Microsoft: This Could Be A Problem

Weak guidance for quarterly revenue shows that Microsoft is not as immune to the COVID-19 economic environment as many investors originally thought.

Share prices are falling even after Microsoft posted better than expected results for the first-quarter reporting period, showing investors are focused on year-end trends as a more meaningful performance indicator.

In our view, the company’s main area of strength lies in Azure and results from the most recent reporting period indicates excellent potential for growth into 2021.

However, weaker guidance remains for investors and we believe search revenue remains a key problem for Microsoft that is likely to become more obvious in upcoming reporting periods.

For these reasons, MSFT could see further dips if we encounter a surge in volatility in the main U.S. stock benchmarks, and income investors should wait for more favorable entry points before building positions.

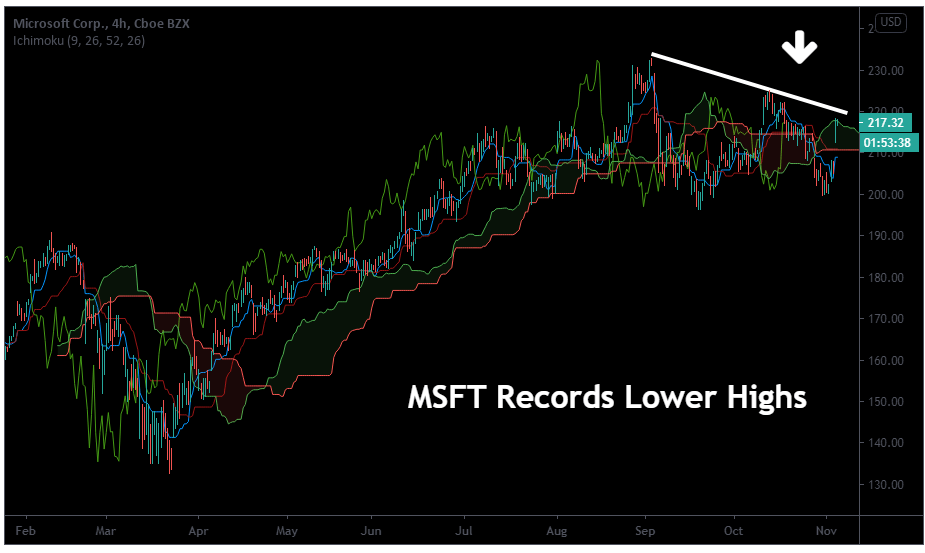

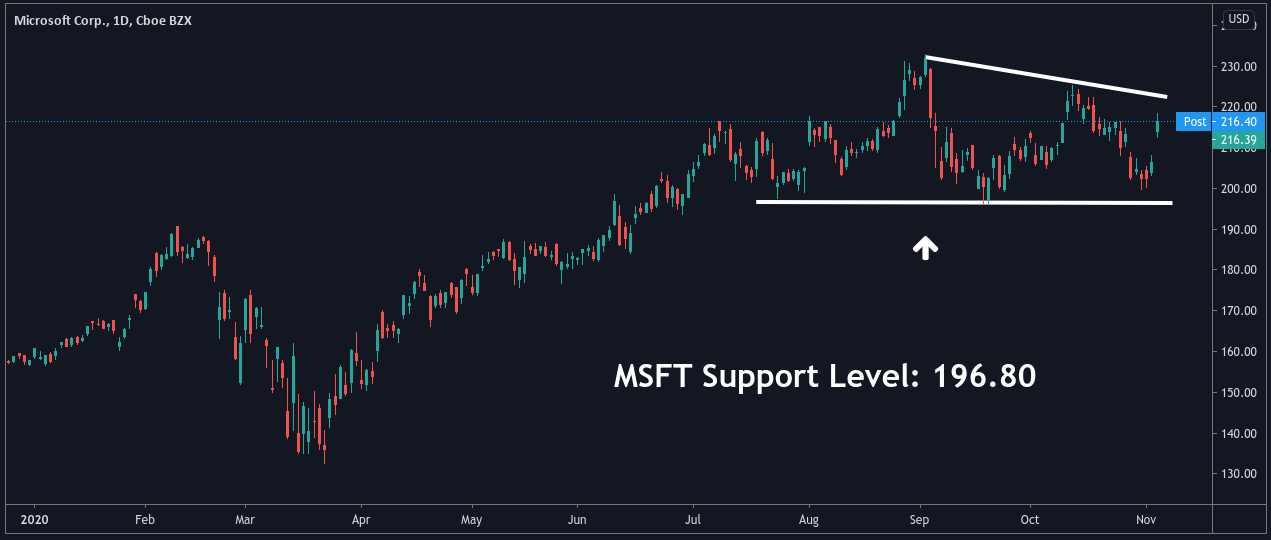

Microsoft Corp. (NASDAQ: MSFT) has been moving lower since the beginning of September, and these downside moves continued even after the company released favorable earnings results for the first-quarter reporting period. On the downside, Microsoft’s guidance figures suggest that investors should be ready for more weakness than analysts were initially expecting and we think these factors could put additional downside pressure on the stock. If this anticipated downtrend does occur, we think income investors should consider buying MSFT closer to $195 per share.

Source: Author via Tradingview

First, it’s important for us to note that while earnings were strong during the fiscal first-quarter period, Microsoft’s guidance for the upcoming reporting period was somewhat disappointing and this could give the market an excuse to sell the stock in cases where the broader market is experiencing surges in stock volatility.

Getting into the specifics, the company sees revenues for the fiscal second quarter coming within a reported range of between $39.5 billion and $40.4 billion. Hypothetically, if we split the difference while looking at these range projections, we come up with roughly $40 billion in potential revenues for the second-quarter period and this indicates a rate of nearly 9% growth for the company on an annualized basis. However, this figure is still marginally below the market’s prior expectations ($40.43 billion) and this might give investors more of a bearish argument to sell the stock in cases where the broader market is encountering downside volatility.

