Arrow Financial: Decent Loan Growth Likely To Drive Earnings

Low interest rates will likely increase the residential loan portfolio size in the coming quarters. Loan growth will likely be the chief driver of an earnings increase.

Provision expense will likely decline sequentially, but remain above normal due to pandemic-driven loan losses.

The net interest margin will likely continue to decline because of a lagged impact of the interest rate cuts on the average portfolio yield.

The June 2021 target price suggests a limited upside.

Earnings of Arrow Financial Corporation (NASDAQ:AROW) improved to $0.71 per share in the third quarter from $0.61 per share in the second quarter of 2020. The improvement was attributable to slightly lower provision expense and a surge in gains on sales of loans. Earnings will likely decline from the third quarter’s level in the coming quarters but remain high on a year-over-year basis. I’m expecting mid-single-digit loan growth to undermine margin compression next year. Further, I’m expecting the provision expense to be lower on a year-over-year basis. Overall, I’m expecting AROW to report earnings of around $2.52 per share in 2020 and $2.63 per share in 2021. The June 2021 target price suggests a limited upside from the current market price; therefore, I’m adopting a neutral rating on AROW.

Low Interest Rates to Bolster Residential Mortgage Demand

AROW’s loan portfolio has historically grown very strongly and organically every year because of the strength in its markets in New York State. Loans will likely continue to grow strongly next year due to low interest rates that will maintain high demand in AROW’s focus area of residential loans, which made up 36% of total loans at the end of the last quarter.

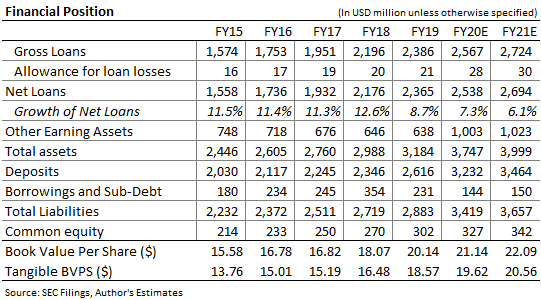

However, I’m expecting loan growth in 2021 to be lower than in the past due to a slow recovery from the COVID-19 pandemic, which will impact commercial loans. As of the end of September, commercial loans made up 11% of total loans, and commercial real estate loans made up 21% of total loans, according to details given in the third quarter’s 10-Q filing. Overall, I’m expecting loans to grow by 6% year over year in 2020, as shown below. The table also shows my estimates for other balance sheet items.

Lagged Impact of Interest Rate Cuts to Constrain Earnings

AROW’s net interest margin (“NIM”) declined to 2.90% in the third quarter from 3.05% in the second quarter of 2020, as mentioned in the 10-Q filing. The reduction in NIM was attributable to the adverse impact of the interest rate cut, high cash balances, and low yield for Paycheck Protection Program Loans (“PPP”), as mentioned in the third quarter’s earnings release. Accelerated booking of fees from PPP will likely temporarily boost NIM in the fourth quarter. As mentioned in the 10-Q filing, AROW started assisting customers in the PPP forgiveness process in the third quarter. AROW funded $142.7 million of PPP loans, as mentioned in the earnings release. Assuming that a quarter of the loans are forgiven early in the fourth quarter, and loans carry a yield of 3%, PPP will likely add around $1 million to the interest income in the fourth quarter.

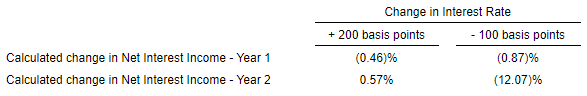

Excluding the impact of accelerated amortization of PPP fees, the NIM is likely to decline in the coming quarters. As AROW’s loan portfolio is tilted towards residential mortgages, a large part of the portfolio was not repriced this year after the interest rate cuts. Therefore, the rate cuts will impact the portfolio’s average yield when the mortgages and other fixed-rate loans mature. The management’s interest rate sensitivity analysis also shows that NIM experiences a greater hit in the second year of rate cuts than the first year. The following table from the 10-Q filing shows the results of the management’s rate sensitivity analysis.

Considering the factors mentioned above, I’m expecting the average NIM in 2021 to be 13bps below the average for 2020.

Provisions Likely to Decline but Remain Above Normal in Coming Quarters

AROW deferred the adoption of the new accounting standard for credit losses that is based on expected losses called the Current Expected Credit Losses, or CECL. Instead of CECL, AROW used the old incurred loss model to determine the provision expense with an adjustment to cover upcoming losses from the COVID-19 pandemic. Due to the incurred loss model, I believe AROW is less prepared to manage upcoming pandemic-driven loan losses than other banks that used the expected loss model. Consequently, I’m expecting the provision expense to remain higher than usual in the coming quarters.

