are linked to long-term assets. You can see the recent evolution of this proportion (in millions of USD except percentages):

Source: Author’s work

These assets will not pay off immediately and they have increased a lot in 2019, so we are estimating a yearly average of 7.6% of long-term assets going forward, taking the latest quarter as a reference.

Since a big part of the business is to invest in other companies, we are projecting CRM to continue to grow the balance sheet aggressively in the coming years, and operating profit to increase faster than revenue, given the earnings from strategic investments that we explained earlier.

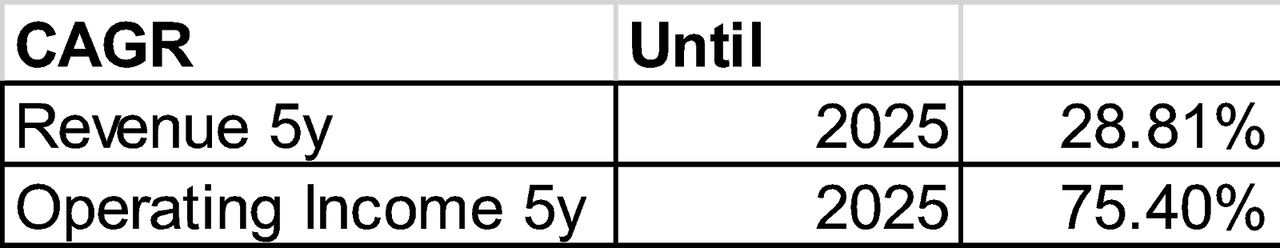

With a projected growth above other estimates and increasing profitability, we can estimate a potential cash return of just over 9%. You can see the summary below, with items in millions of USD except percentages and per share items. Note that each year refers to the fiscal year ending in January, so we are currently in FY 2021.

Source: Author’s work

Risks

So, what could go wrong for CRM? From what we have talked about above, we can distinguish two different sets of operations, each with its own potential downsides. The main business is providing software for CRM. This is the most "reliable" part of the investment. Having said this, the company is facing competition with other players both big and small. The biggest threat to Salesforce is also its biggest opportunity. The market is changing rapidly due to innovation. This allows for growth, but it could also reshape the market. For now, Salesforce has by some measure a superior product, but this could change as CRMs become ever more powered by AI and data-centric. The company could lose its edge here to more "sophisticated" firms like Microsoft Corp. (NASDAQ:MSFT). Having said this, we can see Salesforce is clearly working hard to stay ahead, having increased its R&D at a fast rate over recent years.

Then we have the investment side of the business. We have made our best attempt at quantifying this potential, but it remains a speculative estimate. This is perhaps the most significant identifiable downside with Salesforce. There is not an established track record for these investments. This may also mistake some investors who want to invest due to the stability of the main line of business. CRM could actually suffer significant losses if these investments don't pan out. This also makes it more exposed to a market crash and liquidity conditions. Many of the companies Salesforce promotes are start-ups, which rely heavily on funding during their first few years. If credit dries up, so will returns.

On a final note, the company is almost fully priced, giving us a return of 9.28% at the current price. While this is not a bad return, we have certainly identified "better" investments in the last few months. Having said this, the financial solidity, quality of its product, and growth outlook make this a decent investment now, and a very compelling one on any pullback.

Takeaway

CRM is an operationally great company. Furthermore, we see a lot of potential from its investment arm coming in the next few years. We see a value investing opportunity here because we don't think the market has appreciated the potential upside from these investments. We expect Salesforce Ventures to continue to grow and be a leading force in the expansion of the cloud market. While the company is not cheap, this is a business that we are happy to hold for the long term, and could also surprise us in the short term.

Macro Trading Factory is a new service focused on macro views, market outlook, and asset-allocation.

We demonstrate portfolio and risk management, in a simple and relaxed manner.

Our model-portfolio is:

well-diversified, containing up to 25 leading ETFs and CEFs.

managed by a team of professionals, led by TMT.

aiming to outperform the SPY on a risk-adjusted basis.

allowing you to keep-up with your daily-routine.

MTF is your perfect solution if you're looking for an ongoing, professional, trusted, affordable guidance, especially with little time on their hands.

Macro Trading Factory for An Upward Trajectory!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.