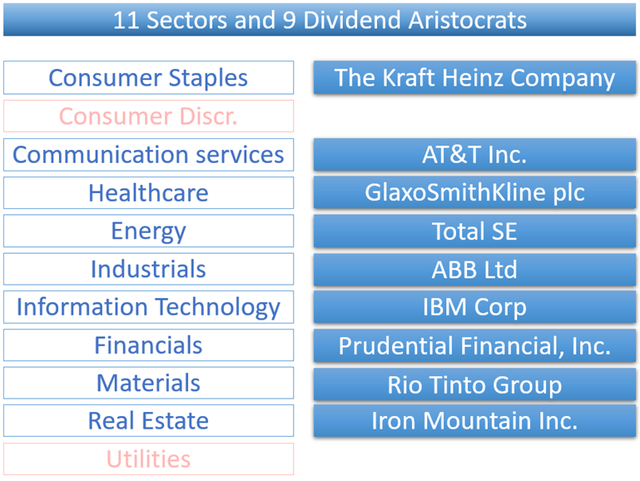

We selected 9 defensive Dividends Aristocrats from 9 Sectors with average dividend yield of 6.7%, including several yielding more than 9%.

The stocks in our selection have relatively low correlation with each other and therefore bring an additional diversification benefit as a portfolio.

We have excluded two sectors: Consumer Discretionary for being too economically sensitive and utilities due to low dividend yield.

In this article you will find a selection of 9 Dividend Aristocrats as well as some alternatives, which pay on average 6.7% in dividend yield, and some of them up to 9%.

The portfolio is built top-down, meaning first looking at the sectors and then selecting individual companies within that sector.

According to Global Industry Classification Standard (GICS), there are 11 sectors to categorize all major public companies. The classification was created by Standard and Poor's (S&P) in 1999 and classifies the companies based on their main activity. This classification is more stable than identifying a publicly traded company as growth or value stock. Here's a great piece from Fidelity on Investing Sector Guide.

Some of the sectors like Consumer Staples, Healthcare and Utilities are less sensitive to the economic recession than the others e.g. Industrials, IT or Real Estate. The reason for that is that these sectors satisfy the basic human need like groceries, medical care or electricity. Therefore their consumption cannot be cut substantially as part of the household saving e.g. during a recession.

As you will probably agree that we are currently going through a rough patch in the economy, therefore today we propose a selection of Dividend Aristocrats from the sectors that are more resilient in the times of recession and less volatile.

Here's the list of our 9 Dividend Aristocrats:

Source: Author's analysis

We haven't picked any stocks from Consumer Discretionary due to its volatility in recession times and we have skipped Utilities due to their low dividend yield. Below we go through each of our picks for Dividend Aristocrats.

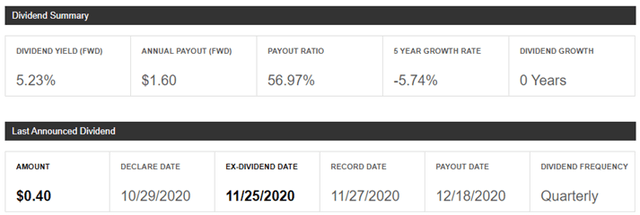

Consumer Staples - KHC with 5.2% Div Yield

The Kraft Heinz Company (KHC) pays $0.40 in quarterly dividends or $1.6 p.a. and has kept its dividend stable since the onset of COVID-19. The current payout ratio is just below 60%, which is still at sustainable level.

At the current share price of $30.6, KHC is still offering a dividend yield of 5.23%, which is on the lower end of our selection. However, we still include KHC due to its profile as a defensive stock.

Source: Seeking Alpha

Fundamentals: KHC has announced on October 29, that in Q3 the company has increased both its quarterly revenues ($6.44bn, up 7.4% y-o-y) and Adjusted EBITDA ($1.67bn, up 13.5% y-o-y). Q3 was KHC's second full COVID-19 quarter ending on September 26, 2020. The company delivered adjusted EPS of $0.7 for the quarter and declared $0.4 in dividends. The U.S. remains company's largest market accounting for 74% of sales. The stability in Q2 and Q3 results suggests that KHC might be able to keep its revenues and earnings stable throughout the corona crisis and therefore keep its dividend.

Consumer Discretionary - too risky and volatile in recession

Consumer discretionary is a sector most vulnerable during a recession as consumer discretionary income shrinks, leaving little to no budget for a nice-to-have items such as luxury bags, going out to theaters, restaurants, expensive subscriptions and larger ticket items.

