Breaking Up AIG: Simply Compelling At 0.6x Tangible Book With A Catalyst

Breaking up is hard to do.

AIG management is proactively seeking to unlock shareholder value and should be applauded.

Life and Retirement division is worth substantially more than currently implied in the share price.

Management is finally addressing the conglomerate discount.

AIG is a compelling buy at 0.6x adjusted tangible book.

AIG (AIG) has announced its intention to pursue a separation of the Life & Retirement ("L&R") business from AIG. This was on the back of a comprehensive review of AIG's current composite structure including strategic, operational, capital and tax implications.

AIG's Management believes that this will unlock substantial shareholders' value and narrow the valuation discount to book as well as peers.

The sell-side is somewhat skeptical and has not yet completely got on-board. This is an opportunity for the nimble retail investor.

AIG has been on my watch list for a number of years due to perceived deep value and perennial discount to book. However, I did not pull the trigger for primarily three reasons:

- It is hard to get excited about insurance companies in lower rates for longer environment;

- I could not see a clear, time-bound catalyst for rerating; and

- Whilst the AIG 200 transformation appeared sound, it was fraught with execution risks and trajectory was certainly going to be "a long and winding road".

There was simply no clear narrative for a rerating or at least one that I could identify.

This has all changed now. The proposed staggered disposal of L&R, in my view, is a complete game-changer.

(source)

The thesis

The whole is (significantly) less than the sum of the parts when it comes to AIG. Currently, Mr. Market attributes ~0.6x tangible book valuation for the AIG composite valuation. The staggered disposal of the L&R is likely to be done at much more generous multiples. The stock has to rerate.

It is all about the removal of the conglomerate discount. It also opens the opportunity, over time, for significant share buybacks and dividends.

Finally, the General Insurance ("GI") division is also showing good progress with the combined ratio expected to be lower than 90 percent by the end of 2022. This is a 10 percent improvement from 2018.

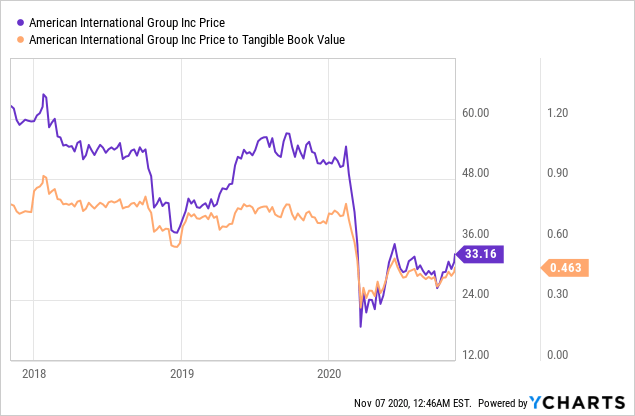

AIG valuation

The below chart demonstrates the substantial impact the pandemic had on AIG's share price and price to tangible book. The COVID19 impacts the bottom line immediately through loss provisions as well as the secondary effect of lower interest rates.

Data by YCharts

Data by YCharts

The chart above shows a 0.463x multiple of tangible book value but the reported measure includes some noise such as AOCI, tax assets and other accounting adjustments. For prudence, it is more productive to use an "adjusted tangible book value" metric that stands at $51 per share as of 30 September 2020. On this basis, AIG currently trades at ~0.6x tangible book. This is a distressed valuation for an insurance company suggesting it is effectively destroying capital given its cost of capital is ~10 percent.

The composite structure

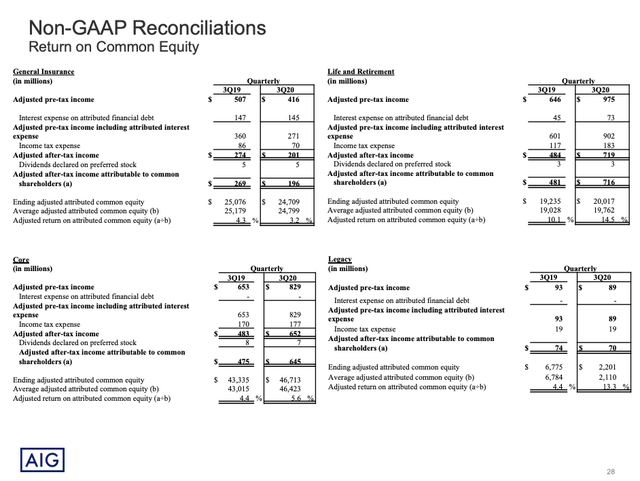

Below is an extract from the latest earning report:

As can be seen from above, L&R is attributed ~$20 billion of common equity whereas the General Insurance division is attributed ~25 billion.

