SDIV: Dividend Cuts Decrease Bankruptcy Risk, But Another Round May Be Coming

Ultra-high dividend companies have had awful performance this year, as many have poor cash balances and have suffered extreme COVID-19-related losses.

As expected, the Global X Super Dividend ETF has failed to take part in the general recovery in equity markets.

Dividend cuts in SDIV's holdings have improved much-needed dividend coverage, but forward earnings uncertainty is extremely high.

SDIV's exposure to South Africa (and EMs in general) has increased, which is both a risk and potential reward factor.

Overall, SDIV is more attractive today than it was months ago, but it still seems best to avoid high-risk bets until the bottom is clearly in.

High dividend investing is not always a strong strategy, particularly when looking at stocks with dividend yields in the 10-20% range as many of these companies are highly unprofitable and struggling to survive. This is a chronic issue in the Global X SuperDividend ETF (SDIV), which I explained in the article "SDIV: Borrowing Money To Pay Dividends Is A Recipe For Disaster" last November. The ETF is down 37% since then and is only up 2% since I wrote "SDIV: The Crash Has Come, Don't Expect A Rebound" in May this year.

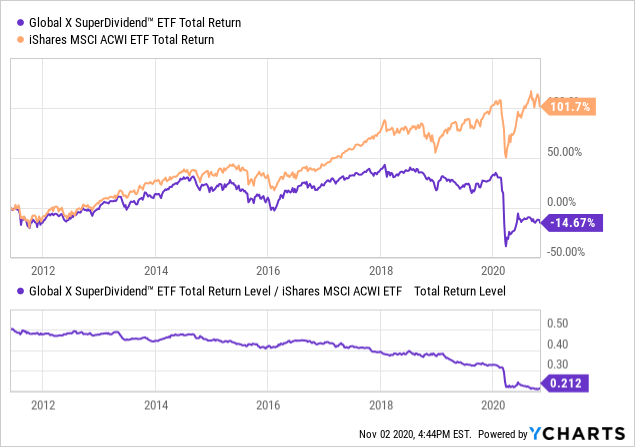

Indeed, SDIV is a very interesting ETF. It attracts significant investor attention with AUM of $630 million. However, it has delivered negative total returns since 2012 and has underperformed the all-world Index ETF (ACWI) on a relatively consistent basis. See below:

Data by YCharts

Data by YCharts

Importantly, I'm using total returns, which account for dividend returns. As you can see in the lower chart, SDIV's underperformance trend is chronic, and it has never exhibited a period of outperformance that has lasted over around three months. In fact, its underperformance has become even more extreme over the past two years, 2020 in particular.

How Has SDIV Changed Since May?

So, what is the core issue with SDIV? The ETF pays a very strong dividend yield of 9%, so it would seem that its yield should make up for equity dilutions. However, the fund appears to generate negative alpha from its selection bias. The fund's strategy is simple - it purchases the top 100 highest dividend-paying equities in the world subject to liquidity requirements.

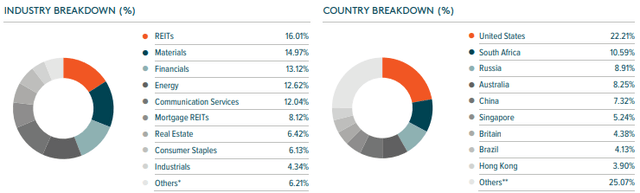

This strategy gives the ETF relatively strange exposure. The vast majority of its holdings are in emerging markets, with South Africa and China being significant areas of concentration. As you can see below, an additional 22% of the ETF is currently invested in the U.S:

(Source: Global X - SDIV)

SDIV's U.S exposure is dominated by REIT and mortgage REITs. These include companies like Annaly (NLY) and Brookfield (BPY), which have taken extreme losses this year due to high forbearance and delinquency rates stemming from COVID-19. Since I covered SDIV in May, the fund has seen increased exposure to traditional REITs and less to mortgage REITs. In general, REITs are the more stable of the two. However, many of its current holdings are in the retail space, which carries high bankruptcy risk today.

SDIV has also seen increased exposure to financials and communications services, and declines in exposure to energy and materials. This is likely due to dividend cuts in energy and higher valuations in materials. Banks have generally maintained dividends but have not seen significant recoveries (particularly smaller overseas banks). SDIV's exposure to emerging markets has also climbed significantly, with its South Africa exposure doubling likely due to higher dividends among the nation's many commodity exporters.

