Johnson & Johnson Looks Vulnerable After Falling From Highs

Johnson & Johnson’s earnings results for the third-quarter period indicated strength in pharmaceutical demand medical device sales.

However, the company has faced critical obstacles during this coronavirus trading period and this has adversely impacted a key dividend stock that might otherwise be making YTD highs.

As a result of these events and trends, this great dividend stock (with its 2.95% yield) is heading lower after posting marginal highs near $157 on April 23rd, 2020.

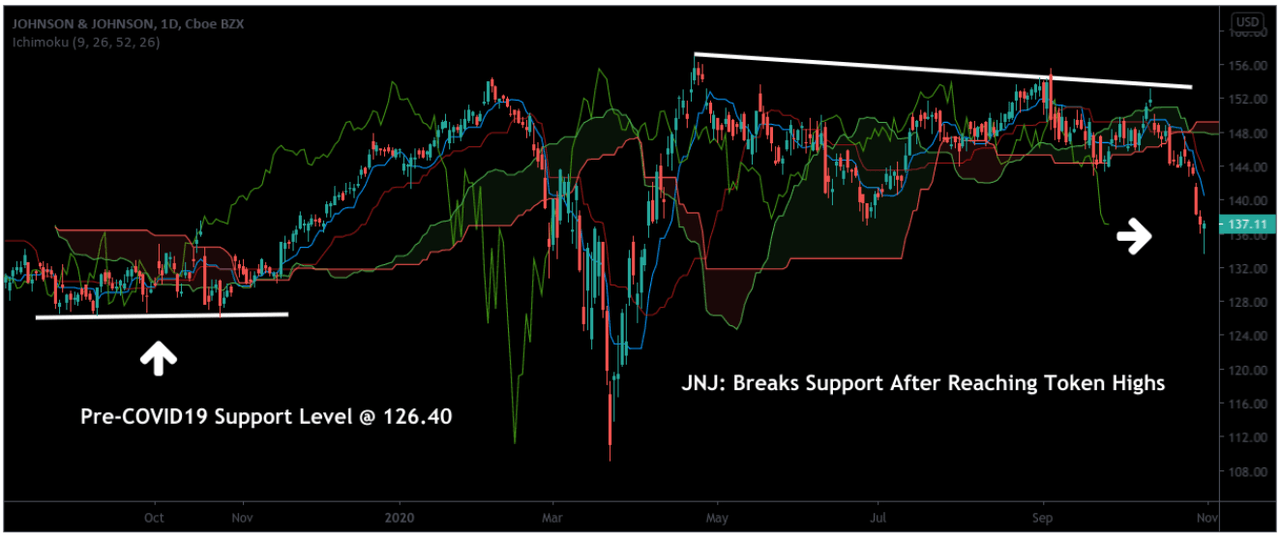

In this low-interest rate environment, Johnson & Johnson is still looking vulnerable but we saw strength in the company’s top-line and bottom-line figures and investors can add to long positions near the $126.40 level.

