Sabra: Dividend Safety Despite Distressed Tenants

Sabra Health Care REIT, Inc. delivered what appeared to be impressive Q3-2020 results.

The CARES Act was singlehandedly powering these numbers.

We look at the investment case and examine the dividend safety.

Sabra Health Care REIT, Inc. (NASDAQ:SBRA) has had a wild 12 months. The stock got caught in the COVID-19 malaise and tanked more than 60% at one point from its peak. The drop was far worse than even our bearish stance had warranted and we changed to a bullish stance, admittedly too quickly. The stock eventually rebounded and has hovered at more or less the same spot for a few months. The company released its Q3-2020 results and we pull back the curtain to reveal what is behind the main numbers.

Q3-2020

Sabra's top numbers were tepid (more on that below), but there was a great deal of margin expansion that flowed to the bottom line. Normalized adjusted funds from operations, or AFFO, came in at 46 cents. The company is now blending the COVID-19-related extra expenses into the normalized AFFO rather than taking it out. We think that makes sense as it must have been a giant pain to track each expense in that regard separately. The main reason for the expansion in margins though was due to recognizing $4.2 million of government grant income during the third quarter of 2020.

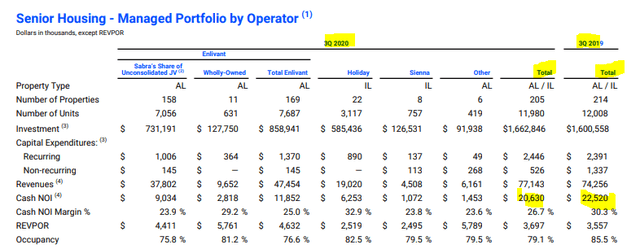

Source: Sabra Q3 Supplemental

Out of a total of $20.63 million of NOI, the $4.2 million is a big standout.

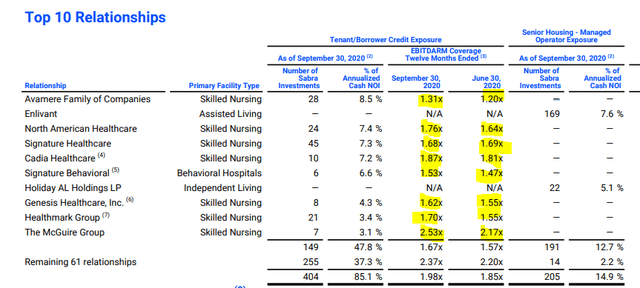

On the triple-net side, Sabra has been collecting the rents on time and it updated this even for November. The reason we have not seen any material impact here is that the same grants that Sabra got also were received by its tenants. We can see this in the EBITDARM coverage by its tenants.

Source: Sabra Q3 Supplemental

Most of them improved significantly including the rather distressed Genesis Healthcare (NYSE:GEN). While this is a great development, it is of course temporary. The CARES Act will help through the end of the year, but none of these operators can work with the current low occupancy. Based on that information, we believe Q1-2021 will be a tough one barring substantial additional relief.

Valuation

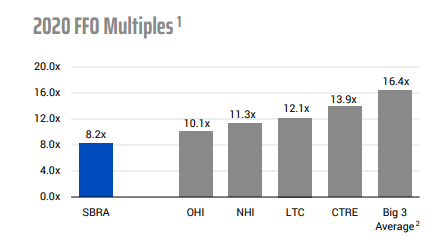

Sabra is certainly cheaper than all of its peers and the 8.0X FFO multiple is attractive.

Source: Sabra Presentation

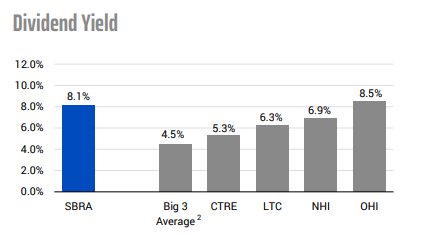

Sabra also pays a much larger dividend and an 8%-plus yield is hard to find today.

Source: Sabra Presentation

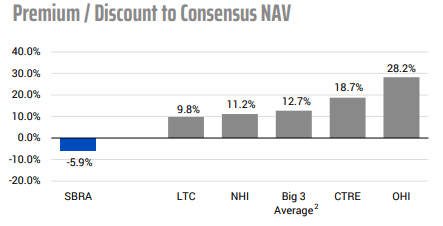

Finally Sabra actually trades at a modest discount to its NAV value. By comparison the others trade at steep premiums.