As can be seen from above, L&R is attributed ~$20 billion of common equity whereas the General Insurance division is attributed ~25 billion.

Note that the total market cap of AIG is a mere ~$28 billion.

What valuation will the market attribute to L&R?

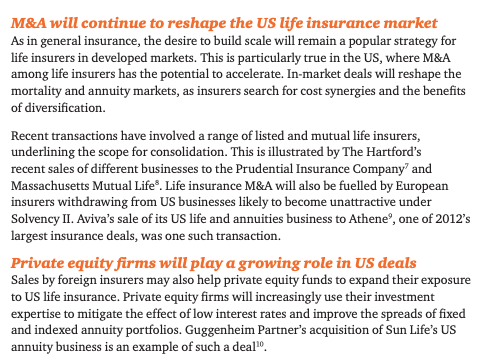

That is clearly the biggest unknown. However, there will be no shortage of interested counter-parties including private equity firms as indicated in this recent PwC report.

Given that L&R earns well above its cost of capital, I presume that any sale price should be completed well-above its book value.

Given that L&R earns well above its cost of capital, I presume that any sale price should be completed well-above its book value.

Interestingly, in the earnings call, Tom Gallagher of Evercore provided some insight on recent sales of life insurers in the private market at a premium:

Peter, you mentioned that you don't intend to break up the Life Insurance business and sell it off in pieces. I guess my question is, we've seen some recent indications in the market that private values are potentially double that of current public market values of life insurers. Have you taken that into consideration and still concluded your path is the best one for shareholders?

The above factors suggest that the selling price (whether through IPO or private price) should be achieved at a significant premium to book. This makes the current market cap of AIG of $28 billion appear somewhat out of keel.

Breaking up is hard to do

So that begs the question why didn't AIG do this earlier?

Back in 2015, activist investor Carl Ichan has begun building a substantial stake (~5 percent) in AIG and demanded to break up the firm. AIG management strongly resisted the pressure to break up citing the following three key reasons:

1) Capital diversification synergies existing in the composite structure. In other words, on a stand-alone basis, additional capital would necessarily be required;

2) The composite structure enables cost synergies as overheads are shared across the Group;

3) Anxiety of losing the benefit of substantial tax assets (U.S. NOLs as well as foreign tax credits).

Mr. Ichan finally yielded and sold his stake in 2018 believing the then-new CEO Mr. Brian Duperreault would be opposed to breaking up the company.

As such, the recent comprehensive strategic review and conclusions took the market by complete surprise. Analysts are now scratching their heads to understand the potential outcomes and hence recent volatility in the share price.

The Times They Are a-Changin

Much has changed since 2016 and the points noted above are no longer the "showstoppers" once thought.

Under the stewardship of Mr. Duperreault, AIG comprehensively derisked its operations, especially so in the GI division. As such, the company projects that no additional equity capital will be required on separation and that the "capital diversification" argument is no longer as acute.

Secondly, the AIG 200 program has transformed the management of the cost base and will be further leveraged to optimize outcomes on separation. Going-forward on a stand-alone basis, AIG indicates lower absolute costs than the current run-rate whilst still acknowledging the investment dollars required to achieve separation:

if we're going to do an IPO with Life and Retirement, there will be additional investment in order to have that company stand up on its own. But how I would think about it is that the benefits of AIG 200 to Life and Retirement will be at or more than what the investment costs were. So there'll be no additional costs in terms of the run rate today.

And then I do think that there will be more expense synergies at AIG post separation, and we're working through that and that would be in addition to AIG 200, and we'll just give you some more insight in one of our future quarter calls as we do a little bit more ground up work on it.

Finally, the company does not expect any material write-down of its deferred tax assets or foreign tax assets. In fact, this is a key reason for the staggered disposal structure contemplated beginning with a 19.9 percent stake in L&R.

Final thoughts

I applaud management for actions taken to unlock shareholder value. It appears to be a well-considered and thorough strategic review and its conclusions are simply persuasive.

I see a significant upside in the stock once the market realizes the third-party valuation attached to the L&R division. The conglomerate discount should quickly disappear.

Furthermore, the transformation of the GI division is also very encouraging. In its outlook provided in the 3Q'2020 earnings, management guided to "top-line growth in 2021" and by the end of 2022 achieve a "combined ratio, excluding CAT, below 90 percent". This is a full 10 percent improvement since 2018.

AIG is certainly in deep value territory but this time there are also clear near-term catalysts to force the issue. I am now increasingly bullish and initiated a medium-sized position.

Disclosure: I am/we are long AIG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.