Why Public Storage Is Outperforming Most REITs

Public Storage is up year-to-date. That's pretty rare among publicly-traded REITs.

The company is benefiting from owning recession-resistant assets.

While Public Storage hasn't increased its dividend in recent years, the outlook is better than it may seem at first.

Public Storage is fairly valued as is, and has a great deal of hidden value as a uniquely high-quality inflation hedge.

It's generally been a difficult year for the REIT sector. The novel coronavirus has absolutely crushed certain segments of commercial real estate such as offices, malls, and shopping centers. And even seemingly safer holdings such as apartments have still underperformed the market due to uncertainty around the economic outlook going forward.

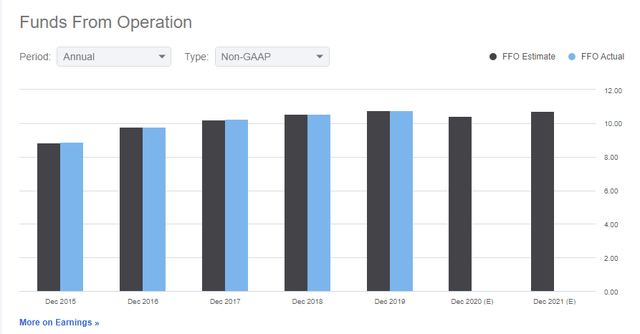

One category that isn't struggling, however, are the storage REITs. Public Storage (PSA) in particular has advanced to new 52-week highs recently, even as its peer REITs are still stuck in the mud. Add it up, and PSA stock has outperformed the industry benchmark by 23% year-to-date:

Data by YCharts

Data by YCharts

So is it time to cash in PSA stock and rotate the funds into struggling REITs? I'd say, "not so fast." Here's why I'm maintaining Public Storage shares as my largest holding within the REIT sector.

Now, More Than Ever, Focus On Safe Dividends

The REIT sector has gotten clocked in 2020. Aside from the obvious economic impacts of the virus, also think about investor behavior.

The main draw to most REIT investments is the dividend yield. REITs traditionally offer a significantly higher dividend than the S&P 500 as a whole, and the disparity has grown in recent years. In a zero interest rate world, REITs paying 5%, 7%, or even more appeared to solve the problem of falling retirement incomes as interest rates have declined.

However, as a stock's yield goes up, often, its risk increases as well. The market is smart about this sort of thing; generally if you see a large dividend yield, the associated risk is also elevated. Thus, it's hardly surprising that many of the REITs that saw their yields spike in 2018 and 2019 -- such as the malls and shopping centers -- have slashed or eliminated their payouts this year. Other REIT subsectors such as offices seem vulnerable to major dividend reductions in coming years as well as a result of this year's events.

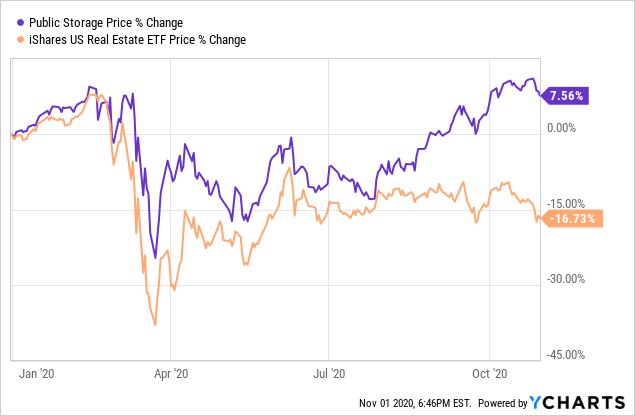

Against that backdrop, it increases the appeal of a REIT with a safe dividend. Enter Public Storage. It's paid out $2/share in dividends every quarter since 2016:

Data by YCharts

Data by YCharts

Public Storage has not attracted the same sort of passionate fanbase as many REITs in part because it doesn't have a commitment to raising its dividend every year. As you can see, the company didn't hike the dividend much in the 2003-7 economic expansion. And now it's put a complete pause on dividend increases as the storage market has lagged from 2016-on.

