Japan Tobacco: Future Dividend Cut Is The Key Risk

All eyes are on the retail price increase and the RRP sales contribution in Japan Tobacco's home market Japan.

Foreign exchange movements and down-trading for Japan Tobacco's international tobacco business are also in the spotlight.

Japan Tobacco's high dividend yield is a key factor supporting its valuation, and a cut in future dividends represents a significant risk for the stock.

Japan Tobacco trades at 11.5 times consensus forward FY 2021 P/E, and it offers a consensus forward FY 2021 dividend yield of 7.4%.

Elevator Pitch

I have a neutral rating on Japan Tobacco, Inc. (OTCPK:JAPAF) [2914:JP], the third largest tobacco company globally.

All eyes are on the retail price increase and the RRP (Reduced-Risk Product) sales contribution in Japan Tobacco's home market Japan. Also, foreign exchange movements and down-trading for the company's international tobacco business are also in the spotlight. More importantly, its high dividend yield is a key factor supporting its valuation, and a cut in future dividends represents a significant risk for the stock.

Japan Tobacco's relatively low market share in the RRP market in Japan remains a major concern in the medium term, while the short-term performance of its premium brands in foreign markets could potentially be hurt by consumer down-trading to more affordable value brands.

The company trades at 11.5 times consensus forward FY 2021 P/E, and it offers a consensus forward FY 2021 dividend yield of 7.4%. Japan Tobacco's P/E valuations are reasonable, but I am mindful that future dividends could be cut, which justifies a Neutral rating.

Readers have the option of trading in Japan Tobacco shares listed either on the Over-The-Counter Bulletin Board/OTCBB as ADRs with the ticker JAPAF, or on the Tokyo Stock Exchange with the ticker 2914:JP. For those shares listed as ADRs on the OTCBB, note that liquidity is low and bid/ask spreads are wide.

For those shares listed in Japan, there are limited risks associated with buying or selling the shares in terms of trade execution, given that the Tokyo Stock Exchange is one of the major stock exchanges that is internationally recognized, and there is sufficient trading liquidity. Average daily trading value for the past three months exceeds $80 million, and market capitalization is above $35 billion, which is comparable to the majority of stocks traded on the US stock exchanges.

Institutional investors which own Japan Tobacco shares listed in Japan include BlackRock, The Vanguard Group, MFS Investment Management, Capital Research Global Investors, and Geode Capital Management, among others. Investors can invest in key Asian stock markets either using U.S. brokers with international coverage such as Interactive Brokers and Fidelity, or international brokers with Asian coverage like Hong Kong's Monex Boom Securities and Singapore's OCBC Securities.

Company Description

Japan Tobacco is the market leader in Japan's tobacco market and the world's third largest tobacco company.

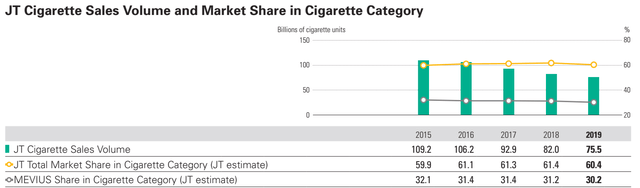

Market Share In Domestic Cigarette Category

Source: FY 2019 Factsheet

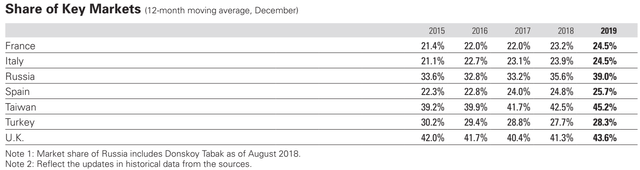

Market Share In Key Foreign Markets

Source: FY 2019 Factsheet

The company derived 28.1% and 60.3% of its FY 2019 revenue from its domestic tobacco business (home market Japan) and international tobacco business (foreign markets), respectively. Non-core businesses such as processed food, pharmaceuticals and others accounted for the remaining 7.3%, 4.1% and 0.2% of the company's top line in the most recent fiscal year. The domestic tobacco business and international tobacco business also contributed 34.0% and 54.5% of Japan Tobacco's operating profit for FY 2019 respectively. I will be focusing primarily on Japan Tobacco's core tobacco business (both domestic and foreign markets) for the purpose, as it represents the bulk of its revenue and earnings.

All Eyes On Price Increase And RRP Sales Contribution In Home Market Japan

Japan Tobacco announced the company's 3Q 2020 financial results on October 30, 2020, and its financial performance was decent in the third quarter of the year. The company's revenue declined marginally by -2.3% YoY from JPY575.2 billion in 3Q 2019 to JPY561.9 billion in 3Q 2020, while its net profit attributable to shareholders decreased by -4.7% YoY from JPY89.7 billion to JPY85.5 billion over the same period. Notably, adjusted operating profit (mainly adjusting for amortization cost of acquired intangibles arising from business acquisitions) on a constant-currency basis increased by +4.2% YoY from JPY163.7 billion in 3Q 2019 to JPY170.6 billion in 3Q 2020.

