Massive Options Bets Suggest Long-Term Upside For Microsoft

Microsoft reported much better than expected quarterly results.

Its cloud unit is the expected driver of strong revenue and earnings growth in the future.

Someone made a tremendous bet through options that the shares rally more than 20%.

Someone is making a big bet that Microsoft's (NASDAQ:MSFT) stock goes on a multi-year move up. It could even result in the stock rising by more than 23%, to over $275. The big bet comes following the company's better than expected quarterly results.

Microsoft is well positioned to continue to see strong growth out of its intelligent cloud business unit, its big growth engine, with revenue growing by almost 20% to $12.9 billion in the fiscal first quarter. Analysts currently estimate revenue for that same business unit will grow by almost 16% in the fiscal second quarter to $13.7 billion.

Long-Term Growth

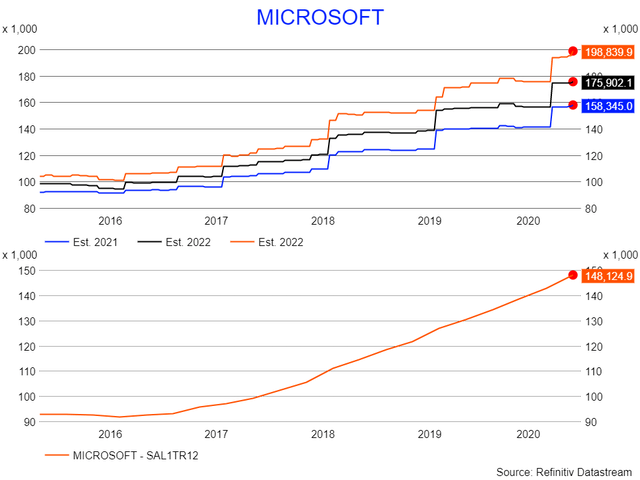

More importantly, the cloud's growth helps to drive revenue for the company, which is forecast to rise by 10.7% in 2021 to $158.3 billion, 11% in 2022, and 13% in 2023 to $198.8 billion. Those revenue estimates have been steadily rising and took a big jump higher after reporting results.

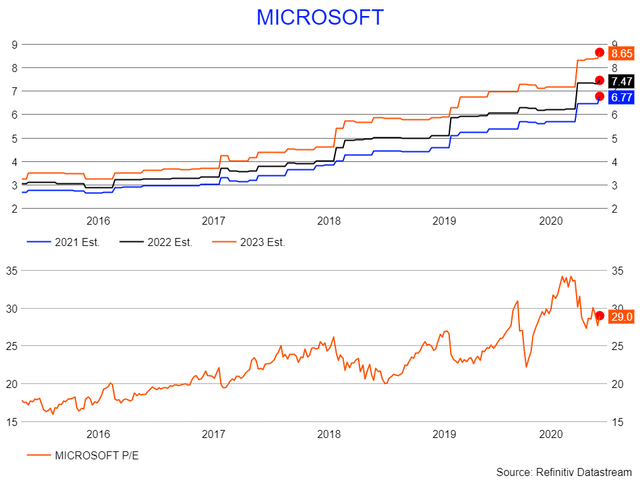

Meanwhile, earnings growth is expected to be very strong over the next few years too. Growing to $8.65 in 2023 from $5.76 in 2020, a compounded annual growth rate of 14.5%.

The growth in revenue and earnings has led someone to make a long-term bet that Microsoft growth continues, and potentially even better than estimated. That's because the PE multiple on Microsoft isn't cheap at 29, near its highest level in years. Still, if the company can continue to deliver better than expected results, analysts will boost their future estimates, bringing that earnings multiple down over time, as long as the earnings growth rate doesn't slow too much.

The Options Play

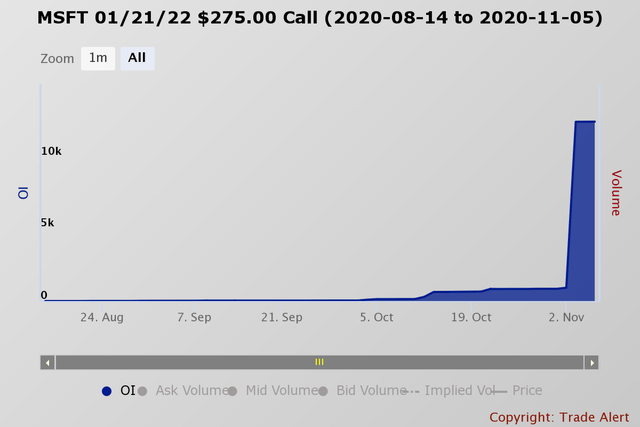

That's likely why someone bought Microsoft January 2022 $275 calls and paid nearly $8 per contract. These are deep out of the money calls, and still, the trader bought around 11,500 contracts. That means they paid around $9 million for the calls. It also means that the stock needs to rise to around $283 per contract, which is nearly 27% higher than the stock price on Nov. 5, around $222, to earn a profit by the expiration date.

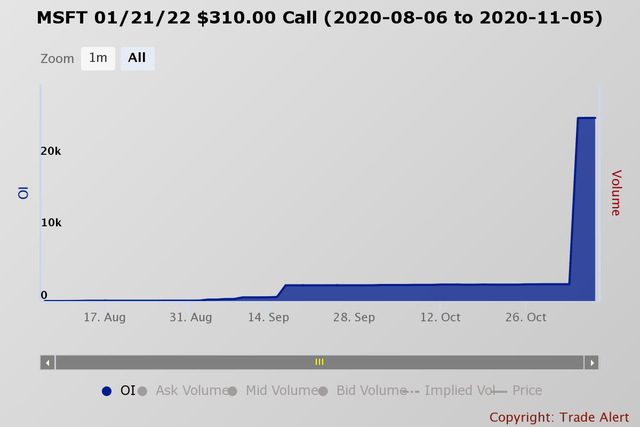

This is based on changes in the open interest level, which increased by around 23,000 contracts. It appears the same trade may have also sold January 2022 $310 calls and collected a premium of $4.14. If that is the case, the trader likely took around $9 million in premiums, offsetting the initial cost. However, it gives the trader basically a way to play the potential upside in Micorosft's stock over the next two years without having to lay out capital.

Risks

Risks

Should Microsoft climb as the trader is betting, to around $275 by the expiration date in January 2022, it would be trading for around 23 times 2024 earnings estimates of $9.61 per share, which isn't overly expensive. However, it also would need to see earnings growth outpace stock price gains over that time. It also would mean that the company would need to continue on the path that analysts have laid with out interruption. While there may be no major setbacks over time, there's a risk of the economy slowing down or a new competitive threat that could stand in the way, which causes the outlook to darken.

Truly, Microsoft's outlook appears as strong as ever, and it isn't surprising to see traders or investors participating in the potential upside the stock presents.

Love this article? Then hit the follow button at the top of the story!

Let The Market Be Your Guide

Let The Market Be Your Guide

Finding the next big move in the market is never easy, so let us help you determine what that move will be. Every day, Reading The Market uses changes in fundamentals, technicals, and options markets to determine the next significant move in stocks, sectors, and indexes.

To Find Out More Visit Our Home Page

Disclosure: I am/we are long MSFT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Mott Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Past performance is not indicative of future results.