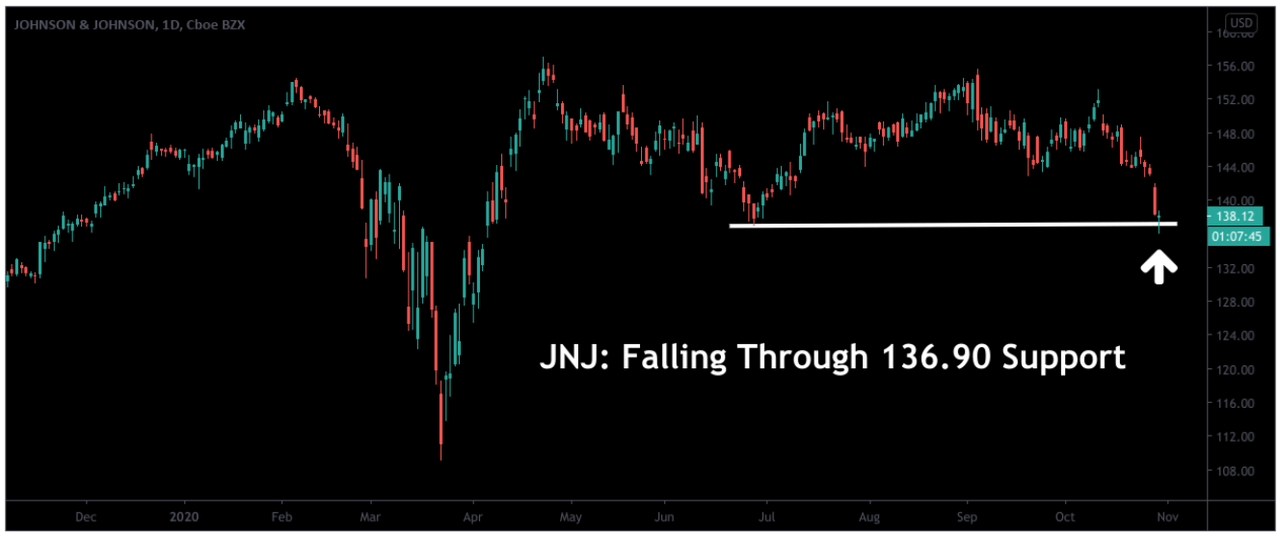

Despite its history as of of the market's most reliable dividend payers, Johnson & Johnson (NYSE: JNJ) is looking vulnerable after reporting quarterly earnings that were actually quite strong on the top-line and bottom line figures. During the most recent reporting period, we saw improved demand for some of Johnson & Johnson’s drug offerings and excellent sales in medical devices. Ultimately, these trends made it much easier for the company to beat analyst estimates for the period but the recent break below $136.90 per share has us concerned and (while we are currently long the stock) we recommend waiting for a better opportunity to buy JNJ closer to the $126.40 level.

Source: Author via Tradingview

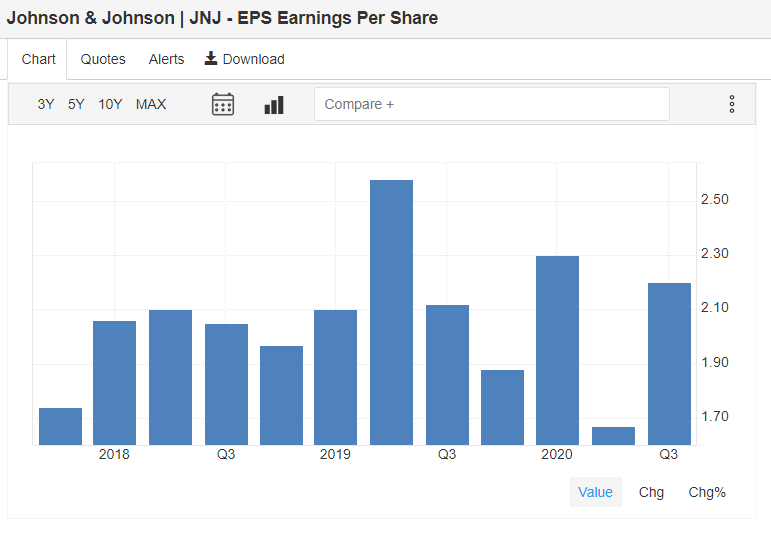

For the third-quarter period, Johnson & Johnson generated an EPS figure of $2.20, which beat Wall Street estimates (EPS of $1.98) by a wide margin:

Source: Trading Economics

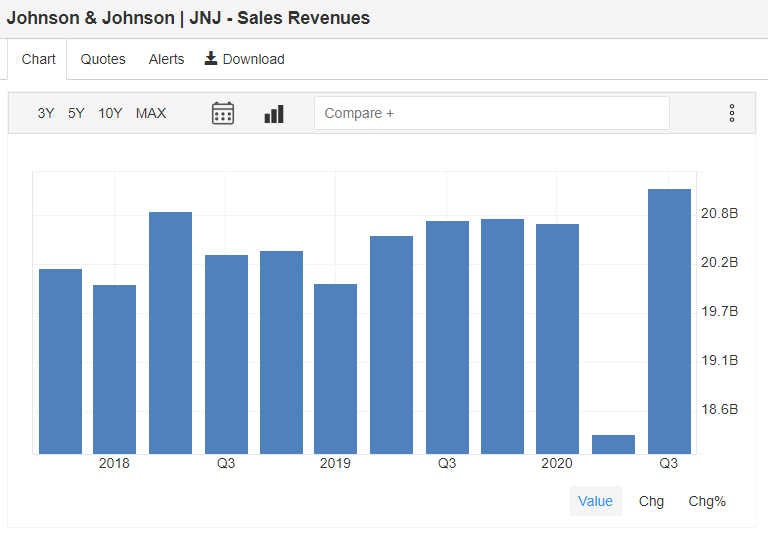

Johnson & Johnson also reported revenues of $21.08 billion, beating analyst estimates by more than a billion dollars and indicating an annualized growth rate of 1.7%. Of course, this might not seem like much of a bullish performance but given the state of the macroeconomic environment, any growth at all should be considered a major win for the company.

Source: Trading Economics

For the full-year period, Johnson & Johnson’s guidance figures were raised (with expectations ranging from $7.95-8.05 per share). Prior guidance figures ranged between $7.75-7.95 per share.

