The next important resistance is placed at 11,930-11,950 levels, which is an upper area of the recent consolidation, Nagaraj Shetti of HDFC Securities said.

The market staged a spectacular performance with the Nifty50 reclaiming the 11,800-point mark on November 3 following a rally by global peers after economic data points were released. Banking & financials outperformed Nifty50 by wide margin for a second consecutive session amid an improvement in the business outlook.

The BSE Sensex closed above the 40,000 mark, rising 503.55 points or 1.27 percent to 40,261.13 points, while the Nifty50 gained 144.30 points or 1.24 percent to 11,813.50 points, and formed a bullish candle on the daily charts.

"This pattern could be a signal of short-term bottom reversal in the market and the unfilled upside gap could be considered as a intraday bullish breakaway gap," Nagaraj Shetti, technical research analyst at HDFC Securities told Moneycontrol.

The overall market breadth has turned up slightly with broad market indices like NSE Midcap 100 closing higher by 0.70 percent and Smallcap 100 closed on a flat note. This could be a minor cause of worry for the market to sustain the highs, he said.

related news

"Initial resistance of 11,750 levels has been broken on the upside and and Nifty sustained above it. The next important resistance is placed at 11,930-11,950 levels, which is an upper area of the recent consolidation, he added.

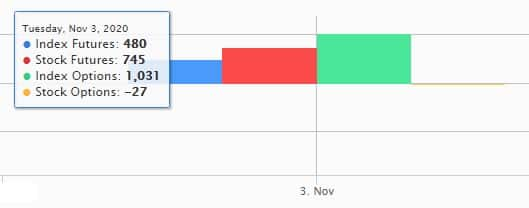

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 11,745.8, followed by 11,678.1. If the index moves up, the key resistance levels to watch out for are 11,858.7 and 11,903.9.

Nifty Bank

The Bank Nifty climbed 790.30 points or 3.17 percent to 25,682.80 and outperformed the Nifty50 for second consecutive session on November 3. The important pivot level, which will act as crucial support for the index, is placed at 25,258.77, followed by 24,834.73. On the upside, key resistance levels are placed at 25,933.77 and 26,184.73.

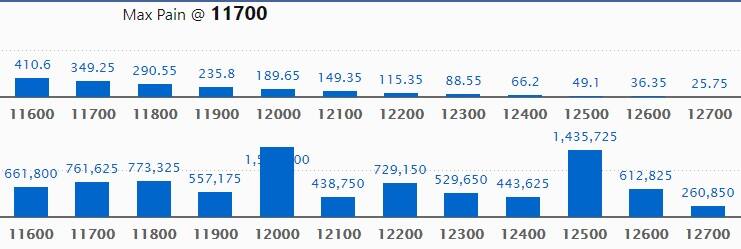

Call option data

Maximum Call open interest of 15.04 lakh contracts was seen at 12,000 strike, which will act as crucial resistance in the November series.

This is followed by 12,500 strike, which holds 14.35 lakh contracts, and 11,800 strike, which has accumulated 7.73 lakh contracts.

Call writing was seen at 12,200 strike, which added 1.36 lakh contracts, followed by 11,800 strike which added 1.05 lakh contracts and 12,700 strike which added 57,750 contracts.

Call unwinding was seen at 11,600 strike, which shed 1.5 lakh contracts, followed by 12,500 strike which shed 1.19 lakh contracts.

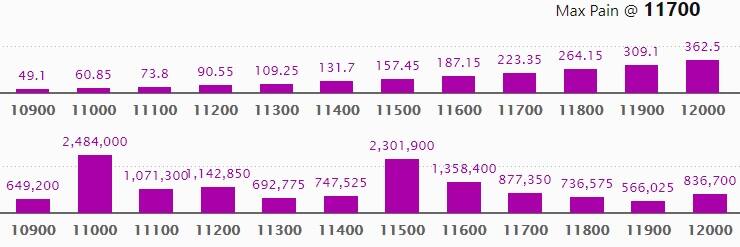

Put option data

Maximum Put open interest of 24.84 lakh contracts was seen at 11,000 strike, which will act as crucial support in the November series.

This is followed by 11,500 strike, which holds 23.01 lakh contracts, and 11,600 strike, which has accumulated 13.58 lakh contracts.

Put writing was seen at 11,500 strike, which added 1.93 lakh contracts, followed by 11,600 strike, which added 1.81 lakh contracts and 11,800 strike which added 1.68 lakh contracts.

Put unwinding was witnessed at 11,000 strike, which shed 1.6 lakh contracts, followed by 11,300 strike which shed 18,825 contracts.