Both the domestic and international tobacco businesses performed well in 3Q 2020, and I will be discussing about the company's international tobacco business in the next section of this article. For the domestic tobacco business, the selling price increase and sales contribution from Reduced-Risk Products, or RRP, are the key issues.

Japan Tobacco's domestic tobacco business saw adjusted operating profit grow +1.8% YoY from JPY56.2 billion in 3Q 2019 to JPY57.2 billion in 3Q 2020, and the company also raised its guidance for full-year FY 2020 adjusted operating profit for the domestic tobacco business by +6.0% from JPY160.0 billion previously to JPY166.0 billion. Apart from lower operating costs due to disruptions caused by the coronavirus pandemic and better cost control, Japan Tobacco's domestic tobacco business benefited from consumer demand being pulled forward in 3Q 2020 ahead of price increases in October 2020 and better-than-expected RRP sales volume (+20% YoY increase) in the third quarter of the year.

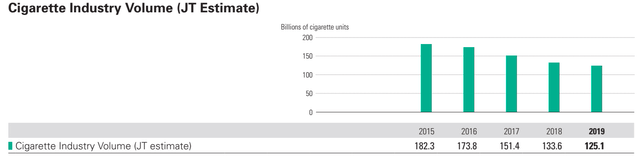

The cigarette industry in Japan is shrinking in terms of sales volume, as per the chart below. This implies that the company needs to either to raise prices (to offset volume decline) or increases sales contribution from other tobacco products that have higher demand to survive and thrive in the domestic market going forward.

Japan's Cigarettes Sales Volume For The Entire Industry

Source: FY 2019 Factsheet

It came as a positive surprise that Japan Tobacco announced in July 2020 that the company applied for a JPY50 increase in the retail price per pack for 224 of its tobacco products, and this was approved by Japan's Ministry of Finance. The increase in selling price was higher than expected and has come into effect on October 1, 2020.

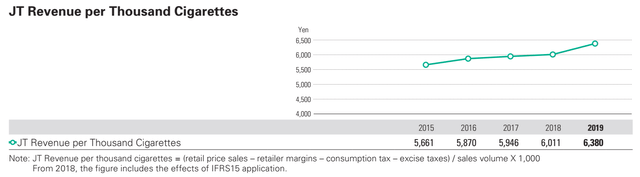

It is noteworthy that Japan Tobacco's revenue per cigarette and retail price have been increasing steadily over the past few years as per the chart below, and this is supported by the fact that cigarette prices in Japan are relatively low compared to global averages. This supports the case for future cigarette retail price increases in Japan going forward, but any retail price increase in the future is still subject to approval by Japan's Ministry of Finance.

Japan Tobacco's Revenue Per 1,000 Cigarettes

Source: Japan Tobacco's FY 2019 Factsheet

Separately, Japan Tobacco's sales contribution from Reduced-Risk Products, or RRP, is also a key area of focus for the company's domestic tobacco business. Japan Tobacco defines RRP as "products with the potential to reduce the health risks associated with smoking."

In Euromonitor's July 2020 report on the tobacco market in Japan, it was highlighted that "heated tobacco is seen to offer the greatest potential for growth" in the Japan market, and "leading tobacco giants continued to expand their investment outside of traditional products" to counter "declining cigarettes sales" in the country. As of end-2019, Japan Tobacco's RRP portfolio includes three tobacco vapor offerings (heated tobacco) and five types of e-cigarettes.

It is noteworthy that while Japan Tobacco has a 60% market share in the Japan cigarette industry, it only has a 11% share of the RRP market in Japan. Notably, RRP accounts for more than a quarter of Japan's tobacco market. Unless Japan Tobacco can increase its market share of the RRP segment in Japan significantly going forward with new products, the domestic tobacco business is unlikely to achieve significant top-line and bottom-line growth in the near future.

Down-Trading And Unfavorable Foreign Exchange Movements For Foreign Markets In The Spotlight

The international tobacco business' reported revenue was up marginally by +0.1% YoY at JPY3,116 billion in 3Q 2020, while its reported adjusted operating profit declined by -8.3% YoY to JPY949 billion in the most recent quarter. In contrast, the international tobacco business's revenue and adjusted operating profit would have increased by +6.8% YoY and +5.5% YoY on a constant-currency basis.

