Charles River Labs: And The Beat Goes On

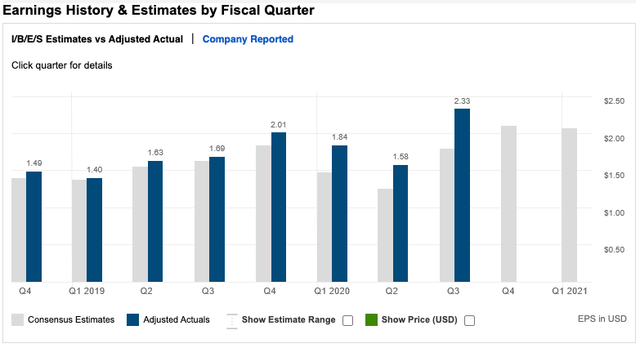

Charles River reported Q3 2020 results that beat the top- and bottom-line estimates. Moreover, the company has beat analysts' earnings estimates in each of the last eight quarters.

Charles River appears to be well-positioned for 2021 and beyond, which also factors in the anticipated near-term COVID headwinds.

We are long Charles River, and we are looking to add to our position on any pullbacks.

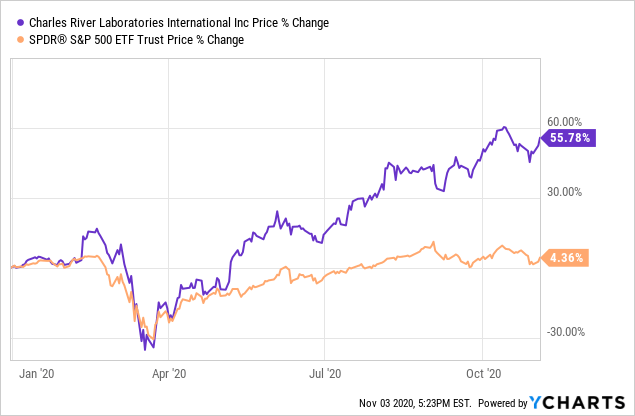

Charles River Laboratories' (NYSE:CRL) stock has performed well so far in 2020, as shares are outperforming the broader market by a wide margin over the last 11-plus months.

Data by YCharts

Data by YCharts

And it helps the bull case that the company's Q3 2020 results were well-received by the market, even after considering the fact that COVID has impacted several industries that Charles River operates in. Over the last few years, one thing has been consistent when it comes to Charles River Laboratories - the company consistently beats the top- and bottom-line estimates. For Q3 2020, the beat goes on.

The Latest, The Beat Goes On

On October 29, 2020, Charles River reported record quarterly revenue, adjusted EPS and free cash flow. Think about that for a second - during this environment, Charles River reported solid results almost across the board. Additionally, the company again beat the consensus top- and bottom-line estimates. And this should sound familiar as the company has been able to top the consensus earnings estimate in each of the last eight quarters.

Source: Fidelity

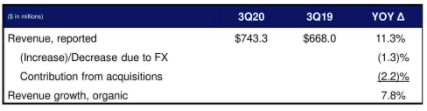

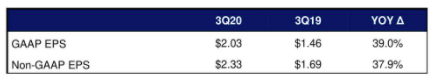

For Q3 2020, Charles River reported adjusted EPS of $2.33 (beat by $0.53) on revenue of $743.3mm (beat by $27.7mm), which also compares favorably to the year-ago quarter.

Source: Q3 2020 Earnings Slides

The highlights:

- Quarterly revenues increased organically by 7.8% YoY with solid revenue growth for both of its main operating units.

- Free cash flow came in at $151.1m as compared to $120.7mm in the prior period.

- Operating profit margin increased by 400bps (from 13.9% to 17.9%) when compared to the year-ago quarter.

- Net income increased by 40% YoY (from $72.8mm to $102.6mm) as management was able to squeeze out excess costs.

Charles River's Q3 2020 results were good from top to bottom, but as management described during the conference call, the company still had earnings and margin pressure due largely to the heavy investments being made in its business. This is a short-term headwind, in my opinion. But, as described above, there was also a lot to like about Charles River's Q3 2020 operating results.

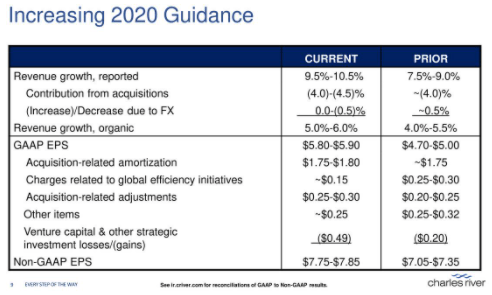

And looking ahead, management increased its full-year 2020 guidance.

