Buy One Fulgent, Get COVID-19 Testing Business Free

Fulgent has a successful genetic testing business growing at 50% that should benefit from the reduced cost of sequencing.

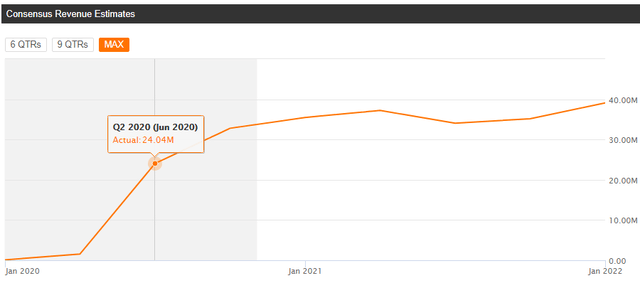

However, more recently, Fulgent's COVID-19 business has seen greater success and is expected to quadruple total revenue this year.

Comparing Fulgent with comparable companies show that the market is attributing little to no value to this very valuable COVID-19 business.

Our estimates show that based on multiples of other COVID-19 testing pure-play businesses like CODX, Fulgent could be undervalued substantially.

Genetic testing has been a major megatrend in this decade ever since the introduction of Illumina's (ILMN) Next Generation Sequencing technology to the world. Costs have been driven down, leading to strong growth in test volumes, and this trend is only likely to continue over the next few decades as costs continue to trend lower.

There are many ways to play this megatrend, but amidst the COVID-19 pandemic, we have found Fulgent (FLGT), a genetic testing company that has released a COVID-19 test to great success. While Fulgent stock is up substantially from March lows, we believe that the current valuation doesn't reflect the success of its COVID-19 test that will likely be used by over 1mil people this year alone. Considering the success of this business, we believe Fulgent could be potentially worth 50% more than its current price.

Core genetic testing

Fulgent is at its core a genetic testing company, offering genetic testing for clinics to test for rare diseases and sequencing as a service, primarily ordered for research purposes by research institutions. The company offers 18k gene tests, thousands more than most competitors, and 900 panels that collectively screen for 5.7k genetic conditions.

Fulgent differentiates itself from the competition through its wide array of tests, proprietary gene probes that are designed in-house, and algorithms that collect information from Fulgent's proprietary database and the broader scientific community, drastically reducing the time needed to analyze data.

The company has seen strong growth over the past few years for this core business, including over 50% growth in 2019. Unlike Invitae (NVTA), which has burned through hundreds of millions of dollars, Fulgent has been relatively conservative and nearly hit break-even last year.

In Q2 2020, the traditional genetic testing business was expected to decline 25-30% due to the impact of COVID-19, but volumes turned out flat as Fulgent signed new customers and saw a rebound in existing customers.

However, given the incremental business we saw on signing additional strategic customers in the quarter and a record rebound from our existing customers during the month of June, volumes ordered from our core business in Q2 was flat with what we saw in Q1 even with the uncertain regarding lockdowns throughout the various industries

This is in line with competitor NVTA, which stated in its Q2 presentation that volumes were already starting to improve and were close to normal levels.

Source: Q2 2020 NVTA presentation

Due to the rebound, Fulgent now expects strong growth in this business to continue in H2 2020. Over the long run, the trends that have fueled increased adoption of genetic testing, namely price declines, should continue as technology continues to advance, meaning strong volume increases are likely to continue for Fulgent. With just 58k tests conducted last year, there is a lot of room to grow revenue even if ASP continues to see massive declines.

The COVID-19 opportunity

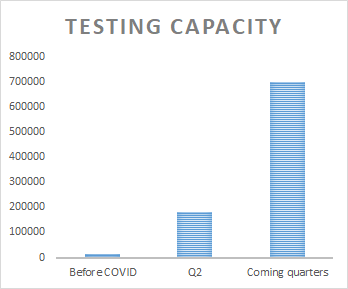

Fulgent has fully capitalized on the COVID-19 pandemic. In March, it launched a COVID-19 test using its next-generation sequencing technology and in June, it launched an at-home COVID-19 test. These tests have been very successful and Fulgent had to ramp up testing capacity substantially to meet demand.

