Regency Centers Is A Fat Pitch: Swing At This 6% Dividend Yield

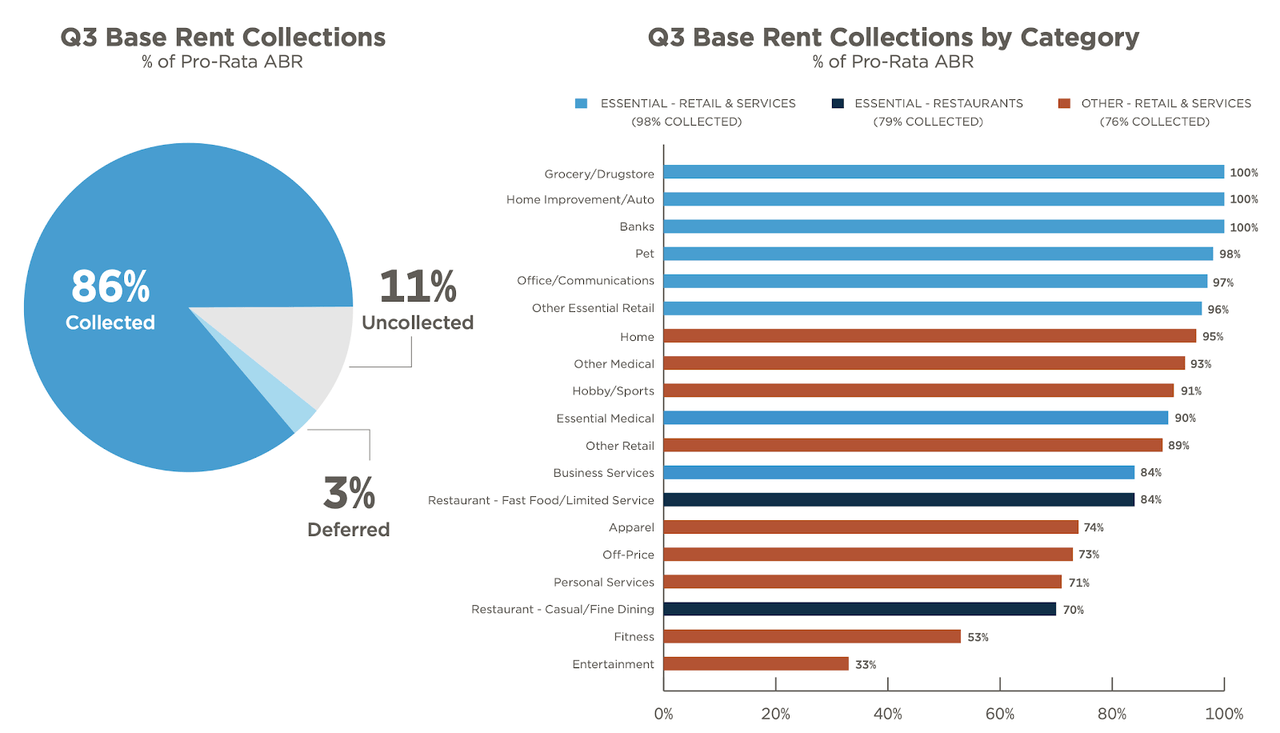

Rent collection improved to 86%.

Leasing spreads were surprisingly pressured in the quarter.

Shares yield in excess of 6% in spite of a very strong balance sheet.

I believe strongly in the resiliency of REG’s high quality shopping center properties, and rate shares a strong buy.

Regency Centers (REG), a core holding in the Best of Breed portfolio, reported a mixed quarter in which improvements in rent collection was offset by deterioration in pricing power. With 97% of its portfolio open and operating, I am optimistic that rent collection can improve further moving forward. REG maintains one of the strongest balance sheets in the REIT sector, which may allow the company to play offense if circumstances permit. I rate shares a strong buy with over 50% total return upside.

