Vallon Pharmaceuticals Files For IPO Funding For ADHD Drug

Vallon Pharmaceuticals has filed to raise $17 million in a U.S. IPO.

The firm is developing reformulated drug treatment candidates for ADHD and narcolepsy.

VALL is related to investor Arcturus Therapeutics, from whom it obtained its core technologies.

Quick Take

Vallon Pharmaceuticals (VALL) has filed to raise $17.25 million in an IPO of its common stock, according to an S-1 registration statement.

The firm is developing new formulations for the treatment of ADHD and narcolepsy.

VALL obtained its core technologies from Arcturus Therapeutics, which is an investor in the firm.

I’ll provide an update when we learn more about the IPO from management.

Company & Technology

Philadelphia, Pennsylvania-based Vallon was founded to create an abuse-deterrent reformulated version of the existing approved drug Adderall to treat persons suffering from attention deficit hyperactivity disorder and narcolepsy.

Management is headed by president and CEO David Baker, who has been with the firm since 2019 and was previously CEO of Alcobra, where he oversaw development of the firm's drug, ADAIR.

Below is a brief overview video of ADHD:

Source: Psych Hub Education

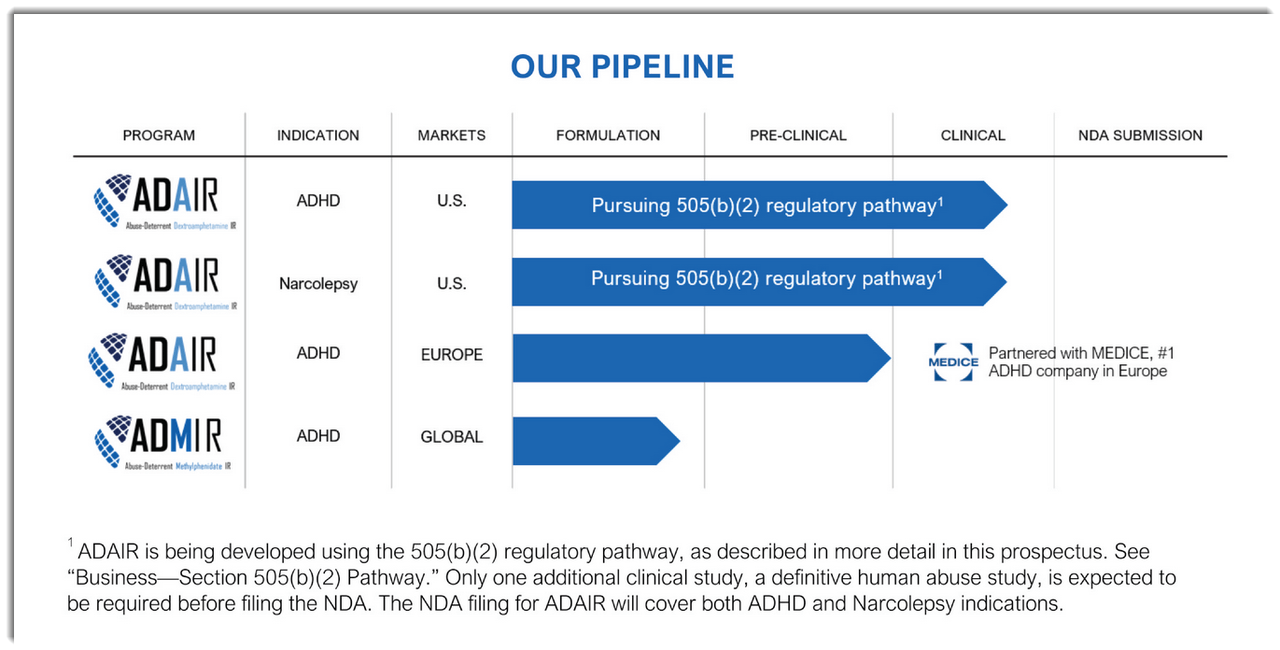

The firm's candidate, ADAIR, is designed to limit injecting and snorting, the two most common ways people abuse the drug.\Management is pursuing a 505 [b](2) regulatory pathway in order to speed the approval process.

Below is the current status of the company’s drug development pipeline:

Source: Company S-1 Filing

Investors in the firm have invested at least $11 million and include SALMON Pharma GmbH, Arcturus Therapeutics (ARCT), Adamas Health Care Fund and individuals.

Market & Competition

According to a 2019 market research report by Grand View Research, the global market for ADHD treatments is forecast to reach $24.9 billion by 2025.

This represents a forecast CAGR (Compound Annual Growth Rate) of 6.4% from 2020 to 2025.

Key elements driving this expected growth are an increase in awareness regarding the condition by patients, and physicians.

Also, there has been consistent growth in the number of diagnosed ADHD patients, with prevalence for children and adolescents rising from 6.15 IN 1997-1998 TO 10.2% IN 2015-2016.

