AstraZeneca Restarts Vaccine Trial With Earnings On The Horizon

AstraZeneca is set to report third-quarter earnings results on November 5, and analysts expect earnings to decline slightly from last year.

Earnings have grown more rapidly in the last few quarters, while revenue growth has been pretty consistent.

The stock has gone through a pullback over the last four months, and it is now in oversold territory on the weekly chart.

Like many of the largest pharmaceutical companies in the world, AstraZeneca (AZN) is working on a vaccine for COVID-19. In fact, the company’s vaccine appears to be one of the ones that could be rolled out before the end of the year. There was a setback in September when a trial participant experienced an unexplained illness. Trials were allowed to restart last week after it was determined that the illness was unlikely to have been a result of the shot.

Because of the various cycles of the virus, the spread and the vaccine trials, the stock has been more volatile than usual in 2020. AstraZeneca is set to report third-quarter earnings on November 5. Analysts expect the company to report earnings of $0.44 for the quarter, and that is slightly below the $0.50 it reported last year. Revenue is expected to come in at $6.67 billion, and that’s up 4.1% from the $6.41 billion reported in Q3 2019.

AstraZeneca has seen earnings decline by an average of 3% per year over the last three years, but they have increased in the last few quarters. Second-quarter earnings increased by 32% compared to the previous year, and first-quarter earnings were up 17.8%.

Revenue has increased by an average of 5% per year over the last three years, and it was up 8% in the second quarter. Analysts expect revenue to increase by 7.7% for 2020 as a whole, and it is expected to jump by 14.3% in 2021. Earnings are expected to jump by 28.3% in 2021.

AstraZeneca’s management efficiency measurements are above average. The return on equity is 31.7%, and the profit margin is 20.8%. The stock’s trailing P/E is pretty high at 62.2, but the forward P/E is much more palatable at 21.6. The company does pay a dividend, and the current yield is 2.74%.

Overall, I would say that AstraZeneca is above average in most fundamental categories. The recent earnings growth and the forecasted growth are encouraging. The revenue growth has been consistent, and the management efficiency measurements are better than average. The trailing P/E is high, but the forward P/E is much better. The dividend is a bonus.

If AstraZeneca does end up being one of the first companies to produce an effective vaccine, that will only help boost its earnings and revenue.

Recent Drop has the Stock Sitting Just Above Its 52-Week Moving Average

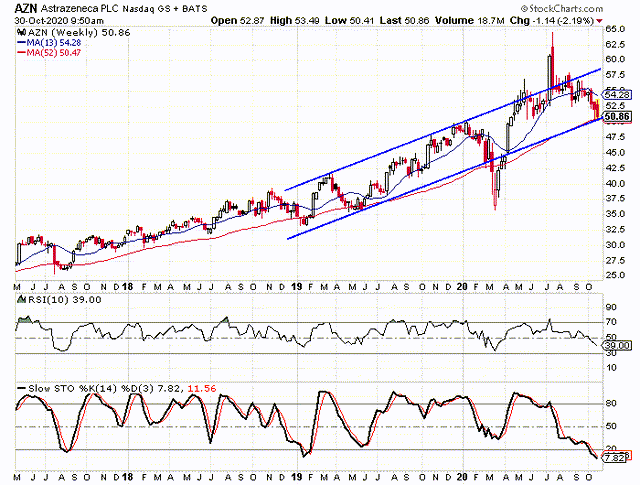

AstraZeneca saw its stock trend higher from the end of 2016 through the end of 2019, and then it fell in the first quarter of this year. It rallied back just like most stocks and peaked in late July. There has been some selling over the last few months, and that has brought the stock back down to its 52-week moving average.

I took note of the trend channel the stock was in throughout most of 2019, with the upper rail being the foundation for the channel. The increased volatility in February and March caused the stock to drop below the lower rail, and the excitement about a possible vaccine pushed it above the upper rail in July. As the trial results started coming in, and with the trial being halted in early September, the stock fell and is now sitting right at the lower rail and the 52-week moving average.

The recent slide has put the weekly stochastic indicators in oversold territory for the first time since early 2019 and only the second time in the last three and a half years. The 10-week RSI is below the 40 level currently, and it has only been below that threshold four times in the last three and a half years, including in March.

When the oscillators have dropped to their current levels, they haven’t stayed that low for very long before the stock rallied. This could be a good sign for how the stock is going to react after the earnings report.

Not as Much Coverage on the Stock as I Expected

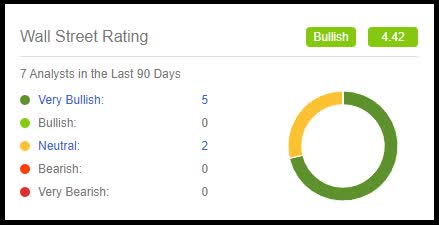

When I started researching AstraZeneca for this article, one of the most surprising things that I found was how little analyst coverage there was on the stock. In terms of market cap, it is one of 10 largest pharmaceutical companies in the world, yet there are only seven analysts following the stock. There are five “Buy” ratings and two “Hold” ratings. This gives us a buy percentage of 71.4%, which is in the average range, but I think we could see coverage increase in the coming years, especially if the company ends up being a major player in the vaccine race.

The current short interest ratio is at 1.41. That reading is a little low and indicates that there is slight optimism toward the stock. The ratio being low isn’t terrible, it just means that there is little chance of a short-covering rally. The average short interest ratio is in the 3.0 range.

One area where there seems to be a considerable amount of optimism is in the options market. There are 42,284 puts open and 123,154 calls open at this time. This gives us a put/call ratio of 0.35. That is one of the lowest put/call ratios I have seen in the past year.

Because of the increased volatility surrounding the virus and the vaccine, it could be that investors are choosing to buy call options rather than buying the stock. If AstraZeneca stock sees a huge bounce because the company is the first to come to market with a vaccine, the leverage of options would create a bigger return with a smaller investment. It is a higher risk-higher reward scenario.

My Overall Take on AstraZeneca

The company's fundamentals are what got my attention first and then I noticed the chart. The way the stock trended higher within a trend channel through 2019 and the first few months of 2020 caught my eye. When I expanded the lines out, it appears that the channel could still be in play if you overlook the extreme low in March and the extreme high in July.

I like how AstraZeneca's earnings growth has accelerated in the last few quarters and how earnings are expected to grow even more in the next few years. Revenue growth has been consistent in the last few years and is expected to accelerate in the next few years. Part of that accelerated growth is likely being attributed to the possible COVID-19 vaccine, but not all of it.

AstraZeneca has beaten estimates in six of the last seven quarters, and the stock has gapped higher on a couple of occasions after the earnings reports. One occasion where the stock gapped higher was last October, when the company reported better-than-expected third-quarter results.

I am bullish on the stock for the long term, but I think it might be wise to wait until after the earnings report if you are considering adding it to your portfolio. A positive earnings report would likely shift the momentum from the downward swing the stock has seen in the last four months. Seeing a bullish crossover from the weekly stochastic indicators would serve as a confirmation that the momentum is shifting.

If you would like to learn more about protecting and growing your portfolio in all market environments, please consider joining The Hedged Alpha Strategy.

One new intermediate to long-term stock or ETF recommendation per week

One or two option recommendations per month

Bullish and bearish recommendations to help you weather different market conditions

A weekly update with my views on the market, events to keep an eye on, and updates on active recommendations

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.