CenterPoint Energy's Strategic Shift Gains Momentum

CenterPoint Energy has had a tough 18 months; an adverse rate case result, a reduced distribution from Enable, a 47% dividend cut.

The goal is now to be a pure play regulated utility; electric and gas.

Significant progress has been made toward that goal.

The Enable Midstream stake is still on the table.

Steps are underway to refit Indiana generating capacity by 2024; less coal, more solar and wind.

CenterPoint Basics

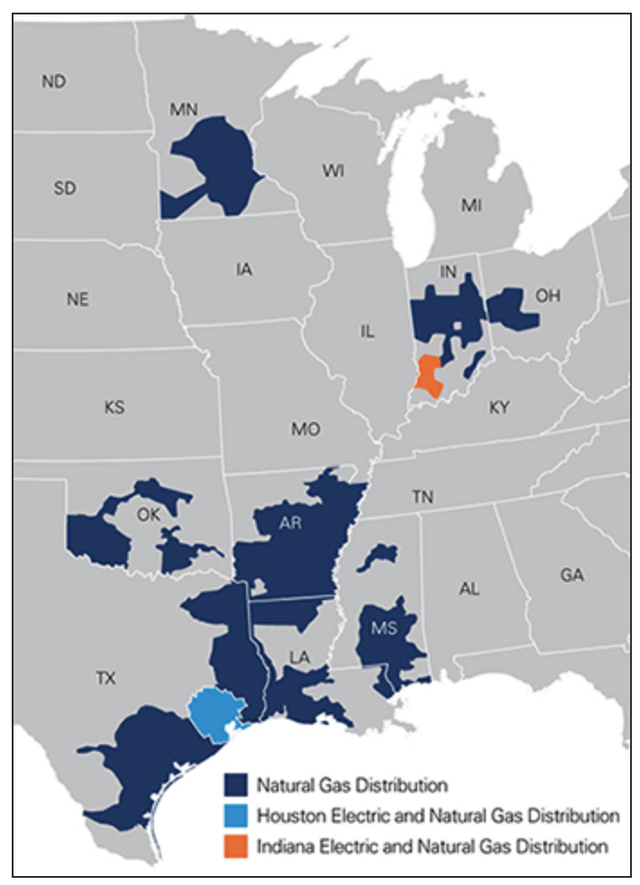

CenterPoint (CNP) is a Mid Cap utility holding company. It provides electric generation, transmission, and distribution to 2.6 million electric customers in Texas and Indiana, and gas distribution to 4.6 million gas million metered gas customers in eight states - Arkansas, Indiana, Louisiana, Minnesota, Mississippi, Ohio, Oklahoma and Texas. It also owns over half of Enable Midstream (ENBL).

The map below shows the service footprint for both electric and gas.

Source: CNP

CNP's strategic direction changed in 2019, with the new goal to be a pure play regulated utility. To that end, it sold two unregulated businesses in 2020 – Energy Services and Infrastructure. The ENBL stake is yet to be divested.

The other large issue on the table is refitting the Indiana power generation portfolio to reduce coal and emphasize solar and wind.

Let's look in a bit more detail.

The Electric Business

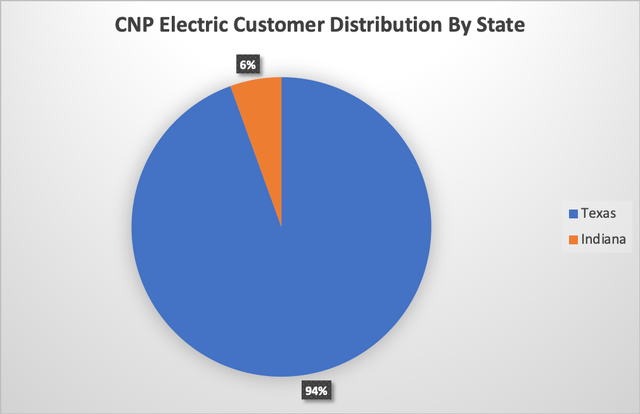

CNP's electric business operates in two states - Texas and Indiana.

