REITs aren’t just still worth buying. They’re crucial to buy since they actively and intensely invest in real estate: The glue that holds the world together.

Technology can’t replace the kind of human interaction that happens beneath physical roofs.

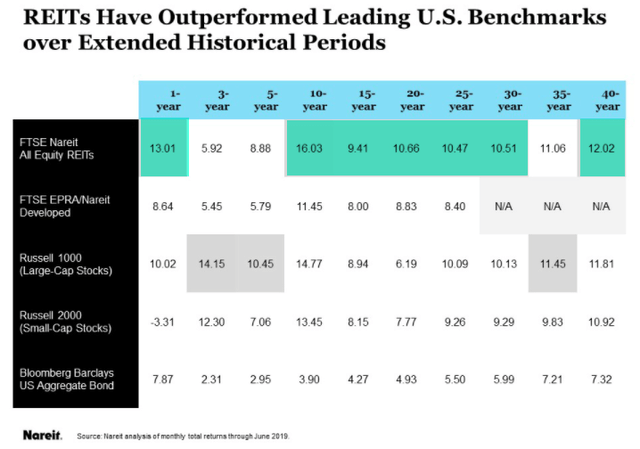

REIT total return performance over the past 20 years has outstripped the performance of the S&P 500 Index and other major indices–as well as the rate of inflation.

Who did you vote for in the U.S. presidential elections?

You’re more than welcome to say in the comments, though I’d probably caution against it. Unless you’ve got tons of time to get into pointless debates about an already decided outcome.

Or is it?

I honestly don’t know, since I’m writing this on Election Day afternoon.

For all I know, nothing’s been decided yet. It’s a very real possibility that we might not know for a few days. That’s thanks to the Supreme Court’s recent ruling that Pennsylvania mail-in ballots can be counted if received within 72 hours of Election Day – provided they’re postmarked appropriately.

And everyone agrees on two things about the state:

- It’s in play.

- It could decide the election.

Pennsylvania, which normally goes blue presidentially speaking – no matter that it’s called a swing state – flipped red for Trump in 2016. And it could go that way now, especially considering Biden’s admission during the final debate.

“I would transition from the oil industry, yes,” he said, leaving many Pennsylvanians panicking. As The Washington Examiner writes:

“According to the American Petroleum Institute, more than 300,000 of some 6 million Pennsylvanians in the workforce are employed by jobs supported by oil or natural gas. That’s 5%, or (one) in every 20 workers there, who rely on those related industries.”

Then again, what am I blathering on about? Whether Trump won or Biden won/wins, my conclusion about real estate investment trusts (REITs) remains the same.

They’re still worth buying.

REITs Trump Technology

Actually, let me take that statement back for a moment, though only to amend it.

Because REITs aren’t just still worth buying. They’re crucial to buy since they actively and intensely invest in real estate: The glue that holds the world together.

Technology fans will no doubt take issue with that statement. After all, we don’t communicate through real estate, personally or professionally. We don’t move goods with real estate. We’re even congregating less and less within real estate.

Or are we?

As human beings, we’re social creatures. We crave some kind of interaction – even those who consider themselves introverts. And while, yes, some of that can be achieved online worse come to worst, it’s not the same as:

- The challenge of dribbling a ball while simultaneously trying to outsmart the guy in front of you at the gym

- The engagement of sitting down at a restaurant with good friends to laugh about old times, commiserate about new times, and speculate about what’s still to come

- The inspiration of attending a church service, conference, or convention with others who share your same mindset, interest, or passions

- The ease of being able to ask a fellow employee or boss for help in the office instead of having to be talked through the process over the phone

Admittedly, some of us would be quite content not to see our fellow employees or bosses in person ever again. Besides, nobody can see us sitting in our PJ bottoms when our screens are properly tilted upward.

I mean, they’re so comfortable! So convenient! What kind of idiot would willingly volunteer to put on work pants again, Monday through Friday?

Believe it or not, that would be 63% of the 2,000 Americans, a OnePoll study surveyed last month.