Most of SDIV's holdings are extremely cheap. The fund has a weighted-average P/E ratio of merely 9X today, which is over 50% below the global average. This, however, is much higher than its P/E valuation last year of 6.6X, largely due to EPS declines from this year's recession. On that note, TTM EPS will not bottom until (at least) Q1 2021, which means SDIV's true forward P/E valuation is likely a bit higher than 9X.

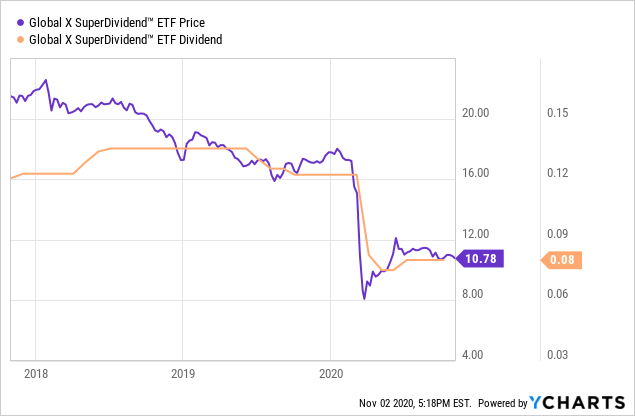

This makes it quite possible that the fund will see another dividend cut. It cut its monthly dividend from $0.12 to $0.07-$0.08 this year, which translates to a forward dividend yield of 8.9%. As you can see below, the ETF's dividend is highly correlated to its price:

Data by YCharts

Data by YCharts

From this standpoint, SDIV is slightly better than it was before, since its holdings do not appear to be paying out dividends they are not earning. In the past, the fund's dividend yield was significantly above its earnings yield, which meant its companies were effectively borrowing money to make dividend payments. This does not appear to be the case today, since its dividend has been reduced significantly.

SDIV Has An Attractive Valuation, But Risks Remain

Overall, SDIV appears to be better-positioned today than it was before. Its exposure to money-losing industries is slightly reduced, and dividend cuts have resulted in greater dividend coverage. Still, most of these companies have seen significant earnings declines over the past year, so continued declines are possible.

Fortunately, it is also possible that many of these companies will recover and likely increase their dividend in 2021. A large portion of SDIV is invested in emerging markets, which overall have seen less-significant COVID-19-related economic losses. According to the IMF's latest update, advanced economies are expected to see 5.8% GDP losses this year, while emerging markets are only expected to see 3.3% declines.

Unfortunately, South Africa is expected to see an 8% loss, which is problematic considering SDIV's higher exposure to that country. Russia and Australia are also not in great positions due to 4.2% expected losses. This is largely due to commodity price and demand declines, as these three countries are highly dependent on exports. Still, we're looking at the worst year on record for global GDP growth, and the outlook for 2021 and 2022 does not forecast a full return.

With the global economy still in a difficult position and COVID-19-related lockdowns returning in many nations, many companies in SDIV may see another round of earnings expectation declines. Early on, most expected this would be over by year-end of 2020, however, that does not seem to be the case. Renewed lockdowns will bring another decline in demand for commodities and higher bank defaults, which could force many companies in SDIV into bankruptcy.

Bottom Line

Overall, SDIV appears to be a bit better than it was before, largely because dividends and equity prices have declined to more reasonable levels. In SDIV's case, lower dividends are good simply because they mean companies are increasing their liquidity during times of high instability, which reduces bankruptcy risk. Poor working capital was a major risk in SDIV's holdings last year. Lower equity prices are beneficial, since they offer greater return potential given an economic recovery.

At this point, I would not bet against SDIV, but I would not buy the ETF until the global economy reaches a clear bottom. We've seen the bounce, and now we're seeing another potential wave lower. Once that downward wave reaches its bottom (perhaps early next year), it will be a better time to look toward deep-value ETFs like SDIV. Until then, I believe it is best to reduce exposure via cash or volatility hedging.

Interested In More Alternative Insights?

If you're looking for (much) more research, I run the Conviction Dossier here on Seeking Alpha. The marketplace service provides an array of in-depth portfolios as well as weekly commodity and economic research reports. Additionally, we provide actionable investment and trade ideas designed to give you an edge on the crowd.

As an added benefit, we're allowing each new member one exclusive pick where they can have us provide in-depth research on any company or ETF they'd like. You can learn about what we can do for you here.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.