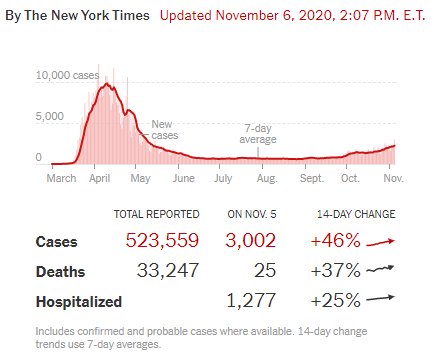

However, the provision expense in the quarters next year will likely be lower than the expense reported for the first and second quarters of 2020. The pandemic is worse than before, with the United States reporting a record daily increase in cases; however, there is little threat of a second lockdown as strict as the one in the second quarter. Further, the New York State is in a much better position than earlier this year when it was a hotspot, as shown in the chart below from the New York Times.

AROW’s credit risk is currently somewhat limited as COVID-19-related payment deferrals made up just 3.9% of total loans, according to details given in the 10-Q filing. Around 65% of these deferrals were from hotels/motels, which are likely to require further assistance in the next couple of quarters as the travel industry will likely continue to suffer till life returns to normal. I’m not expecting normalization till months after a COVID-19 vaccine first becomes available, most probably in early 2021. On the positive side, hotels/motels made up just 4.1% of total loans in the third quarter, as mentioned in the 10-Q filing.

Considering the factors mentioned above, I’m expecting AROW to report a provision expense of $8 million in 2021, down 28% year over year.

Expecting Earnings of Around $2.63 per Share in 2021

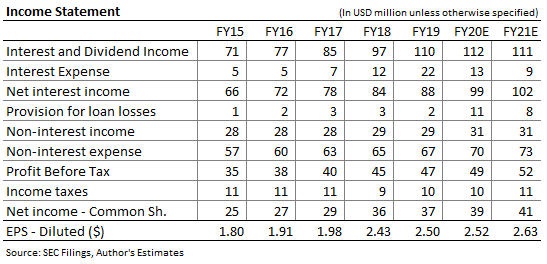

The loan growth and lower provision expense will likely drive earnings next year, while NIM compression will limit earnings growth. Overall, I’m expecting AROW to report earnings of $2.63 per share in 2021, up 4% from my earnings expectation of $2.52 per share in 2020. The following table shows my estimates for income statement items.

Actual earnings may differ materially from estimates because of the uncertainties related to the COVID-19 pandemic.

Considering the slight earnings increase and AROW’s payout history, I’m expecting the company to maintain its quarterly dividend at the current level of $0.26 per share. This quarterly dividend suggests a dividend yield of 3.9% for 2021. Apart from the cash dividend, AROW has a 12-year-long tradition of giving an annual stock dividend. I’m expecting AROW to continue to give a 3% stock dividend next year.

June 2021 Target Price Suggests a Limited Upside

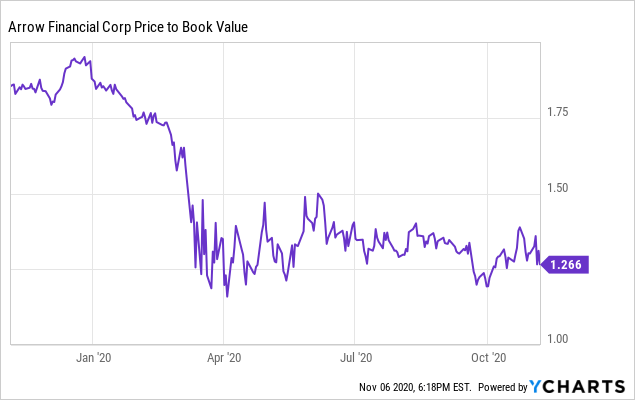

I’m using the historical price-to-book multiple (“P/B”) to value AROW. The following chart shows the historical P/B multiple.

Data by YCharts

Data by YCharts

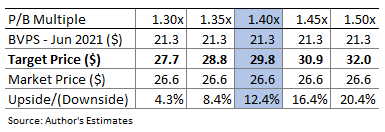

The stock has traded at an average P/B ratio of 1.4 in the first nine months of 2020. Multiplying this P/B multiple with the forecast book value per share of $21.3 gives a target price of $29.8 for the mid of next year. This price target implies only a 12% upside from the closing market price for November 6, 2020. The following table shows the sensitivity of the target price to the P/B ratio.

Based on the limited price upside, I’m adopting a neutral rating on AROW. The expected loan growth, which will likely drive earnings next year, appears to be mostly priced-in.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: This article is not financial advice. Investors are expected to consider their investment objectives and constraints before investing in the stock(s) mentioned in the article.