Robust demand from domestic consumption in foreign markets and market share gains at the expense of weaker competitors have helped Japan Tobacco to offset lower sales from tourists due to international travel restrictions, as evidenced by the strong growth in revenue and adjusted operating profit for the international tobacco business. On the flip side, the 3Q 2020 results suggest that the international tobacco business is exposed to foreign exchange risks, as any significant depreciation in the currencies of the key international markets that Japan Tobacco operates in could translate into lower reported revenue and earnings for the company in its reporting currency JPY.

Down-trading is a key issue to watch. As many countries globally continue to struggle to contain Covid-19 and tighten social distancing and lockdown measures, the economic fallout from the coronavirus pandemic could turn out to be worse than expected. This increases the risk of consumers down-trading to cheaper value brands, and this could hurt the performance of Japan Tobacco's premium brands in foreign markets.

An Unexpected Cut In Dividends Is A Key Risk Factor

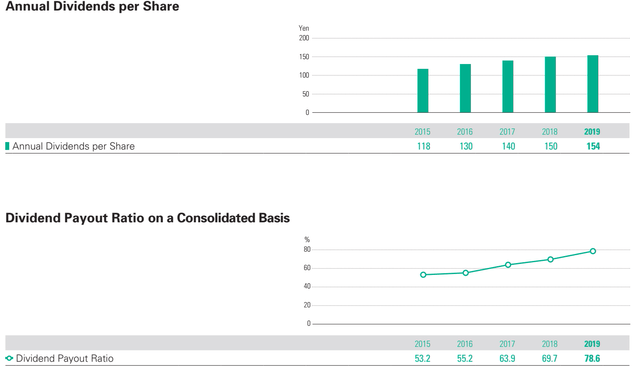

Japan Tobacco has increased the company's annual dividends per share and dividend payout ratio for the past few years. The stock's high forward dividend yield above 7% is a key investment merit.

Japan Tobacco's Historical Annual Dividends Per Share And Dividend Payout Ratio

Source: Japan Tobacco's FY 2019 Factsheet

Source: Japan Tobacco's FY 2019 Factsheet

Japan Tobacco had earlier guided for FY 2020 dividends per share to be maintained at JPY154, same as what was paid out for FY 2019. Sell-side analysts agree with the company, and they see the dividends per share maintained at JPY154 for both FY 2020 and FY 2021. Nevertheless, there is still a risk of Japan Tobacco cutting its dividends in future, if cigarette volume in Japan declines at a faster-than-expected pace, sales contribution from RRP in Japan fails to grow, and its premium brands in foreign markets get impacted by consumer down-trading.

Valuation

Japan Tobacco trades at 12.2 times consensus forward FY 2020 P/E and 11.5 times consensus forward FY 2021 P/E based on its share price of JPY2,062.50 as of November 5, 2020. Market consensus is for the company to deliver ROEs of 12.2% and 13.0% for FY 2020 and FY 2021, respectively. The stock offers consensus forward FY 2020 and FY 2021 dividend yields of 7.5% and 7.4%, respectively.

Although Japan Tobacco's valuations seem attractive on an absolute basis, there are a number of tobacco companies trading at lower forward P/E multiples and offering higher forward dividend yields as per the peer comparison table below.

Peer Valuation Comparison For Japan Tobacco

| Stock | Consensus Current Year P/E | Consensus Forward One-Year P/E | Consensus Current Year Dividend Yield | Consensus Forward One-Year Dividend Yield |

| Philip Morris International Inc (PM) | 14.1 | 12.6 | 6.6% | 6.8% |

| British American Tobacco Plc (BTI) | 8.0 | 7.7 | 8.6% | 9.1% |

| Altria Group Inc (MO) | 12.7 | 8.3 | 9.0% | 9.3% |

| Imperial Brands (OTCQX:IMBBY) (OTCQX:IMBBF) [IMB:LN] | 8.0 | 7.4 | 11.3% | 11.2% |

Source: Author

Risk Factors

The key risk factors for Japan Tobacco are a failure to raise selling prices and increase sales contribution from RRP in its home market Japan, unfavorable foreign exchange movements and down-trading in foreign markets, new regulations that are negative for the tobacco industry in the markets that the company operates in, and lower-than-expected dividends going forward.

Note that readers who choose to trade in Japan Tobacco shares listed as ADRs on the OTCBB (rather than shares listed in Japan) could potentially suffer from lower liquidity and wider bid/ask spreads.

Asia Value & Moat Stocks is a research service for value investors seeking value stocks with a huge gap between price and intrinsic value, leaning towards deep value balance sheet bargains (i.e. buying assets at a discount e.g. net cash stocks, net-nets, low P/B stocks, sum-of-the-parts discounts) and wide moat stocks (i.e. buying earnings power at a discount in great companies like "Magic Formula" stocks, high-quality businesses, hidden champions and wide moat compounders). Sign up here to get started today!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.