Shopping Centers Are Back

Third-quarter earnings appeared to reflect conservative estimates regarding uncollectible rent. Same property net operating income declined by 15.2% in the quarter. Core operating earnings, however, declined 24%, indicative of operating leverage working the other direction. There’s reason to be optimistic about improving results. Uncollectible lease income of $28.5 million was 10% of total revenues. REG collected 86% of third-quarter rent (up from 77% in the second quarter) as well as 87% of October rent. 3% of third-quarter rent was deferred. For the poor results to continue, REG would essentially see improvements in rent collection stall and prove unable to collect deferred rent. Those assumptions seem overly pessimistic in light of the fact that 97% of the portfolio is open and operating.

Most of the tenants which have not paid rent are in the sectors hit hardest by COVID-19. As we move beyond the pandemic, their businesses should improve as well as their ability to pay rent:

It wasn’t all good news. While renewal leasing spreads was positive 2.2%, leasing spreads on new leases was negative 3.4%, for a blended leasing spread of positive 1.2% in the quarter. 10% of average base rent expires in 2021 which I expect to experience pressured leasing spreads as well. I anticipate leasing spreads to bounce back by 2022 as REG stabilizes occupancy and regains pricing power.

Balance Sheet Analysis

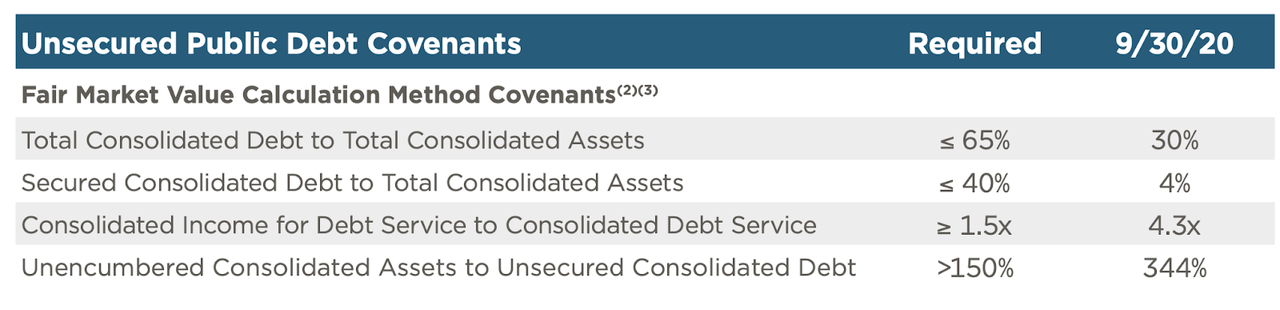

REG maintains a balance sheet rated BBB+ or equivalent by the credit rating issuers. Debt to EBITDA stood at a conservative 5.9 times, marginally higher than the 5.4 times at year-end.