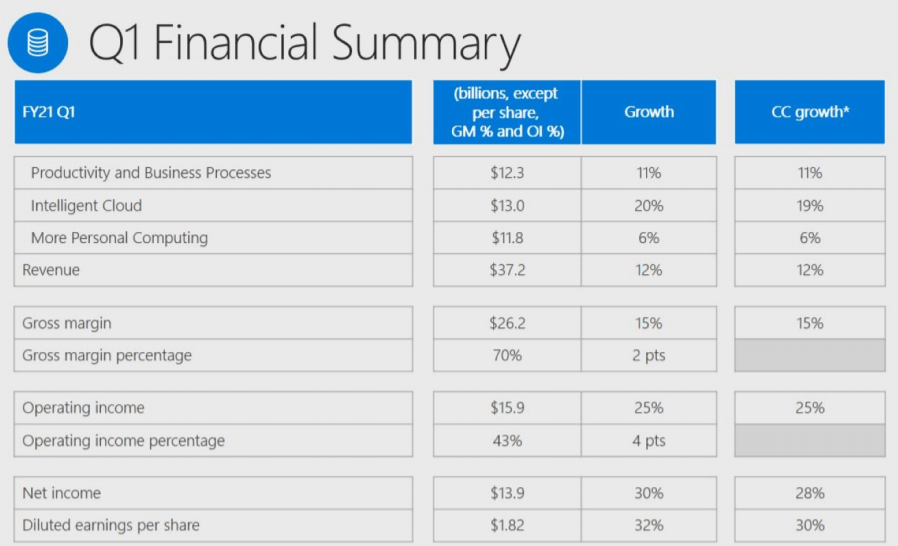

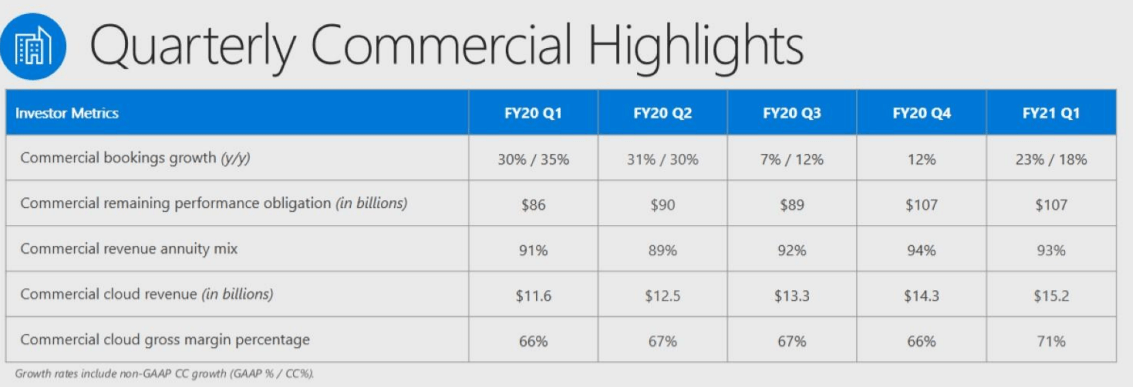

Source: Microsoft Earnings Presentation

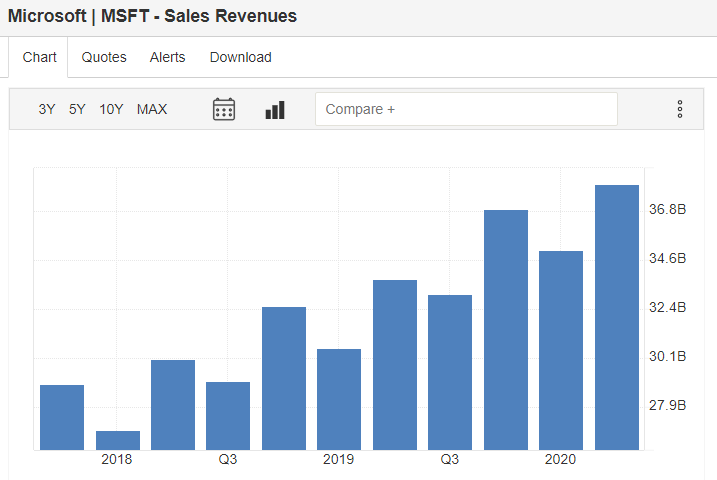

In the most recent quarter, corporate revenues increased at an annual rate of 12% and this was only a slight decline when compared to the revenue growth rates that were reported during the prior quarter (13%).

On the negative side, commercial PC revenues collapsed by -22% and this suggests that some of the company’s prior performance trends have peaked. Interestingly, revenues from Microsoft’s PC segment began to decline just a short time after Microsoft’s Windows 7 support was discontinued. However, the disruptive economic effects of the coronavirus pandemic also impacted these figures and it is now looking as though we could see weakness in these areas for the full-year period.

In large part, this may be due to the fact that 2019 was an excellent year for the commercial PC category. It could be argued that analysts should expect strong underlying momentum in