Weingarten Realty: Cheaper Than Dispositions, Recovery In Full Force

WRI collected 90% of third-quarter rent.

The stock trades at a lower valuation than the prices WRI is getting on dispositions.

WRI maintains a conservatively managed balance sheet with low leverage and ample liquidity.

I rate shares a buy with 50% total return upside.

Weingarten Realty (WRI) continues to report improving fundamental results amidst little fanfare. Rent collection has surged to 90% and leasing spreads remain healthy. Curiously, WRI trades for an implied cap rate higher than the cap rate on dispositions, which serves to show the valuation disconnect between the public and private markets. WRI maintains a strong balance sheet, which suggests that the stock remains deeply undervalued. I rate shares a buy with over 50% total return upside.

That’s What I Call A Recovery

WRI’s third-quarter results showed a common theme across the shopping center REIT sector: fundamentals are improving.

Rent collection improved to 90%, up from 82% in the second quarter.

WRI generated a blended 5.5% leasing spread on new and renewal leases, showing that shopping centers are still retaining significant pricing power, in spite of the pandemic.

Core FFO came in at $0.44 per share, down from $0.53 a year prior but up from $0.34 in the prior quarter. Half of the decline was attributed to COVID-related abatements and uncollectible rent reserves, while the other half was attributed to elevated disposition activity.

Speaking of dispositions, WRI saw dispositions of $152.4 million at a 7% cap rate:

This is a significant observation that highlights the undervaluation of WRI’s stock. WRI has $1.77 billion of net debt and trades with a $2.18 billion market cap. Based on $292 million in annualized net operating income, WRI trades at an implied cap rate of 7.4%. In other words, WRI’s stock is trading at a lower valuation than the princes that WRI is able to get rid of its undesirable properties.

Balance Sheet Analysis

Given where WRI’s stock price trades at, you’d think that the company would have a terrible balance sheet. That isn’t the case.

WRI has earned a balance sheet rated BBB or equivalent from the credit rating issuers. WRI maintains a low leverage ratio at 5.9 times debt to EBITDA even annualizing the latest quarter’s results. The low ratio was due to WRI having entered the year with debt to EBITDA around 5 times.

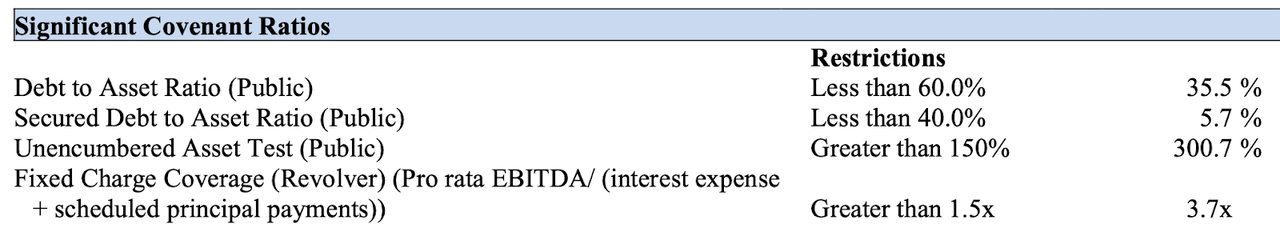

WRI has $498 million in liquidity available under its revolving credit facilities with no near term debt maturities. We can see below that WRI is in no danger of violating any covenants:

WRI’s balance sheet is very strong, suggesting that the low stock price might be due more to less investor interest than balance sheet red flags.

Valuation and Price Target

WRI pays a $0.18 quarterly dividend, good for a 4.3% dividend yield. WRI has noted that “will likely pay a special dividend near year-end to cover additional 2020 taxable income resulting from its 2020 disposition program. (Earnings Release)” I anticipate that core FFO should rebound strongly over the next 12 months, but even annualizing the latest quarter’s results, WRI trades at only 9.5 times core FFO. My 12-month fair value estimate is $26, representing 15 times core FFO. I expect the stock to trade towards that target once WRI reinstates a more realistic common dividend. Shares have over 50% total return upside to that target.

Risks

There may be more bankruptcies on the horizon. While rent collection and operational levels have improved dramatically, there is no guarantee that there aren’t more bankruptcies to come. While WRI’s balance sheet is well-positioned to weather any storms, the stock price is unlikely to experience multiple expansion until results stabilize.

There is no guarantee that WRI can collect deferred rent. Investors should not consider deferred rent as paid until the cash is in the bank. Rent deferrals represented only 4% of the rent in the third quarter but totaled 14% in the second quarter. With rent collection improving to 90% in the latest quarter, this problem may become less of an issue, but WRI may need to report further write-offs in future quarters if past deferred rent proves uncollectible.

It is unclear if the country is close to a stable recovery from the pandemic. If the localities in which WRI operates decide that further lockdowns are needed, then WRI may once again experience difficulties collecting rent, reversing the progress made over the past several months. WRI should be considered an investment hinging on recovery from the pandemic.

Conclusion

WRI still trades at around half of pre-pandemic levels in spite of its fundamentals experiencing a substantial recovery. The company maintains a conservatively managed balance sheet which might even give it the flexibility to become more aggressive on the acquisition front. Shares trade very cheaply even based on current numbers, which does not seem justified on account of the resilient fundamentals and strong balance sheet. I rate shares a buy with over 50% total return upside.

Discover More High Conviction Ideas

Shopping Center REITs are one of my 8 high conviction ideas. Subscribers to Best of Breed to get access to my top 10 holdings and full access to the Best of Breed portfolio. Exclusive Best of Breed content includes industry deep-dives, new compelling ideas, and high conviction picks.

Ignore the noise. Avoid bubbles. Stick to high quality and buy Best of Breed.

Become a Best of Breed Investor Today!

Disclosure: I am/we are long WRI. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.