Source: Chart by author, 31 December 2019 data, from CNP 2019 10-K

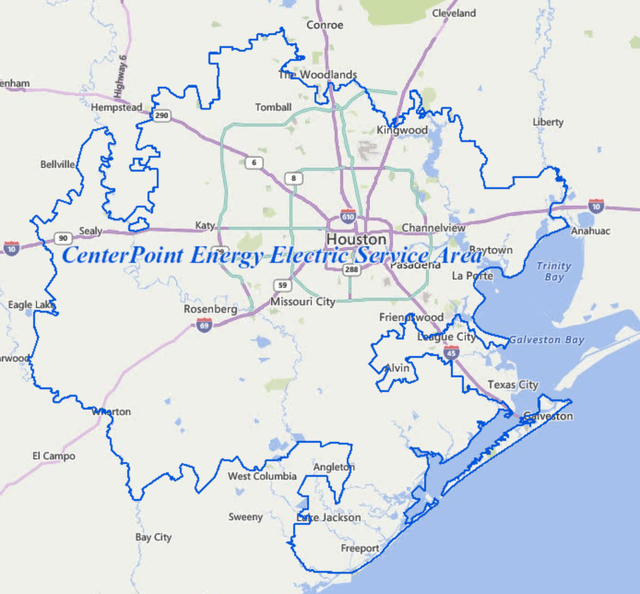

The CNP electric business in Texas is the core of the company, and provides about half of operating income. CNP’s footprint covers a 5,000 square mile area around Houston, with 3800 miles of high voltage transmission lines, and 55,000 miles of distribution lines. This is a Transmission and Distribution (T&D) business only; CNP generates no electricity in Texas.

Annual customer growth has been about 2% for three decades. The service area footprint is essentially the Houston metro area, and maps fairly well to the Houston-Woodlands-Sugarland Metropolitan Statistical Area, the fifth largest in the US with 7 million people.

Source: CNP

The electric business in Indiana (centered around Evansville) has 148,000 customers, with 1024 miles of high voltage transmission lines, and 7,000 miles of distribution lines. This is a traditional utility model, providing both power generation and T&D, and should provide about 13% of operating income for the electricity segment.

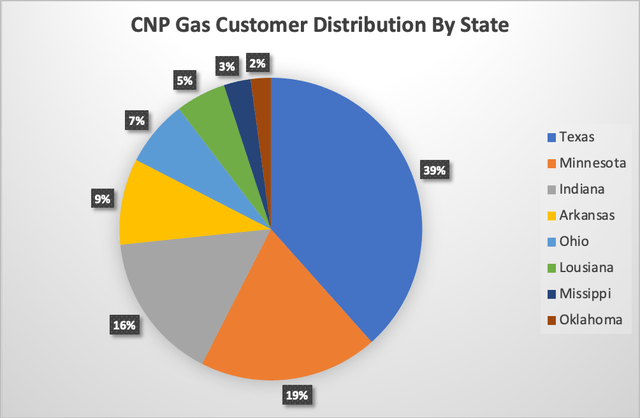

The Gas Business

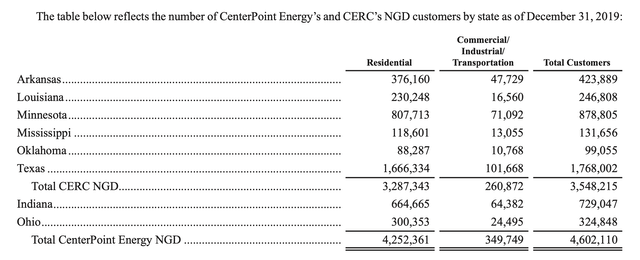

CNP's gas business is a set of Local Distribution Companies (LDCs), operating in 8 states, and serving 4.6 million customers.

Source: Chart by author, 31 December 2019 data, from 2019 10-K

Residential customers account for 90% +- 5% of the total gas customer count, but only about 40% of total gas volume. As part of the distribution system, CNP owns and operates 10 underground natural gas storage facilities, with 16 BCF of working volume.

Source: CNP 2019 10-K

The Non-Regulated Businesses

CNP began 2020 with two significant business lines and one significant investment outside the scope of a regulated utility.

- Infrastructure Services

- Energy Services

- Enable Midstream

Non-Regulated Services

Infrastructure Services and Energy Services were both sold in Q2 2020, yielding $956 million used to pay down debt (recouping about 15% of the Vectren purchase price).