these portions of Microsoft’s business. But the numbers simply don’t support this and we do not expect to see relative outperformance for the segment for the remainder of 2020.

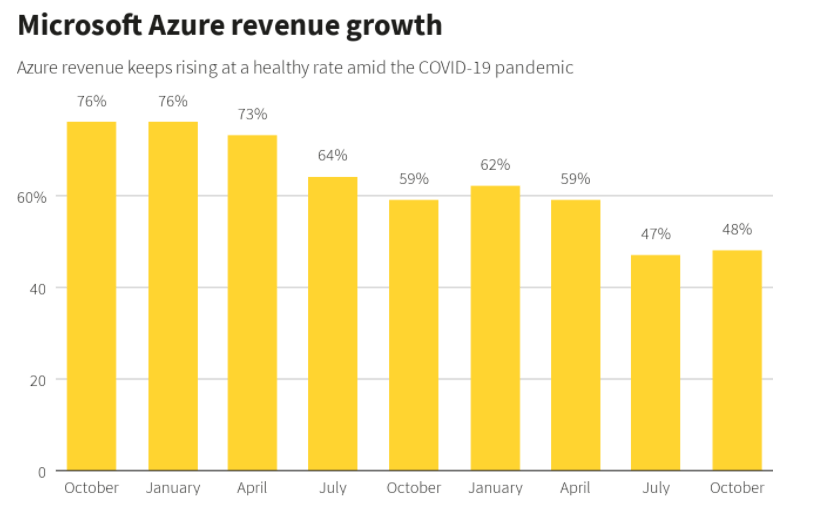

Source: Ayanti Bera, Subrat Patnaik, Reuters

Fortunately, the positives surpass the negatives and we are continuing to watch for growth in Microsoft’s cloud products. Over the last several quarters, Microsoft’s Azure has been the key driver of growth that showed signs of bottoming in the fiscal first quarter (when growth rates of 48% were reported). For the company, this performance beat analyst expectations of 44% by a wide margin.

Of course, when I say bottoming, this refers to the prior quarterly period (which was marked by a still-incredible annualized growth rate of 47%). So, this isn’t cause for concern by any means and the market’s renewed focus on the ability of the technology space to power the coronavirus-impacted macro economy could produce much better growth rates in these areas in the quarters ahead.