As you might know we have a BUY recommendation for Tapestry: Use The Opportunity To Acquire A Great Dividend Stock. The stock went up 56% since we published a recommendation to buy. In our article the assumption was that the company will resume paying dividends in the future. As for the purpose of this article, TPR does not fit the profile of Dividend Aristocrats due to currently missing dividend and low Div Yield.

We have SELL recommendations for Lululemon: Take Your Profit Ahead Of Q1 Earnings and Peloton's Upside Already Priced In as Consumer Discretionary stocks.

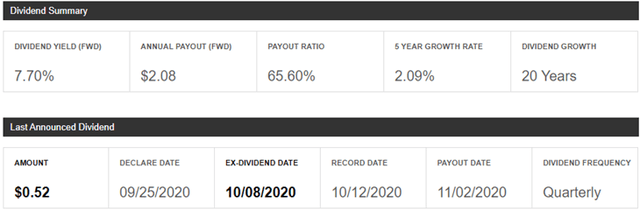

Communication Services - T with 7.7% Div Yield

AT&T (T) pays $0.52 in quarterly dividends. The next dividend to be paid on November 2 to the shareholders on record as of October 8th. Annual T's dividend comprises $2.08 p.a. with the payout ratio of 65% according to Seeking Alpha and expected 2020 payout ratio in the high 50s% according to AT&T.

At the current share price of $27, T offers a dividend yield of 7.7% and earns a place in out Dividend Aristocrat portfolio.

Source: Seeking Alpha

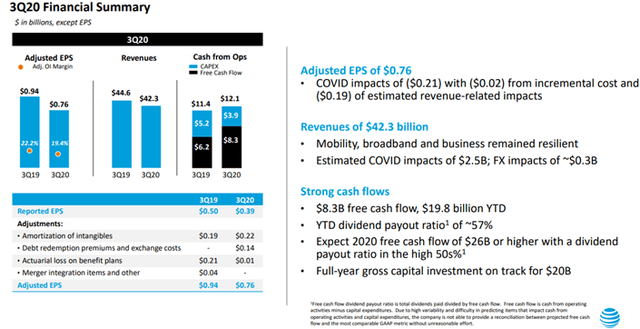

Fundamentals: T published its Q3 results on October 22nd, meeting consensus estimates on EPS ($0.74) and beating the expectations on revenues, despite revenues going down 5.1% to $42.3bn. AT&T's largest segment is Communications, accounting for 81% of revenues. The segment is subdivided into Mobility, Entertainment Group and Business Wireline. The impact of COVID-19 was most-pronounced in media segments such as Entertainment Group and Warner Media, where the revenues decreased by ~10% in Q3 2020. along with EBITDA margin decrease.

Source: AT&T Q3 2020 Earning Presentation

Analyst estimates for the next quarter are at $0.74, which is still at sufficient level to keep the payout of dividends.

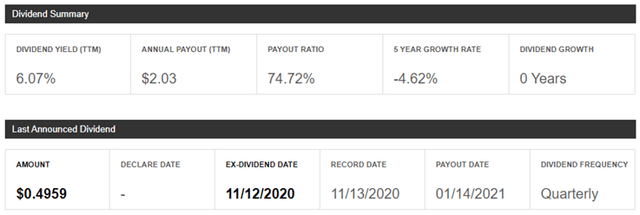

Healthcare - GSK with 6.07% Div Yield

GlaxoSmithKline plc (GSK) is to pay $0.49 in quarterly dividends on January 15, 2021. Annual GSK's dividend comprises $2.03 p.a. with the payout ratio of 74.7% according to Seeking Alpha. GSK's management has reiterated in the last 3 dividend announcements the following statement (author comments in brackets):

The Board currently intends to maintain the dividend for 2020 at the current level of 80p (x2 for ADRs) per share, subject to any material change in the external environment or performance expectations. Over time, as free cash flow strengthens, it intends to build free cash flow cover of the annual dividend to a target range of 1.25-1.50x, before returning the dividend to growth.

At the current share price of $33.4, GSK offers a dividend yield of 6.07%. Relatively high payout ratio combined with the risks associated with Brexit, makes GSK a risky investment in the sector. However, at the same time, GSK shares trade at around 10x trailing P/E, or at least 30% discount compared to its peers. Therefore, we believe the risk is priced in and add the stock to the Dividend Aristocrats portfolio.