Source: Q3 2020 Earnings Slides

It should be noted that the strong guidance includes COVID-19-related headwinds (revenue hit of ~$70mm that occurred in Q2 2020), but this is more of a backward looking factor because management does not expect much of a COVID-related headwind through early 2021. This company was built for this type of environment as the pandemic, in my opinion, will forever change the way we live. Management said it best during the conference call:

At Charles River, we have never been so essential to our diverse and growing client base, and we remain fully operational and continue to enable our biopharmaceutical clients to move their programs forward across a wide range of therapeutic areas, including COVID-19.

Our resilience through the pandemic has served to enhance our position as the partner of choice for our clients' early stage research needs as we continue to differentiate ourselves through our broad portfolio, our scientific expertise and our superb client service.

Charles River was already viewed as a mission-critical business partner for most of its customers and I believe that this pandemic has only added to that viewpoint.

The Bull Case Remains Intact (Actually Its Stronger)

Nothing that I've heard so far in 2020 has changed my view of Charles River being a great, long-term investment. Charles River's story is straightforward: this company is a vital part of its customers' business processes. The company provides value-added products and services that are fully integrated into most of the drug discovery and development processes around the globe.

Furthermore, management continues to tuck in valuable assets, which allows it to provide additional value to its customer base. The company is viewed as a critical business partner, and rightfully so, for most of the major players in its industry.

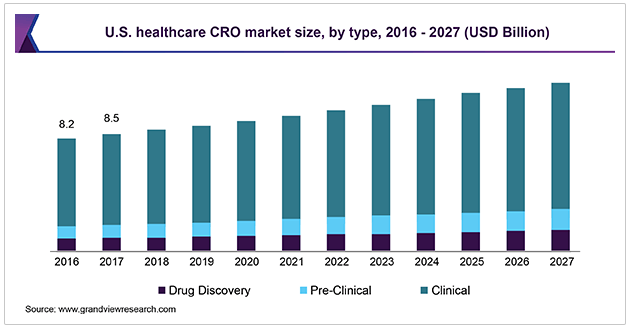

And let's not forget that Charles River is a top CRO company that operates in an industry that is expected to experience strong growth in the years ahead.

Source: Grandview Research

And more specifically, Charles River's management team believes that the company has a significant addressable outsourced market in several different key industries. At the end of the day, there is a lot to like about Charles River's long-term business prospects.

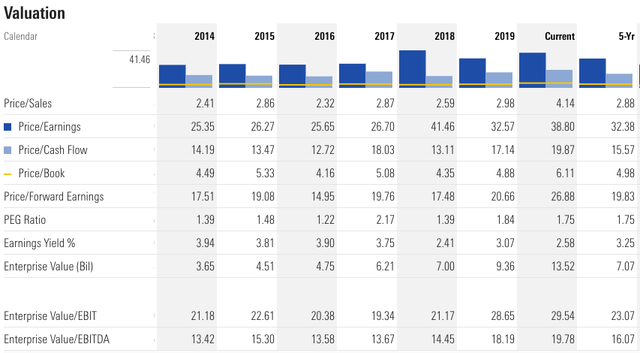

Valuation

Charles River's stock is richly valued based on its own historical metrics.

Source: Morningstar

While this valuation is definitely not cheap, I believe that Charles River's story gets even more impressive the further that you are able (and willing) to look out. Plus, let's remember that management is investing for the future so the company is contending with earnings headwinds that will eventually become tailwinds. Therefore, this small-cap company has the potential to more than grow into its current valuation heading into 2021.

Risks

Investing in small-cap companies comes with many risks, but the major risk for Charles River is related to the company's reliance on pharmaceutical and biotechnology companies. If these companies cut back their operations and/or outsourcing needs, Charles River's business would be negatively impacted.

Additionally, the company's growing debt balance should be closely monitored in the quarters ahead. Please also refer to Charles River's 2019 10-K for additional risk factors that should be considered before investing in the company.

Bottom Line

Charles River's Q3 2020 operating results were strong even after factoring in several COVID-related headwinds. The next few quarters could turn out to be a tough operating environment for Charles River, but the company's long-term investment thesis remains intact. Moreover, I believe that Charles River is already seeing potential long-term benefits from COVID-19-related changes that will impact the industry for many years to come. Therefore, investors with a time horizon longer than three to five years should consider adding CRL shares on any pullbacks.

Disclosure: I am/we are long CRL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: This article is not a recommendation to buy or sell any stock mentioned. These are only my personal opinions. Every investor must do his/her own due diligence before making any investment decision.