Even Microsoft Wants to Back in the Office

Here’s The Sacramento Bee’s writeup on that finding:

“A survey of 2,000 Americans revealed that the benefits of staying in your pajamas and working from home all day aren’t all rainbows and butterflies…

“The top reasons why people have considered quitting are unreasonable workloads in short periods of time (17%), lack of connection to their team (14%), and their company’s poor handling of their transition from in-person to remote locations (14%).”

They also say their workdays are longer thanks to being able to start earlier and end later – which naturally adds more stress. Worse yet, those extra hours wouldn’t be nearly so necessary if not for:

“… communication over too many platforms (41%), a ‘significant uptick’ in online messages with coworkers (34%), insufficient IT support (34%), and general confusion due to spotty communication between different teams across a company (32%).

“‘More apps create more noise – and noise is stressful in an already challenging year,’ Nate Abbott, head of product at Front, said in a news release sent to McClatchy News.”

Meanwhile, Google (NASDAQ:GOOG) (NASDAQ:GOOGL) has decided that its engineers’ productivity drops when working from home too long. And even Microsoft (NASDAQ:MSFT) CEO Satya Nadella – despite extending his company’s work-from-home policies around the world – said he was exhausted by the status quo in an interview last month.

India Tech Today summed up his statements on the matter like this: “… the nature of working from home makes him sleepy and tired all the time. He particularly blames video calls that he finds require more effort to concentrate and make people tired.”

So what’s my point with all of this? My point is that technology can’t replace the kind of human interaction that happens beneath physical roofs.

Not really.

Not for long.

Real Estate Is a Huge Asset Class

None of this is to say I think that certain subsectors aren’t more at risk than others. I’ve been saying as much about the mall space for a few years now – far before the shutdowns began.

But the majority of REITs aren’t dying. Most of them are going to stay relevant since, over time, demand for commercial real estate only rises.

In which case, I’m willing to bet that most investors don’t allocate nearly enough to it. So let’s take a closer look at some of our top picks right now…

Medical Properties Trust (MPW) is a “pure play” hospital landlord which simply means that the company’s exclusive focus is to own acute care, inpatient rehab, and behavioral health facilities.

National healthcare expenditures represent around 17.8% of GDP and hospital expenditures represent $1.2 trillion (5.8%) of GDP. There are more than 5,100 community hospitals in the U.S. ($500 to $750 billion in value) and MPW is primed to take advantage of the sale/leaseback opportunities within the sector.

MPW is the second largest owner of hospitals in the U.S. with a portfolio value of $17.3 billion (based on assets). The company has 224 properties located in the U.S., with 153 locations in Europe and 11 in Australia. MPW has 45 operators and over 42,000 hospital beds.

On a recent podcast, MPW’s Senior Director Drew Babin told us that MPW plans to expand into Colombia:

“… we will be making our first property investments there in the fourth quarter. We're not talking about cities or individual hospitals yet, some of those details are to come. But the Colombian government is highly supportive of healthcare.

And frankly, as far as the healthcare economy and friendliness to US investment, it actually steps beyond many other places in South America. And the government does provide healthcare for all its citizens. It's an underserved population, especially in some of the more dense areas.”

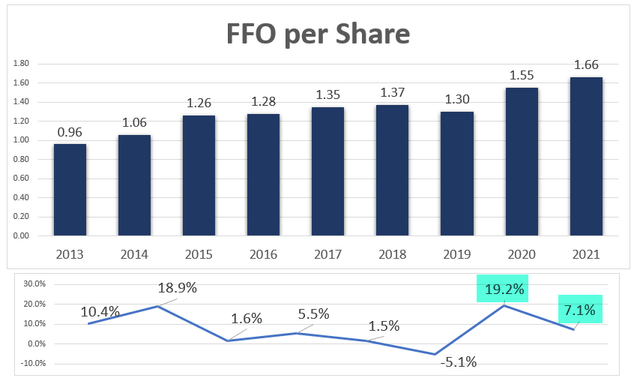

One of the things that attracts us to MPW is the company’s’ growth profile. During one of the worst pandemics the world has seen, the company has delivered a year-over-year increase in FFO of 24%, that ranks number one among U.S. REITs exceeding $3 billion in equity market cap. As viewed below, the growth profile has been steady and predictable:

Source: Wide Moat Research

As viewed above, based on analyst estimates, MPW is likely to grow by 20% in 2020 and another 7% in 2021 (consensus). There aren’t many healthcare REITs spitting out these types of numbers these days.

