KKR's stock has appreciated nicely so far this year, and strong business performance has the company poised for more gains.

Book value is a solid pillar of value, is growing, and should continue to grow.

Earnings growth is supported by a number of sustainable or accelerating trends.

Put it together and KKR is poised for more gains.

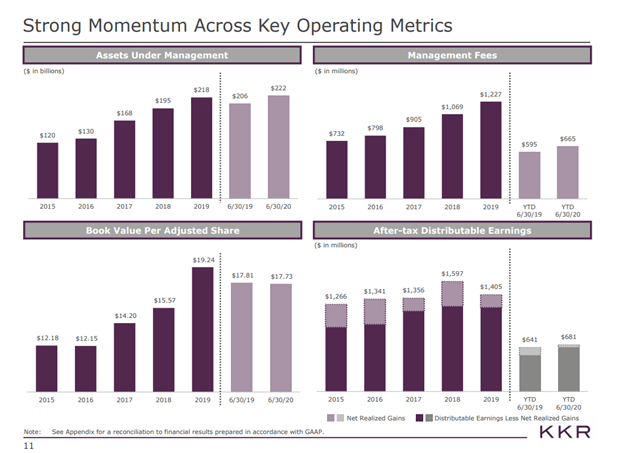

KKR (NYSE:KKR) reported Q3 earnings on October 30th and continues to perform well. Book value was up 14% in the quarter and is now a positive 5% YTD and 11% over the last 12 months. Management fees are also on the rise and are 13% higher than in Q3 of 2019. This steady growth should continue as KKR is looking at a record year of fundraising and deployment. Additionally, it recently announced a transaction with Global Atlantic that will serve as a catalyst for continued growth. KKR has been a good performer this year with the stock price advancing 17% through the end of October. The company's continued strong performance will support future gains.

September 2020 Investor Presentation

Growing Book Value

Unlike some of its alternative asset manager peers, KKR has a large balance sheet. In 2016, the company decided that instead of distributing most of its earnings, it would retain more of its earnings in its various funds alongside its fund investors. This is in contrast to many of its peers, such as Apollo (NYSE:APO) or Blackstone (NYSE:BX), which pay out the bulk of their earnings in dividends and carry a much smaller balance sheet. KKR's balance sheet approach is more similar to that of Brookfield Asset Management (NYSE:BAM).

At the end of Q3, book value stood at $20.26/share, more than half of KKR's current share price. There are legitimate arguments over whether it is better to have an asset-light balance sheet like APO or BX or a more robust balance sheet such as KKR. However, if you choose to accumulate a large book value like KKR has, it is indisputable that the robustness and growth of the book value is important.

KKR's book value/share has been steadily rising since KKR decided to grow its balance sheet. Book value stood at $12.15/share at the end of 2016 and has grown 66% to reach the current level of $20.26/share. In comparison, the S&P 500 was up roughly 50% in the same time frame. KKR's funds have historically achieved impressive returns and are highly sought after. Fund investors include sophisticated parties such as pensions, endowments, sovereign wealth funds and high-net-worth individuals. In the third quarter alone, these investors entrusted KKR with over $8B of capital. KKR's own capital should be well taken care of, and I expect the book value to continue to increase at a nice rate.

Distributable Earnings Stream

In addition to book value, KKR earns money for managing these funds. KKR had distributable earnings (DE) of $1.67 in 2019. So far in 2020, DE has come in at $1.28. Annualizing that would put the company at $1.71 for the year.

Like the book value, these earnings should also continue to grow. Assets under management (AUM) are the lifeblood of the earnings, and the AUM has been growing at a fast pace, including 12% in the last year. AUM now stands at $234B as of the recent Q3 report.

There are a number of reasons these earnings should continue to grow. Low rates have investors searching for places for return and increasing allocations to alternative managers. Additionally, institutional investors have been concentrating their investments in the few largest and most successful alternative managers, of which KKR is one. As with many trends, COVID is accelerating the trend that is already in place. Rates have gone lower and look to stay lower for longer. Also, uncertain markets and a lack of in-person meetings make fund investors even more likely to invest with companies they already have relationships with. That's happening with KKR as it is on track for a year of record fundraising.

