Eurobank Ergasias: All Negativity Already Priced In

Eurobank Ergasias’s prospects are solid.

Geopolitical issues are not a real threat.

Covid-19 concerns will not last forever.

There is a clear mismatch between Eurobank’s low market cap and its strong fundamentals.

Investors seem to have lost faith (again) in the Greek banking system, which is roughly made up of the four biggest Greek banks, including Eurobank Ergasias (OTCPK:EGFEY).

Of course, the pandemic crisis has brought a lot of uncertainties and, from time to time, Turkey, Greece’s unstable neighbor, becomes a cause of concern for the international community. However, at the moment, Eurobank’s shares are priced for the worst possible scenario, namely a bail-in.

Data by YCharts

Data by YCharts

This is unlikely to happen for several reasons. The most intuitive is probably that Eurobank’s balance sheet is in a much better position than all its Greek peers and, therefore, if it failed it would mean that all the Greek financial system had failed first. In a time of such abundance of cheap liquidity, the Greek government and the European institutions will just not allow it to happen.

Eurobank Beyond the Incumbent Crisis

As Europe is hit by a second pandemic wave and Turkey becomes increasingly unruly with its neighbors (especially Greece and Cyprus), things look worrisome at the moment, but it is absolutely not clear how this situation could affect the results for the Greek banks, which have very limited or no exposure to Turkey.

Regarding the pandemic, apart from the alarming headlines, much more information is now available compared to a few months ago and the big picture doesn’t look so terrible.

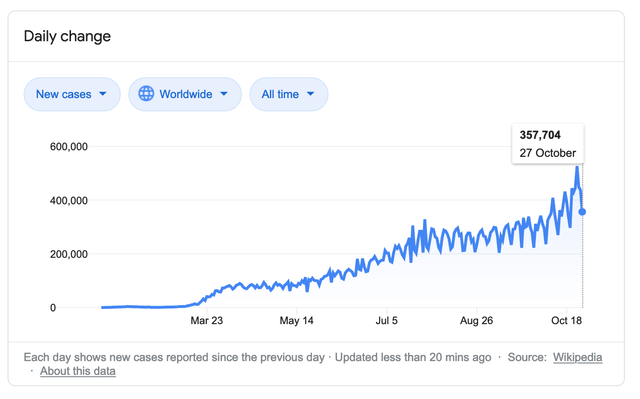

Certainly, Covid-19 cases increase daily, but such an increase is due more to a higher testing capability rather than a real worsening of the situation compared to last spring.

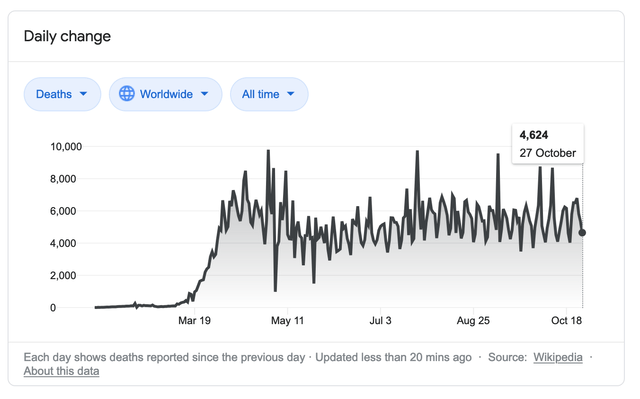

Worldwide, the two-week moving average death toll has been roughly at the same level since April, while active cases have increased significantly only in the last four weeks (see the pictures below).

Covid-19 daily total fatalities - Source: Wikipedia

Covid-19 daily total fatalities - Source: Wikipedia

Covid-19 daily detected cases - Source: Wikipedia

Covid-19 daily detected cases - Source: Wikipedia

In Greece we have a similar picture, with the notable exception that there were basically no deaths in June and July. Overall, the country has been quite safe in comparison with its European counterparts, with an average of about 58 deaths per million, while countries like Italy, France or even Germany have much higher numbers (Italy: 607 per million, Germany: 127!).

That should bode well for the future, as the chances of the Greek economy being completely shut down again are arguably lower.

In terms of the impact that the incumbent crisis will have on the Greek economy and, in particular, on the banking system, we now have more information than during last spring.

Specifically, the amount of projected Covid-related NPLs are seen at around €5B in Greece, significantly less than in the first projections forecasting a two or three times higher amount.

If we simply divide this number by four, we could come out with a rough estimation of Eurobank’s exposure.

On the other hand, we have the numbers related to the moratoria granted by the banks to their borrowers: at the end of the second quarter, the total amount was about €7.2B (€5B just in Greece), and about €3B of that total have been effectively requested. Eurobank signaled that the number of loan applications dramatically decreased over the summer, so, at the moment, that figure does not seem too far off.