Johnson & Johnson’s guidance for sales now ranges from $82-82.8 billion (previous guidance figures indicated a range between $79.9-81.4 billion) and this tells us that the company is not expecting to see a negative long-term impact based on macro declines seen in the broader economy.

Source: Johnson & Johnson’s Earnings Presentation

Johnson & Johnson’s pharmaceutical business produced revenues of $11.4 billion and this marks an annualized gain of roughly 5%. Of course, this is the unit that recently halted late-stage trials for Johnson & Johnson’s coronavirus vaccine after patients experienced “adverse events”.

For these reasons, investors can see that this is a unit that clearly needed a win this earnings season. In our view, this performance certainly qualifies and the pharmaceutical business might continue to be the main area to watch in the fourth-quarter period.

Source: Johnson & Johnson’s Earnings Presentation

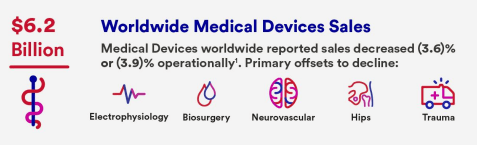

Johnson & Johnson’s consumer product segment (including brands like Nicorette, Listerine, and Aveeno) produced revenues of $3.5 billion (which marks an annualized gain of 1.3%) and the company’s medical device segment produced revenues of $6.2 billion.

Source: Johnson & Johnson

Overall, this marks a steady level of strength throughout Johnson & Johnson’s diverse segments and we think this is excellent news for income investors that are capitalizing on the stock’s fantastic dividend yield at 2.95%. In discussing the company’s quarterly performances, Johnson & Johnson CEO Alex Gorsky explained:

Our third-quarter results reflect solid performance and positive trends across Johnson & Johnson, powered by better-than-expected procedure recovery in Medical Devices, growth in Consumer Health, and continued strength in Pharmaceuticals. I am proud of the relentless passion and Credo-led commitment to patients and customers that our colleagues around the world continue to demonstrate as we boldly fight the COVID-19 pandemic.

Our world-class R&D team is working tirelessly to advance the Phase 3 trials of our COVID-19 vaccine and to uphold the highest standards of transparency, safety and efficacy; while other dedicated teams provide ongoing support to hospitals and patients as they return to sites of care, and ensure patients and consumers have the medicines and products they need. This resilient mindset, combined with our strategic capabilities and execution excellence, increase our optimism for continued recovery in 2020 and strong momentum entering into 2021.

Despite these stable performance results, shares of Johnson & Johnson stock are trading lower and we have to think that a large portion of this negative sentiment has been driven by the story to pause its phase three coronavirus trial tests.

For the company, the unfavorable story was important for several different reasons. Johnson & Johnson joined just three other pharmaceutical companies in entering into tests for phase three trials for the Operation Warp Speed program that was initiated by the Trump administration.

CEO Alex Gorsky Image Source: Wharton.UPenn.Edu

CEO Alex Gorsky Image Source: Wharton.UPenn.Edu

Obviously, these are high-profile endeavors and each company has a lot to gain or lose based on its ability to devise an effective approach to managing coronavirus patients more effectively. With a testing program that involved 60,000 patients, Johnson & Johnson began its phase three COVID-19 vaccine trials in late September.

However, Johnson & Johnson recently confirmed that the clinical studies would be paused due to an “unexplained illness” in one of the trial’s patients. Unfortunately, the vague nature of these descriptions has turned-off many investors and the prior enthusiasm that helped the stock bounce off its post-coronavirus lows appears to be evaporating from the market.

Similar news was seen with AstraZeneca (NASDAQ: AZN) in early September after a U.K. patient developed unexpected symptoms and it can be argued that all of these unfavorable news stories are starting to weigh on stock valuations throughout the sector.

Source: Author via Tradingview

From a chart perspective, we can already see these fundamental factors are influencing JNJ’s price action itself. Ultimately, the recent break below $136.90 per share is a major warning signal as it suggests we could see much lower valuations in the stock before the end of 2020.

While we are currently long the stock, we recommend waiting for a better opportunity to buy JNJ closer to the $126.40 level. Johnson & Johnson’s failure to maintain near-term support levels after posting only token highs during the post-pandemic trading period suggests that the momentum is focused on the downside and bullish income investors may encounter further declines in coming weeks.

However, we are looking at most of this pandemic trading activity as transitory in nature and this is why we have identified price support levels that existed just before the coronavirus trading volatility really began to surge. In this case, we will be watching for a test of $126.40 as an excellent area for investors to build long exposure to JNJ and capture its rock-solid 2.95% dividend at a better discount.

Thank you for reading. Now, it's time to make your voice heard.

Reader interaction is the most important part of the investment learning process. Comments are highly encouraged! We look forward to reading your viewpoints.

Disclosure: I am/we are long JNJ. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.