In the company’s Intelligent Cloud division (which combines GitHub, Microsoft Enterprise Services, Windows Server and SQL Server products, and Azure cloud products), we saw revenues of nearly $13 billion. Not only did this surpass analyst estimates but it also indicated an annualized growth rate of 20%. Ultimately, this tells us that Microsoft is still beating expectations in a broad manner and these trends are likely to continue in coming quarters.

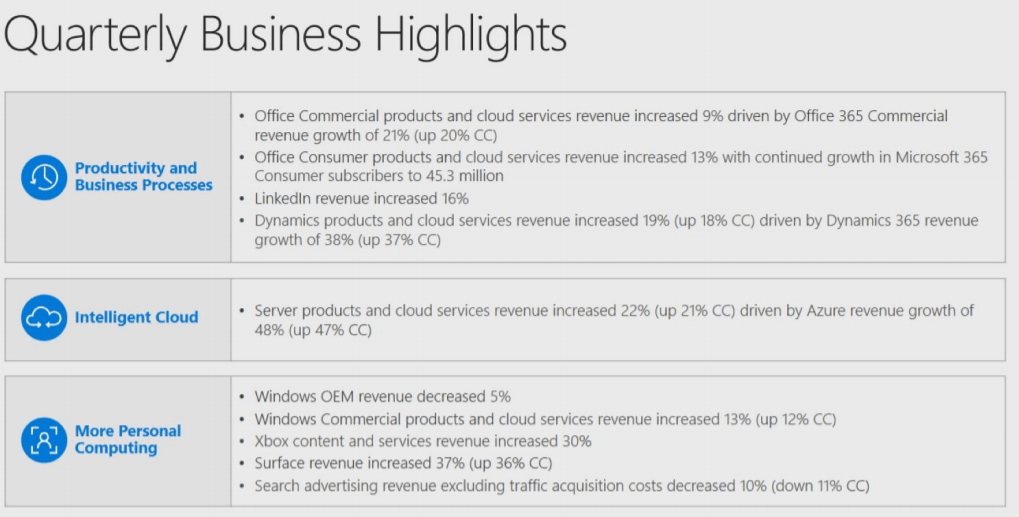

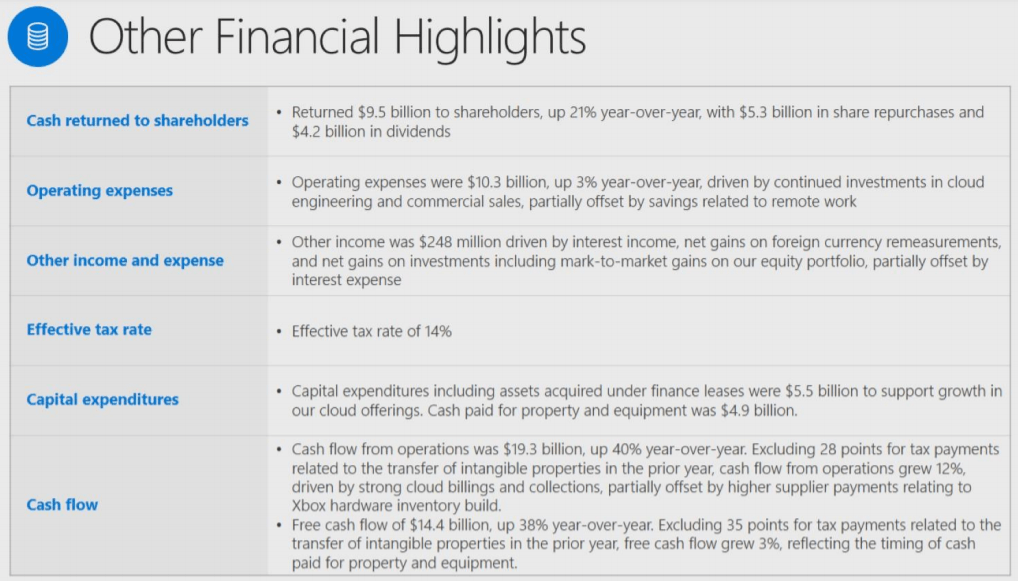

Source: Microsoft Earnings Presentation

In the segment devoted to productivity and business processes (Microsoft Office, LinkedIn, and Dynamics), the company generated revenues of $12.3 billion, which beat expectations by more than $500 million and the performance indicates an annualized growth rate of 11%.

