Apple Hospitality REIT: Feeling The Pain

Investing in the hotel and travel industry via specialized REITs has generated strong dividend income in the past.

Apple Hospitality REIT owns a portfolio of mostly rooms-focused hotels with wide geographic diversification and with room rates at the lower end of the spectrum.

Make no mistake, despite all the positive spin of management on the current situation, the REIT is feeling the pain.

While we have passed full-on crisis mode where occupancy reached levels of 20% there is no guarantee that things cannot get worse again especially if the evolving pandemic triggers a new administration into another lockdown.

Given the high level of uncertainty and the unclear trajectory as to how long it might take to get back to pre-pandemic occupancy levels I can only take a "neutral" position on the stock at this stage.

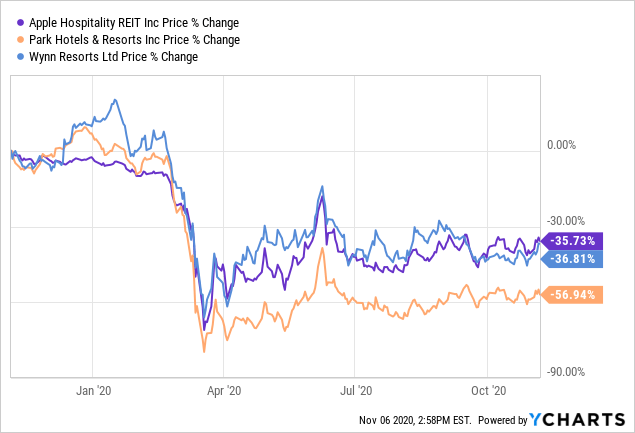

Investing in the hotel and travel industry via specialized REITs has generated strong dividend income in the past with the likes of Apple Hospitality REIT (APLE), Park Hotels (PK) or Wynn Resorts (WYNN).

However, a tragic pandemic which has led to worldwide disruptions in travel and hospitality has been stress-testing entire industries and cannot be automatically compared to situation we would be in if we were having "just" a regular recession.

Apple Hospitality REIT owns a portfolio of mostly rooms-focused hotels with wide geographic diversification and with room rates at the lower end of the spectrum. Thus, it has widely been regarded as a more recession-resistant business model but it was unclear as to how well it would perform during a pandemic.

Source: Apple Hospitality REIT Investor Relations

Now that we are more than 8 months into the pandemic we can confidently claim that this hypothesis is true despite the dividend suspension announced in March.

Investing in such a stock right now is not for the faint-hearted and in my view only advisable for long-term dividend investors. The REIT has recently posted earnings for Q3/2020 which featured some really promising bright spots.

What is going on at Apple Hospitality REIT?

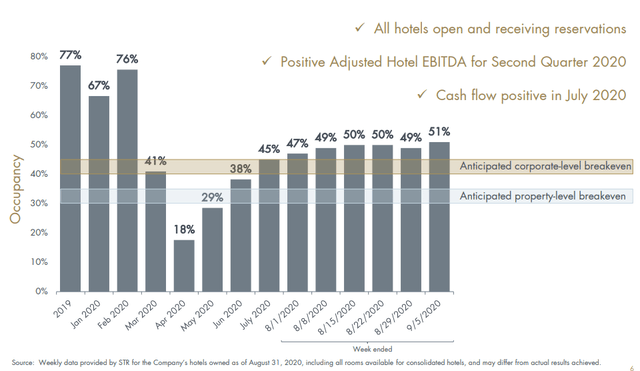

Apple Hospitality's third-quarter earnings have continued the positive trend we have been observing ever since occupancy hit a historic low of 18% in April 2020. The REIT delivered a major milestone by turning FFO positive again as it generated $0.04 in FFO which represents a significant improvement from the -$0.11 posted in Q2. Revenue jumped sequentially from $81M to $148M but is unsurprisingly still significantly below the prior year's number of $332M.

Still, both metrics comfortably beat expectations and demonstrate how APLE has adapted its business model to the current extraordinary situation. This is crucially important given that it remains uncertain when occupancy levels will return to the pre-pandemic status with occupancy in the mid 70s.

Source: Apple Hospitality REIT Investor Relations

Occupancy levels have now stabilized around 50% ever since they hit that level in early August. All of Apple Hospitality's hotels are now open and the REIT has consistently hit and exceeded both its property-level breakeven and corporate-level breakeven points in Q3/2020. That allowed the REIT to stay cash flow positive in Q3 and should easy concerns about potential liquidity issues barring a major second lockdown.

The REIT has undertaken various capital preservation measures over the last two quarter which helped generate such a strong performance. Overall, Apple Hospitality's operating model of rooms-focused hotels makes it much easier to mitigate costs, make operational changes and generally scale down to lower occupancy levels.

On top of that cross-trained employees have made a difference in the sense they enabled APLE to "effectively serve our guests with minimal staff present at each hotel." which is especially valuable and cost-efficient in case there are multiple properties in close distance. This clustering of operations has resulted in meaningful "synergies".

Another area where management could leverage the strengths of its operating model is its focus on cleanliness:

In an environment where there is increased focus on cleanliness, our ownership of select service hotels has been especially beneficial given the fact that compared to full service hotels, we have meaningfully less public space to sanitize, the flexibility to cross utilize employees to maximize efficiencies and fewer outlets to manage. We have been able to meaningfully scale back food and beverage offerings while continuing to provide convenient options for our guests.