Source: CNP Q2 Earnings Presentation

Enable Midstream

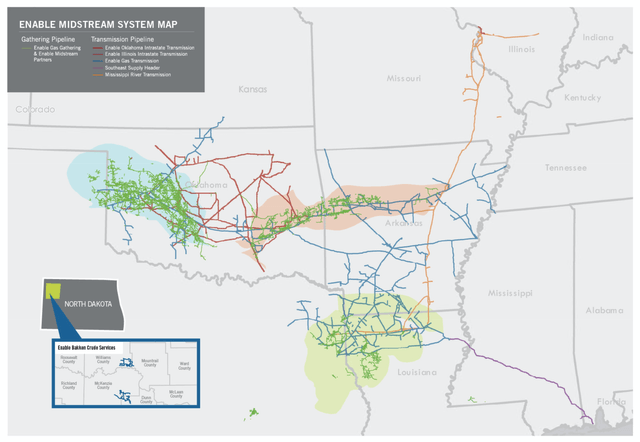

Enable Midstream Partners, LP (ENBL) is a $2 billion market cap publicly traded MLP, created in 2013 by combining the midstream assets of CNP and OGE Energy Corp (OGE). CNP and OGE each own 50% of the general partner Enable GP, LLC, while CNP owns 57.3% of the common units, OGE 25.5%, with 17.2% held by the public.

ENBL includes substantial interstate, intrastate, and gathering pipelines, and gas processing and storage assets.

Source: Enable Midstream

ENBL announced April 1st 2020 that they were reducing quarterly distributions by 50%, from $0.33 to $0.165, or about $290 million per year. While the cut was due to (perhaps temporarily) reduced activity and commodity prices, it also positions ENBL to support the now preferred midstream model to "live within your cash flow". In any case, this is $155 million per year no longer available to CNP for dividends.

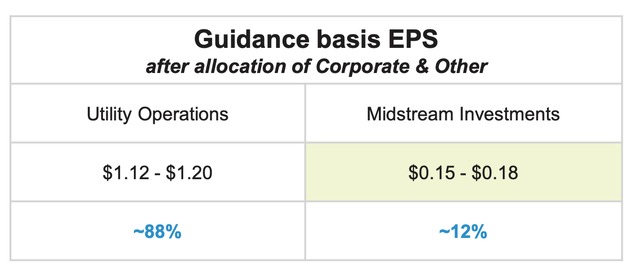

CNP estimates that going forward, ENBL contributes about 12% of earnings per share.

Source: CNP Q3 Earnings Presentation

Given the current lack of enthusiasm for midstream assets, it's perhaps not the best time for CNP to be putting their ENBL stake on the block, but recent (October 2020) reports indicate that CNP and OGE are now both working with advisers to sell their interests in ENBL.

The new CNP dividend rate ($0.60/yr) is set at a 50-55% payout of utility earnings, fitting exactly to the current $1.10-$1.20 earnings estimate. I think the message there is pretty clear - CNP is not including any ENBL earnings in the mid-long term plan.

Key Milestones - The Evolving Strategic Direction

To understand CNP’s current situation, it's useful to recall a few recent events:

- Apr 2018 CNP announces plan to merge with Vectren

- Feb 2019 Bought Vectren for $6 billion cash; including Infrastructure and Energy Services

- Apr 2019 Comprehensive Base Rate submission for Houston Electric; not successful

- Feb 2020 Revised Base Rate approved, with ROE reduced to 9.4%

- Feb 2020 President and CEO Scott Prochazka leaves CNP

- Apr 2020 Enable distribution reduced 50%

- Apr 2020 CNP dividend reduced 47%

- Apr 2020 Infrastructure Services sale closed

- May 2020 $1.4 billion equity investment

- May 2020 Barry Smitherman joins board

- May 2020 Business Review and Evaluation Committee established

- Jul 2020 David Lesar named President and CEO

- Jun 2020 Energy Services sale closed

- Aug 2020 RFP for 1000 MW solar, 300 MW wind for Indiana Electric

Some of these milestones deserve further comment.

Merger Vision

At the time of the April 2018 merger announcement, CNP's stated vision was broader in scope than a pure play regulated utility. The stated advantages of the merger included

Opportunities to leverage and expand competitive energy-related services across a larger U.S. footprint.

By the time the 2019 Annual Report came out, the old CEO was gone, the strategy had changed, and the competitive business lines were on the block.