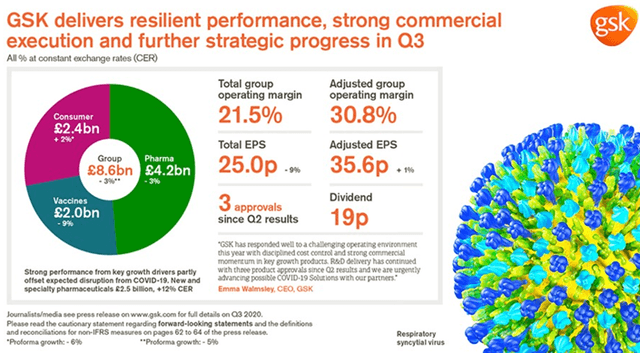

Fundamentals: GSK reported 8% decrease in Revenues to $11.2bn) in Q3 2020, as well as adjusted EPS to $0.92 (beat estimates by $0.07). GSK's major segments are Pharmaceuticals, where revenues were down 7% to $5.4bn; Vaccines had 12% hit in revenues (after 29% drop in Q2 2020) and Consumer Healthcare, where revenues have declined 4%. Compared to Q2 results, GSK saw some recovery in vaccinations and stabilization of results. Assuming that the drop in vaccinations rates is temporary and the vaccinations will be resumed after the COVID-19 waves pass, GSK has a good chance of restoring its profitability to pre-corona levels, which will bring its dividend payout ratio to a slightly lower level.

Source: GSK Q3 Earnings Presentation

Alternatives: the list of other dividend-paying stocks in Healthcare sector includes (but is not limited to) Pfizer (PFE) with 4.3% Div Yield, AbbVie (ABBV) with 6.1%, Bayer (OTCPK:BAYZF) with 6.5%, Eli Lilly (LLY) with 2.3% and Johnson & Johnson (JNJ) with 3% Div Yield. Feel free to pick the one that best suits your dividend portfolio. For our take on JNJ read our piece from September: Johnson & Johnson: Pick It In The Absence Of News.

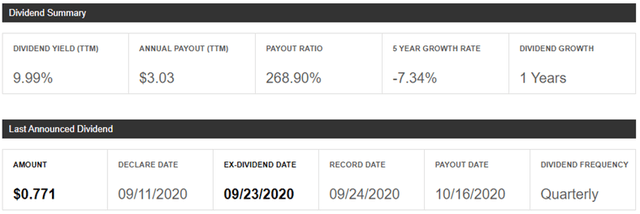

Energy - TOT with 10% Div Yield

Total SE (TOT) paid $0.77 in last quarterly dividends on October 16th 2020. Next dividend at $0.78 will be paid to ADS holders as of December 30th, 2020 on January 21, 2021. TOT's annual dividend comprises $3.03 p.a. with the staggering payout ratio of 269% according to Seeking Alpha. According to company's management:

A dividend is supported in an environment at $40 per barrel.

Brent crude oil prices have stabilized around $40 level in July 2020, however, dropped below that level in the past weeks.

Source: Seeking Alpha

At the current share price of $30.3, TOT is offering a dividend yield of 10%. The company has already confirmed the payment of the next $0.79 dividend on April 19, 2021 to ADS holders.

Fundamentals: Total SE's adjusted EPS in Q3 2020 amounted to $0.29, down 74% compared to $0.97 a year before. Total SE generated consolidated net income of $181m, compared to $8.4bn net loss in the previous quarter. Barely achieving break-even point and then paying $1.9bn in dividends on top, means that the company is burning through its retained earnings and this is not sustainable in the long run. The reason why we have included TOT in our Dividend Aristocrats portfolio is because if its strategy to invest into the renewable energy portfolio, which makes it less dependent on oil price.

Alternatives: Exxon Mobil (XOM) with 10.6% Div Yield is the most obvious alternative.

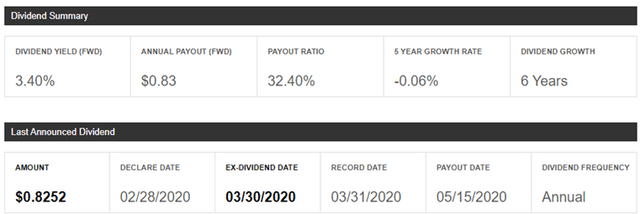

Industrials - ABB with 3.4% Div Yield

ABB Ltd (ABB) pays $0.83 in annual dividend with a very sustainable current payout ratio of 32%.