Also, MPW has grown its dividend by an average of 3.3% since 2013, and it appears there’s more capacity in future years based upon the 70% payout ratio.

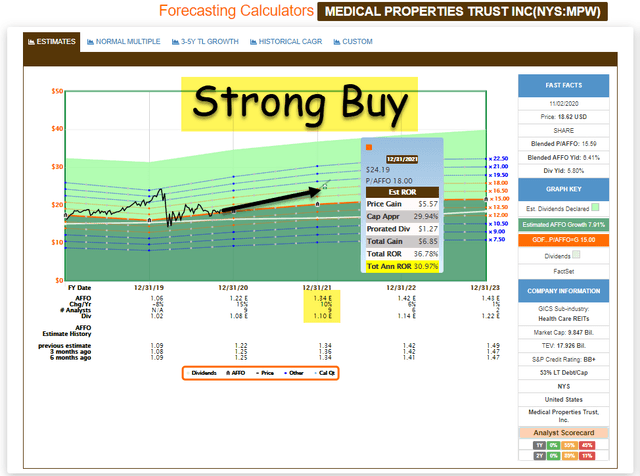

In terms of valuation, we are maintaining a Strong Buy, based upon our $21.00 FV target and dividend yield of 5.8%. Shares are trading at 12.3x P/FFO, below the three-year average of 13.0x. As viewed below, believe that shares could return 20% to 25% over the next 12 months.

Source: FAST Graphs

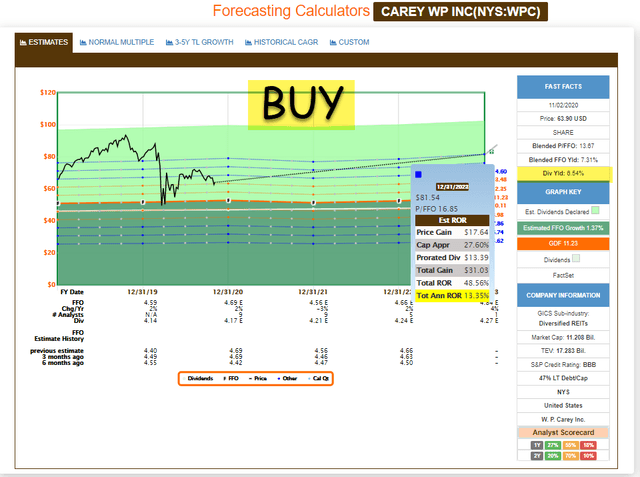

W.P. Carey (WPC) is another quality REIT that derives shelf space within an intelligent REIT portfolio. We recently wrote an article explaining that “W.P. Carey remains one of our favorite REITs. Its uniquely diversified holdings offer exposure to different industries and geographic locations that other examples just don’t.

About 63% of its portfolio is located in the U.S. and 35% or so in Europe. The company also has small exposures to Canada, Mexico, and Japan.”

We can now see that REITs with diversified platforms perform best during a pandemic, and we like the composition of WPC’s buildings that range from industrial properties, to retail properties, to warehouses, to self-storage, to offices. We explained,

“WPC has largely benefited from its broad industry diversification throughout this volatile year. It has made a habit of posting rent collection data in the high 90% range, including in the overall third quarter.”

Another very consistent part of the WPC business model is the balance sheet, that has remained strong during the pandemic. The company ended Q3-20 with debt to gross assets at 40.6% and Net debt-to-EBITDA of 6.1x. The company has around $1.9 billion of total liquidity, including $1.6 billion of availability on the credit facility.

