The Bottom Fishing Club: iShares U.S. Oil & Gas ETF

Using a sector ETF may be the smartest, risk-adjusted way to accumulate greater oil/gas exposure at depressed pricing.

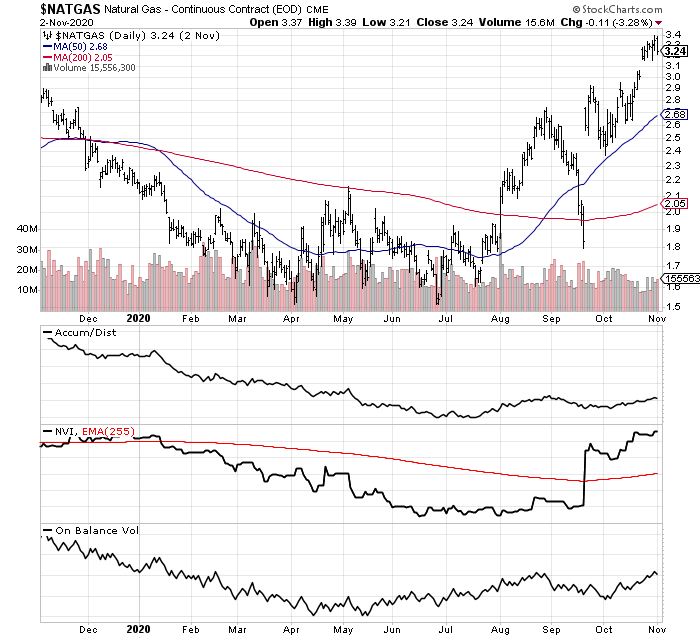

Natural gas prices and supply/demand balance have moved into a bullish phase.

A final wave of coronavirus economic shutdowns this winter may pinpoint the best E&P buying opportunity since the Great Recession lows of 2008-09.

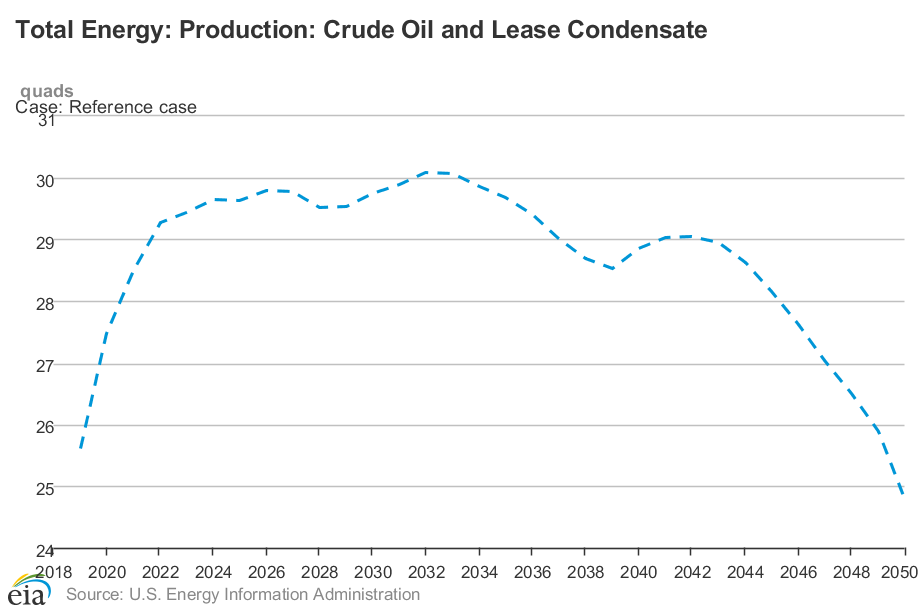

The iShares U.S. Oil & Gas Exploration & Production ETF (IEO) is a diversified trust holding 39 companies, and 44 positions in total at the end of September. You can use IEO in portfolio construction to acquire cheap oil & gas assets focused in America, at lower risk overall, albeit with lower return potential versus a standalone E&P selection. The presidential race this past month has included plenty of discussion and debate about oil drilling and related environmental pollution in the U.S. Both Biden and Trump have touted their desire to keep pumping fossil fuels out of the ground, no matter who is the winner. And as long as we continue to fly planes, run trains and drive automobiles, we are still looking at a decade or two before electric vehicle acceptance overtakes the economic demand picture for gasoline/oil. The U.S. Energy Information Administration forecasted a rising U.S. petroleum and gas production trend into 2033 in its latest annual data publication, before the coronavirus pandemic hit our economy. Essentially, renewables and battery energy are not expected to take the handoff from oil & gas as the primary energy driver for another 13 years.

