Apple Will Win Big If The DOJ Cuts Google's Wings

Google and Apple's $12 billion search engine exclusivity agreement could end due to the current anti-trust case against Google.

This has lead Apple to make efforts to develop and push its own search engine on its users.

In the long term, Apple could stand to win big from this. We estimated yearly revenues of around $50 billion.

How the DOJ probe on Google affects Apple

While the current antitrust investigations on tech giants' anti-competitive behavior have put the limelight on Alphabet Inc. (GOOG)(NASDAQ:GOOGL) and Facebook Inc. (FB), little has been said of how the outcome affects other companies that operate in close competition.

Apple Inc. (AAPL) could be a short-term loser but potentially a long-term winner from these proceedings. Apple will lose out on the revenues it receives from Google, but will in turn have an opportunity to enter the lucrative market of search engine advertising. Overall, I believe this is a compelling reason to add (more) Apple to your portfolio.

To begin with, let’s revise some of the key points of the ongoing antitrust investigation against Google:

Entering into exclusivity agreements that forbid preinstallation of any competing search service.

Entering into tying and other arrangements that force preinstallation of its search applications in prime locations on mobile devices and make them undeletable, regardless of consumer preference.

Entering into long-term agreements with Apple that require Google to be the default – and de facto exclusive – general search engine on Apple’s popular Safari browser and other Apple search tools.

Generally using monopoly profits to buy preferential treatment for its search engine on devices, web browsers, and other search access points, creating a continuous and self-reinforcing cycle of monopolization.

Source: justice.gov

As we can see, Apple was expressly mentioned by the DOJ for having an exclusivity agreement with Google, which pays Apple up to $12 billion annually to be the de facto search engine on their devices. This agreement has worked very well in the past, and bear in mind, $12 billion is over ⅕ of Apple’s total earnings.

Why would Apple bother competing with Google when it can instead collect a hefty fee? The problem is, this may no longer be an option in the future, so Apple is faced with no other choice but to start their own search engine.

There are already various reports of Apple beginning to make efforts to develop and push their own search engine. In the latest iOS update, the company began showing its own search results when people enter a question into the home screen. Furthermore, Apple’s web crawler has allegedly reported unusually high activity in the last few weeks. In an interesting turn of events, it may be Google’s ex-head of search, John Giannandrea, who will spearhead the project, having been poached by Apple in 2018.

The case for Apple building its search engine is now more compelling than ever, especially if Google is going to be prevented from striking similar exclusivity deals with other hardware makers.