Source: Sabra Presentation

One problem though with a direct comparison is that while all its peers are into senior housing and skilled nursing, there are substantial differences.

Source: Sabra Presentation

LTC Properties Inc. (NYSE:LTC) is possibly the closest comparative, but uses substantially lower leverage than Sabra. Still LTC trades at 4.0X higher, and on a relative basis, there is certainly reason to prefer Sabra. LTC also has its share of distressed tenants, so Sabra is not alone in that regard.

Our overall take here is that Sabra is modestly cheap relative to its peers and perhaps more attractive on a relative basis. But we don't see that translating into a "buy" rating. Our rationale for that is that once the artificial life-support ends, we will see more tenant issues and further rent cuts or distressed asset sales. This brings us to the top-line miss by Sabra. The company wrote off straight line rent related to two tenants.

During the three months ended September 30, 2020, the auditors for Genesis Healthcare, Inc. ("Genesis") and subsidiaries of Signature Healthcare ("Signature") that lease facilities from us each expressed substantial doubt over the respective abilities of Genesis and Signature to continue as a going concern. Accordingly, we concluded that our leases with Genesis and Signature should no longer be accounted for on an accrual basis and wrote off $14.3 million of non-cash rent receivable balances and lease intangibles related to these leases, resulting in a reduction of rental revenues; by comparison, during the three months ended September 30, 2019, we wrote off $1.5 million of non-cash rent receivable balances related to leases no longer accounted for on an accrual basis. Excluding these write-offs, rental revenues for the third quarter of 2020 increased $3.4 million, or 3.0%, over the third quarter of 2019.

Source: Sabra Press Release

Signature is not publicly traded, but Genesis is. We have enough insight into its financials to believe that it is highly distressed, and staving off a bankruptcy would require some massive help from its landlords and creditors. Genesis is a very big player in the skilled nursing sector, and its bankruptcy could set off even more tenants asking for rent relief from Sabra.

Dividend Safety

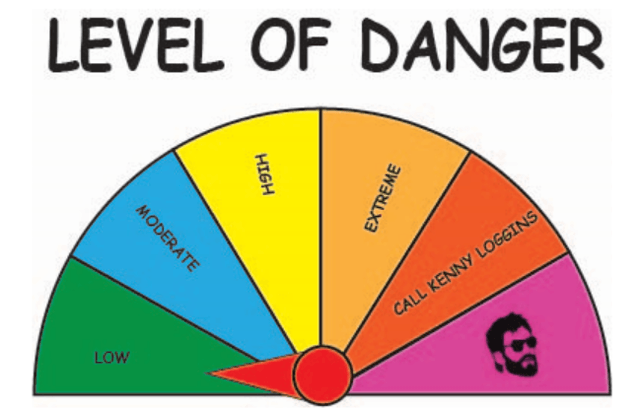

Sabra's payout ratio appears modest, but it is aided by the generous payments of the CARES Act. We think the payout ratio will trend higher in Q1-2021, but even then, the new dividend is safe for the next 12 months. We would give this Sabra a rating of "low" in our proprietary Kenny Loggins scale:

A low danger rating implies a less than 15% probability of a dividend cut in the next 12 months.

Conclusion

Sabra is keeping an eye on its debt rating and issuing equity using its ATM program as needed. It issued 1.4 million shares this quarter. We expect this to keep pressure on the price. The dividend is safe for now as the payout ratio is rather low. Sabra also cannot really handle a more expensive cost of equity. which is what it will get if it cuts its dividends. So the dividend makes it over the next 12 months, regardless of the turbulence. The longer-term investing case is harder to make, and we believe this is best watched from the sidelines.

If you enjoyed this article, please scroll up and click on the "Follow" button next to my name to not miss my future articles. If you did not like this article, please read it again, change your mind and then click on the "Follow" button next to my name to not miss my future articles.

Are you looking for Real Yields which reduce portfolio volatility and outperform in bear markets?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Cash Secured Put and Covered Call Portfolios are designed to reduce volatility while generating 7-9% yields. We focus on being the house and take the opposite side of the gambler.

Learn more about our method & why it might be right for your portfolio. We are offering the next 20 subscribers a 20% discount to try our method risk-free!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.