Gold as well as GLD have had a fantastic time this year.

The gold prices have been lingering near the $1,900 mark for a while due to high uncertainty around additional fiscal stimuli in the US. However, this situation is quite temporary.

Due to the presidential elections, the coronavirus pandemic, and other macroeconomic and political risks, gold prices should soar, thus pushing GLD prices to unseen before highs.

The SPDR Gold Trust ETF (GLD) price has been stuck at around $180 for a while now. Many investors might be thinking that the ETF's astonishing rally is already over. But I disagree with this. The main reason for this temporary halt is plenty of uncertainty around additional fiscal stimuli in the US. But, in my view, the question of extra "helicopter money" is just a question of time. Even more attraction of gold ETFs and other safe havens will also be due to unprecedented political tensions. Here I will explain my price targets for the yellow shiny metal and GLD.

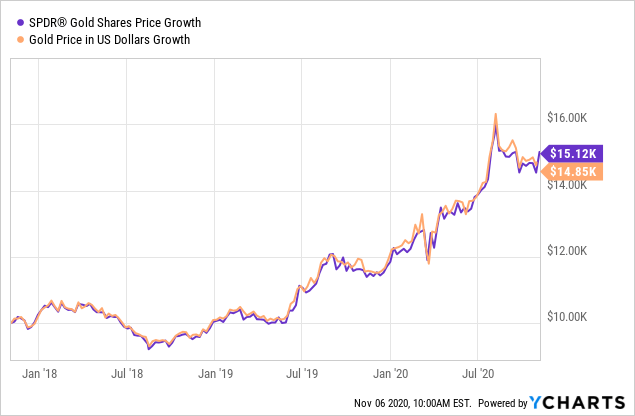

SPDR Gold Trust - historical performance

Data by YCharts

Data by YCharts

As can be seen from the graph above, $10,000 invested in physical gold and GLD at the beginning of 2018 would have been worth about $15,000 now. Obviously, gold and GLD prices have a very strong correlation. So, any change in the price of the yellow metal should lead to a proportional change in GLD price, in my opinion.

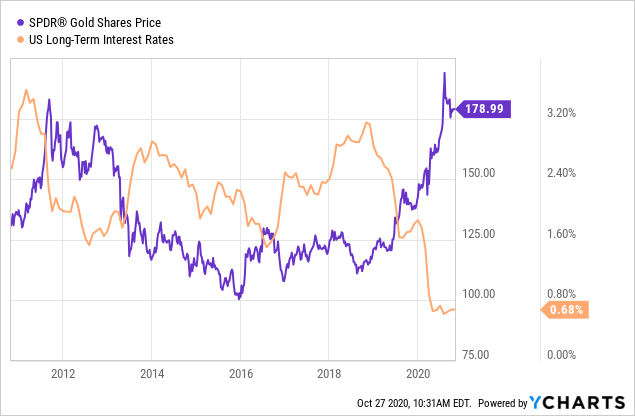

Cyclical nature of gold

Gold is quite a cyclical commodity. Its price rises when interest rates fall or stay depressed for a while. This can be seen from the diagram below.

Data by YCharts

Data by YCharts

Now, we are in a very favorable situation for the yellow shiny metal since the low interest rates are near zero. What is more, the Fed is planning to hold them near zero through 2022 to help the economy recover from the pandemic. Also, the Fed will still keep buying bonds, thus flooding the financial system with cheap money. This alone is bullish for gold.

However, it's not the only thing that matters here. It is also the coronavirus pandemic, which also plays a crucial role. It might look like many governments are still unwilling to impose another lockdown. After all, this spring many countries took this measure to give the local authorities and hospitals time to purchase the necessary medical equipment and drugs. However, it was recently announced that France and Germany implemented a four-week lockdown. It is possible that more European countries will follow their example. Moreover, some US states might also have to take similar measures due to a surge in COVID cases.