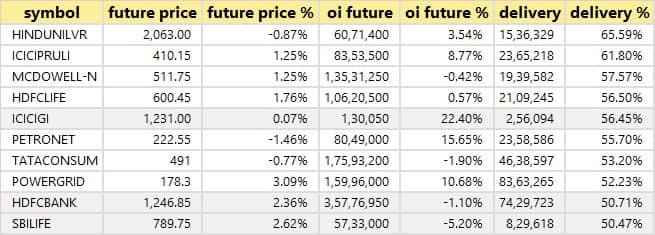

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

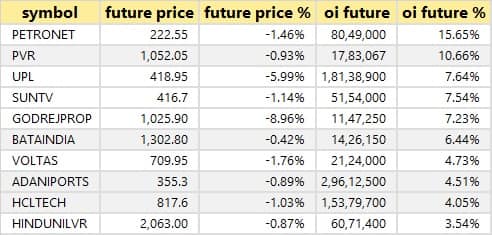

Forty-six stocks saw longs build-up

Based on the open interest future percentage, here are the top 10 stocks in which a build-up by longs was seen.

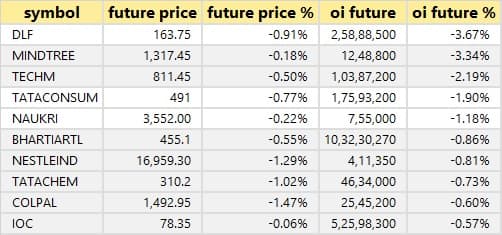

Eleven stocks saw longs unwinding

Based on the open interest future percentage, here are the top 10 stocks in which longs were seen unwinding.

Twenty-four stocks saw short build-up

An increase in the open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are top 10 stocks in which short build-up was seen.

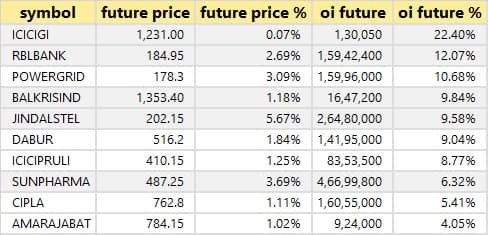

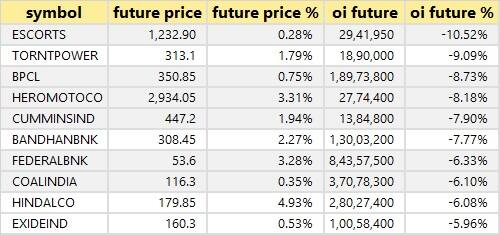

Fifty-seven stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are top 10 stocks in which short-covering was seen.

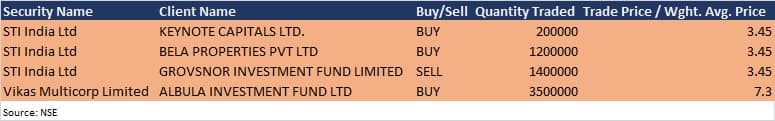

Bulk deals

(For more bulk deals, click here)

Results on November 4

State Bank of India, Lupin, HPCL, Adani Enterprises, Adani Green Energy, Apollo Tyres, Asahi India Glass, Balrampur Chini Mills, BASF India, Gati, Godrej Agrovet, Greenply Industries, Happiest Minds Technologies, Hikal, Indian Hotels, JK Lakshmi Cement, Jubilant Life Sciences, Jyothy Labs, Kalpataru Power Transmission, KEC International, Nelco, Nilkamal, Pidilite Industries, Praj Industries, SRF, Thermax and United Spirits among 91 companies will declare their quarterly earnings on November 4.

Stocks in the news

Ratnamani Metals: Company reported consolidated profit at Rs 56.7 crore in Q2FY21 against Rs 76.5 crore year-on-year; revenue fell to Rs 576.9 crore from Rs 610.2 crore YoY.

PVR: Company posted consolidated loss at Rs 183.9 crore in Q2FY21 against profit of Rs 47.9 crore; revenue fell to Rs 40.4 crore from Rs 973.2 crore YoY.

Adani Gas: Company reported higher profit at Rs 136 crore in Q2FY21 against Rs 120 crore; revenue dropped to Rs 441 crore from Rs 503 crore YoY.

Ajanta Pharma: Company reported higher profit at Rs 170.2 crore in Q2FY21 against Rs 116.4 crore; revenue rose to Rs 715.9 crore from Rs 642.8 crore YoY. The company's board approved a share buyback worth up to Rs 135.97 crore at Rs 1,850 per share.

Adani Ports: Company reported consolidated profit at Rs 1,387 crore in Q2FY21 against Rs 1,054.1 crore; revenue rose to Rs 2,902.5 crore from Rs 2,821.2 crore YoY.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 2,274.4 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 1,100.92 crore in the Indian equity market on November 3, as per provisional data available on the NSE.

Stock under F&O ban on NSE

Not a single stock is under the F&O ban for November 4. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.