Timberland Bancorp: Trading At Just 7 Times Earnings And A 4% Dividend Yield

Timberland Bancorp is a small bank focusing on Seattle and its surroundings.

The majority of the loan book consists of mortgages, and should have a relatively attractive risk profile.

About 20% of its total assets are held in cash and cash equivalents: liquidity is not an issue.

Trading at TBV, 7X earnings and a 4% dividend yield, TSBK is an attractive regional bank.

Introduction

This year I have been keeping an eye on regional banks. Although they obviously aren’t as well-diversified as the major banks, one could argue they are able to limit their risks by knowing their core markets due to the local focus. Timberland Bancorp (TSBK) has just completed its financial year 2020 and despite the COVID-19 pandemic, this local bank in Washington State with just a handful of branches around Seattle reported the 10th net profit increase in a row.

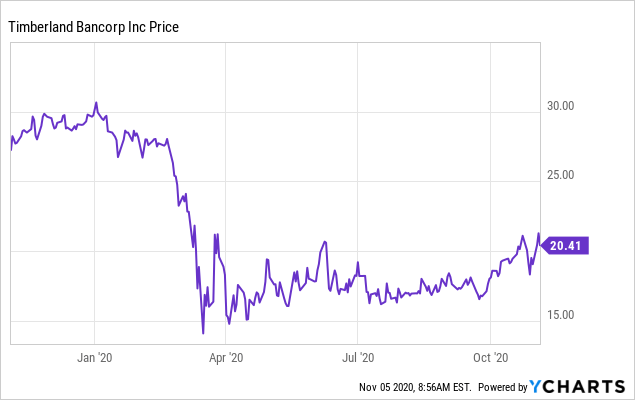

Data by YCharts

Data by YCharts

Timberland’s net income increase in FY 2020 is remarkable

Timberland’s financial year ends in September, so the most recently reported financial results of the small regional bank are the full-year results of FY 2020.

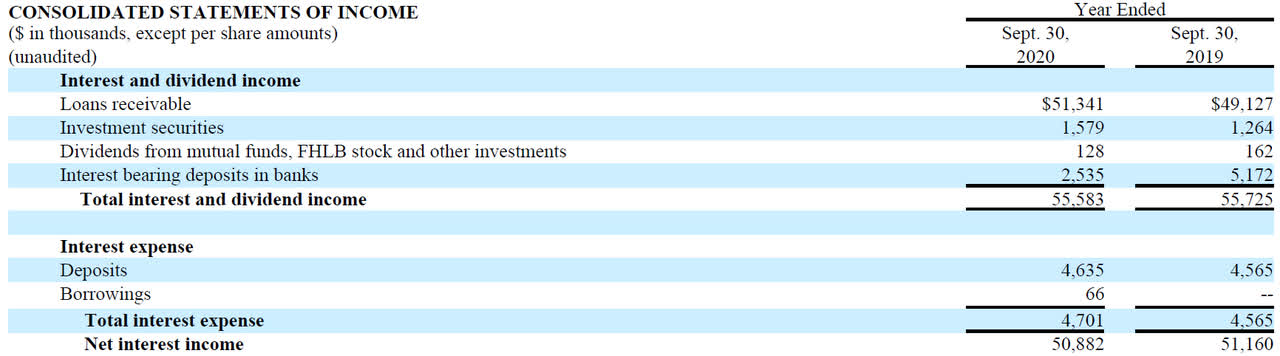

The bank reported a very small decrease in interest income (less than 0.5%) while the interest expenses increased by a same marginal percentage. This caused the net interest income to decrease by around half a percent to $50.9M. Hardly a disaster, but it’s an interesting development to see the interest expenses increase.

