BGC Partners: The Rally Still Has Legs

Despite lower trading volumes in Q3 '20, BGC's earnings showed plenty of promise.

The Fenics electronic platform is asserting itself as a leader in US Treasuries, options and Forex trading.

The diversification into insurance brokerage is starting to pay off.

A new distribution policy is set to be announced in Q1 '21 that should boost shareholder returns.

At first glance, BGC Partners' (BGCP) third quarter financial results were uninspiring. The interdealer broker's trading volumes were down markedly from the same period last year, and so were its adjusted earnings.

There were, however, plenty of positives that suggest that the share price recovery still has legs. Management's guidance for Q4 showed confidence, the growth initiatives (Fenics electronic trading platform, brokerage business) are starting to pay off, and upcoming improvements to the dividend policy and the corporate structure could provide catalysts in the next few months.

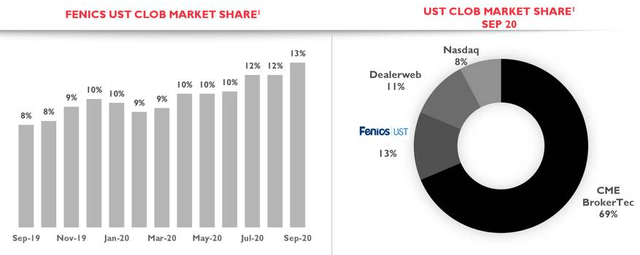

Fenics On The Rise

Interdealer brokerage in its traditional, voice-based form, is a mature business. The growth prospects for the industry reside in the implementation of electronic platforms, which offer clients more flexibility, and tend to bring higher margins. While the subdued volatility in Q3 had a negative impact on BGC and its peers (such as Compagnie Financière Tradition (OTC:CFNCF) which I discussed in previous articles), BGC's electronic platform Fenics performed strongly.

Fenics has been gaining traction in US Treasuries, with a 13% market share among CLOB (central limit order book) platforms:

Source: BGC's Q3 earnings presentation

Fenics GO, the options trading segment, has also experienced fast adoption, and Fenics' FX business contributed meaningfully, something CFO Steve Bisgay expects to continue going forward:

There was nothing one-time in there, it is -- it's just there. I think, as we mentioned before, it's a good asset class for us, part of the business, and it has performed strongly this quarter.

Source: BGC Partners' Q3 earnings call transcript

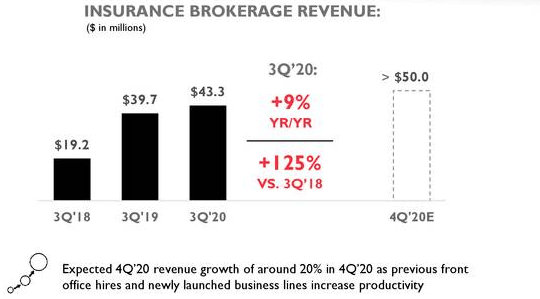

Insurance Brokerage Gains Traction

Meanwhile, revenue from BGC's insurance brokerage business has been increasing. Against the backdrop of a hardening insurance market (with rising premiums resulting in rising commissions for brokers), this positive trend is set to continue.

Source: BGC's Q3 earnings presentation

The division should achieve breakeven for FY 2020 and, according to management, start contributing to the company's earnings in 2021:

Our insurance brokerage group has reached its size and scale. We're expected to be profitable for the fourth quarter and improve BGC's bottom-line by over $25 million in 2021 compared to 2020.

BGC Partners CFO Steve Bisgay. Source: BGC Partners' Q3 earnings call transcript

Upcoming Catalysts

A couple of moves regarding the capital return policy and the corporate structure could make the shares more attractive: the definition of a capital return policy, and the potential move to a C-Corp status.

New Capital Return Policy

Back in March, the share price tanked as BGC Partners reduced its quarterly dividend to one cent per share (among other defensive moves). There could be more positive news ahead for investors, with management planning to revise its policy, with potential announcements as soon as Q1 '21. Do not expect a return to the high distributions of 2019, though, given that BGC will probably use a more balanced approach mixing buybacks and dividends:

Historically, as you're aware, the firm has been entirely dividend focused. And as part of our planning, we will definitely consider evaluating share buybacks as part of our capital return policy, but we will have more to say certainly next quarter.

