Orchard Therapeutics: An Undervalued Stock With Upcoming Catalysts

Orchard just received a positive node from CHMP for its lead drug candidate.

US approval should be next.

The stock's low price makes no sense.

Orchard Therapeutics plc (ORTX) has a gene therapy asset targeting multiple rare disease indications where it has not only shown outstanding results, but has also received a positive opinion from CHMP in an ultra rare indication. Orchard owns the entire gene therapy portfolio of GlaxoSmithKline (GSK), possesses decent cash with a 2-year runway, and the lead indication can generate at least a couple hundred million dollars in annual revenue within 2-3 years of US approval, which may be next year.

Despite all that, the stock has gone down nearly by half since I last covered it in May.

So, unless I am vastly mistaken or missing something somewhere, this stock is highly undervalued. Wall Street analysts estimate price targets of $17, so my optimism is in good company. However, truth be told, I still can't figure out what made the stock go from $10+ to less than $5 in the last 6 months; and that troubles me.

Admittedly, covid-19 and the ensuing delay of some 6 months for the US approval could claim some responsibility. In order to save cash, the company then shut down a facility in Fremont, California, and it reduced some workforce.

The other major story is the development of Leukemia in a patient being treating by strimvelis under a compassionate use program. The company released a statement where it said:

Leukemia arising from the insertion of gammaretroviral vectors into the genome, a process known as insertional oncogenesis (or mutagenesis), is a known risk factor for gammaretroviral vector-based gene therapy and is described in the Strimvelis product information as a potential risk of treatment.

Strimvelis is the only gammaretroviral vector-based gene therapy in Orchard’s portfolio. Each of Orchard’s other pipeline therapies employ a self-inactivating (SIN) lentiviral vector-based approach that has been specifically designed to avoid insertional oncogenesis after administration. No evidence of insertional oncogenesis related to lentiviral vector-based hematopoietic stem cell (NYSE:HSC) gene therapy has been reported in any indication.

Like the company says, this is a known safety issue with strimvelis, and strimvelis is an almost-abandoned program for ORTX. Moreover, the rest of its pipeline should be able to avoid this problem. Thus these are easily explainable things, and do not explain this drop in price especially before multiple catalysts ahead. So I am forced to wonder - is this the real deal? Have we found the ultimate holy grail of biopharma investing - a gem that no one has discovered yet?

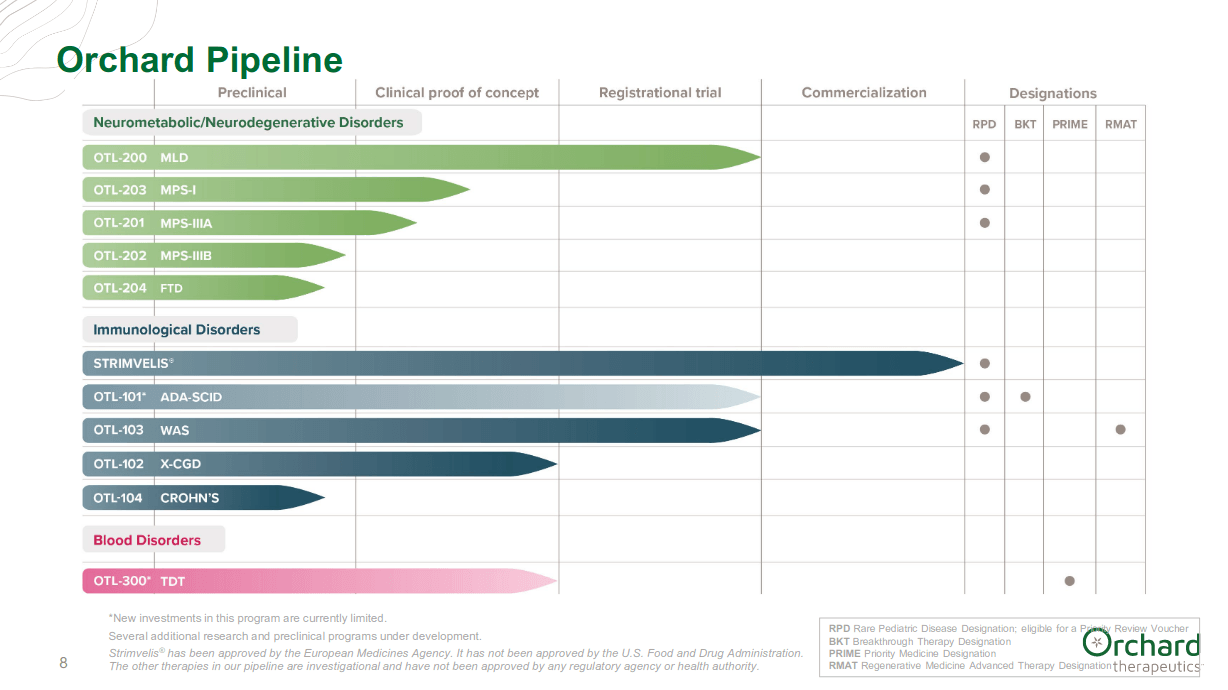

Just yesterday, Orchard reported 3Q-2020 financial results and provided a portfolio update. Orchard has two candidates in late stage development, with registrational trials.

