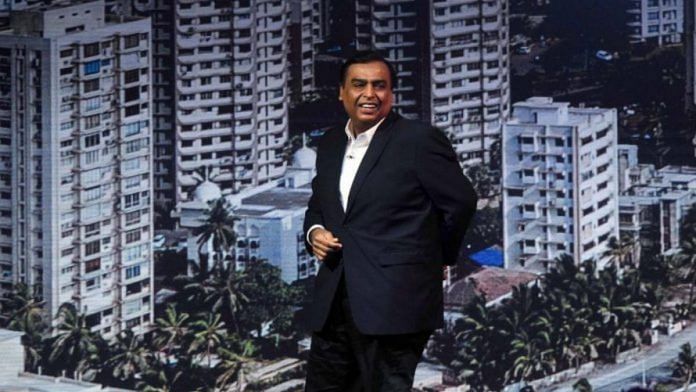

Mumbai: Saudi Arabia’s Public Investment Fund, or PIF, plans to invest about $1.3 billion in Mukesh Ambani’s retail unit as Asia’s richest man continues to add marquee backers in a fundraising spree that has now surpassed $6.4 billion.

The sovereign wealth fund will pick a 2.04% stake in Reliance Retail Ventures Ltd. for 95.55 billion rupees ($1.3 billion), parent Reliance Industries Ltd. said in an exchange filing Thursday. The stake sale values India’s largest retailer at about $62.4 billion, it said.

| Investor | Date Announced | Amount (INR Billions) | Stake (%) |

|---|---|---|---|

| PIF | Nov. 5 | 95.55 | 2.04 |

| ADIA | Oct. 6 | 55.1 | 1.20 |

| TPG | Oct. 3 | 18.4 | 0.41 |

| GIC | Oct. 3 | 55.1 | 1.22 |

| Mubadala | Oct. 1 | 62.5 | 1.4 |

| General Atlantic | Sept. 30 | 36.8 | 0.84 |

| KKR & Co. | Sept. 23 | 55.5 | 1.28 |

| Silver Lake +co-investors | Sept. 9, 30 | 93.8 | 2.13 |

| Total | 472.75 | 10.52 |

Source: Company Filings

Key insights

Market performance

- Shares of Reliance Industries have soared 30% this year while the broader gauge S&P BSE Sensex has gained 0.2%.

Subscribe to our channels on YouTube & Telegram

Why news media is in crisis & How you can fix it

India needs free, fair, non-hyphenated and questioning journalism even more as it faces multiple crises.

But the news media is in a crisis of its own. There have been brutal layoffs and pay-cuts. The best of journalism is shrinking, yielding to crude prime-time spectacle.

ThePrint has the finest young reporters, columnists and editors working for it. Sustaining journalism of this quality needs smart and thinking people like you to pay for it. Whether you live in India or overseas, you can do it here.