U.S. Election Makes Frontier Markets Seem Less Crazy

This year's US election makes political risk in frontier markets seem comparatively less severe.

With frontier markets trading at less than half the valuation of developed markets, at least investors are being compensated for the risks.

The only pure play frontier market ETF available to US investors is about to go through a major rebalancing of its country allocations.

These changes will give it much larger exposure to stock high growth markets, and improve the industry diversification.

The increased allocation to Vietnam, which has thrived during the pandemic, is especially favorable to long term investors.

Regardless of political views, it's likely most investors agree that there is political risk to investing in the US market. Shops in major cities around the country have boarded up in anticipation of election unrest. I’m writing this on election eve, but I can guarantee that people will dispute the results once they are known. One poll found that 44% of Americans believed there would be significant voter fraud in the 2020 election. Regardless of who wins, a large portion of the population will be convinced that the winner is an existential threat to their livelihood. With the S&P 500 (NYSEARCA:SPY) near all time highs US investors are clearly not being compensated for this political risk.

The current situation in the US makes the case for diversification into frontier markets even stronger. Moreover, it makes the political risk in frontier markets seem comparatively less severe than before. The iShares MSCI Frontier 100 ETF (FM) trades at less than half the valuation of the US market. Frontier markets are also much cheaper than the broader world markets, and even emerging markets.

Fund | P/E | P/B |

iShares MSCI Frontier 100 ETF (FM) | 10.41 | 1.50 |

iShares MSCI Emerging Markets ETF(EEM) | 15.80 | 1.74 |

iShares MSCI ACWI ETF | 18.91 | 2.30 |

SPDR S&P 500 ETF Trust (SPY) | 22.36 | 3.47 |

Source: Fund Websites

With frontier markets, at least you are being compensated for political risk with cheaper valuations. FM is about to rebalance its country allocation in a way that makes it more heavily tilted to the long term growth opportunity offered by frontier markets.

Consequences of the Rebalancing

The country allocation of FM is about to go through a drastic change. Currently Kuwait accounts for 28% of the portfolio. However MSCI has reclassified Kuwait as an emerging market, so they are planning to remove Kuwait from the index that FM follows, and rebalance the remaining countries. MSCI originally planned to make the change in May 2020, but in April 2020 they announced plans to delay. Since frontier market are relatively small and less liquid than developed markets, the MSCI must slowly implement this change through five phases beginning in November 2020. They will implement additional adjustments in February, May, August, and November 2021.

Since they are removing Kuwait, they will be adding larger weights to other countries. The process is more complex in frontier markets than it is in developed country indexes. Most global indexes follow relatively simple rules for market cap and float adjustment of index components. However, several frontier market countries have stock markets that are too small to support additional index buying. In particular, Bangladesh, Lebanon, and Nigeria will all keep the same index weights after Kuwait leaves the index. In contrast, FM’s allocation to Vietnam will more than double from 12.2% of the index to 28.8% of the index. Morocco will also increase from 10.8% to 12.5%, and Romania will increase from 10.2% to 12.3%.

The following table shows how the weightings of different countries will change after MSCI completes the changes:

Country | Current Weight | Sum Weight after Phase 1 | Simulated Weight After Full Implementation | Change |

VIETNAM | 12.2% | 15.8% | 28.8% | +16.6% |

MOROCCO | 10.8% | 11.8% | 12.5% | +1.6% |

ROMANIA | 8.2% | 8.7% | 10.3% | +2.1% |

KENYA | 8.3% | 7.9% | 9.5% | +1.2% |

BAHRAIN | 8.1% | 8.3% | 9.5% | +1.4% |

NIGERIA | 8.7% | 7.8% | 7.8% | -0.9% |

BANGLADESH | 6.1% | 6.4% | 6.4% | +0.2% |

OMAN | 3.6% | 4.4% | 5.1% | +1.5% |

KAZAKHSTAN | 3.0% | 3.4% | 3.9% | +0.8% |

KUWAIT | 25.2% | 21.1% | 0.0% | -25.2% |

Source: Simulation provided by MSCI, Author’s Calculation

The rebalancing will have two main impacts. The first impact is greater allocation to the fast growing Vietnamese economy. The second, more subtle, impact is better industry diversification.

