Align Technology: Pandemic Is A Double-Edged Sword

Thanks to the digital shift and pandemic-driven behavioral changes, Align has made a rapid recovery from a sharp contraction.

The consensus estimates suggest a record revenue for the next 12-month period, and the shares, in terms of forward earnings, trade at a sizable premium to the historical average.

The resurging pandemic can threaten the heady valuation as the proacted battle over another round of stimulus pressures consumer spending.

Yet, with a strong balance sheet, and a renewed focus on digitalization, the company is well-positioned to access a highly underserved market.

Despite near-term headwinds, we, therefore, believe Align is a ‘Hold’ for long-term investors.

Investment Thesis

After a sharp contraction at the start of the year, Align Technology (ALGN) has made a swift comeback. With more disposable income for patients, the company has positioned its digital tools to benefit from the pent-up demand and pandemic-induced behavioral changes. With revenue rising over two-fold sequentially in the third quarter, the consensus suggests a record revenue projection for the next twelve months. As political uncertainty holds up the next stimulus package and pressure consumer spending amid the resurging pandemic, the low-cost rivals with virtually-driven operating models can threaten the heady expectations.

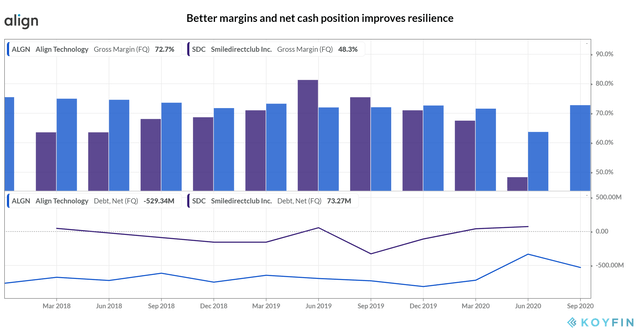

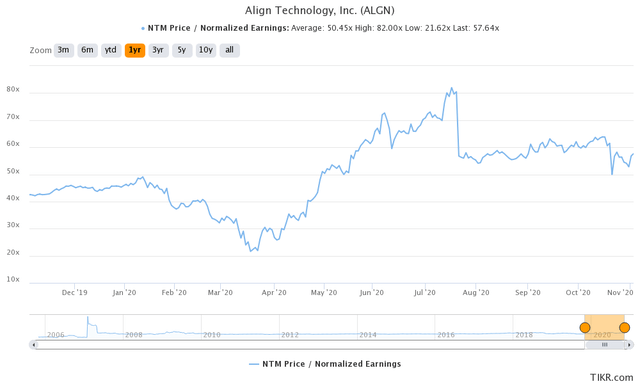

Yet, the shares in terms of NTM per share earnings trade at a sharp premium to the historical average, which, along with the current consensus forecast, indicates an overvalued stock. However, as the pandemic accelerates its digital shift, the company with a strong balance sheet is well-positioned to pursue a vastly-underpenetrated market in the long term. Therefore, despite the impending headwinds to valuation, the stock is a ‘Hold’ for long-term investors.

Source: The Company Website

Source: The Company Website

Splendid Performance Boosts Valuation

The ongoing pandemic is validating Darwin’s theory of evolution of natural selection. Akin to species that thrived due to inherited changes, the organizations that better adapt to the new normal will survive the effects of fast-changing human behavior. Thanks to its digital transformation, Align has done just that, as its latest quarterly results indicate. The writing was on the wall for the company when widespread lockdowns at the start of the year shuttered the dental offices, and patients were forced to postpone dental visits amid infection fears. Relying on the U.S. for nearly half of its revenue, the pioneer in clear aligners was quick to embrace digitalization. On Align's earnings transcripts, a quick search for the word 'digital' hints at the digital direction of the company. It has come up 55 times on average in its last three earnings calls compared to a little over 17 times averaged in 2019.

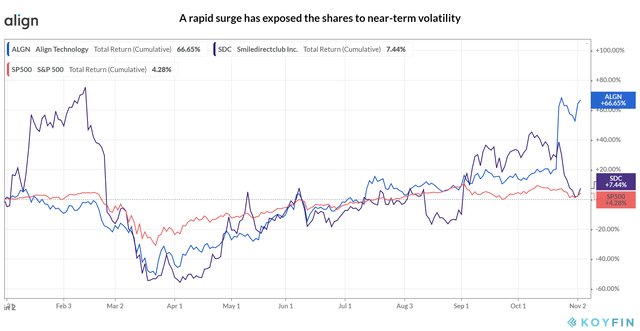

The contraction in the second quarter was followed by a swift recovery in Q3 2020 when the revenue and EPS were higher than analyst estimates by ~37.3% and ~206.8%, respectively. In comparison, the revenue and EPS beats for the S&P 500 components have reached only ~3% and ~20%, respectively, according to FactSet data based on 63% of firms that have announced the quarterly earnings so far. Following a ~38.5% gain since the earnings announcement compared to the ~2.0% drop in the S&P 500, the impressive performance has turbocharged the shares to trade near a 52-week high. With the 12-month forward PE multiple at ~57.6x, more than double that of the S&P 500, the market expects the momentum to continue. But all good things, as they say, must come to an end. Let’s find out.