Major competitive vendors that provide or are developing related treatments include:

Eli Lilly (LLY)

Pfizer (PFE)

Johnson & Johnson (JNJ)

Lupin (OTC:LUPNY)

Shire (SHPG)

Mallinckrodt (MNK)

Prude Pharma

NEOS Therapeutics (NEOS)

Financial Status

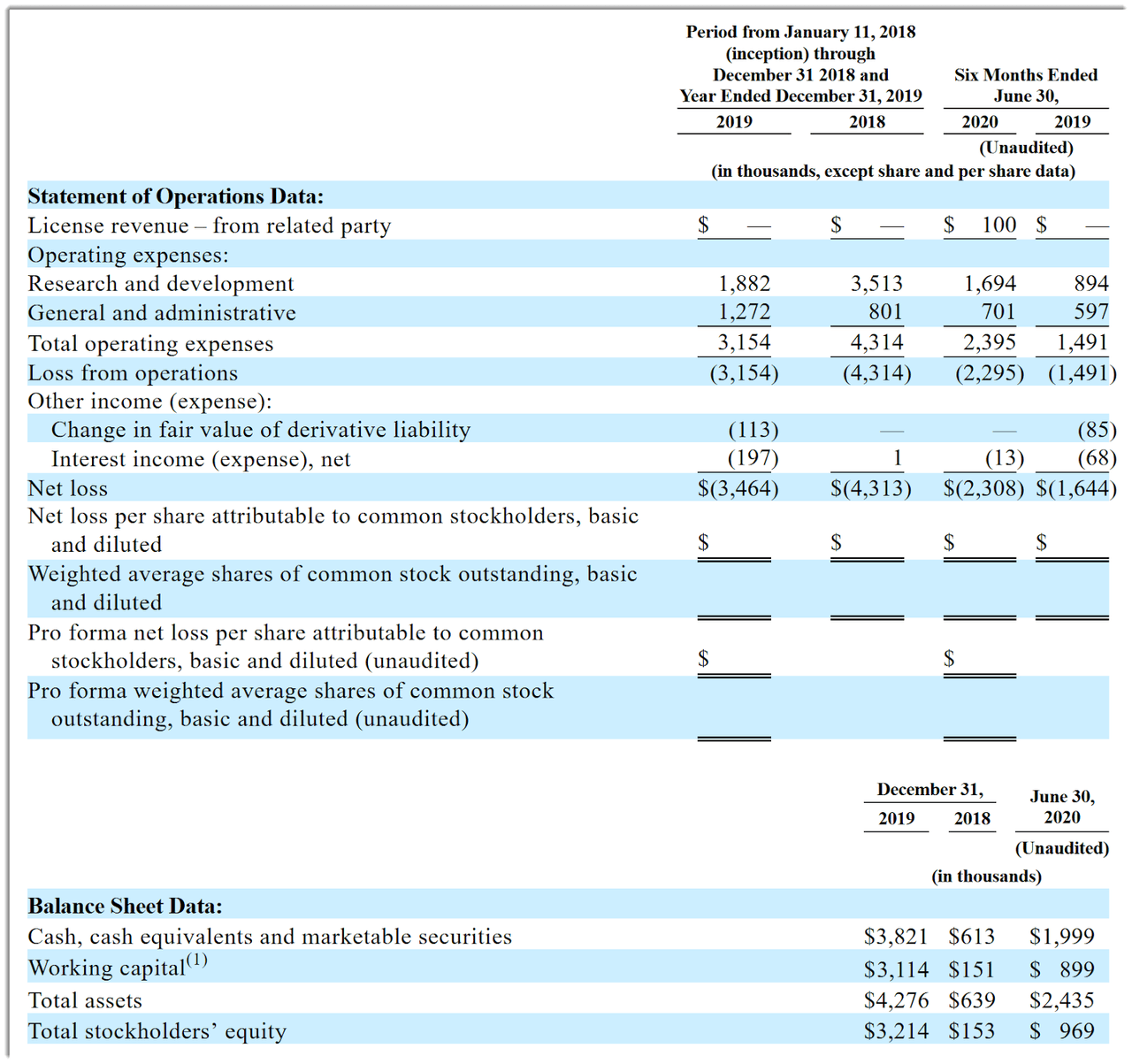

Vallon’s recent financial results are typical of an early stage biopharma in that they feature little or no revenue and material R&D and G&A expenses associated with its drug development efforts.

Below are the company’s financial results since January 2018 (Audited PCAOB for full years):

Source: Company registration statement

As of June 30, 2020, the company had $2.0 million in cash and $1.5 million in total liabilities. (Unaudited, interim)

IPO Details

Vallon intends to raise $17.25 million in gross proceeds from an IPO of its common stock, although the final figure may differ.

No existing shareholders have indicated an interest to purchase shares at the IPO price, although this element may become a feature of the IPO if disclosed in a future filing.

Management says it will use the net proceeds from the IPO as follows:

Planned pivotal human abuse liability clinical trial and non-clinical studies for ADAIR

Manufacturing of ADAIR, including stability studies

Regulatory and additional development costs for ADAIR and ADMIR

General working capital and general corporate purposes

Management’s presentation of the company roadshow is not available.

The sole listed bookrunner of the IPO is ThinkEquity.

Commentary

Vallon is seeking a quite small IPO transaction to fund its leading drug candidate through what it believes will be limited trials before approval status, if successful.

The firm’s lead candidate, ADAIR, is being tested in the U.S. and Europe for the treatment of ADHD and narcolepsy.

The global market opportunity for treating ADHD conditions is quite large and expected to grow at a moderate pace in the coming years, but there are numerous major competitors in the space.

Vallon is collaborating with MEDICE for its European trial of ADAIR for the treatment of ADHD and considers MEDICE to be the premier ADHD firm in the region.

The company’s investor syndicate includes Arcturus Therapeutics, from whom Vallon obtained the core technologies for its drug candidates.

When we learn more about the IPO’s pricing and valuation details, I’ll provide a final opinion.

Expected IPO Pricing Date: To be announced.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis. Get started with a free trial!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.