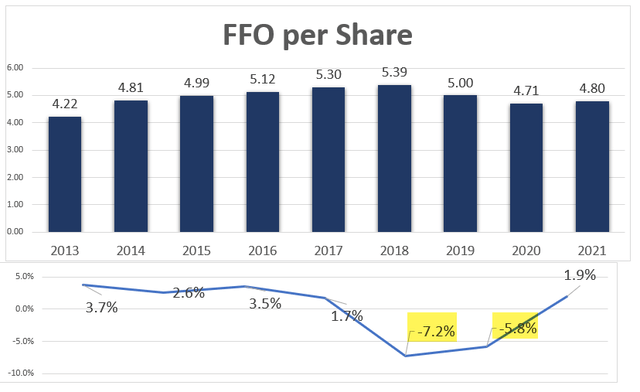

Also, in Q3-20 the company reinstated 2020 AFFO guidance with a range of $4.65 to $4.75 per share, including real estate AFFO of between $4.51 and $4.61 per share. In addition, the company said that it's guiding $750 million to $1 billion of new investments for 2020 (closed $567 million YTD).

Source: Wide Moat Research

As illustrated above, WPC’s AFFO declined in 2019 as a result of the removal of the non-traded REIT income, and it appears that the company is on a path to begin to increase its AFFO per share in 2021.

Meanwhile, WPC has a very successful dividend growth history in which the company has increased its dividend every year since going public in 1998. The company also has maintained a conservative and stable payout ratio since conversion to a REIT in September 2012 (payout ratio is now 85%).

In terms of valuation, we are maintaining a Buy, based upon our $73.00 FV target and dividend yield of 6.5%. Shares are trading at 13.4x P/AFFO, below the three-year average of 13.8x. As viewed below, believe that shares could return 12% to 15% over the next 12 months.

Source: FAST Graphs

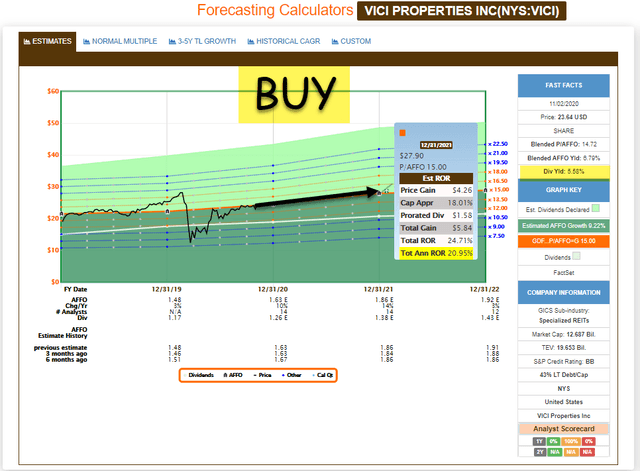

Our last pick is VICI Properties (OTC:VICI), a gaming REIT that could be one of the highest growth REITs in 2021. The company is in the gaming sector and owns a geographically diverse portfolio of 29 market leading properties leased to leading brands: Caesars (83%), Penn National (6%), JACK (5%), Hard Rick (3%), and Century Casinos (2%).

All of VICI’s properties are subject to Triple Net leases and the portfolio is 100% occupied (weighted average lease term is 32.9 years). The company has around 31% of portfolio rent being generated from Las Vegas assets and the remaining 69% is from other regions of the country.

VICI has done a great job of managing its balance sheet since going public in 2017, resulting in 7.9% unlevered yield on incremental Investments to date. In Q3-20 the company closed on the acquisition of three new properties: Harrah's Atlantic City, Harrah's New Orleans, and Harrah's Laughlin.

These strategic investments in Q3 led to the following financial accomplishments: (1) Grew adjusted EBITDA year-over-year by 41.9%, (2) grew AFFO year-over-year by 38.4%, and (3) increased the dividend by 10.9%.