Houston Electric Rate Case

The Houston Chronicle notes that the Public Utilities Commission of Texas (PUCT) initially raised concerns in January 2018 that CNP’s rates did not reflect savings from reduced Federal tax rates. In response, CNP submitted a Base Rate Case to the PUCT in April 2019, the first such general review since 2010.

This filing was based on a rate base of $6.4 billion, a capital structure of 50% debt / 50% equity, and a ROE of 10.4%, up from the current 10.0%. Among the inputs to the PUCT were reliability complaints from H-E-B, a grocer with 150 stores in the Houston area, which had resorted to installing back up natural gas generators at its stores.

After extended negotiation, the application was approved in February 2020, with a capital structure of 57.5% debt/42.5% equity, and a ROE of 9.4%. Other provisions required increased separation of the finances and credit of Houston Electric from other CNP obligations, perhaps reflecting concerns about ENBL.

Equity Investment

The $1.4 billion equity investment includes $725 million in mandatory convertible preferred shares with an initial conversion price is $15.31 per share, and $675 million in common shares at $16.08 per share. Investors include Elliott Management Corporation, sometimes referred to as an activist investor.

Barry Smitherman Joins Board

In May 2020, CNP announced the addition of Barry Smitherman, age 63, to the board. Mr. Smitherman was formerly chairman of both the Public Utility Commission of Texas and the Railroad Commission of Texas (the Railroad Commission regulated the oil and gas business in Texas).

It's hard to know if this addition was directly in response to the Houston Electric rate case, but as CNP noted at the time, “this experience will be invaluable in supporting strong regulatory strategies for CenterPoint Energy”.

David Lesar Hired as President and CEO

Also appointed to the Board in May, David Lesar became President and CEO in July 2020. Previously CEO of Halliburton, Lesar is 67 years old and has no previous utility experience. He left Halliburton due to their mandatory retirement age policy.

One might speculate that at 67, Lesar is unlikely to be CEO long term. It's interesting to note that Jason Wells joined CNP as the new CFO in September, having previously been CFO for the larger utility Pacific Gas and Electric (PCG).

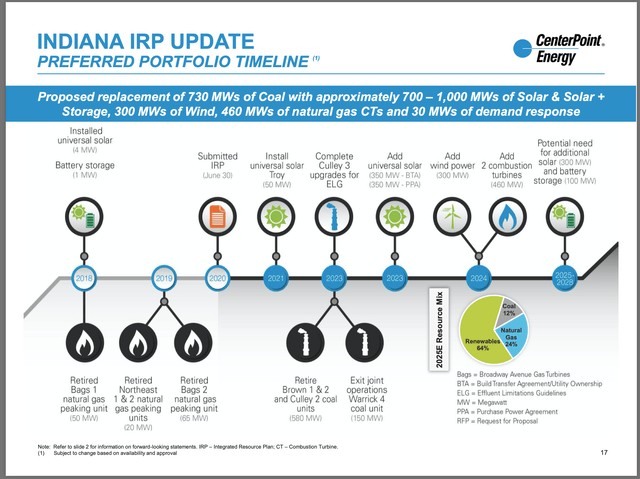

Indiana Electric Generating Capacity Refit

I'm going to go into a bit of detail here, because I want to provide the context to discuss the implications for CNP's strategy.

CNP maintains an Integrated Resource Plan (IRP) for Indiana Electric generating capacity, updated every three years. The current IRP was a bigger effort than normal. An extensive planning process was conducted between August 2019 and June 2020, including four public stakeholder meetings. (There are several hundred slides from the four meetings here, which provide a detailed discussion of the options considered and the rationale for the chosen plan).

One of the more interesting outcomes of this process was their realization that the old integrated utility model of capacity modeling was no longer adequate.

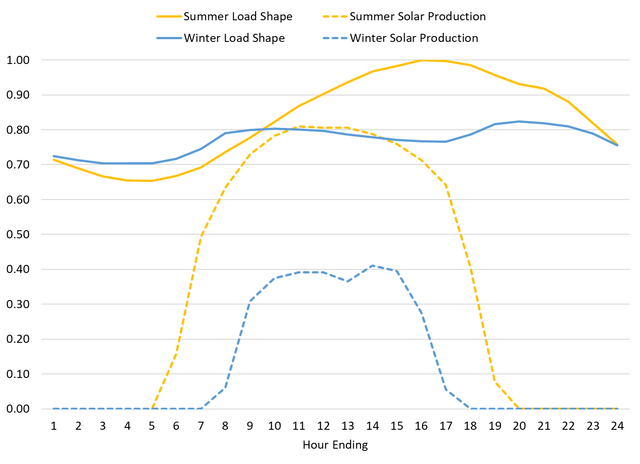

The old approach was to design the system to meet the "maximum hour" load, which is usually an afternoon hour in late summer. If the system could meet that load, experience had shown it was adequate at all other hours during the year.