Source: Apple Hospitality REIT Q3/2020 Earnings Call

There are undeniably a lot of challenges the hotel and travel sector is facing but I am impressed with how quickly and efficiently APLE's management has responded to that by leveraging the strengths of the rooms-focused operating model:

Our ability to keep our hotels open and operate efficiently at low occupancy levels and our discipline in maintaining low leverage late cycle enabled us to preserve our balance sheet, protecting the value of our equity and uniquely positioning us to pursue opportunities in the early stages of a recovery.

Our rooms-focused hotels do not rely on large group business and have proven appeal with the broadest group of potential customers. Our association with top brands combined with the strong value proposition of the upscale select service model, have historically led to strong performance during all phases of economic cycles.

Source: Apple Hospitality REIT Q3/2020 Earnings Call

Apple Hospitality is broadly diversified both geographically and in terms of its exposure to a variety of different types of markets such as urban and suburban. That location mix has been changing over the last years and decades and trending more towards big suburban centers rather than the far more expensive big urban areas.

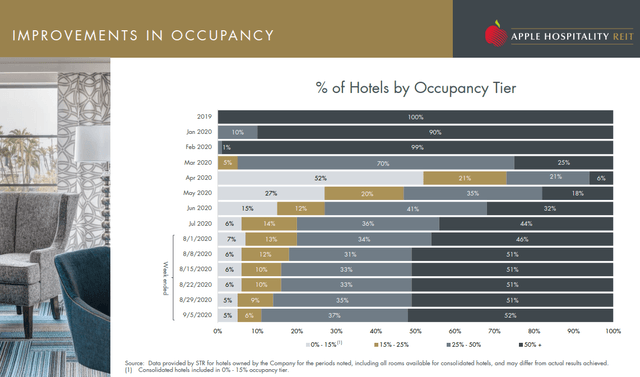

Right now, more than half of the portfolio is at occupancy levels of at least 50% whereas only 37% are between 25% to 50%. By the end of the second quarter only 44% of properties were in that 50%+ occupancy tier and 41% in the 25% to 50% tier.

Source: Apple Hospitality REIT Investor Relations

That obviously boosted revenues and the all-important revenue per available room (RevPAR) metric has almost doubled from $28.44 to $50.94 sequentially but is still down more than 50% compared to the prior year. The average daily room rate increased to $104.78 from $100.76 in Q2 and is down 25% Y/Y.

Despite the challenging business conditions, probably the most challenging since the inception of the company, Apple Hospitality REIT remains an active participant in the property transactions market. They closed a deal on a dual-branded Hyatt House and Hyatt Place in Tempe, Arizona which was contracted back in 2018 for a purchase price of around $58M. Another $50M deal on a Hilton Garden Inn in Madison, Wisconsin "remains on track and we anticipate acquiring the hotel in early 2021".

The REIT has over $300 million in available liquidity at its disposal and while none of that will be channeled towards shareholder distributions, unless something dramatic happens in Q4, management is confident that this is sufficient to "navigate the current uncertainty".

How about the dividend?

Apple Hospitality REIT is one of the few REITs which historically has been paying monthly dividends and I termed it "the lean mean monthly dividend machine". That machine is now undergoing some heavy maintenance as the dividend has been suspended ever since the Q1 distribution of $0.10 was paid on March 16, 2020.

The REIT's focus rightly remains on capital preservation and liquidity and as this quarter has shown the company can operate cash flow positive even a historically low occupancy levels. Management made its current thinking about the dividend as clear as possible:

At this time, we do not anticipate paying additional shareholder distributions for the remainder of 2020 unless required to do so in order to maintain our REIT status for federal income tax purposes.

Source: Apple Hospitality REIT Q3/2020 Earnings Call

So anybody hoping for a catch-up dividend following Q4/2020 is likely to get disappointed unless financials meaningfully improve in the final quarter of the year which could force the company to pay a distribution in order to maintain its REIT status. Given the current rise in COVID-19 cases across the entire U.S. I would be very surprised if occupancy reaches a level which would warrant to pay such a catch-up dividend.

The bright spot here though is obviously that Apple Hospitality managed to turn cash flow positive sooner than expected and if that trend continues it could be one of the first hotel REITs to reinstate the dividend albeit probably at a (much) lower level in the beginning.

This is not really what a dividend investor is after but given the severity of the situation caused by the pandemic it is wishful thinking that things will be back to normal anytime soon. Long-term though if you believe that travel will boom again the REIT should be in a great position to benefit from such a development.

Investor Takeaway

Make no mistake, despite all the positive spin of management on the current situation, the REIT is feeling the pain. The current business environment is anything but normal and an investment into Apple Hospitality REIT is unlikely to generate any meaningful returns over the short-term.

While we have passed full-on crisis mode where occupancy reached levels of 20% there is no guarantee that things cannot get worse again especially if the evolving pandemic triggers a new administration into another lockdown.

The investment case for the REIT is basically to start a position now or average down with the expectation that once we have passed this difficult economic cycle and have learnt how to travel safely again and are willing to do so the financials will come roaring back and the previous monthly dividend of $0.10 will be restored. Based on today's price of $10.76 that would translate into a hypothetical yield of 11%.

This is not a very compelling investment case right now but with patience long-term dividend investors could be handsomely awarded. Given the high level of uncertainty and the unclear trajectory as to how long it might take to get back to pre-pandemic occupancy levels I can only take a Neutral position on the stock at this stage.

One final word

If you like this content and want to read more about this and/or other dividend-related topics, please hit the "Follow" button on top of the screen and you will be notified of new releases.

Disclosure: I am/we are long APLE. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not offering financial advice but only my personal opinion. Investors may take further aspects and their own due diligence into consideration before making a decision.