Country Allocation

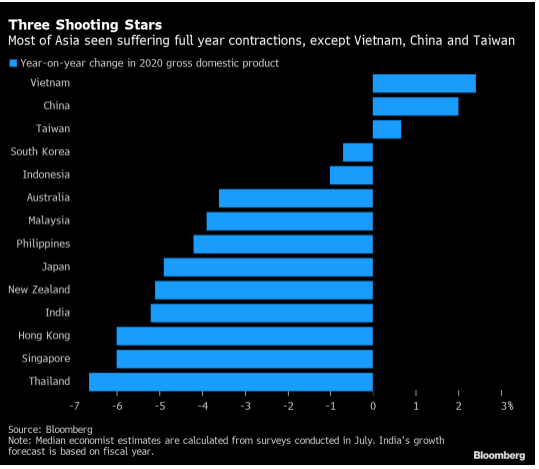

Removing Kuwait will change the economic drivers behind FM’s long term performance. FM’s larger allocation to Vietnam is beneficial from a macro perspective. Vietnam is doing better than most emerging markets during the Covid-19 pandemic, and is the best performing economy in Asia this year. While most of the world contracts, Vietnam expands.

This chart shows how Vietnam has outperformed the rest of Asia:

Source: Bloomberg, Asia Frontier Capital

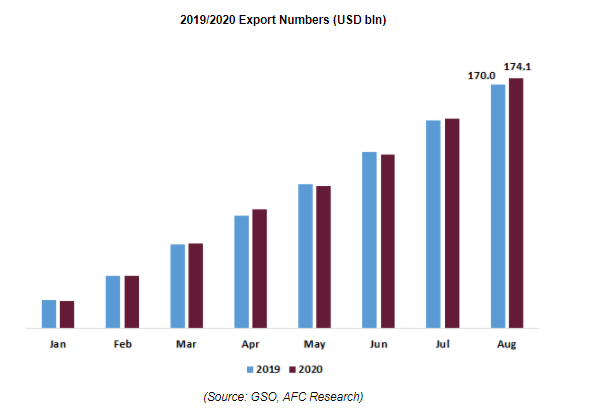

Closely related Vietnam’s Exports have kept expanding, right through the pandemic.

Source: Asia Frontier Capital

Vietnam’s recent success is partially due to the US-China trade war from which it benefits. Throughout the Trump administration companies have been relocating manufacturing capacity in Vietnam to avoid the risk of tariffs. For example, Vietnam is now the largest destination for outbound FDI from South Korea because Samsung and other major manufacturers have relocated there. Apple has also been slowly shifting more and more of its supply chain into Vietnam. This has led to the creation of “ boomtowns” in some of Vietnam’s northern provinces where per capita income has tripled within a decade. The flood of foreign investment creates job opportunities and promotes a rising consumer class. China’s furniture manufacturing sector has also benefited from Covid-19 lockdowns around the world, because people are spending more time at home.

The increased allocations to Morocco, Romania, Kenya and Oman are also net positives for investors in FM. As I noted in a previous article, in contrast with Kuwait, none of these countries with increased allocations will be over reliant on any one industry or any export partner.

Industry Allocation

In its current form, FM has too much (55%) financial sector exposure. Banks and other financial companies dominate the investable universe in Kuwait. Approximately 72% of FM’s Kuwait companies are in the financial sector. Put differently, Kuwait holdings accounted for 37% of the ETF’s financial sector holdings. Bahrain, which will only have a slightly increased allocation was the second biggest source of financial sector exposure, accounting for 7%. None of the countries with large financial sector components will see their total allocation increased drastically. Notably, Vietnam, which will have the biggest increase accounts for only 2% of the current financial sector exposure. The total financial sector exposure will likely be 25%-35% once the rebalancing is complete. Volatility could skew the industry allocation, but it will certainly have a lot less financial exposure than it does in its current form.

The financial sector in Kuwait is also directly impacted by energy prices, but the rebalancing will shift away from commodities into higher growth industries. The new index will have much larger exposure to Communications, Consumer staples, and Real Estate. Based on the guidance provided by MSCI, its likely that there will be larger allocations to the Kenyan telecom company Safricom , Vietnam Dairy Product and Vingroup JSC, a leading residential real estate company in Vietnam.

Conclusion

With US valuations near all time highs, US based investors need to look around the world for opportunities. Although frontier markets have plenty of political risk, it seems comparatively less severe when the US election is so contentious. Frontier markets are far cheaper than the US, and FM’s forthcoming rebalancing will give it more growth exposure and make it an even better long term portfolio holding.

Disclosure: I am/we are long FM, EEM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.