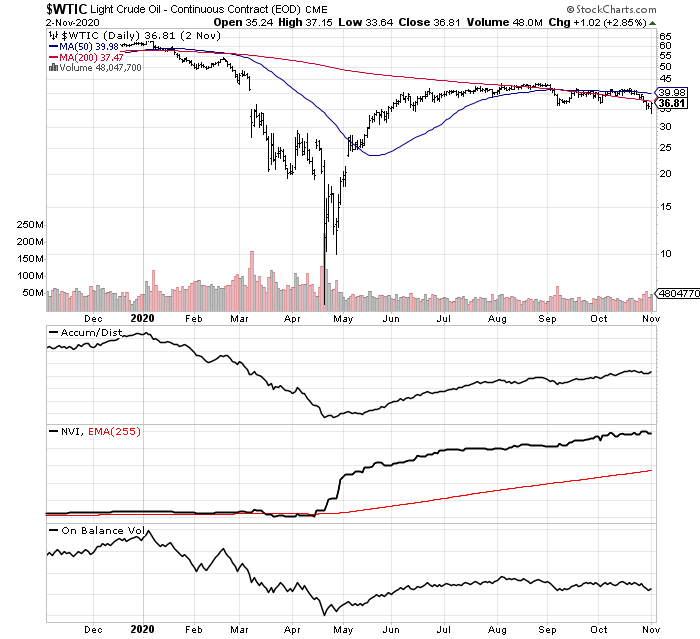

Then, the coronavirus pandemic hit. Crude oil and natural gas demand imploded with stay-at-home orders and reduced travel schedules for work and play. Spot crude plunged close to zero for a price in April, as excess inventory could not find a place for storage. However, prices have recovered some. Today, crude oil is selling just under $40 a barrel, although far below the "all-in" cost of production. Including exploration and finding costs, cash production, plus delivery of the liquids to markets and refiners, a price level closer to $55 a barrel is necessary to keep U.S. supply at a stable rate.

Just this week, it was announced the OPEC+ agreement (including Russia and others) to cut production amid the pandemic may be extended well into 2021. American E&P companies cannot earn a profit or drill for new oil for very long at sub-$40 quotes, and neither can foreign producers. Estimates of $70-80 a barrel to sustain current levels of supply from the Middle East (and create geopolitical stability over time as oil profits support desert economies) are a critical fact to understand why a rebound back toward $100 a barrel may be approaching in 2021-22. Crude oil, in particular, is one of the most cyclical of all commodities because of heavy and constant reinvestment needed to keep replacing quickly depleting in-ground reserves, on top of its sensitivity to swings in global demand.