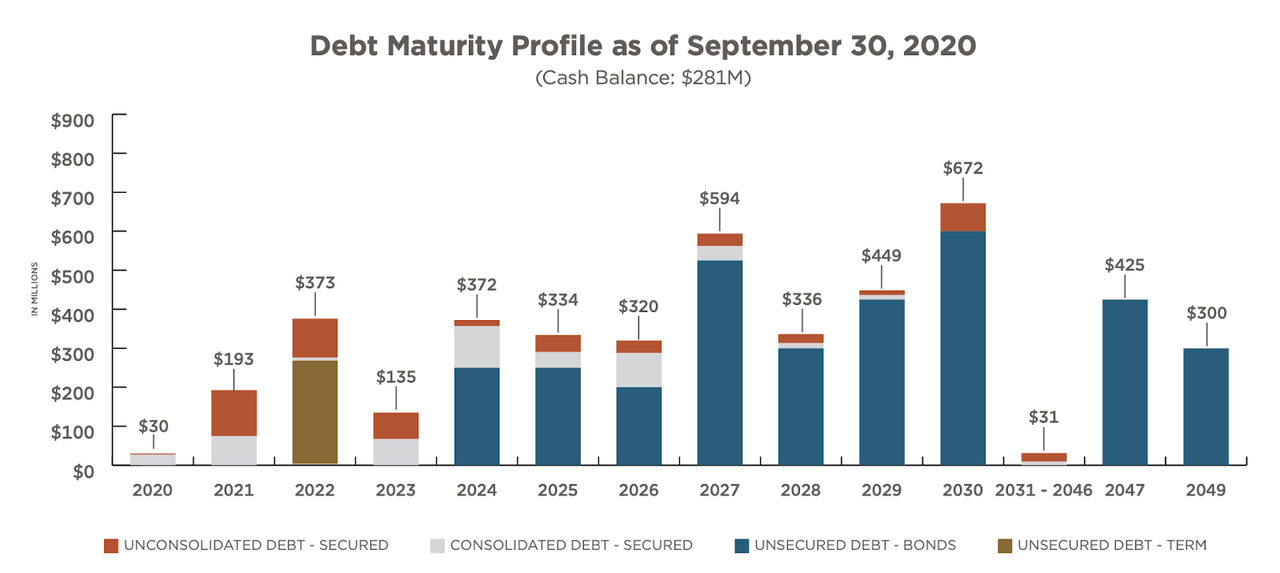

REG has a very manageable debt maturity outlook in the near and long term:

In addition to manageable near-term debt maturities, REG maintains $1.5 billion in immediate liquidity. As we can see below, REG is in no danger of violating any of its unsecured debt covenants:

Because REG is already cash-flow positive, net debt of $4.25 billion as of the latest quarter was actually lower than 2019 year-end. Even though leverage is higher than at the end of 2019, I still see room for prudent leverage expansion if REG comes across attractive acquisition opportunities. At the very least, the strong balance sheet may prove to be an important margin of safety if rent collection remains pressured for much longer.

Valuation and Price Target

REG trades at a 6.4% dividend yield. Based on the current core operating earnings per share, the dividend payout ratio is 86%. I anticipate core operating earnings to rebound strongly over the next year as REG stabilizes occupancy and rent collection. Shares trade at only 11.5 times core operating earnings - a far cry from the 17-18 times multiple it traded at before the pandemic. My 12-month fair value estimate is $55, representing a 4.3% dividend yield. This valuation looks justified if REG can return to the 3-5% growth it was trending at prior to the pandemic. Shares have over 50% total return upside to that target.

Risks

There may be more bankruptcies on the horizon. While rent collection and operational levels have improved dramatically, there is no guarantee that there aren’t more bankruptcies to come. While REG’s balance sheet is well-positioned to weather any storms, the stock price is unlikely to experience multiple expansion until results stabilize.

There is no guarantee that REG can collect deferred rent. Investors should not consider deferred rent as paid until the cash is in the bank. Rent deferrals represented only 3% of the rent in the third quarter. With rent collection improving to nearly 90% in the latest quarter, this problem may become less of an issue, but REG may need to report further write-offs in future quarters if past deferred rent proves uncollectible.

It is unclear if the country is close to a stable recovery from the pandemic. If the localities in which REG operates decide that further lockdowns are needed, then REG may once again experience difficulties collecting rent, reversing the progress made over the past several months. REG should be considered an investment hinging on recovery from the pandemic.

Conclusion

Balancing it out, I expected stronger rent collection from REG due to the quality of its tenant base, but perhaps what used to be strong tenants before the pandemic have proven to be weak tenants during the pandemic. REG maintains a strong balance sheet which leaves me scratching my head why shares still yield over 6%. I believe strongly in the resiliency of REG’s high-quality shopping center properties, and rate shares a strong buy.

Discover More High Conviction Ideas

Shopping center REITs are one of my 8 high conviction ideas. Subscribers to Best of Breed to get access to my top 10 holdings and full access to the Best of Breed portfolio. Exclusive Best of Breed content includes industry deep-dives, new compelling ideas, and high conviction picks.

Ignore the noise. Avoid bubbles. Stick to high quality and buy Best of Breed.

Become a Best of Breed Investor Today!

Disclosure: I am/we are long REG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.