At the current share price of $24.3, ABB offers a dividend yield of 3.4%, which is the lowest in our selection. However, in Q3 2020 ABB has conducted ~3% of share repurchases, which brings the total yield to 6.4% and therefore is in line with other selections in the portfolio.

Source: Seeking Alpha

Fundamentals: ABB announced its Q3 2020 results on October 23 with revenues down 4% to $6.6bn and operational earnings per share of $0.21, which translates into 37% decrease y-o-y. At the same time ABB had $5.0bn book gain (net of tax) from the Power Grids disposal. Therefore, the diluted EPS for 9M 2020 amount to $2.45, which is supportable of dividend payment (at least this year).

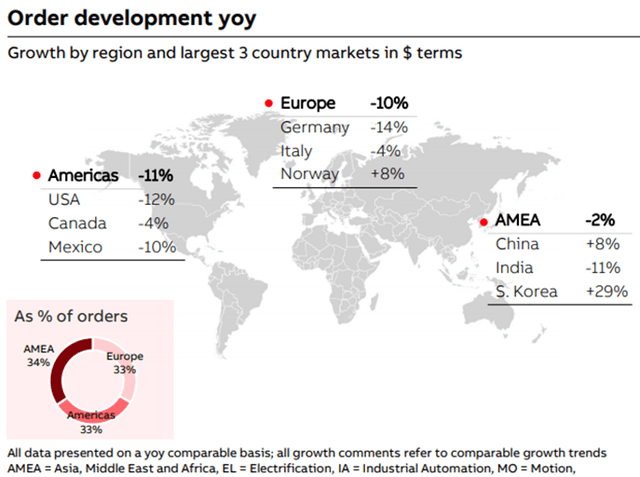

Source: ABB Q3 2020 Results Presentation

Company's orders are balanced between Americas, Europe and AMEA, each accounting for a third of company's revenues. At the time when Europe's and Americas suffer 10% decline, AMEA orders are down only 2% with weak performance in India being offset by strong performance in China and South Korea.

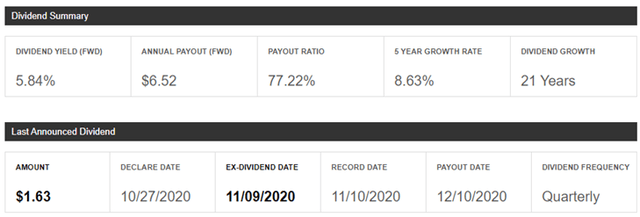

Information Technology - IBM with 5.8% Div Yield

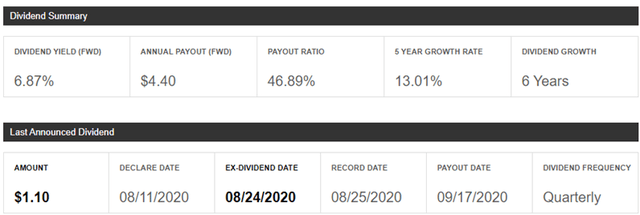

IBM pays $1.63 in quarterly dividends. Annual IBM's dividend comprises $6.52 with the payout ratio of 77% according to Seeking Alpha. IBM's payout ratio is on a higher side, however, given that it's a mature company with $4.3bn in operating cash flow, returning $1.45bn (~1/3) in dividends to shareholders does not seem too high.

At the current share price of $112, IBM offers a dividend yield of 5.6%.

Source: Seeking Alpha

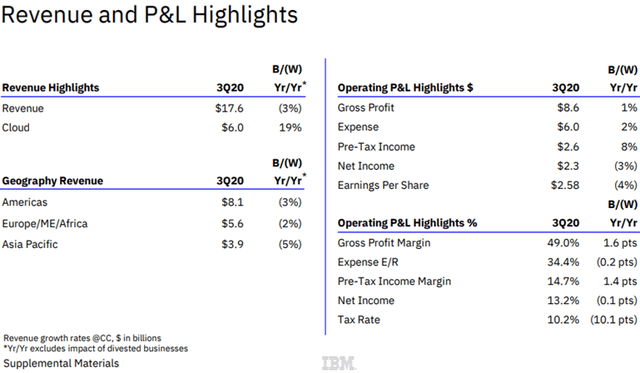

Fundamentals: IBM has announced its Q3 results on October 19, with revenues declining 2.6% to $17.56bn and net income remaining flat at $1.7bn. The company has generated $2.58 in adjusted EPS for the quarter in line with analyst's estimates. In fact this has been the case for previous quarter's earnings as well and has been just a minimal positive surprise at earnings announcement.