The US stimulus bill looks like a major hurdle for gold prices. But, in my opinion, it will eventually get passed. After all, the US economy has not fully recovered from the pandemic, whereas some more restrictions might follow soon. So, supporting people in need and small businesses seems to be necessary. The size of this package is still unclear but could probably be over $2 trillion. This money will not come out of nowhere. The Fed will have to do more bond-buying, thus devaluing the dollar.

This environment is highly bullish for the yellow metal and GLD. What is more, there is election uncertainty, which is also an extremely bullish factor for safe havens.

The US elections

My Seeking Alpha colleague had analyzed how US elections generally affect gold prices. History shows that the link between gold prices and the elections is rather indirect. However, it seems that this time the situation is quite different.

To start with, there is a risk that there may be no clear election winner. So, there might be a contested election. What is more, due to the massive voting by mail, there might be further delays, which will also increase the overall level of uncertainty.

The political risks might further delay the widespread economic recovery since they might lead to a fall in investor confidence. This would make the Fed further supply the financial system with liquidity.

GLD - advantages

Sure, GLD is the largest gold ETF in the world. But one of this fund's main advantages is the fact that it's backed by physical gold bullions and not futures. The latter seems to be the case with many other funds. It is extremely important because it gives investors the possibility to convert the ETF shares to physical gold. Some investors might be thinking that it is not necessary since they would still be able to profit from any price rise.

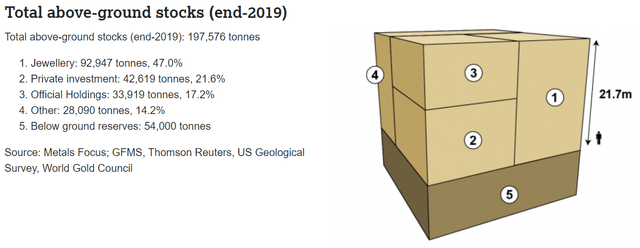

However, the problem is that physical gold reserves are highly scarce. According to the World Gold Council, there are just 197,576 tonnes of above-ground gold currently available to the world. That's not much at all. If all this gold were put together, the resulting cube would only measure around 21 meters on each side. What is more, 47% of this gold is due to jewelry. It might seem that below ground reserves are quite high. But, unfortunately, they are not. Geologists estimate there are just 54,000 tonnes of them.

Source: World Gold Council

Certainly, there is more paper gold than physical gold. Some claim that the paper to physical gold ratio is around 250:1. This is enormous. As soon as the demand for physical gold surges, there will not be enough to go around for everyone, in my view. So, the option to convert paper gold into physical gold is highly useful. If the ETF is physically backed by gold bullions, then it looks like there is such a possibility.

Too much enthusiasm about gold ETFs? I don't think so

Some experts think that there have already been too many positive net flows of capital into gold ETFs, including GLD. What is more, the fact that the price is stuck near $1,900 per ounce and $180 per share, respectively, at the time of writing might suggest the rally is completely out of steam. So, there is a gold bubble set to burst.

But I disagree. One can judge if there is an asset bubble according to the level of investors' enthusiasm, in my opinion. It looks to me that investors are quite indifferent to gold right now. In the business press, there is plenty of information on high-tech stocks, including the likes of Microsoft (MSFT), Apple (AAPL) and Tesla (TSLA). However, the yellow metal hasn't got that much media coverage. What is more, Robinhood traders don't seem to be highly interested in buying gold miners' stocks. So, in that respect, the gold market doesn't look overheated right now, whereas the fundamental factors suggest lots of upside potential.

Conclusion

Price guessing is quite an ungrateful task. However, E.B. Tucker, who correctly predicted gold would hit an all-time high this year, expects gold price to hit $2,500 per ounce by year-end. If his prediction turns out to be true, I expect GLD to hit the price of $236.84.

Here is how I arrived at this result.

$1,900 - current price per ounce at the time of writing

$180 - current price of GLD share at the time of writing

$2,500 - price target

$1,900/$180 = 10.56

$2,500/10.56 = $236.84

This forecast might not be entirely accurate. However, in spite of the recent gold selloff, I expect the yellow metal to shine, thus giving GLD investors great returns.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.