Tandem Diabetes Care: Pump Provider Trailing Insulet But Shares Have Growth Potential

Tandem provides automated insulin pump solutions that integrate with CGM systems. Shares currently trade at $117.

The company reported Q3 earnings this week. Pump shipments were up 23% and revenues were up 31% year-on-year to $123.6m. FY20 sales are expected to be ~$457m.

The company has come back from near bankruptcy in 2018 by launching a competitive product that is the smallest in a competitive field - and has more in the pipeline.

Tandem is targeting 500,000 users by YE24, which ought to see revenues double, if achieved.

The strength of the iCGM market makes me bullish on Tandem's long-term growth prospects. I can see the share price climbing above $150 within the next 12 months.

Investment Thesis

Three companies focused on developing integrated continuous glucose monitoring ("iCGM") technology and automated insulin delivery for diabetics - Dexcom (DXCM), Insulet Corporation (PODD) and Tandem Diabetes Care (TNDM), the subject of this article - have all reported Q3 earnings in the past 10 days.

Dexcom's earnings were the first to be released on Oct. 27, and despite outperforming analysts' expectation for the nth time in succession, delivering record quarterly revenues of $501m, and raising its FY sales guidance to $1.9bn, the results triggered a bizarre market sell-off - Dexcom stock plunged from a price of $420, to $310 - a 26% drop - in a matter of days.

The next to report, on Nov, 4, was Insulet Corp, an insulin pump manufacturer and distributor whose products are often used in conjunction with Dexcom's G6 iCGM device, to create a fully automated glucose monitoring and insulin delivery system for diabetics which is often referred to as the "artificial pancreas."

Insulet's shares had fallen in lockstep with Dexcom's, from $255 on Oct. 26, to $215 on Nov. 3 - a 16% drop - the day before its earnings were released. This led me to publish a note on Insulet cautioning that even Q3 earnings outperformance might not be enough to trigger share price gains - despite the exceptional long-term promise of the iCGM industry - given what had happened to Dexcom.

I have to admit that I called this one wrong, because whatever it was that caused the market to panic sell Dexcom stock after it announced its record breaking earnings, the sentiment did not last long. Insulet stock roared back to trade at $255 yesterday, after reporting a 22% year-on-year rise on revenues, while Dexcom stock rose to $355, making up nearly half of its post earnings losses.

Tandem manufactures and sells an almost identical product to Insulet - its t:slim X2 Insulin Delivery System is one of the main rivals to Insulet's Omnipod device, along with Medtronic's (MDT) 530G and 630G systems, and Roche's (OTCQX:RHHBY) Accu-Check Combo.

Tandem stock only suffered slight losses after Dexcom's earnings release, however, falling from a price of $117, to $107. Shares have since spiked to reach $117 at time of writing. Tandem posted revenues of $123.6m, compared to Insulet's $234m, and posted a net loss of $9.4m, while Insulet reported net income of $11.6m. For FY20, Tandem raised its revenue guidance to ~$457.5m, a 26% year-on-year increase - while Insulet has forecast FY20 sales growth of ~20.5%, up from its original ~18%, to ~$890m.

Tandem's market cap of $7.3bn is less than half that of Insulet's $16.8bn, and its share price of $120 is less than half of Insulet's $255 (Tandem's share count is ~61m compared to Insulet's ~66m). Since Tandem is marginally loss making, and Insulet marginally profitable, it's more instructive to compare price to sales ratio rather than PE ratio. Insulet's P/S ratio is 19x, whilst Tandem's is 16x, which might imply that, all else being equal, Tandem represents the slightly better investment opportunity.

In this article I will take a deeper dive look at Tandem and its business, to try to determine if this thesis stands up to closer examination. I also will try to set a fair value price for the company, and discuss what the future might hold for the company.

Interestingly, over the past five years, Tandem's share price has grown by just 17%, significantly underperforming the S&P 500 (74% growth), and nowhere near the 668% gain made by Insulet stock. This is due to the company's near bankruptcy in 2018, when shares traded as low as $3, but its breakthrough t:slim X2 pump revived its fortunes and has seen it make a rapid recovery.

Insulet may still look more like the momentum play, but now that the investment community seems to have gained a better understanding of the dynamics of the iCGM market, this may not count for much going forward. Indeed, analysts' consensus one-year price targets for both companies (Tandem = $125, Insulet = $246) are underwhelming.