However, that simple model doesn't work when significant intermittent solar and wind sources are in the generation mix. Instead a more complex "every hour counts" model is required, which explicitly considers the intermittent nature of those sources.

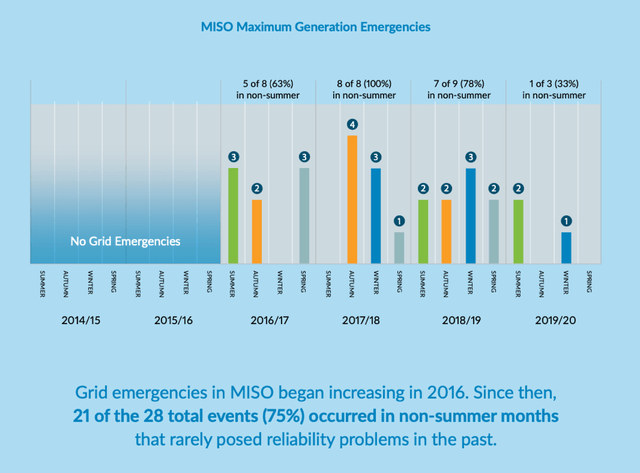

Intermittent sources are becoming more common, as the old (often coal) 24/7 baseload plants are shut down. The Midcontinent Independent System Operator (MISO), responsible for grid reliability in the area where Indian Electric operates, has already noted both an increase in the frequency of grid emergencies, and that the emergencies are more difficult predict, i.e. they are not falling at the summer "maximum hour".

Source: MISO Aligning Resources Report - August 2020

Source: MISO Aligning Resources Report - August 2020

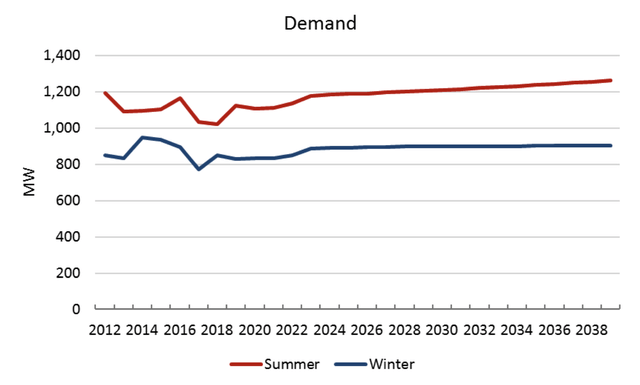

The demand that Indiana Electric must meet was assessed in some detail, with the results summarized below. Source: CNP IRP Stakeholder Meeting - October 2019

Source: CNP IRP Stakeholder Meeting - October 2019

The characteristics of solar output is seen in the figure below, which shows the variation in solar output both by season and hour, compared to the seasonal load.

Source: CNP IRP Stakeholder Meeting #2 - October 2019

Source: CNP IRP Stakeholder Meeting #2 - October 2019

The outcome of the IRP process is a plan to retire 730 MW of coal, leaving only one coal plant (the 270 MW Culley 3, in service since 1973), and add 700-1000 MW of solar, 300 MW of wind, and 460 MW of natural gas, by 2025.

This can be assessed in the context of the results of the demand analysis. The 730 MW available on a windless night (460 MW of gas + 270 MW of coal) would leave CNP dependent on importing power from another utility to meet demand.

While the plan anticipates the Culley 3 coal plant to continue operation to 2040, I think that's unlikely, but this plan buys some time to gain experience with solar and wind, and to decide how to replace the Culey capacity.

The most recent take on the intended portfolio is presented here. Note that compared to last quarter, this now calls for 350 MW of owned solar and 350 MW via Power Purchase Agreement, and adds another 300 MW + 100 MW of storage in the post 2025 time frame.