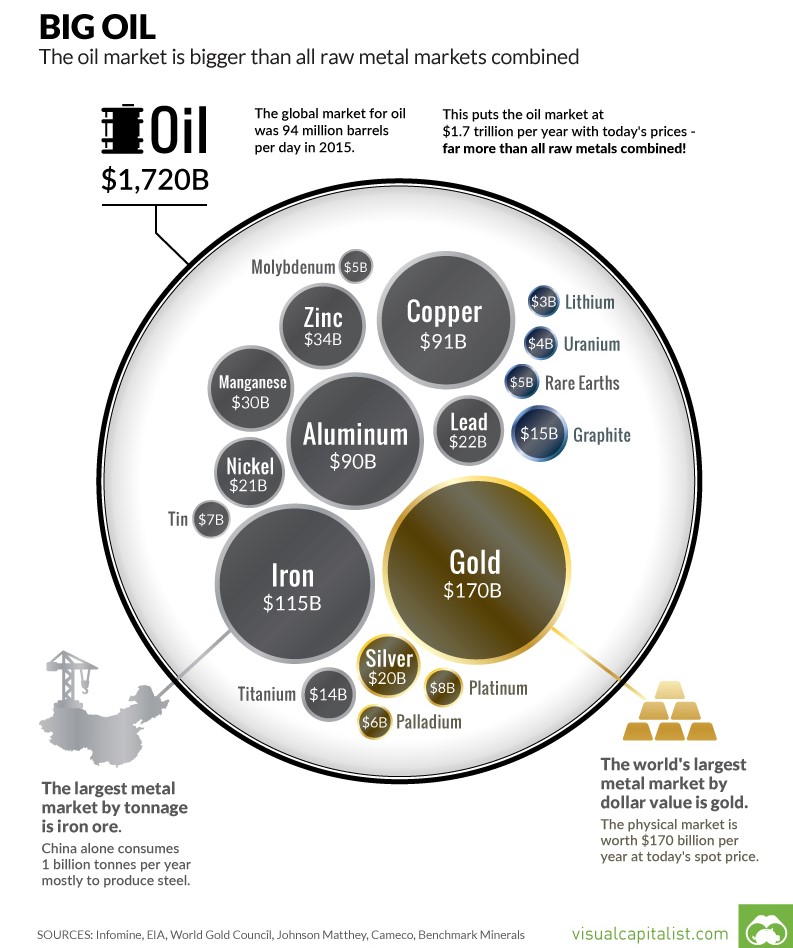

Remember, crude oil is the primary engine powering the worldwide economy. As an example of the difficulty replacing the commodity, its annual production value dwarfs the dollar size of all metals mined in a year (using 2015 prices in the graph below, including $49 crude oil).

The U.S. natural gas price reached $1.50 per MMBtu in the early summer, but has already started a rebound to multi-year highs in October-November. The quick change from a bearish to a bullish phase could soon become the recipe for a 2021 rebalance in crude oil, with sharply higher valuations for oil & gas production outfits.

Basically, lower prices have “cured” the oversupply of natural gas. Total U. S. gas supply was projected by the EIA a few weeks ago to decline nearly 12% between December 2019 and May 2021, largely a result of lost gas by-product from crude oil shut-ins. Monthly average U.S. production is expected to fall from a record 97.0 Bcf/d last December to 85.9 Bcf/d in May 2021, before increasing slightly. Specifically, higher-cost Permian basin oil/gas supply isn’t being drilled, and production for some has become cash flow negative with crude prices under $40 a barrel. The end result has been a material drop-off in immediate natural gas supplies from Texas, Oklahoma and New Mexico wells.

On the demand side, home, business and utility consumption is projected to decline roughly 8% between the end of 2019 and the end of 2021 - a pandemic recession casualty. However, exports of liquefied natural gas (LNG) to Asian and European customers, alongside pipeline product to Mexico, are already expected to reach for all-time records in November-December. Lower production and higher export demand levels have some observers wondering if something of a shortage will develop in 2021 as the U.S. economy recovers from COVID-19.

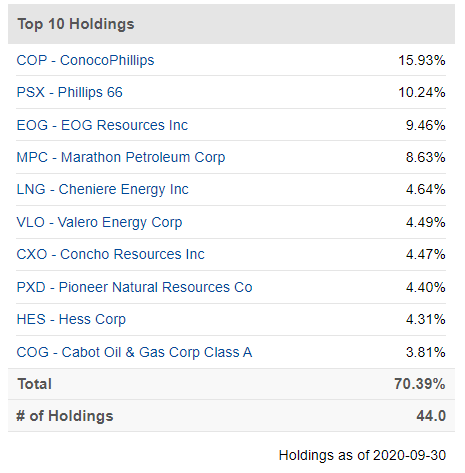

IEO Holdings

I have written about Cabot Oil & Gas (COG), CNX Resources (CNX), EOG Resources (EOG), Parsley Energy (PE), and several oilfield services companies as bullish investment selections since the March-April oil price crash. Most of them are a part of IEO.