In my view, much depends on how both companies can balance growth vs. profitability in the years to come, which company can innovate the most to satisfy users changing needs, and which emerges as the more likely acquisition target for the market's more dominant players e.g. Dexcom, Abbott (ABT), Medtronic (MDT), Roche, another big pharma, or perhaps even a tech giant e.g. Apple (AAPL) or digital health pioneer like Teladoc (TDOC).

If Tandem can squeeze OPEX and sales margins, expand its international markets, and put its $600m of near-term cash to good use to drive further technological innovation, given the size of its TAM, I believe the company could go on to match Insulet's current sales volumes (overtaking them may be a stretch), and theoretically at least, come close to matching its rivals >$250 share price.

Market Overview

Based on data from 2016 / 2017, it's estimated that 0.5% of US adults (~1.65m) have Type 1 diabetes - meaning their bodies are unable to produce insulin, and that 8.5% (~25m) of the US population have Type 2 - meaning they are unable to produce insulin in sufficient quantities. According to Tandem, the worldwide prevalence of Type 1 and Type 2 diabetes is ~24m, and ~207m respectively.

Both Type 1 and Type 2 diabetics can benefit from use of insulin pumps, but Tandem estimates that 90% of its domestic customers have Type 1, and that ~70% of the US diabetic population still rely on the use of multiple daily injections ("MDI"), and fingerstick glucose testing, to manage their condition, whilst 30% are using insulin pumps and continuous glucose monitors. Pump use outside of the US is estimated to be around 10%-20%.

According to Grand View Research, the global insulin pump market was valued at ~$3.3bn in FY18, and is expected to reach ~$6.9bn by 2026, growing at a CAGR of 9.6%. At a rough estimate, this would imply that Tandem currently has a ~12% share of the market.

Tandem's Business

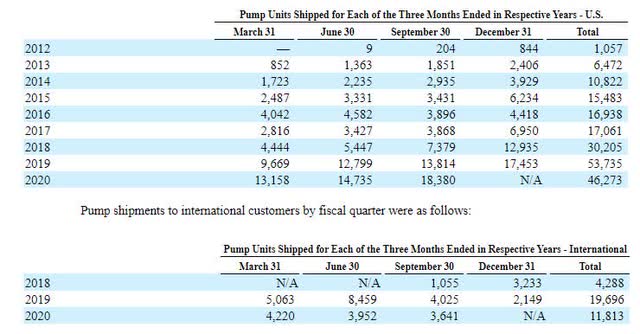

In Q320, Tandem shipped 22,021 pumps (which have a list price of ~$7,000, but cost ~$4k when reimbursed in the US, and $2-3k overseas, according to management) worldwide, up from 17,839 in Q319, and over the past four years it has shipped ~190,000 pumps worldwide.

Tandem pump unit shipment history. Source: company 10Q submission Q320.

Tandem pump unit shipment history. Source: company 10Q submission Q320.

The company estimates that it has ~400k pump users across its geographies at the present time, and has set a goal of having 500,000 customers worldwide by YE24. That would effectively give it about 125,000 new product buyers each year, since its Slim X2 product works on a reimbursement cycle of around four years, which the company estimates earns it ~$8k - taking into account product sales and cartridges / infusion sets - both in the US and overseas.

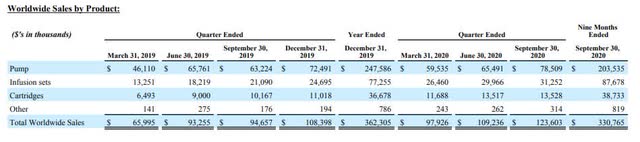

Tandem global sales by product. Source: company investor relations section.

Tandem global sales by product. Source: company investor relations section.

Pumps make up about 65% of all Tandem's revenues, with the remainder coming from infusion sets (24% of revenues), cartridges (11%), and other sources (0.1%).