Source: CNP Q3 Investor Presentation

My Perspective

I bought CNP before the Vectren merger. I was attracted to the fact that it was a T&D only electric utility (thus avoiding the turmoil in the generation side of the business), and local distribution gas company, both centered around the high growth Houston and Texas. The Enable stake was a convenient way to hold a bit of midstream, with the potential for higher return than a pure play regulated utility.

The Vectren acquisition brought the electricity generation issues, as well as more complexity with non-regulated businesses. The additional gas LDCs added 2.8 million customers (a 160% increase), but spread among 7 more states.

I would rather the Vectren deal had not been done, but that’s water under the bridge now. The major non-regulated businesses have already been sold.

As a pragmatic matter, the Enable stake should probably be sold as well; I expect that to happen within the next year. From the "we are a regulated utility" viewpoint, it essentially now amounts to a speculative investment in the midstream space, which is out of synch with their stated goal. Selling ENBL has the added advantages of focusing management attention on the utilities and simplifying their story for investors.

I’d like to see them sell Indiana Electric, and get out of the power generating business entirely. With only 140,000 customers, I don’t think this is a large enough footprint in the evolving intermittent source heavy generating mix. However, this is clearly not their plan.

This raises the question of where CNP should grow. In the Q2 earnings call, the CEO Dave Lesar made a couple of relevant comments in the Q&A that suggest there is plenty of opportunity in Texas:

... we have the luxury of having more opportunities in front of us than at this point, we can fund ...

Every time, I seek Kenny Mercado, for instance, who runs our electric business, he has a sheet of paper he brings with him with all the extra areas that we could invest just in Houston Electric or Indiana.

In the Q3 Investor Presentation, the capital plan has been upped from $13 billion to $16 billion.

I see several opportunities for growth, outside of more or less routine utility upgrades.

For the electric business, my first choice would be additional high voltage transmission lines in Texas to support the expanding wind, and perhaps solar, generating capacity that is often located distant from customers.

For example, CNP energized the 60 miles, $285 million 345 kV Brazos Valley Connection in April 2018, and the 55 miles, $490 million 345kV Bailey-Jones Creek Transmission Project is under construction with completion expected in 2022.

My second choice would be T&D acquisitions in Texas, ideally contiguous to the current footprint. An example would be the Texas-New Mexico Power T&D service area Southwest of Houston (a purchase of Texas-New Mexico Power by Avangrid was announced in late October 2020.)

For the gas business, add bolt-on contiguous gas LDCs. The gas LDC footprint extensions would probably be at least to some extent opportunistic, but could be done within a prepared strategic plan that identified the best opportunities.

Investor Takeaway

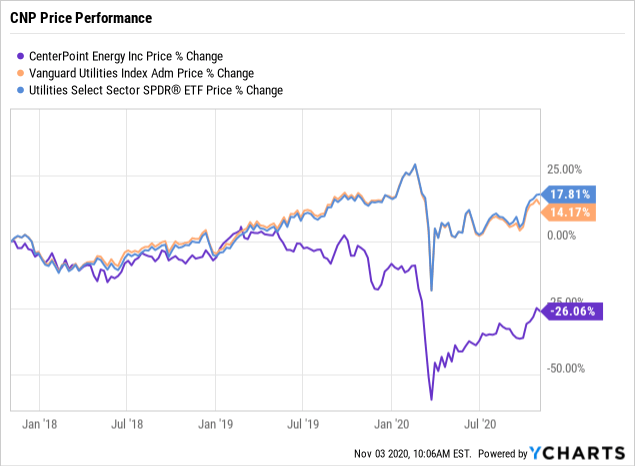

As we said at the start, it's been a tough 18 months. Compared to a Utility Index fund, CNP has provided negative alpha over the past couple of years. The Elliot Management investment at around $16 in May 2020 looks like a win - perhaps something to keep in mind for the future.

With a current P/E of about 16.5, and a 2.8% yield per Seeking Alpha, and a CNP projected 5-7% utility EPS CAGR for the next few years, I view it as around fair value and a hold today, with an expectation (and hope) that management will settle down into their chosen regulated utility world and focus on execution.

Results for Q3 were announced earlier this morning, and the results of their Business Review and Evaluation Committee will probably be detailed at their December 7th Investors Day.

Data by YCharts

Data by YChartsDisclosure: I am/we are long CNP. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.