One of the best-performing aspects of the Office 365 bundle has been Microsoft Teams, which now boasts 115 million daily active users (DAUs). In April, Microsoft reported having 75 million DAUs involved with the Teams application and we can see that the coronavirus economy has had a material impact on the way regular consumers view the company.

Source: Microsoft Earnings Presentation

More Personal Computing is the name given to the segment that includes Xbox, Windows, Surface, and search advertising. This segment generated revenues of $11.9 billion during the fiscal first quarter, which indicates an annualized gain of 6%. Fortunately, this performance also beat analyst estimates by nearly $700 million and here we have another example of broad product strength that has been established by the company.

In mid-November, Microsoft is scheduled to release two different Xbox consoles (the Series S and the Series X) and the company now sees revenue growth in the gaming segment to show second-quarter gains above 20%. In our view, these projections might turn out to be conservative if continued coronavirus lockdown measures are implemented during the winter months ahead and further stimulus programs are initiated in the United States.

Source: CNBC

When we combine each of these factors with an increased potential for sales during the holiday season in the United States, we have a winning set of elements that could generate significant upside surprises after the 21.6% annual growth rate that was posted during the most recent reporting period.

On the downside, we have highlighted a few potential concerns with respect to Microsoft’s licensing revenues and these stem mostly from the -5% declines in Windows device licenses during the company’s most recent reporting period. Specifically, commercial devices were associated with declines in licensing revenue of more than 20% and this follows a 4% decline during the fiscal fourth quarter.

Source: CNBC

For Microsoft, this is the weakest number that we have seen in over five years and this is why we think income investors with a focus on the technology sector must continue to watch these numbers as we head into Microsoft’s next reporting period. Other areas of concern can be found in search advertising, as this aspect of Microsoft’s business also fell by 10% during the most recent reporting period and current guidance suggests that this decline will continue (albeit at a slightly slower pace) into next quarter.

In our view, this is the area that could turn out to be Microsoft’s next important problem heading into next quarter. Fortunately, these weaknesses are relatively limited when we assess the company within a broader context. Microsoft’s Commercial Cloud brands (Dynamics 365, Office 365, Azure, and LinkedIn commercial products) generated revenues of $15.2 billion.

Source: Trading Economics

As we can see, this substantial figure makes up more than 40% of Microsoft’s total revenue figure and this indicates gains relative to the previous quarter (when Commercial Cloud revenues accounted for roughly 38% of the company’s total revenue figure). Overall, it should be noted that gross margins in this segment rose to an incredible 71% and this is the first time in Microsoft’s history that gross margins in Commercial Cloud surpassed 70%.

Of course, these performances also follow favorable M&A news as Microsoft recently acquired Zenimax Media for $7.5 billion. Seasoned gamers might remember that Zenimax Media is the entity that brought to market classic video games like Quake and Doom, so this seems to be an addition that could be capable of driving renewed interest amongst gamers in the Gen-X age demographics.

Source: Microsoft Earnings Presentation

Additionally, it appears that Microsoft has spent a great deal of time working on its image within the broader market. At this stage, we are all probably familiar with the political debacle that surrounded a potential deal to buy controversial social media app TikTok and we will not get into the details here. Suffice to say, these discussions turned out to be an abject failure and this poor showing of negotiation skills added another “black eye” for the company.

Source: Author via Tradingview

Since the beginning of this year, shares of MSFT have gained by about 38%, but the stock has encountered difficulties near resistance levels at $232.80, and we think this could set up an interesting area for buy entries just above $195 per share. Given the stock’s outperformance relative to the S&P 500 (which has gained by just 6.58%), we think that MSFT could be vulnerable to larger declines in the event volatility surges hurt the stock benchmarks.

In our view, Microsoft is now in a position to encounter weaknesses in business demand during the current quarterly period and this trend could make a significant impact on the company’s licensing revenues in the fiscal second quarter. For income investors, these areas will remain the important points of concern along with the key problem of expected weakness in search revenues in coming quarters. For these reasons, MSFT could see further dips ahead if we encounter a surge in volatility in the U.S. stock benchmarks and income investors should wait for more favorable entry points before building positions.

Thank you for reading. Now, it's time to make your voice heard.

Reader interaction is the most important part of the investment learning process. Comments are highly encouraged! We look forward to reading your viewpoints.

Disclosure: I am/we are long MSFT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.