Source: FLGT Q2 call, WY Capital

Even with its genetic testing capacity down around 25-30%, Fulgent has increased test volume 13x YoY in Q2 2020 and is projecting 1.3mil tests over the full year, which is 22x last year's test volume. Although COVID-19 test ASPs are far lower than ASPs for normal tests, Fulgent is expected to quadruple last year's revenue of $32mil to around $135mil.

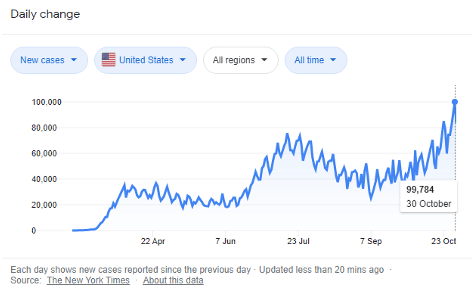

While this COVID-19 testing business helped account for FLGT's rise from less than $10 per share to over $50/share, it is also the main reason why FLGT's shares have declined substantially since August. Due to a decline in new cases since early August, COVID-19 stocks have declined, dragging FLGT along.

This trend in COVID-19 stocks has not reversed even though cases have continued to climb after September, recently hitting highs of nearly 100k. This could point to an interesting buying opportunity, as COVID-19 stocks would obviously benefit from higher case counts. In fact, FLGT seems to have benefited somewhat from the new increase, signing 2 deals in Utah and Ohio recently.

Nobody knows what direction COVID-19 will take over the next few years, but as you will see below, Fulgent's current valuation pretty much doesn't reflect any value for the COVID-19 testing business.

Valuation

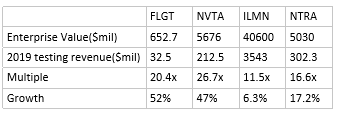

Source: SeekingAlpha, Financial reports

As you can see, Fulgent's genetic testing business trades at a very reasonable valuation of just 20x sales despite its top tier growth of 52% and despite the fact that unlike cash-burning NVTA, Fulgent is actually near profitability and demonstrating strong EOS, with a 2019 net loss of around $400k, an improvement of over $5mil.

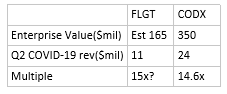

Source: Seeking Alpha, Financial reports

This is attributing no valuation to the COVID-19 business, which generated $11mil in revenue in Q2 2020 and is expected to generate around $100mil in revenue over the whole of 2020. Co-Diagnostics (NASDAQ:CODX), the main comparable we use, trades at a $350mil valuation, or around 15x revenues. At that multiple, Fulgent's COVID-19 testing business alone should be worth around $165mil.

Source: SeekingAlpha earnings estimates

Even this estimate is likely to be conservative, as Fulgent's COVID-19 testing business is expected to ramp substantially over Q3 and Q4, far outpacing CODX's growth of around 30% QoQ. This would put Fulgent on pace to exceed CODX's Q4 2020 total revenue by up to 30%. Since CODX has an EV of $350mil currently, there really is no reason why Fulgent's testing business should not be worth at least that much.

Regarding risks, I believe the main risk for Fulgent is COVID-19 numbers going down or a vaccine being given in large quantities, which could lead to declining testing volumes. Obviously, this is not the case right now, and considering the behavior of most people, I believe the pandemic could last for a while. Regarding the core genetic testing business, I believe the conservative nature of management reduces risk compared to more aggressive companies like NVTA, though it could potentially lead to lower market share in the long run. Either way, I don't believe there is much risk in buying Fulgent stock.

Conclusion

Overall, Fulgent's current valuation is incredibly conservative and does not reflect the success of the COVID-19 testing business, which is currently just beginning to ramp up. With an improving genetic testing business and a fast-ramping COVID-19 business driving growth in H2 2020, we see big potential ahead in FLGT stock.

Disclosure: I am/we are long FLGT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.