In terms of the Top 10 holdings for the trust, Cabot and EOG are included in the mix. In addition, you get exposure to ConocoPhillips (COP), Phillips 66 (PSX), Marathon Petroleum Corp. (MPC), Cheniere Energy (LNG), Valero Energy (VLO), Concho Resources (CXO), Pioneer Natural Resource (PXD), and Hess Corp. (HES).

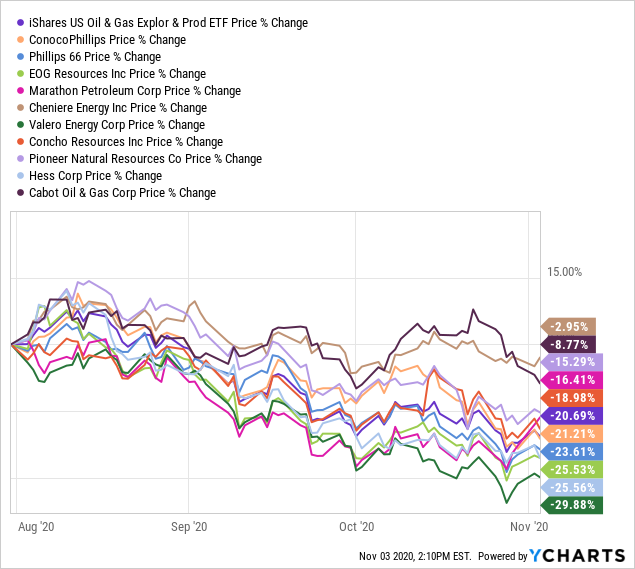

Currently, when you buy this ETF, you are getting unlimited upside to an eventual U.S. oil & gas sector turn higher, while diversifying your ownership away from a single company and related risks. The fund charges 0.42% of net assets yearly to manage the product for investors. You can see on the 3-month chart below the varying price performance of the Top 10 holdings, before consolidation into a single investment vehicle.

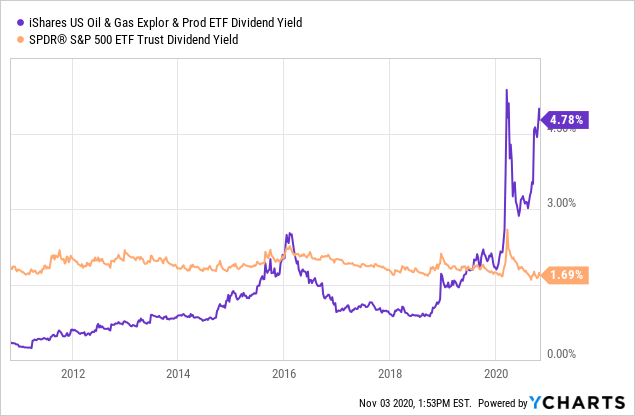

After the anticipated supply/demand rebalance reason for ownership, another bullish argument is found in the dividend yield story for IEO unit holders. New money can purchase the ETF’s strongest relative yield to the S&P 500 over the last decade, as of this writing. The 4.8% trailing cash distribution is almost 3x the equivalent SPDR S&P 500 Trust ETF (SPY) yield of 1.7%. The really great news for income investors is a rebound in crude oil prices next year, to match the natural gas surge taking place in late 2020, could mean vastly higher dividend payouts are coming into 2022. If you believe our economy will recover nicely from COVID-19 effects starting in the spring, like I do, today’s IEO price may morph into an annual dividend yield of 6% or more in 18-24 months. Compared to risk-free Treasury rates under 1% on the short end of the duration curve, IEO may be a bargain income idea today.