However, by not pushing up the dividend during economically sour times, Public Storage has left itself far more wiggle room. The firm is expected to earn around $10.40 per share in FFO this year, with that rising to $10.70 next year and $11 in 2022. That's against its current dividend obligation of $8 annually. As you can see, that leaves Public Storage with a comfortable amount of excess cash flow over its current dividend.

Now, shareholders can complain that Public Storage hasn't increased its payout since 2016. That's a valid objection. But would things be any better if PSA were, let's say, paying $12/share ($3/quarter) in dividends now but it wasn't covered by funds from operations and everyone was worried about an imminent dividend cut? In a year as hectic as 2020, it's nice having my top holding in the hard-hit REIT sector be immune to dividend cut fears.

Operating Results: Pretty Good

There's this idea out there that the storage industry has been ravaged by massive oversupply. Capital flowed easily the past few years, and people put up a lot of storage units as a means of attempting to cash in on these low-interest loans. You even had whole companies go public like Jernigan Capital (JCAP) that primarily existed to try to arbitrage the cost of capital in lending to new storage facilities.

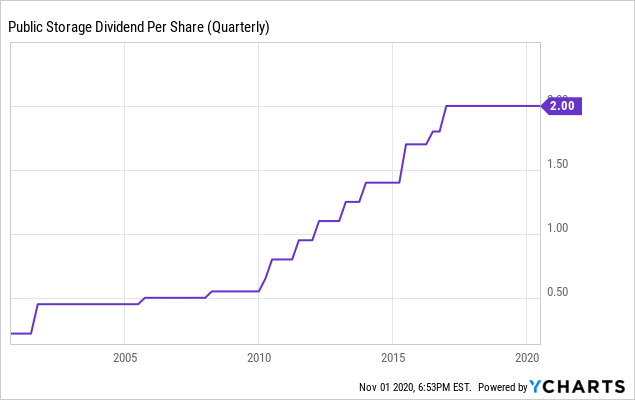

Against this flood of new storage facilities in the market, surely Public Storage's operating results have slumped right? Well actually, not really. In fact, the company has posted rising FFO each year:

Source: Seeking Alpha

These aren't huge gains by any means, to be clear. It's understandable why Public Storage stopped increasing the dividend in 2016 as its growth slowed. But if this is what your earnings look like during a so-called industry slump, you know you own a pretty good business. And now, even with the economic downturn, analysts only forecast the tiniest of FFO declines for 2020 with Public Storage returning to 2019 levels of profitability next year.

PSA Stock: A Bond Proxy With Multiple Layers Of Inflation Protection

The case for owning Public Storage is a simple one. You get a reasonably attractive starting dividend yield (high 3% in recent months) along with a decent level of growth. In a zero interest rate world, Public Storage is an easy bond-like asset to lock in for a steady to slowly rising yield with significant stock price upside, particularly in an inflationary environment.

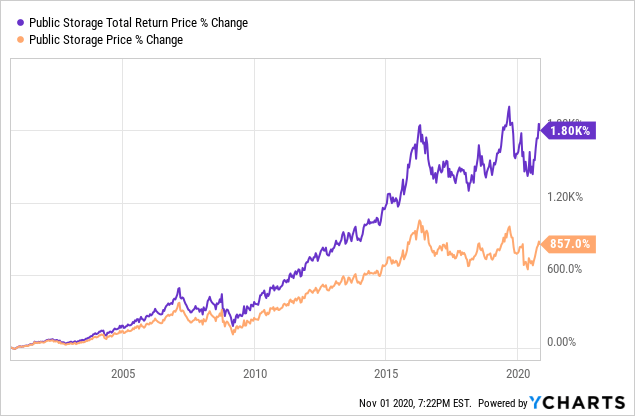

Data by YCharts

Data by YCharts

Over the past 20 years, for example, Public Storage has produced half its returns, 857%, merely from the stock price going up with the other 950% return coming from the accumulated dividends.