Source: Koyfin

Source: Koyfin

The Digital Shift and ‘Zoom Effect’ Lead Recovery

The rapid recovery from a sharp slowdown, however, needs further scrutiny. The ~41.3% YoY slump in revenue in Q2 2020 was led by roughly a similar fall in clear aligner volumes, which made up ~84.2% of revenue in 2019. As lockdowns eased and the dental offices reopened to serve the pent-up demand, the company sprang into action. The usual price hike in the third quarter didn’t come into effect, and instead, price discounts were introduced. The incentives to dentists encouraged their shift from traditional orthodontics to clear aligners. The fee-based consultancy service, ‘ADAPT’, has also facilitated the digital transformation. The pandemic-driven changes to work, meanwhile, ushered in unintended effects. With remote working becoming the norm, the misaligned teeth have come into sharper focus during the video calls, the company notes. The avenues for entertainment expenditure remained muted, and with higher disposable income, the patients under the so-called ‘Zoom effect’ have tried the clear aligners. Driven by ~28.7% YoY rise in case volumes, the revenue for Q3 2020 has, therefore, climbed over two-fold from the prior quarter leading to a ~20.9% YoY expansion in the top line.

Soaring Expectations Don’t Reflect Uncertainty

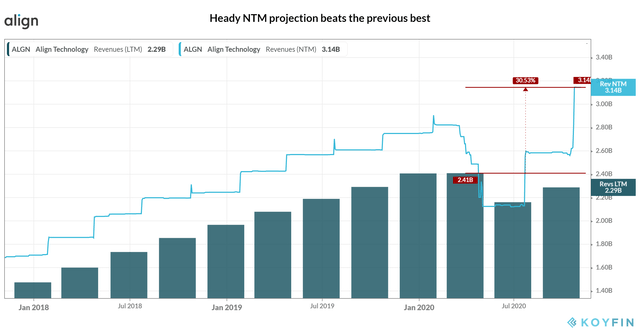

Yet, citing the uncertainty due to the pandemic, the company hasn't issued a guidance for the year. But the Wall Street projects ~$3.1 billion of revenue for the NTM period, a forecast that could be ~30.5% higher than Align's highest ever 12-month revenue figure of ~$2.4 billion recorded in Q1 2020. Such over-the-top expectations look shaky as the pandemic resurfaces and the economic environment changes. According to the company, many dental clinics have yet to reach the pre-pandemic level of patient visits, and the resurgence of COVID-19 cases can further delay the recovery. Meanwhile, overseas travel hasn't taken off, and restaurants and theme parks operate with limited capacity. Therefore, spending avenues continue to remain blocked. But with a jobless rate well above the pre-pandemic low, the disposable income has also come under pressure, particularly since the expiry of the additional unemployment benefits in July. With more political uncertainty following the election, a stimulus package to support spending looks even more remote now.

Source: Koyfin

Source: Koyfin

Digitalization Supports Long-term Goals

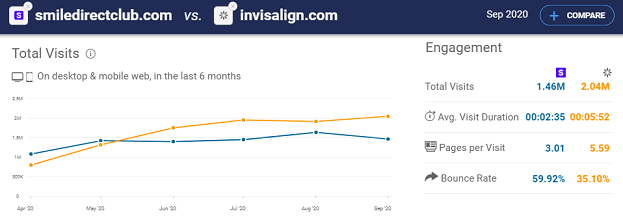

However, the company is rushing through the digital shift, as highlighted by the latest web traffic data. The recently introduced ClinCheck Pro 6.0, a cloud-supported treatment planning software, minimizes the doctor-patient interaction, as does the ‘My Invisalign app’ currently available in over 40 countries. According to data from SimilarWeb, the company has a far more engaging website compared to the rival, SmileDirectClub, Inc. (SDC). From April to September, its monthly user visits have more than doubled, outperforming the ~31.8% increase for the site run by SDC.

Source: SimilarWeb

Source: SimilarWeb

However, the authorities can reinforce the social restrictions to contain the resurging pandemic, and a delay in stimulus can pressure consumer spending. It is a scenario that can benefit low-cost direct-to-consumer rivals such as SDC at the forefront of remote teledentistry. Yet with a market share of only ~17%, Align has a long-term opportunity in the hugely underpenetrated global aligner market where 12 million cases start every year. As the pandemic accelerates its digital transformation, we believe the company with a strong balance sheet is well-positioned to reach its goal of ~300 million Invisalign patients from the current ~7.5 million.

Source: Koyfin

Source: Koyfin

Soaring Multiple Is Under Pressure

However, the long-term prospects are no reason for near-term multiples to run ahead of the fundamentals. After a surge of nearly two-thirds of value for the year, far outpacing the S&P 500, Align's shares trade at ~57.6x the per-share earnings for the NTM period, a premium of ~10.6 - 14.3% to the one year and three-year averages of ~50.5x and 52.1x, respectively. Assuming the latter, the current consensus 12-month forward EPS indicates an overvaluation of ~9.5 - 12.4% for the stock. Even in the current analyst recommendations, ‘Sell’ and ‘Hold’ outnumber the ‘Buy’ ratings by eight to six encourage caution. We, therefore, expect the stock to suffer near-term volatility and yet remain attractive for the long haul as the pandemic speeds up Align's digital shift to access a mostly untapped market.

Source: TIKR.com

Source: TIKR.com

Conclusion

Following a swift recovery in the third quarter, Align touts its digital focus, a strategy that benefitted from rapidly changing patient behavior as higher disposable income drove pent-up demand. Wall Street has penciled in a record revenue forecast for the NTM period. Yet the momentum is at stake. The pandemic is resurging, and the uncertainty over the next round of stimulus can tighten the disposable income. Therefore, with plenty of downside risk for the heady near-term multiple, we believe Align is a ‘Hold’ as the company, with a robust balance sheet, accelerates the digital shift to pursue a vastly underpenetrated market over the long run.

If you enjoyed this article and wish to receive updates on my latest research, click "Follow" next to my name at the top.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.