Source: Company press release

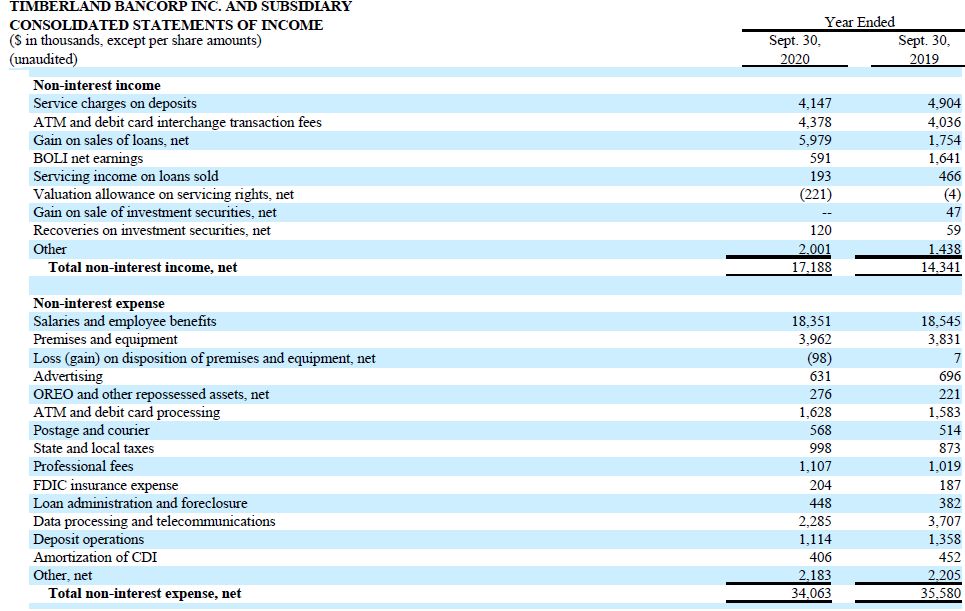

What really helped Timberland in FY 2020 was the strong decrease in the net non-interest expenses. As you can see below, in FY 2019, Timberland spent $35.6M in non-interest expenses while generating $14.3M in non-interest income for a net non-interest expense of around $21.3M.

In FY 2020, we see the non-interest expenses decreased by around 4% to $34.1M while the non-interest income increased to $17.2M, resulting in a net non-interest expense of just around $17M, a decrease of $4M.

Source: Company press release

That’s what really pushed Timberland over the edge, allowing it to record a slightly higher pre-tax income of $30.3M (compared to $29.2M) despite the $3.7M loan loss provision ($0 in FY 2019). However, investors should realize some of the non-interest income may be non-recurring. We notice a $4.2M increase in the gain on the sale of loans and we probably should not rely on Timberland being able to repeat that in the next few years.

But from this year on (FY 2021), we can reasonably expect the loan loss provisions to decrease as well. Timberland recorded $3.7M in loan loss provisions in FY 2020, but looking at the quarterly overview, there’s a clear downward trajectory. Whereas $2.2M of the provisions were recorded in the first half of the financial year, the provisions in Q3 and Q4 were just $1M and $0.5M respectively.

Despite the rather elevated loan losses, Timberland was able to report a net income of $2.91 per share, whereas the H2 net income was $1.51/share. This means that at the current share price of $20.40, Timberland is trading at less than 7 times its earnings while the reconfirmed quarterly dividend of $0.20 per share is pushing the dividend yield to almost 4%.