IBM's biggest business segments are Cloud & Cognitive Software, Global Business Services and Global Technology services, which together account for 91% of company's revenue. On its own, Cloud and Cognitive Software accounts for 32% of revenues ($5.6bn) and half of gross profit ($4.3bn). This business segment is twice as profitable as the others and is the only segment which posted growth (6.7%) in Q3 2020. As demonstrated by its results during the corona crisis, we see IBM as a defensive stock and include it in our Dividend Aristocrats portfolio despite the slightly lower dividend yield.

Source: IBM Q3 Earnings Presentation

Financials/Insurance - PRU with 6.9% Div Yield

Financials is a sector sensitive to the economic environment as the banks are at the end the ones left holding the bag. Therefore, in order to mitigate the risk, we have picked an insurance and asset management company for our Dividend Aristocrats portfolio.

Prudential Financial, Inc. (PRU) pays $1.1 in quarterly dividends. On annual basis PRU's dividends comprises $4.4 with the annual payout ratio of 47% according to Seeking Alpha.

At the current share price of $64, PRU offers a dividend yield of 6.9%.

Source: Seeking Alpha

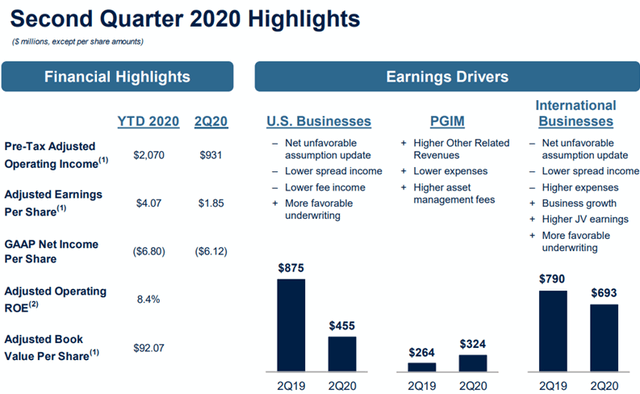

Fundamentals: Prudential Financial, Inc. has three major pillars: two of which are insurance divisions: International Businesses and U.S. Businesses. The third pillar is Prudential Global Investment Management (PGIM) division.

Prudential Financial, Inc. did feel the negative impact of COVID-19. In the Q2 results, which were announced on August 4, PRU's adjusted EPS went down 39% to $1.85 compared to the same quarter last year ($3.03). Out of which $0.66 were due to the annual update of assumptions. Without this adjustment the EPS would be $2.51 per share, which is still 17% lower than in the same quarter last year.

From the three divisions U.S. Businesses witnessed the largest hit with Pre-Tax operating income dropping 48% to $455m. International Businesses suffered a 12% drop and PGIM demonstrated 23% growth to $324 thanks to higher strategic investment earnings.

To watch: PRU is expected to announce its Q3 earnings on Nov 3, after market close. Consensus adjusted EPS estimate is at $2.67

Source: PRU Q2 Earnings Presentation

Alternative: another stock from the insurance sector: MetLife (NYSE:MET) with 4.9% Div Yield.

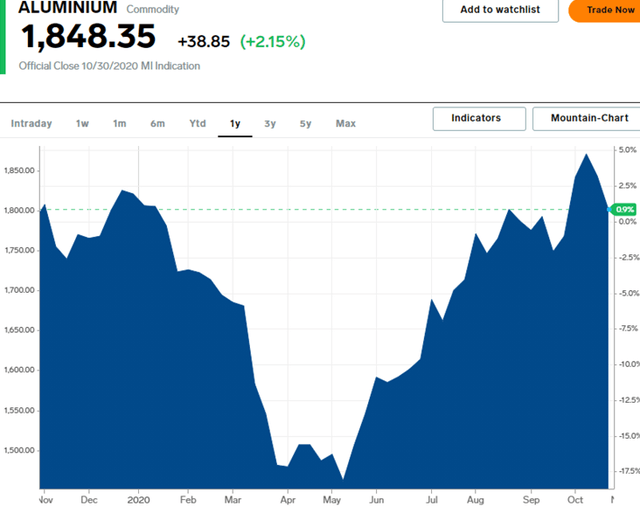

Materials - RIO with 5.5% Div Yield

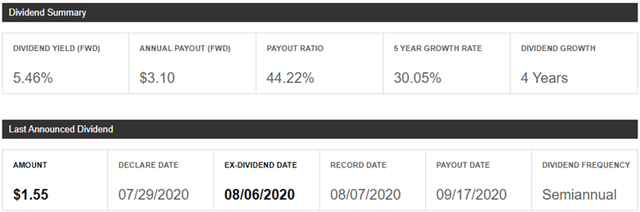

Rio Tinto (RIO) pays $1.55 in semiannual dividends, which add up to $3.1 annual payout. Payout ratio according to Seeking Alpha is 44%