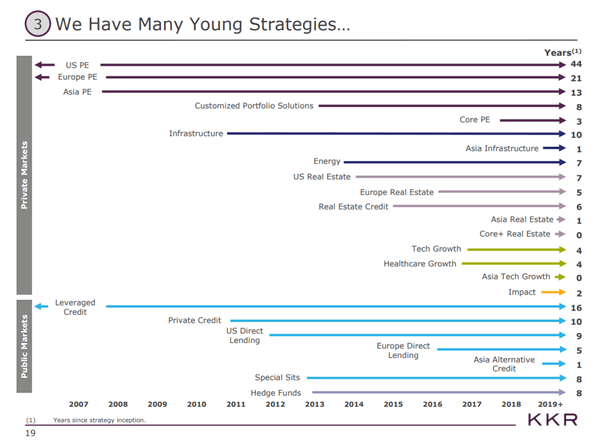

KKR has repeatedly explained that many of its strategies are just starting to reach scale and will become increasingly profitable.

September 2020 Investor Presentation

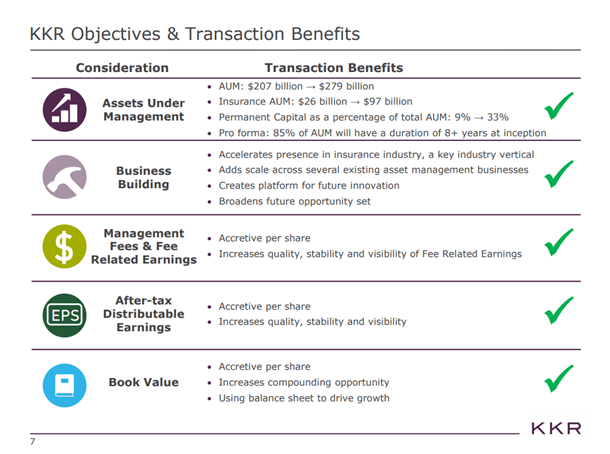

Finally, KKR is making a big move into the insurance space. Low rates have affected not just institutional investors, but insurance companies which are having trouble profitably investing their float. That has provided an opportunity for the alt managers, and KKR is not jumping into the space in a big way with the recently announced acquisition of Global Atlantic. Global Atlantic is a leading provider of fixed annuities and the transaction will provide a step-up in KKR's AUM. KKR expects that it will provide an extra $200 million in management fees, or a double-digit percentage increase to what it should achieve in management fees in 2020.

KKR Global Atlantic Acquisition Presentation

Put together this provides a solid basis for continued double-digit growth in distributable earnings.

Adding it Up

As noted above, KKR's last reported book value was $20.26. I like to value this component of KKR value at simply a 1x multiple. That is $20.26 of book value should be worth $20.26 for KKR's stock price. Given the historical investment success of KKR's funds, I think there is a reasonable argument that the book value should be valued at higher than a 1x multiple, but I prefer to simply use a 1x multiple.

KKR had distributable earnings (DE) of $1.67 in 2019. So far in 2020, DE has come in at $1.28. Annualizing that would put the company at $1.71 for the year. A 15x earnings multiple puts that at $25.65.

Putting these two together gives $20.26 + $25.65 = $45.91 compared to the share price of $38.19 at the close of trading on November 2nd providing a potential 20% upside.

One of the biggest risks to the stock's upside potential is that some of these growth initiatives won't play out. There is no guarantee that KKR's young strategies will grow and mature as successfully as its older strategies. It is also important that KKR successfully executes the Global Atlantic acquisition. Insurance is a large opportunity for KKR, but there is no guarantee it'll succeed with its big expansion in the space. It will be interesting to see how well it executes in this area. If it succeeds, the additional $200 million in management fees mentioned above may be just the beginning, but if it stumbles, it will be a setback and could temper future gains for the stock.

Disclosure: I am/we are long KKR. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.