The loan book is geared towards mortgages

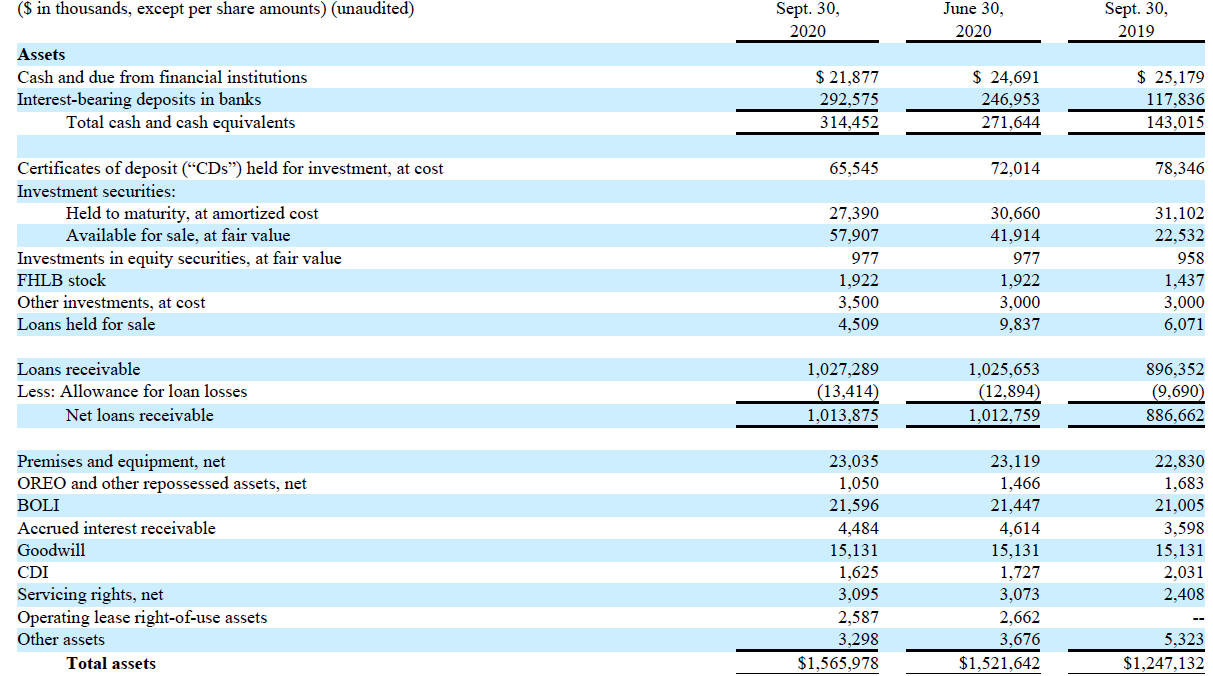

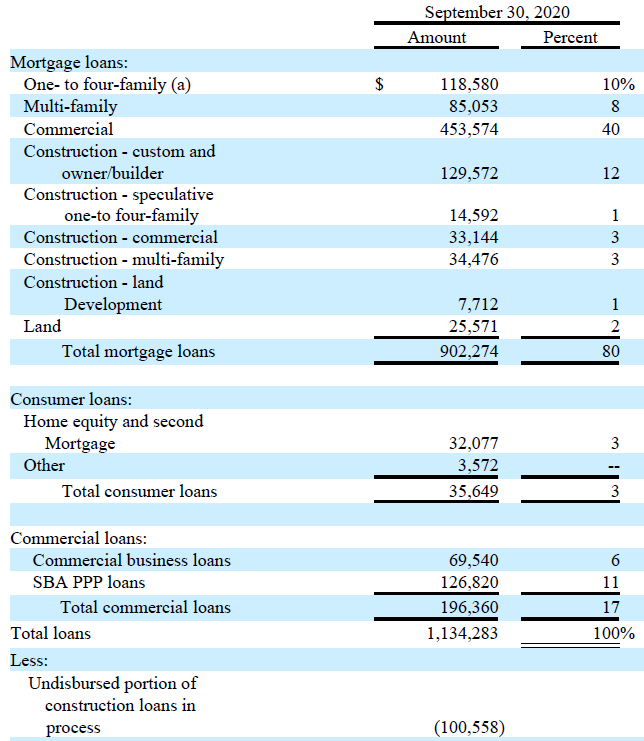

Looking at the balance sheet, the total size of the loan book (excluding investment securities) is $1.014B, which already includes a total allowance for loan losses of $13.4M, or approximately 1.2% of the total loan book.