BGC Partners CEO Howard Lutnick, Source: BGC Partners' Q3 earnings call transcript

Conversion to C-Corp?

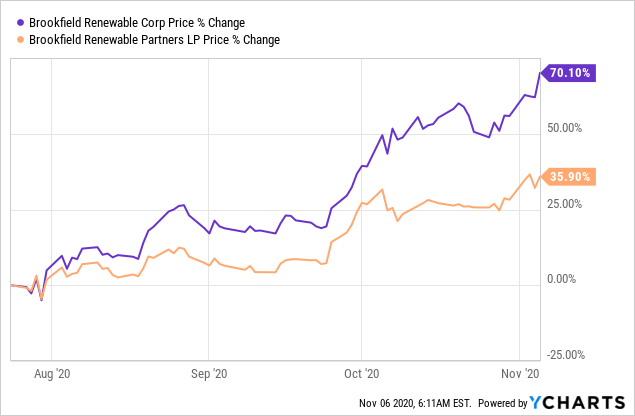

Another move being considered is a transition from a Partnership to a C-Corp status. Such moves usually make shares attractive to a broader range of investors, and could act as a catalyst for the share price. A recent example, that of Brookfield Renewable Partners (BEP, BEPC) which now also trades as a C-Corp as an alternative to the Partnership structure, shows the premium that a C-Corp can command:

I'm not suggesting that a similar move by BGC would trigger a share price increase of this magnitude (Brookfield benefits from the record demand for green investments), but it should have a positive impact nonetheless. The C-Corp change could wait for a few more quarters, though, as management will need more clarity on future tax rates before making a decision.

Valuation

BGC's management keeps pointing to the shares' undervaluation:

We view our stock as being demonstrably undervalued as our earnings return to 2019 levels in the fourth quarter, while our current stock price is over 50 percent below where it was last year”.

Source: BGC Partners Q3 earnings release

There is no guarantee that BGC's shares will make up all the lost ground, but let's see what a realistic target would be if management's projections materialize. According to BGC's financial statements, post-tax adjusted earnings were $241.8m for the first nine months of 2020. In Q4 '20, management expects $65m to $85m in pre-tax adjusted earnings, and a 10-12% tax rate. If we take the midpoint of this guidance ($75m pre-tax), we should get post-tax adjusted earnings of around $67m for Q4. This gives us a total of $309m in adjusted earnings for the year, and a P/E of 4.4 based on the current market cap ($1.35bn).

In 2021, BGC expects improvements of about $65m in pre-tax adjusted earnings (equating to $58m after tax):

We continue to expect profitability in our newer Fenics standalone businesses, which includes Fenics UST, Fenics GO, and Lucera, to improve by $40 million and collectively break-even next year. This improvement, combined with the $25 million improvement in insurance brokerage profitability, will drive overall pre-tax Adjusted Earnings and Adjusted EBITDA at least $65 million higher in 2021, all else equal.

Source: BGC Partners Q3 earnings release

If the projection materializes, this would give us earnings of $367m, and a forward P/E of only 3.7.

| FY 2020 estimate | FY 2021 estimate | |

| Adjusted Earnings (after tax) | $309m | $367m |

| P/E (based on adjusted earnings) | 4.4 | 3.7 |

Obviously, caution is required when dealing with "adjusted" earnings. But applying a conservative P/E of 6 (instead of 3.7) to the 2021 adjusted earnings above, a share price of $3.2 * 6/3.7 = $5.2 looks achievable in 2021. This represents a 62% increase on the current price of $3.2/sh.

Takeaways

After a dismal share price performance so far in 2020, things are looking up for shareholders. The business is resilient, some growth avenues are starting to emerge with the Fenics platform and the insurance brokerage segment. If, in addition, management defines a credible capital return policy in Q1 '21, a rerating of the share price should follow.

Disclosure: I am/we are long BGCP, BEPC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Additional disclosure: The opinions and views expressed in this article are for information purposes only and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security, investment strategy or market sector.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.