Capital gains of this magnitude are a fairly rare feature out of the REIT sector. Public Storage manages to pull it off due to two primary factors. One, it doesn't increase its dividend aggressively every time its FFO goes up. Thus, it retains some capital to reinvest in the business organically. This has allowed Public Storage to avoid the trap of having to dilute the stock significantly to expand its operations. When you look at so many other REITs, by contrast, their NOI gains are largely offset by the dilutive effect of issuing stock to buy those assets.

Second, Public Storage serves, in effect, as a massive land bank. It owns a nearly unfathomable quantity of land in most of America's biggest cities. Since Public Storage has been in the game for decades, it has soaked up a ton of land at reasonable prices. As urban development continues, Public Storage always has the option of converting its land into a higher use such as condos or offices.

You may think that all REITs enjoy this sort of optionality, but that's not the case. Think about a mall or an office building, for example. What's the higher use of that space? If you demolish the existing structure there, you're unlikely to add a lot of value constructing something else there instead. Yes, there are exceptions, but in general, many REITs own properties that have little upside from redevelopment.

Storage, by contrast, is exceedingly cheap to build in the first place. Thus, there's very little there in the way of sunk costs and it's easy to redevelop a property in a hot neighborhood for a far higher use on a price per square foot basis.

Now think about the other side of the balance sheet. Public Storage has inflation protected land as its main asset. For liabilities, it has debt. The value of debt diminishes anyway during inflationary periods, as a dollar paid back in the future is worth less than one received today.

However, it gets better. Public Storage doesn't have much normal corporate debt. Rather, it has stuffed the market full of low-yielding preferred stocks. Current issue Public Storage preferreds now yield less than 5% annually. Perhaps that seems attractive to investors compared to earning almost nothing in other forms of fixed income.

But, remember that preferreds have no fixed expiration date. Public Storage never has to redeem those preferreds as long as it keeps paying interest. So, let's say, inflation runs hot and interest rates on savings accounts go back up to 7% or 8%. Corporate bonds are paying 10%. People are panicking about devaluation of paper money. Not surprisingly, real estate and land prices are soaring as people rush to spend their depreciating dollars.

Yet Public Storage is still paying just 4.5% a year on its preferreds. In fact, it can pay that rate forever if it so chooses. At the same time its competition, which isn't funded by preferreds, will see their cost of capital soar. A rival that was funded on 10-year debt might see their interest rate spike from 4% to 8% when it has to roll that paper over, while PSA's preferreds never reset. This is an incredibly powerful option built into PSA's value.

Perhaps interest rates never go up and Public Storage doesn't get to benefit from its cost of capital advantage. In that case, PSA stock won't see a huge run-up.

That's hardly a bad thing though either. A spike in inflation would be ruinous for many companies in the average stock portfolio, and it can cause other problems more generally. I'm certainly not rooting for a huge spike in inflation. Yet if one hits, I have one of the United States' best land portfolios, packaged in a self-storage wrapper, that will see its assets soar in value while inflation whittles away its preferred stock obligations.

In the meantime, the oversupply in the storage market is finally waning and Public Storage appears set for a rapid return to pre-Covid levels of profitability. The dividend yield is secure and attractive enough at 3.5% to serve as a nice piece of an income portfolio.

Look, if you want a high starting dividend yield, Public Storage isn't the place to be. Perhaps you enjoy the thrill of seeing whether a controversial 8%-yielding REIT is going to maintain or trim its distribution with each and every payout. I'm happy to take a lower yield with no drama, though. As 2020 has showed, reaching for yield often results in getting burned. As it stands now, Public Storage is one of the most compelling options within the REIT space for a steady current income and promising long-term upside.

If you enjoyed this, consider Ian's Insider Corner to enjoy access to similar initiation reports for all the new stocks that we buy. Membership also includes an active chat room, weekly updates, and my responses to your questions.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.