Crunching the Numbers

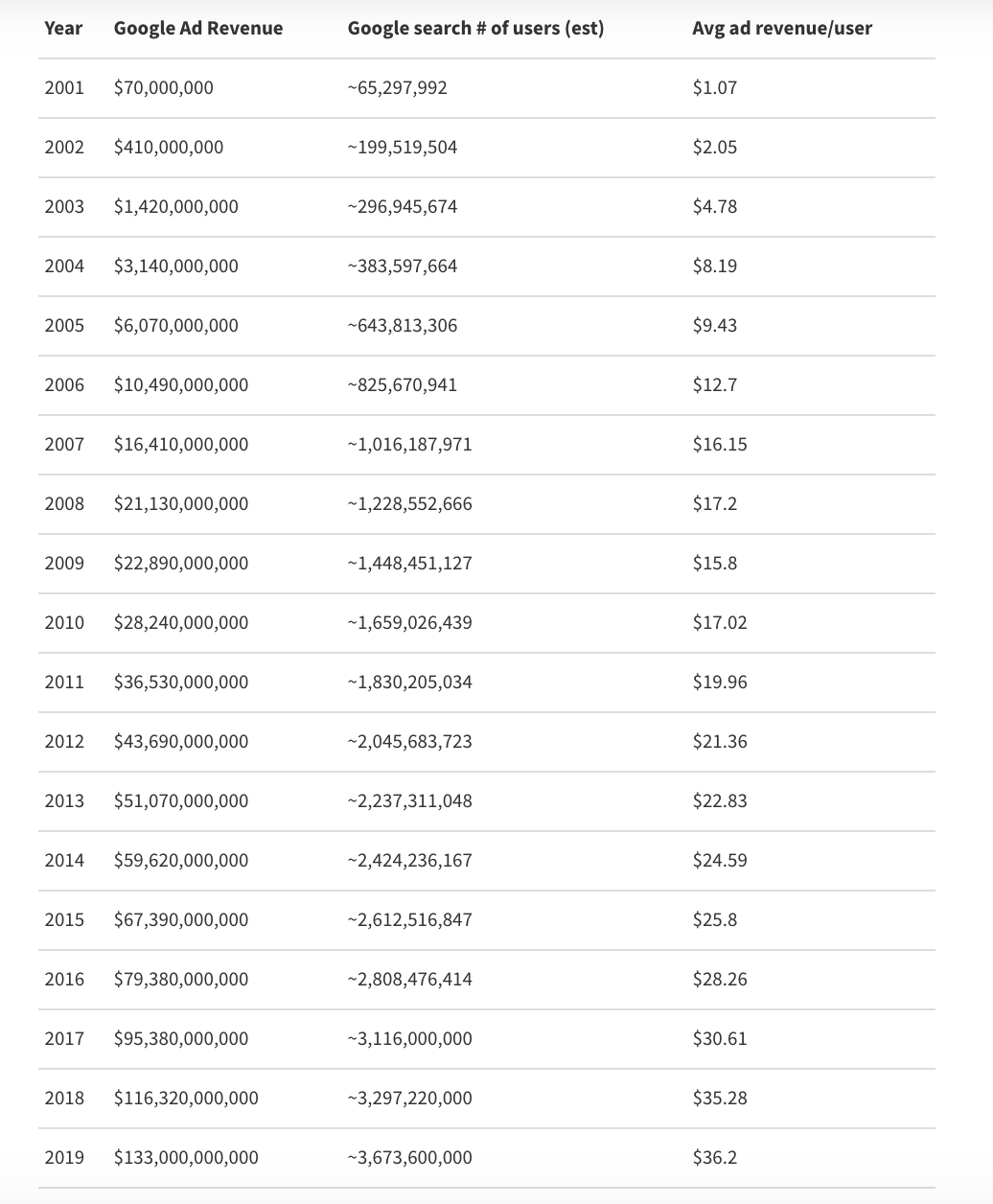

Now, let’s try and quantify how much revenue Apple could potentially make from this. To do so, we must find out how much Google makes per user. Luckily, Yaron Yitzhak at Thenextweb.com provides us with some insight on this. Using data dating back the last 20 years, he calculates the ARPU that Google has produced from its ads. The method used is as follows:

- Take the total yearly Google Ad revenues. In 2019, for example, this was $133 billion.

- Calculate the total number of internet users, using data from The World Bank’s World Development Indicators.

- Use available data to calculate Google’s search engine market share. In 2019, this was 82%.

- Assuming all people use a search engine, we now have the total number of Google users.

- Divide the revenue by the total number of estimated Google users.

The results are as follows:

Source: Thenextweb.com

As we can see, Google’s yearly ARPU has increased considerably since 2001. In the last year, a Google user would have made the company an estimated $36.2 simply from being served ads.

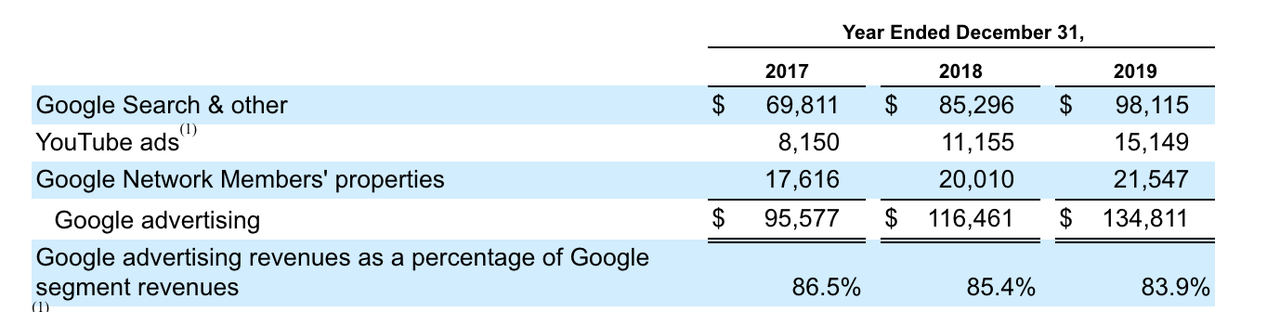

However, as useful as this data is, it does not serve as a proper comparison with Apple. The above Google revenues also include revenues for YouTube and Google Network Properties.

Source: 10-K

Clearly, YouTube ads can be discounted from this revenue. The question is what we should do with the $21 billion in revenues provided by Google Network Members' properties. These revenues are primarily coming from AdSense. These are ads served by Google on someone else’s page, as opposed to on the top of the search bar. To be conservative, I will only take Google Search revenues to calculate ARPU.

The final number for how much money Google Search exclusively makes per user is, therefore, around $27.2. According to Apple’s reports, there are over 1.4 billion active Apple devices. If we are to take each of these as a user and apply Google’s current monetization rate, Apple would stand to make $38.15 billion in yearly revenues if they were to develop a proprietary search engine.

Alternatively, an even easier estimate could be the following. According to Google’s own estimates, nearly half of its traffic came from Apple devices. That would be equivalent to just under $50 billion in revenues, not too far off our own estimates. This is incredibly close to what we get if we add the $21 billion from Google Network into our own calculation.

Calculating final earnings would be a much more speculative task. Google has an operating margin of 20%, but that includes expenses that are unrelated to the search engine, including exclusivity payments such as the one made to Apple. If Apple could convert anywhere upwards of 30% of this revenue into the bottom line, it would translate into $13-16 billion in yearly earnings. This seems more than plausible. The overhead cost of actually running the search engine itself is pretty negligible, somewhere around 100 million, and Apple already has much of the technology and human capital it needs to do so.

Final Thoughts

While both Google and Apple will suffer if this anti-trust legislation gets put into place, the latter stands to win big in the long term. Adding revenues from advertising could be the perfect way to counter a slow-down in iPhone sales. If Apple is going to become anything more than a phone manufacturer, this is a first step in the right direction.

In conclusion, I believe the current case against Google will benefit Apple in the long term. The market has not priced this is in, which makes this a great time to double-down on Apple.

Macro Trading Factory is a new service focused on macro views, market outlook, and asset allocation.

We demonstrate portfolio and risk management, in a simple and relaxed manner.

Our model portfolio is:

Well-diversified, containing up to 25 leading ETFs and CEFs.

Managed by a team of professionals, led by TMT.

Aiming to outperform the SPY on a risk-adjusted basis.

Allowing you to keep up with your daily routine.

MTF is your perfect solution if you're looking for an ongoing, professional, trusted, affordable guidance, especially with little time on their hands.

Macro Trading Factory for An Upward Trajectory!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.