Source: Company press release

I am pretty impressed to see a substantial portion of Timberland’s assets are in very liquid assets: on a total balance size of $1.57B, approximately $314M is held in cash and cash equivalents, that’s approximately 20% of the total balance sheet. If anything, the risk for the bank to run into liquidity issues seems to be almost non-existent. And now the COVID-19 dust seems to be settling, perhaps Timberland will ‘activate’ a portion of its liquid assets. Issuing $50M in additional loans at 3% would boost the interest (and net interest) income by $1.5M without seeing any increase in the interest expenses. This could boost the EPS by an additional 10 cents per share in FY 2021.

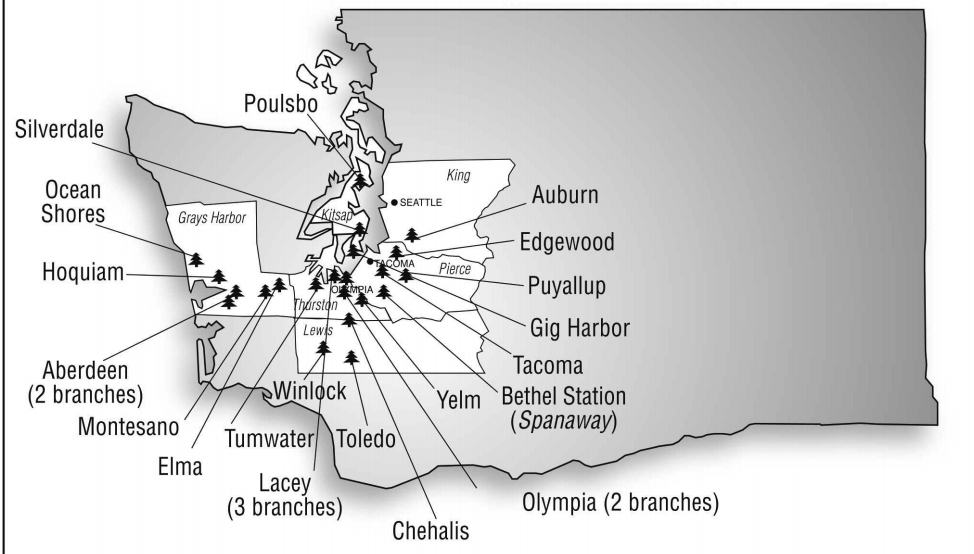

As Timberland Bancorp has a local focus on just a portion of Washington State (see below), we can reasonably assume the bank is in an excellent position to do its due diligence before committing to write a loan.

Source: annual report FY 2019

Of the $1.01B in loans, around $900M consists of mortgage loans. Unfortunately residential mortgages are only a small portion (just over $200M) and the majority of the loans are related to commercial and construction lending. This doesn’t have to be a major problem: considering these are mortgages, there will always be some collateral attached to it. And as the ‘pure’ commercial loans excluding the PPP loans are less than $70M, Timberland should be seen as a bank with a strong focus on real estate.

Source: Company press release

Investment thesis

Timberland Bancorp seems to be knowing what it’s doing and as the loan portfolio is geared towards mortgages (including commercial and construction mortgages), it has been able to keep the loan loss provisions very low. Additionally, as only $0.80 of the $2.91 EPS is being paid out as a dividend, Timberland is retaining $17M per year on its balance sheet which will help to offset any potential loan losses in the future. And with a pure banking income on a pre-tax and pre-provision basis of around $34M versus a total loan book of around $1B, Timberland should be able to manage future loan loss provisions without jeopardizing its future.

I hadn’t bumped into Timberland Bancorp before, but what I see has triggered my interest. I still don’t have a long position yet, but I’m getting very interested now the bank is trading at its tangible book value ($20.56 as of the end of September), while offering a P/E ratio of 7 and a dividend yield of almost 4%.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

NEW at ESCI: A dedicated EUROPEAN REIT PORTFOLIO!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.