(Image source: company presentation)

Orchard announced on 10/16/2020 receiving a positive opinion from the Committee for Medicinal Products for Human Use (“CHMP”) of the European Medicines Agency (“EMA”) for “recommending full, or standard, marketing authorization for Libmeldy (OTL-200) for the treatment of metachromatic leukodystrophy (“MLD”).

Libmeldy is the first therapy recommended for full marketing authorization in the EU for eligible patients with confirmed diagnosis of late infantile or early juvenile MLD variants. The company anticipates a final decision by the EC before the end of 2020. If approved, Libmeldy would be the first commercial therapy and first gene therapy for eligible patients with early-onset MLD.

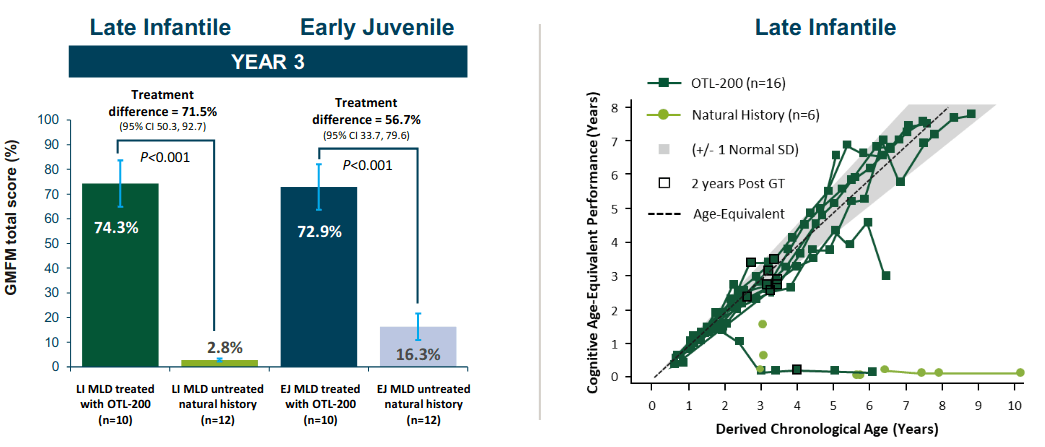

MLD is a fatal genetic CNS disorder which causes relentless loss of physical and cognitive function. Libmeldy is backed by data across 35 patients with follow-up of up to 8 years post-treatment, demonstrating the potential durability of HSC gene therapy. One-time treatment with Libmeldy has been shown to preserve cognitive and motor function in most patients.

(image source: company presentation)

Mechanism of action

Libmeldy is a one-time gene therapy. A patient’s own hematopoietic stem cells (HSCs) are selected, and "functional copies of the ARSA gene are inserted into the genome of the HSCs using a lentiviral vector before these genetically modified cells are infused back into the patient. The ability of the gene-corrected HSCs to migrate across the blood-brain barrier into the brain, engraft, and express the functional enzyme has the potential to persistently correct the underlying genetic condition with a single treatment.”

Cryopreserved autologous CD34+ cells encode the arylsulfatase-A (“ARSA”) gene, causing biallelic mutations in the gene, “leading to a reduction of the ARSA enzymatic activity in children with i) late infantile or early juvenile forms, without clinical manifestations of the disease, or ii) the early juvenile form, with early clinical manifestations of the disease, who still have the ability to walk independently and before the onset of cognitive decline.”

Financials

We (“ACP”) had put the stock on our watchlist in May last. Although the price has gradually slided since then, it is now at an attractive level to take a new, or add to existing, position. Current price is $4.35, near low in a 52 week range of $3.76 to $15.93. Of the 8 Wall Street analysts rating the stock, 5 are very bullish and 3 are bullish; Average rating is very bullish with a score of 4.62/5, and a price target of $14.50. The company has a market capitalization of $388.36 million with 97.58 million shares outstanding, majority of which is held by institutions with 52.56% shares, followed by the public with 15.97%, corporations with 12.76%, PE/VC firms with 10.66% and hedge funds with 7.44%. Insiders hold 0.6% shares.

As of 3Q-2020, the company has a cash balance of $201.3 million against a debt burden of $47.98 million, and a cash burn of $173.7 million in the TTM. Orchard expects that its cash, cash equivalents and investments will provide an operating and capital runway into 2022. The company has also put a commercial team in place for EU launch in 1H-2021. The company projects a revenue of $1.1 million and $8.7 million in 2020 and 2021 respectively.

Bottomline

The market seems to be very cautious about this company. One main reason is the extreme low patient population for the disease, as discussed earlier. The leukaemia death is another reason. However, the stock still looks interesting to me, and I will continue watching it.

About the author

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.