Although it is understandably difficult to figure out how much of the loans under moratoria will effectively become NPEs, the management is quite optimistic on that front, as emerged in the last cc:

Mehmet Sevim, JPMorgan Chase & Co

Do you have any expectations of what the magnitude of NPE transitioned from this EUR 5 billion portfolio could be, taking into account all these support measures, et cetera?

Fokion C. Karavias

Now in your question, what is the percent of the sales that we expect from this EUR 5 billion to be under stress? Obviously, as I said before we have to wait to have a clearer evidence. But I would like to stress that the majority of the loans under the moratoria are of very good quality. They are performing or performing for bond loans. And these are clients which have managed to come over the financial crisis increase during the last 3 years, remaining performing. So, this makes us optimistic that any problem is going to be small and manageable.

Admittedly, there is still a significant amount of uncertainty about the final outcome of this crisis, but the impression is that there is too much negativity on the financial sector right now, as if only the negative side is weighted. We should keep in mind that the Euro area (to which Greece belongs) still enjoys negative rates and there is no doubt that governments and the ECB will do whatever it takes to revive the economy and avoid problems with the banks.

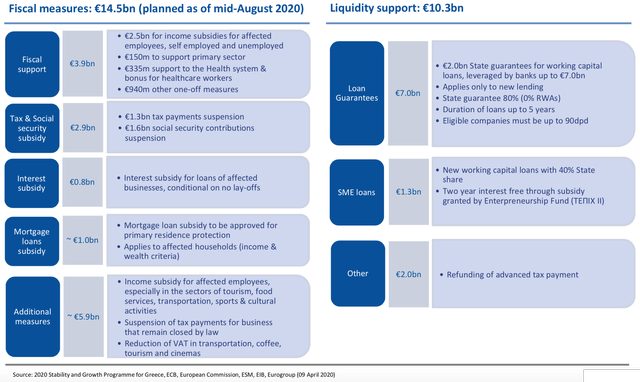

In fact, they have already done that! The picture below shows that the pre-set amount of loans under state guarantee in Greece is almost twice the new forecasted NPE formation.

Source: Company's presentation

Source: Company's presentation

And even if the guarantees do not yet apply to the old loans, which, in fact, are partly under moratoria, there is no doubt that new (cheap) credit lines will help borrowers pay off the old ones, especially because the European governments will not allow them to default (it would be political suicide to ask people to pay back Covid-related loans in full!).

Yet, these positive developments are not considered in the banks’ share prices at the moment, making the sector an interesting long-term opportunity, very similar to how it was in 2009.

The table below shows how Eurobank (maybe surprisingly for some) is one of the best picks among the European banks at the moment.

In this comparison, I adjusted the Greek bank numbers for the remaining amount of NPE, as if the entire sum (roughly €2.4B) was written off and provisions had to cease accordingly.

I didn’t do the same operation for the other European banks: thus, before NPE, ratios outside Greece are a bit worse, of course.

Equity/Total Assets | Price-to-Book Value | ROE | Forward P/E | |

Barclays | 5% | 0.27 | 3% | 7.4 |

BNP Paribas | 4.4% | 0.37 | 7% | 6.7 |

Goldman Sachs | 7.9% | 0.76 | 5.9% | 8.8 |

HSBC | 6.7% | 0.46 | 1% | 8.7 |

ING Groep | 5.3% | 0.49 | 5.4% | 6.5 |

Average | 5.9% | 0.47 | 4.5% | 7.6 |

Eurobank (Adjusted) | 4.5% | 0.36 | 27% | 3.8 |

Source: Author’s elaboration

Eurobank is, then, the better choice right now, from a quantitative viewpoint, because of the bank’s ratios themselves and because the Greek economy entered this crisis better than its peers in the Euro area, and it will probably come out of it in better shape too, considering the pandemic outbreak has hit the country considerably less. That should be particularly significant when it comes to tourism, as global touristic routes will likely undergo a change in the years to come. In fact, Europeans will probably prefer to visit Greek islands rather than other exotic destinations, at least for the next couple of summers.

Bottom Line

I know it is a hard right now to make a convincing case for banks and why you should buy shares of one of the biggest Greek banks. It sounds a bit insane, doesn’t it?

But, if the basic principles of investing have not changed, as I think they haven’t, now should be the best time to turn bullish on the European financial sector.

The situation is dire and pessimism is running high, but there are several positive catalysts for the European banks, which are very cheap right now and, as strange as it may seem, Eurobank Ergasias is the best of breed of all the European banks (at least within the Euro area).

With numerous sectors at their all-time high, including fixed income vehicles, it does make a lot of sense to bet on an upbeat stock like this one. Remember: the lower the price, the safer the purchase.

Disclosure: I am/we are long EGFEY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long Eurobank Ergasias, through its ordinary shares listed in the Athen's SE