Dominion: Still Worth A Shot Ahead Of Earnings

Ahead of the company's earnings day, I think that Dominion could be a good addition to a portfolio - for reasons that transcend the dividend.

Blending stocks like Dominion inside an equities portfolio would have helped to produce better risk-adjusted results over the past few decades.

I could see a strong case for owning the stock to spread out idiosyncratic risk while maintaining portfolio exposure to the important utilities sector.

Ahead of the company's November 5 earnings call, I revisit Dominion Energy (D). About six months ago, I argued that this stock could "balance out other positions in the portfolio, and at least help to smooth out returns over time".

While not a high-conviction bull on this name who thinks that shares are unduly discounted, I believe that there is a place for this stock in many equities portfolios - including those that seek balanced capital appreciation. Today, I assess my investment thesis once again.

(Image Credit: Seeking Alpha)

Why Dominion might make sense

Will Dominion shares outperform the broad market, or certain popular names like Apple (AAPL) or Amazon (AMZN)? It may not matter. In fact, I do not believe this is the best way to think about this utilities stock. Rather, it might belong in a portfolio for another key reason.

Especially in the case of long-term growth with some level of risk control, this stock has historically been a great diversification tool. Since 1985, Dominion's monthly returns have correlated with those of the S&P 500 (SPY) by a factor of only 0.29. This means, in practice, that the stock barely dipped during the 2000-2003 bear. Meanwhile, it sometimes performed poorly during times of stock market enthusiasm (e.g., late 2017-early 2018).

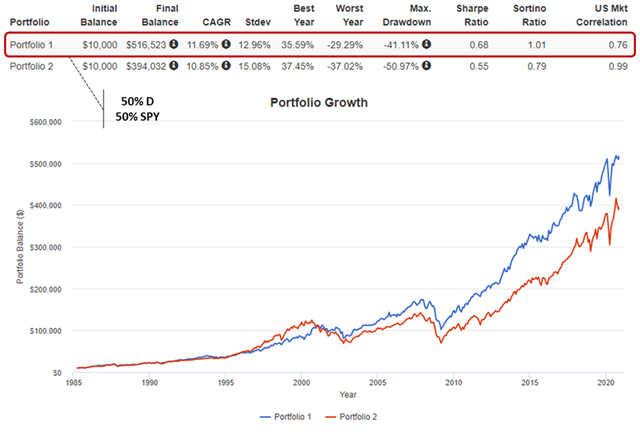

Historically, blending stocks like Dominion inside an equities portfolio would have helped to produce much better results over time. See the chart and table below. Portfolio 1 is a 50/50 blend of D and SPY, while Portfolio 2 is a pure S&P 500 play. Notice that the first strategy would have led to nearly 25% improvement in risk-adjusted returns compared to the benchmark (Sharpe ratio of 0.68 vs. 0.55 for the broad market), while being less exposed to drastic drops from all-time highs (i.e., maximum drawdown).

(Source: Portfolio Visualizer)

It makes sense to me that Dominion's diversification features would remain in place going forward. It is much less exposed to the ups and downs of economic activity. Also, the company has been repositioning its business model to be less dependent on volatile and cyclical oil exploration and production, and focused on more stable, regulated utility operations.

The dividend conundrum

Dominion has fallen out of favor with some investors due to its revised dividend policy. The company currently yields over 4.5%, but the number is projected to dip to about 3% in 2021 - when it expects to pay out $2.50 per share in annual dividends on around $3.85 in post-asset disposition EPS.

Therefore, Dominion will soon cease to be the highest-yielding play in the utilities sector. However, in a low interest rate environment in which the 30-year treasury yields only 1.7%, the utilities stock could still be valuable to income-seeking investors - especially if Dominion maintains its goal of increasing the dividend payments at about twice to three times the inflation rate beyond 2021.

The subject of dividends reminds me of an article I have recently written on AT&T (T). In it, I argued that shares of the Dallas-based telecom could be treated as a bond alternative, especially if properly blended with cash for better risk mitigation. I think that Dominion shares could be used in similar fashion.

Final words

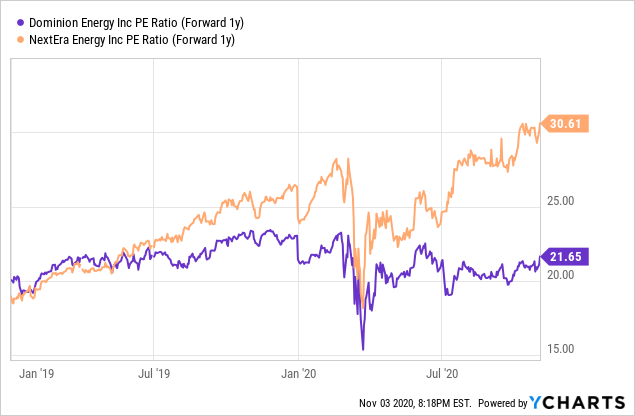

Ahead of the company's earnings day, I believe Dominion could be a good complement to a portfolio. While I maintain NextEra Energy (NEE) as the only utilities stock in my All-Equities SRG, I could see a strong case for adding Dominion to spread out idiosyncratic risk while maintaining portfolio exposure to this important sector. This is particularly true considering the difference in valuation between the two stocks, favoring Dominion as the cheapest by a wide margin (see P/E chart below).

Data by YCharts

Data by YCharts

Beating the market by a mile

Members of my Storm-Resistant Growth community will continue to get updates on NEE (allocation updates, insights, etc.) and the performance of my market-beating "All-Equities SRG" portfolio on a regular basis. To dig deeper into how I have built a risk-diversified strategy designed and back-tested to generate market-like returns with lower risk, join my Storm-Resistant Growth group. Take advantage of the 14-day free trial, read all the content written to date and get immediate access to the community.

Disclosure: I am/we are long AMZN, AAPL, NEE. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.