Questions Loom For Gilead

GILD's Q3 revenue bounced Q/Q on the strength of its COVID-19 treatment.

HIV revenue gained traction as the economy continued to reopen. Sizeable M&A deals may have reduced GILD's dry powder.

It is unclear whether investments in GLGP and IMMU will generate an acceptable financial return.

Questions loom for GILD. I rate the stock a hold.

Source: Barron's

Source: Barron's

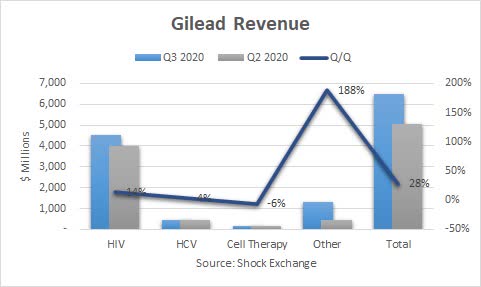

Gilead (NASDAQ:GILD) reported Q3 revenue of $$6.56 billion, non-GAAP EPS of $2.11 and GAAP EPS of $0.29. The company beat on revenue and non-GAAP EPS, but missed on GAAP EPS. Q2 revenue fell in the high-single-digit percentage range Q/Q, as Gilead was negatively impacted by the pandemic. Revenue came roaring back this quarter, rising 28% sequentially and falling 10% Y/Y.

HIV revenue was $4.5 billion, up 14% Q/Q. Channel inventory began to normalize, driving sales higher. Biktarvy sales were $1.9 billion, up 18% Q/Q. This was a sea change from the 5% decline last quarter; Q2 was marked by reduced switches due to a decline in patient visits amid the pandemic. Biktarvy has been a catalyst for HIV sales and Gilead in general. It has been cannibalizing certain of Gilead's HIV products as well as those of competitors.

HIV revenue was $4.5 billion, up 14% Q/Q. Channel inventory began to normalize, driving sales higher. Biktarvy sales were $1.9 billion, up 18% Q/Q. This was a sea change from the 5% decline last quarter; Q2 was marked by reduced switches due to a decline in patient visits amid the pandemic. Biktarvy has been a catalyst for HIV sales and Gilead in general. It has been cannibalizing certain of Gilead's HIV products as well as those of competitors.

HCV revenue of $464 million rose 4% Q/Q as the segment recovers from delayed patient starts due to the pandemic; an increase in Europe also helped. Cell Therapy revenue was $47 million, down 6% Y/Y. The segment included $9 million from Tecartus, which received FDA approved this quarter.

Other revenue more than doubled to $1.3 billion. Veklury generated $873 million in revenue. The FDA granted approval to treat COVID-19 and the European Commission conditional Marketing Authorization to treat COVID-19. Sales could be extremely volatile amid the pandemic. Secondly, the emergence of a vaccine could also hurt sales.

Gilead's gross margin was 83%, up from 79% in Q2. The increase in scale from Veklury helped, as well as revenue growth in higher-margin HIV segment. R&D costs were $1.2 billion, down 11% Q/Q. Gilead has been very acquisitive; leveraged R&D of target companies. This could allow the company to reduce R&D costs further. SG&A $1.1 billion, also down 11%. Combined costs for R&D and SG&A give management a large pool of expenses it could potentially cut into. Operating income was $2.0 billion, which equated to an operating income margin of 30%. Gilead incurred $1.2 billion in expenses for acquired R&D. When this spending trails off, then the company's operating income should improve dramatically. That is a long-winded way of saying the company has levers to pull in order to improve its bottom line.

M&A Is A Question Mark

Gilead's blockbuster HCV regimen generated billions in revenue in cash flow. The potential to use excess cash flow for acquisitions was always there, which made the stock very attractive. However, the stock market appears to have been unkind to the company. Low interest rates and Fed stimulus have helped buoy financial markets to the point where equity values may have been divorced from earnings prospects. This likely made finding attractive deals more difficult.

In my opinion, Gilead is using its dry powder on acquisitions with an uncertain return. The company took a 25% equity stake in Galapagos (GLPG) for $10 billion, gaining access to Galapagos's R&D pipeline. Galapagos's JAK1 inhibitor for rheumatoid arthritis was expected to take market share from rivals once approved. However, the FDA rejected the filing for the JAK1 inhibitor:

Gilead has paused enrollment in clinical trials of filgotinib in three indications pending feedback from the FDA. The cessation of enrollment follows the FDA's decision to reject a filing for approval of the JAK1 inhibitor in rheumatoid arthritis due to toxicity concerns.

In the fourth quarter, Gilead will meet with the FDA to discuss the complete response letter ("CRL"). Talking to investors late on Wednesday, Gilead Chief Medical Officer Merdad Parsey, M.D., Ph.D., said enrollment in trials of psoriatic arthritis, ankylosing spondylitis and uveitis patients has stopped. Gilead took the action in the belief the FDA meeting will inform the broader filgotinib development program.

The complete response letter will delay any approval or launch of the rheumatoid arthritis treatment. Even if it is approved, Gilead/Galapagos will have to compete with other treatments on the market. That is a long-winded way of saying the returns from the Galapagos investment may take longer than expected.

Gilead also recently announced a $21 billion acquisition of Immunomedics (IMMU), whose Trodelvy has demonstrated strong efficacy with metastatic triple-negative breast cancer. Trodelvy garnered Q3 sales of over $50 million, its first full quarter of commercial availability. Robust adoption of the treatment could continue for several quarters. Evaluate Pharma projects Trodelvy's sales could reach $1.44 billion in 2024, so the acquisition would equate to nearly 15x 2024 revenue. The deal is strategic in that it fits with Gilead's goal of building out its oncology portfolio. The question remains, "Can Gilead receive an acceptable financial return at such a robust purchase price?"

There could be M&A opportunities at more attractive prices outside of oncology. Gilead's M&A acumen may not be used to its full potential by focusing so much on the oncology space. Competitors like AbbVie (ABBV) are very acquisitive; the recent acquisition of Allergan allowed AbbVie to expand into the aesthetics space and made AbbVie more diversified. While AbbVie can compete with Gilead in rheumatoid arthritis and HCV, Gilead may not be able to hurt AbbVie in the aesthetics space.

Lastly, Gilead's acquisition of Immunomedics will reduce its dry power. The deal will be funded with $15 billion in cash and $6 billion. It will put a sizeable dent in Gilead's $26 billion cash hoard and potentially limit its flexibility to make future acquisitions.

Conclusion

Questions loom for Gilead, particularly around its M&A prowess. I rate the stock a hold.

I also run the Shocking The Street investment service as part of the Seeking Alpha Marketplace. You will get access to exclusive ideas from Shocking The Street, and stay abreast of opportunities months before the market becomes aware of them. I am currently offering a two-week free trial period for subscribers to enjoy. Check out the service and find out first-hand why other subscribers appear to be two steps ahead of the market.

Pricing for Shocking The Street is $35 per month. Those who sign up for the yearly plan will enjoy a price of $280 per year - a 33% discount.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.