At the current share price of $56.8, RIO offers a dividend yield of 5.46%. Rio Tinto has also share repurchases programs, which may cause minor positive effect on the share price.

Source: Seeking Alpha

Fundamentals: Rio Tinto's revenues were down 6.5% to $19.4bn in the first half of 2020. The company has generated $2.03 in EPS in the first half the year, down 19% compared to the year before. This was before raw material prices such as aluminium, copper, iron ore recovered from the dive during the initial coronavirus wave in April-May 2020. For example iron ore prices jumped in August from $90/MT to $120/MT where they stay till now. Therefore we can expect RIO's earnings to exceed the results from the first half a year. That should be sufficient to sustain dividend payments.

Source: Business Insider

Alternatives: Another Iron Ore produce, which we recommend as alternative is Ferrexpo plc (OTCPK:FEEXF) with 5.9% dividend yield.

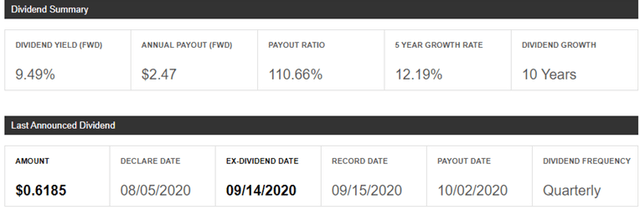

Real Estate - IRM with 9.5% Div Yield

Iron Mountain Incorporated is not a typical real estate stock. The company manages storage spaces and data centers, where revenues tend to be sticky as the contracts run for many years. For a more detailed analysis of Iron Mountain please read our article: Iron Mountain's Dividend Is Not Sustainable, But That Might Change.

IRM pays $0.62 in quarterly dividends, comprising $2.47 p.a. and 9.5% dividend yield. Current payout ratio is 110% (for more details please refer to the article linked above).

Source: Seeking Alpha

Fundamentals: In Q2 earnings IRM delivered $0.53 in FFO, beating consensus estimate by $0.10.

To watch: IRM to announces Q3 results on Nov 5, pre-market. The analysts expect FFO to amount to $0.55 per share.

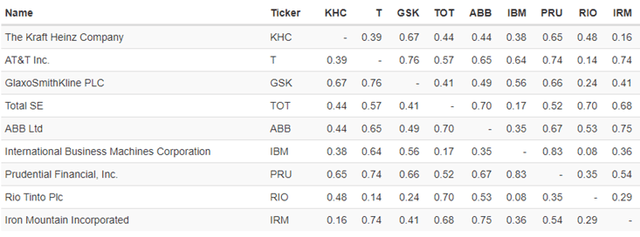

Diversification reduces portfolio risk

These 9 stocks are less than perfectly correlated with each other, which means that they are not expected to move up or down in sync, thus reducing the variance of the portfolio. In the table below you can see how correlated particular stocks are with each other. Correlation coefficient has values between 0 and 1, where 0 mean no correlation at all and 1 means that the stocks move in the same direction. For example KHC has the lowest correlation with IRM (0.16), while IRM and T are highly correlated (0.74). On average the correlation is around 0.4, which a pretty low value that provides the benefits of diversification and will reduce riskiness of the overall portfolio.

Source: https://www.portfoliovisualizer.com/asset-correlations

It is definitely worth checking from time to time the correlations in your portfolio, especially when you add new stocks, in order to reap the benefits of diversification and limit the riskiness of your portfolio.

Conclusion

Nine Dividend Aristocrats, as well as their alternatives, offer at least 6.7% dividend yield, while providing diversification benefits to your portfolio. In the turbulent times when the stock returns are more volatile, dividend income portfolio strategy gains in popularity. Well-diversified dividend portfolios are the crème de la crème as they bring income while protecting your portfolio from excessive losses.

If you liked the article, please follow to receive real-time updates.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.