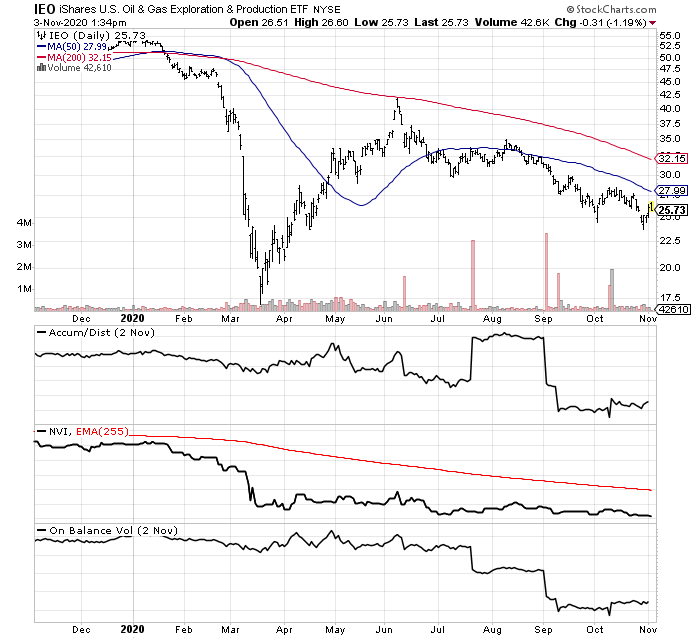

Unfortunately, I have not had a eureka moment that a technical momentum bottom has been reached for the industry. Without doubt, however, the experienced contrarian investor in me (picking important trading bottoms for 34 years) says we are getting close to a unique buying opportunity in oil & gas equities. The chart below highlights we are effectively retesting the April lows for many petroleum-producing stocks. Could the sector fall another 10-15% before reversing higher? Absolutely, but even smarter values and dividend yield would be the result.

Final Thoughts

While I cannot point to a specific momentum indicator signaling a bottom has been made in the oil equity group, I am personally looking to increase exposure to American oil & gas assets on weakness into early 2021. A large second round of coronavirus spread this winter could keep oil & gas prices in check a few more months. Perhaps a steady accumulation plan of buying shares each month the next 3-6 months will be a winning formula for long-term investors. We may have to throw in a fishing line over and over to find the final bottom. But if we are close to an important bullish oil/gas reversal, we can celebrate the profitable catch all of next year.

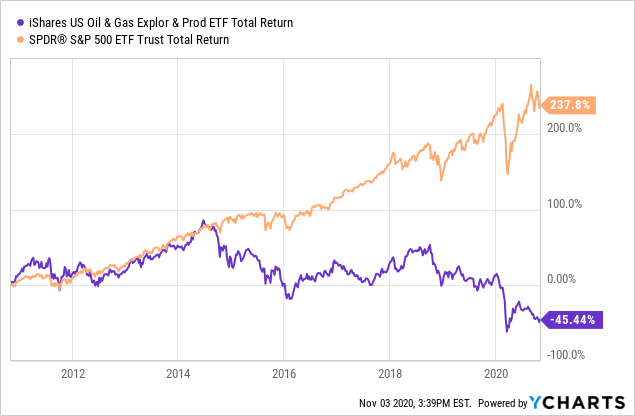

In terms of timing, if we can avoid a final blowout low into January, the worst downside has likely already passed for the oil & gas sector. I am projecting a period of stock market “outperformance,” maybe lasting years, is about to begin. The crude oil downcycle since 2018 (if not 2014) is getting long in the tooth versus historical bust scenarios. Plus, the U.S. natural gas supply/demand condition has just turned higher, favoring bulls into 2021. When both are experiencing an upcycle in business/consumer demand and pricing dynamics, IEO could easily double or more for investors over 2-3 years, like past experiences. Things change - that’s the only constant in life. One day we will notice the oil bust has moved into a new boom phase. Why not participate in the coming advance by acquiring the ultra-depressed pricing available today? After years of underperformance versus the overall U.S. stock market since 2014 (total returns pictured below), the odds increasingly favor a large “relative” rebound during 2021. The level of statistical underperformance in the last six years is very similar to the periods preceding the major 1986 and 1999 oil/gas price bottoms.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

You can become a member of the Bottom Fishing Club and get timely articles on well-positioned, oversold turnaround picks by clicking on the Follow button (Get Email Alerts) at the top of this article.

Disclosure: I am/we are long CNX, COG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am short SPY.

This writing is for informational purposes only. All opinions expressed herein are not investment recommendations, and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication, and are subject to change without notice. Past performance is no guarantee of future returns.