The Slim X2 has many similarities to competing products. It comes with a touch screen and rechargeable battery, remote updateable software, a connected mobile app, and it can also work as a combo with Dexcom's G6 iCGM device, responding to blood glucose readings by pausing, increasing or decreasing basal insulin delivery when necessary, in order to avert hypoglycemic (excessively low blood sugar levels) or hyperglycemic (excessively high blood sugar levels) episodes. In this respect there's little to choose between Slim X2 and Insulet's Omnipod, although Tandem's device is the smallest on the market - 28% smaller than Omnipod, which is an important consideration, since many users will prefer a more discrete device.

Tandem says that 50% of new Slim X2 device users are converted MDI users, and 50% are converts from a different pump device. Given 25% of pump users will renew their reimbursement deal each year (~125k users per annum currently) Tandem ought to have a good chance of pinching market share from its rivals.

It's also interesting to think about how a device that forms an integral part of the "artificial pancreas," and therefore has access to users' vital health information and is considered a trusted source, can be utilized to provide advanced data analytics, and complimentary (potentially monetizable) features, and Tandem is exploring this field with add-on apps like Sugarmate, and a new product, t:sport, which is half as small as Sim X2, and uses a 200 unit cartridge, shorter infusion set, and automated insulin delivery algorithm.

Fair Value Price Forecast

For Tandem to reach its stated goal of 500,000 users by 2024, it will have to add around 75,000 new users per annum, which ought to be well within the company's reach, given it shipped ~54k units in FY19, and looks on track to ship ~66k in FY20 (Q4 is often the company's most productive quarter since it is when most people renew their health insurance deals, and Tandem has shipped 46k units already this year) despite pandemic headwinds.

Tandem also has secured a valuable tie-up with United Healthcare which accounts for ~10% of its device sales, and recorded 8,400 customer renewals so far this year (management revealed on its Q320 earnings call), which ought to become a more and more reliable source of new product demand.

I estimate (in line with management) that each of Tandem's units earn the company just under $2k per annum, which means that, by 2025 (assuming new product shipments continue to grow at an annual rate of ~22% after the 500k user benchmark is hit in FY24), Tandem has a shot at being a blockbuster (>$1bn per annum) selling company.

Tandem management is forecasting EBITDA margins in the mid teens on an adjusted basis, but in my model I have total OPEX coming in at ~99.4% of revenues in FY20. Over subsequent years, however, I have reduced that figure down to ~77% in FY25, and after tax of 23% is applied my net profit margin is 18%, and my free cash flow ~$175m (depreciation ~2% of revenues, CAPEX of ~$20m, and working capital ~-$10m on average).

I said in my intro that Tandem's share price could one day match Insulet's >$250 valuation but in truth this seems optimistic unless the company can find a way to significantly reduce OPEX and widen its margins. I get to a present valuation of the company of $10.7bn and a fair value share price of $177 only by using a generous beta of 0.5 (along with a risk free rate of 1.6% and expected market return of 8%), which may be in line with the exceptional growth prospects offered by the iCGM industry, based on more Type 1 diabetics switching from MDI to pumps, and the opening up of the Type 2 diabetes market as more users are attracted to slimmer, more efficient and data rich models.

Risks and Conclusion

As a company, Tandem almost went bankrupt in 2018, but a $69m loan and the launch of Slim X2 helped the company build itself back up, and drive its share price from $3, to $117 - the stock has risen in value by 117% in the past year alone.

The threat of its technology being once more made obsolete as larger and better resourced companies release more advanced products cannot be ignored, however, although the corollary to that argument is that Tandem's product range proves to be the most attractive on the market, and the company grows sales, and presents itself as an acquisition target - a very attractive prospect for its investors. Besides the competition, an adverse safety event caused by the failure of its technology would be extremely damaging, but this ought to be Tandem's first priority and it has a clean track record in that respect. A final concern would relate to ensuring its products continue to be reimbursed by Medicaid, Medicare, and its network of distributors - which account for 70%-75% of the company's sales, holds firm

The company no longer has any financial concerns, and ought to become profitable within the next couple of years, and as it revenue streams become more populated with repeat users, its product suite increases to encompass more data analytics and digital health related products, and if it can benefit from economies of scale to reduce OPEX down to more profitable levels, it's hard to see anything but growth ahead for the company. Tandem can certainly target its sector rival Insulet, and even if doubling its revenues does not quite double its share price, the company's shares look a good bet to break beyond $150, in my view, within the next 12 months, and perhaps above $200 over a 24-month period.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.