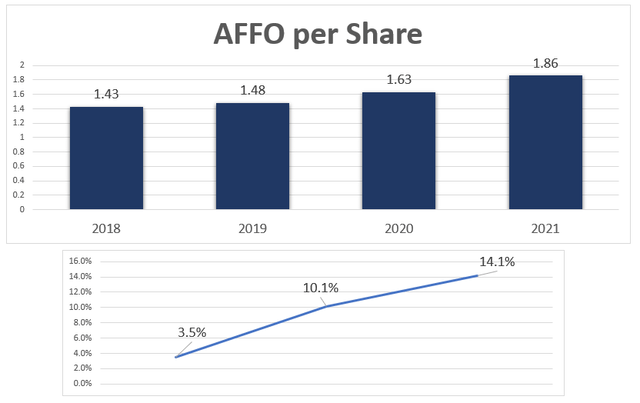

As illustrated below, VICI is forecasted to grow AFFO per share by 10%-plus in 2020 and 14% in 2021. Over this three-year period (on an annualized run rate basis) VICI has grown rent by 100% or $633 million, while significantly lowering leverage from 8.5x to the low end of the target range of between 5.0 and 5.5x.

Source: Wide Moat Research

In terms of valuation, we are maintaining a Buy, based upon our $26.00 FV target and dividend yield of 5.6%. Shares are trading at 15.0x P/AFFO, below the two-year average of 17.0x.

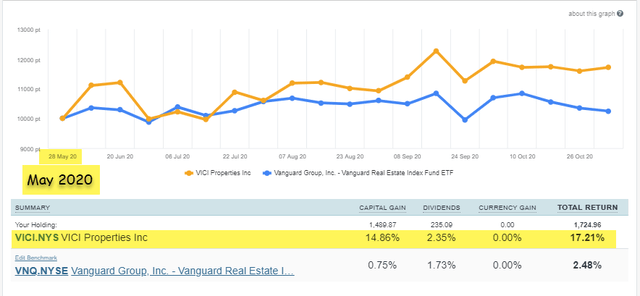

As viewed below, believe that shares could return 20% to 25% over the next 12 months.

(Note: We previously had a Strong Buy rating on VICI, as shares have returned over 40% since April 2020.)

Source: FAST Graphs

Note: We previously had a Strong Buy rating on VICI, as shares have returned over 40% since April 2020. We bought around 500 shares for the Cash is King Portfolio with an average basis of $21.00 per share.

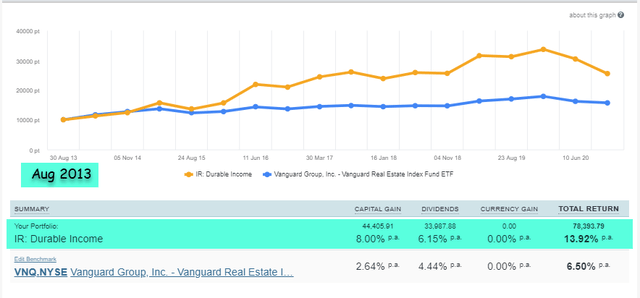

Source: Sharesight

In Closing...

As viewed below, REIT total return performance over the past 20 years has outstripped the performance of the S&P 500 Index and other major indices–as well as the rate of inflation.

Nareit

It's because of REITs' track record of reliable and growing dividends, combined with long-term capital appreciation through stock price increases that investors have benefitted from attractive total return performance for most periods (over the past 45 years compared above).

REITs also are professionally managed and well positioned to attract tenants, so they can earn rental income throughout long-term real estate cycles, even during pandemics.

Personally, I have been a real estate investor since 1990, and during this time I have witnessed the transition of George H.W. Bush, Bill Clinton, George W. Bush, Barack Obama, and Donald Trump. I hope we know who will be the next President of the United States on Wednesday morning, regardless of the outcome.

Yet, as a real estate investor, my job is to manage risk with the REIT sector, and as Howard Marks said, "managing risk is what separates the best from the rest."

The Durable Income Portfolio

Sharesight

Author's note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Join the iREIT Revolution! (2-Week FREE Trial)

At iREIT, we're committed to assisting investors navigate the REIT sector. As part of this commitment, we recently launched our newest quality scoring tool called iREIT IQ. This automated model can be used for comparing the "moats" for over 150 equity REITs and screening based upon all traditional valuation metrics.

Join iREIT NOW and get 10% off and get Brad's book for FREE!

* Listen to our Ground Up Podcast * 2-week free trial * free REIT book *

Disclosure: I am/we are long VICI, WPC, MPW. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.